PDF Attached

Private

exporters report sales of:

-1,844,040

metric tons of corn for delivery to Mexico. Of the total, 1,089,660 metric tons is for delivery during the 2021/2022 marketing year and 754,380 metric tons is for delivery during the 2022/2023 marketing year

-130,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

![]()

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Not

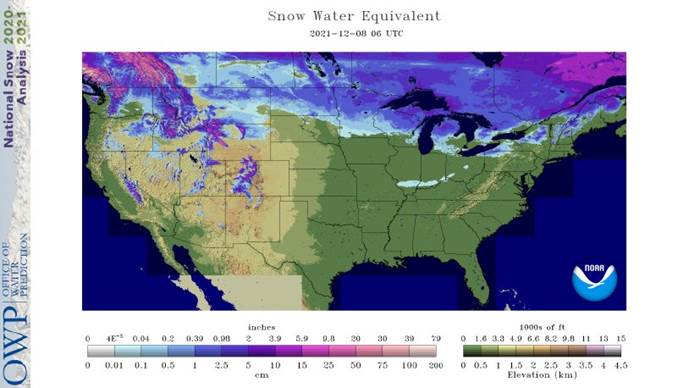

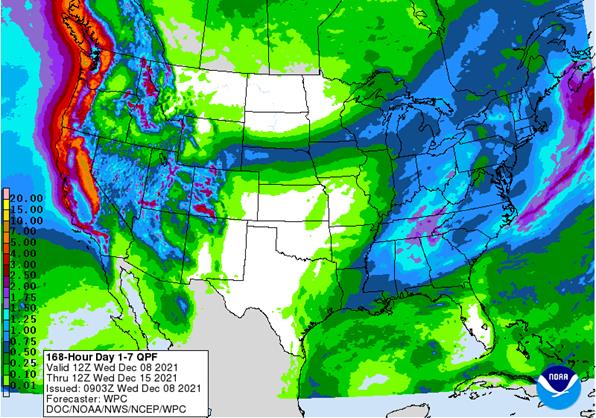

much change occurred overnight in most of the world - California,

the Great Basin and portions of the Rocky Mountain region will encounter stormy weather this weekend through next week

- Significant

snowfall will accumulate in the Sierra Nevada and some of the mountains to the east in the Rocky Mountain States - Significant

rainfall is also expected along the coast and in the central valleys - Some

strong wind will also occur in coastal areas - Snowpack

will improve in the mountains - U.S.

hard red winter wheat production areas will not likely see much “significant” precipitation for the next 8-9 days, although a few showers may occur briefly late next week - A

couple of weather disturbances coming from California and the southwestern desert region may pass through a part of the central and southern Plains Dec. 18-25 that may offer a little relief to dryness in wheat production areas - Confidence

is low, but there is potential for at least “some” precipitation during that week - Snow

is still expected from northern Nebraska and far southern South Dakota into southern Minnesota and Wisconsin Thursday into Friday

- Snow

accumulations of 2 to 6 inches are expected with a few totals of 6-10 inches - The

area impacted will be relatively narrow - U.S.

Lower and eastern parts of the Midwest may be impacted by rain this weekend and again during mid-week next week

- A

larger winter storm “may” impact the northern U.S. Plains, upper Midwest and eastern Canada’s Prairies in the second half of next week and into the following weekend - Significant

snow and some rain may accompany the event - Rain

will also occur from this system in the central and eastern Midwest, Delta and interior southeastern states – mostly during the second weekend of the forecast - West

Texas may get some needed moisture late next week and into the following weekend.

- U.S.

southeastern states will see a mix of rain and sunshine during the next two weeks with more sunshine than rain - U.S.

temperatures will be warmer than usual during the next ten days with some of the readings well above normal

- Crop

moisture stress is evolving in western Parana and some immediate neighboring areas in Mato Grosso do Sul and Paraguay - Rain

is needed in these areas and some may evolve, but not before Sunday and more likely next week when scattered showers and thunderstorms evolve - That

rain will be very important since without moisture stress could become significant to slow crop develop and raise production worries - Rio

Grande do Sul, Uruguay, eastern Entre Rios, Argentina and Corrientes along with southern Paraguay are expecting to dry out as well, but moisture stress for these areas will not evolve as quickly as that of western Parana.

- Dryness

in these areas will be more persistent and will raise the potential crop moisture stress as mid-month approaches - Some

minor crop stress may evolve next week - Other

crop areas in Argentina will remain in favorable condition for the next ten days to two weeks with good plant development expected - Timely

rainfall will occur, although it may be of light intensity at times - Wheat

yields in Argentina are still looking favorable with more of that crop filling and maturing with accelerating harvest progress under way - Summer

crop development will advance relatively well for the next ten days, despite declining soil moisture in the east

- Center

west and center south Brazil crop development will continue to advance favorably - Parts

of the region may run into excessive rainfall during the soybean harvest season late this month and in January, but it is too soon to predict how impactful that may or may not be

- Australia

winter crop harvest weather has improved and will continue more favorably through the next ten days to two weeks - No

more crop quality concerns are expected through at least Dec. 17. - Australia

summer crop conditions are improving after abundant to excessive rain last month - China’s

weather will continue rather tranquil through the next ten days to two weeks with brief periods of precipitation and more sunshine

- Temperatures

will be non-threatening to wheat, rapeseed and livestock - Southern

India weather has been improving this week and this trend will continue for a while - Too

much rain in November hurt the quality of some late season crops and raised the need for replanting of many winter crops - Absolute

dryness is not likely, but rain expected should be brief and light enough to allow some crop development and farming activity to advance relatively well.

- The

driest weather is expected in the Dec. 15-22 period - Central

and northern India weather will remain good for winter crop planting and establishment. - Most

winter crops are likely in the ground and are establishing well - Early

planted wheat and other small grains may be in the vegetative to early joint stage of development - Harvest

progress for summer crops has advanced well recently and little change is expected - Morocco

and northwestern Algeria remain too dry and significant rain must fall soon to get crops planted and established properly - Soil

moisture and rainfall have been sufficient in northeastern and north-central Algeria and far northern Tunisia, but greater rain is needed in interior crop areas - Rain

prospects for the drier areas are not very good for the next ten days - Europe’s

more active weather of late is expected to shift a little more to the east over the next week to ten days - Romania

and Spain are the two driest counties in the continent today and some relief should come to Romania in this coming week while the heart of Spain may be left dry for a while - Soil

moisture elsewhere in Europe has been will continue favorable for winter crops which are moving into dormancy in many areas

- Western

parts of Russia, Belarus and central and western Ukraine will get periods of rain and snow through the next ten days maintaining favorable soil moisture for use in the spring - No

crop threatening cold is expected in any winter crop region - Limited

precipitation will continue in the lower half of the Volga River Basin, far eastern Ukraine and Russia’s Southern Region for a while - South

Africa summer crops will experience a good mix of rain and sunshine over the next ten days supporting additional planting and establishment - Production

potentials are good this year especially with La Nina prevailing - West-central

Africa rainfall is expected to be greatest in Liberia and Sierra Leon during the next ten days - Coastal

areas of Ivory Coast will also be wet biased while most other coffee, cocoa, sugarcane, rice and cotton areas in the region will be left dry

- Favorable

harvest conditions will prevail outside of the wettest areas - Ethiopia

rainfall will be minimal over the next seven days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 17 - Indonesia,

Malaysia and Philippines rainfall will be abundant during the next couple of weeks.

- Some

flooding may evolve, although western parts of Luzon Island and a part of Mindanao will only receive light precipitation - The

second week of the forecast may trend drier in western parts of Indonesia - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain

- Waves

of rain are expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia - Delays

in the loading and shipping of some goods and services may result due to flooding, but the worst of the stormy pattern may be passing - Frequent

rain could still induce some delays - Friday

through the weekend coming up will be the next stormy period - Next

week’s weather will improve with much less storminess expected - Ontario

and Quebec weather will improve briefly after this weekend, but another storm system will bring significant moisture to the region late next week and/or in the following weekend. - Mexico

precipitation will be limited to the east coast over the next ten days with areas from Tamaulipas to Veracruz and Chiapas most impacted - Resulting

rainfall will rarely bolster soil moisture for very long - Net

drying is expected in most other areas - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Not

much change is expected through Monday - Rain

next week may impact a few northern Iraq and western Iran locations while other areas from Syria to Jordan and Israel will remainder biased through most of next week - Colombia

and Venezuela precipitation is expected to occur periodically in coffee and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillational Index was +12.58 and it was expected to move a little more erratically over the next few days - New

Zealand rainfall is expected to be periodic during the next week to ten days with near to above average amounts expected except along the lower east coast of South Island where it will be lighter than usual - Temperatures

will be seasonable

Thursday,

Dec. 9:

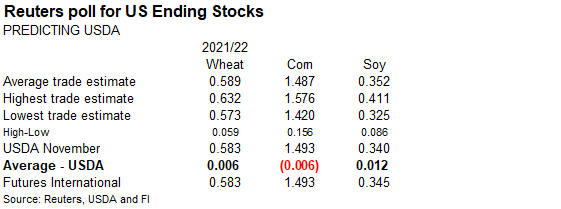

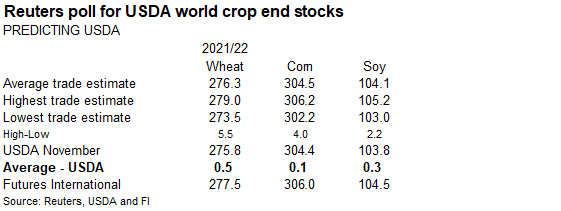

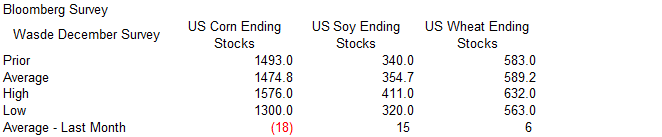

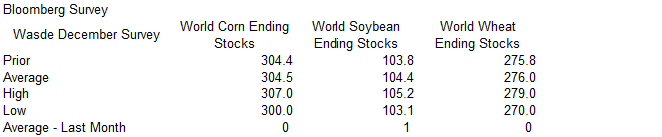

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - China

farm ministry’s monthly crop supply-demand report (CASDE) - Brazil’s

Conab report on yield, area and output of corn and soybeans - Fitch

ESG Outlook Conference Asia Pacific, day 2 - Port

of Rouen data on French grain exports

Friday,

Dec. 10:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board’s data on November palm oil reserves, output and exports - Malaysia’s

Dec. 1-10 palm oil exports - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Macros

U.S.

EPA CONSIDERING MAKING ELECTRIC VEHICLES ELIGIBLE FOR RENEWABLE FUEL CREDITS WHEN IT UNVEILS 2023 BIOFUEL BLENDING MANDATES NEXT YEAR – OFFICIAL – Reuters News

US

DoE Crude Oil Inventories (W/W) 03-Dec: -241K (est -1521K; prev -909K)

–

Distillate Inventories: +2733K (est 1000K; prev 2160K)

–

Cushing OK Crude Inventories: +2373K (prev 1159K)

–

Gasoline Inventories: +3882K (est 2000K; prev 4029K)

–

Refinery Utilization: 1.0% (est 0.4%; prev 0.2%)

·

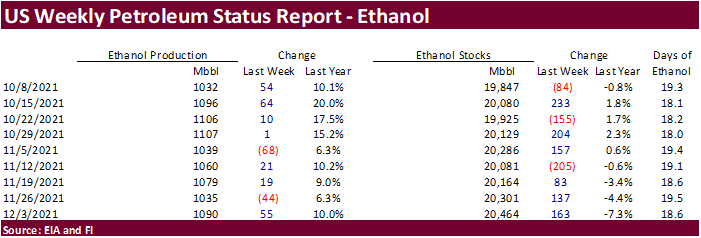

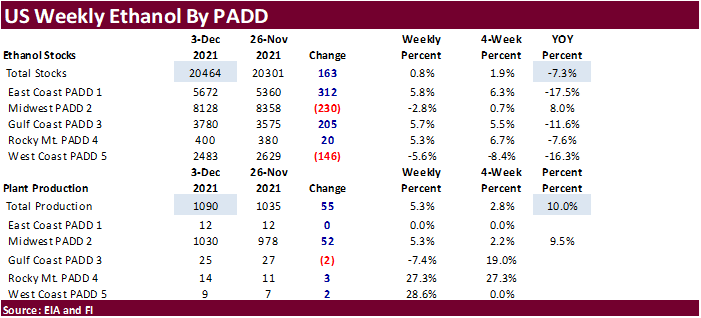

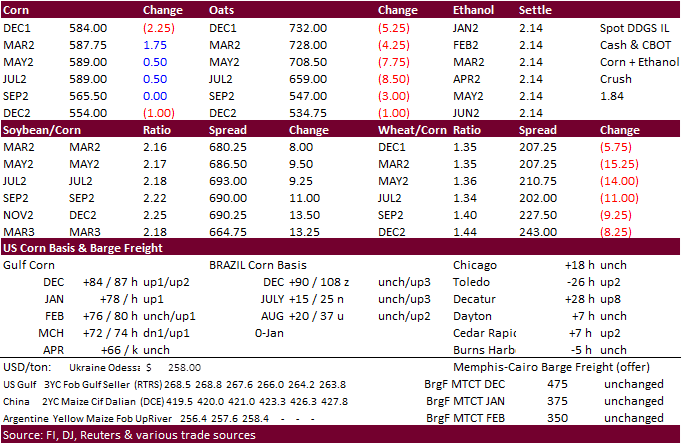

A combination of higher soybeans, large increase in weekly US ethanol production and a large sale to Mexico supported corn futures, but they ended mixed (Mar-Sep slightly higher) in large part to a selloff in wheat futures.

·

Southern Brazil could use some rain and rest of the country is in good shape. Argentina’s weather is good.

·

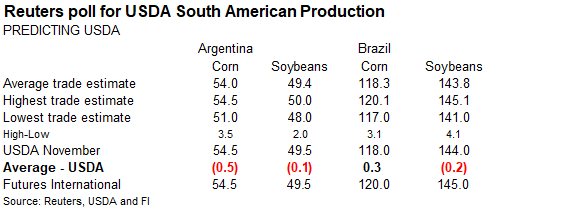

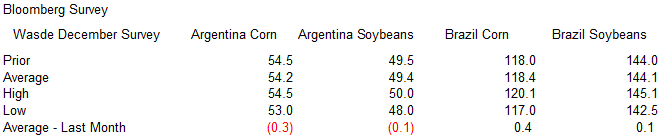

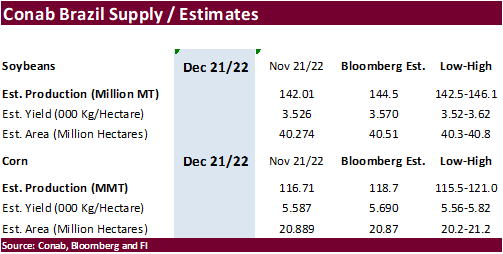

A Bloomberg survey for Brazil Conab crop supply calls for the soybean production to be 2.5 million tons higher from November and corn production to be up 2.0 million tons.

·

Fund bought an estimated net 2000 CBOT corn contracts.

·

Some company subsidies of a major Chinese hog breeder delayed payments on commercial bills, triggering selling in the market, with $3.5 billion wiped in just two days. (Bloomberg)

·

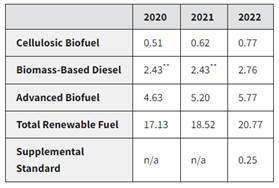

Yesterday EPA proposed retroactively to set total renewable fuel volumes at 17.13 billion gallons for 2020, 18.52 billion for 2021 and 20.77 billion for 2022. The 2020 and 2021 volumes are down from the final set in 2019, while

the 2022 indicates an increase.

·

The USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed up 3 percent. Cumulative placements from the week ending January 9, 2021 through December 4, 2021 for the United States were 8.89 billion. Cumulative

placements were up slightly from the same period a year earlier.

US

DoE Crude Oil Inventories (W/W) 03-Dec: -241K (est -1521K; prev -909K)

–

Distillate Inventories: +2733K (est 1000K; prev 2160K)

–

Cushing OK Crude Inventories: +2373K (prev 1159K)

–

Gasoline Inventories: +3882K (est 2000K; prev 4029K)

–

Refinery Utilization: 1.0% (est 0.4%; prev 0.2%)

EIA:

US Stocks In SPR At Lowest Level Since May 2003

Export

developments.

·

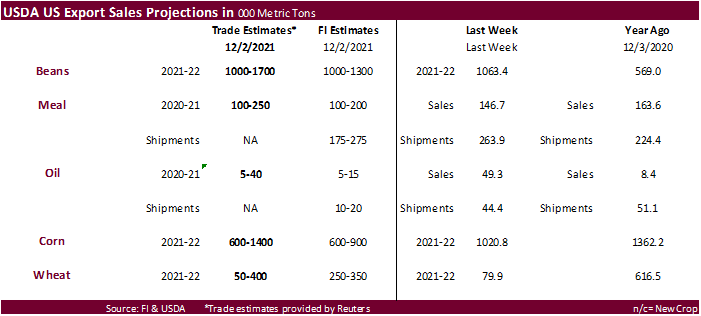

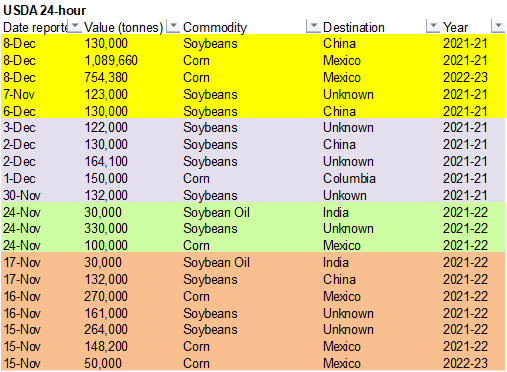

Private exporters report sales of: 1,844,040 metric tons of corn for delivery to Mexico. Of the total, 1,089,660 metric tons is for delivery during the 2021/2022 marketing year and 754,380 metric tons is for delivery during the

2022/2023 marketing year.

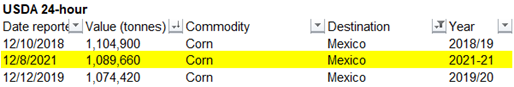

The

large current crop-year sale to Mexico is not that uncommon for the month of December.

Top

three sales to Mexico (corn) over past five years (12/8/21 does not include new-crop sale)

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

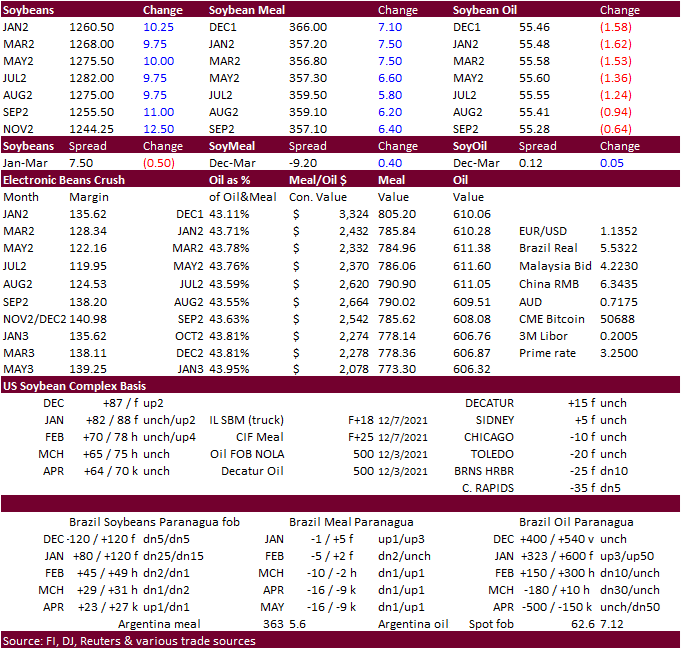

Soybeans were lower to start but rallied 10.25-11.25 cents after meal surged higher by $6.00-$7.50/short ton. Soybean oil fell 88-158 points (bear spreading) after the EPA proposed a less than expected 2021 and 2022 advanced biofuel

mandate.

·

Funds bought an estimated net 8,000 soybean contracts, bought 6,000 soybean meal and sold 5,000 soybean oil.

·

January soybean oil hit a session low of 54.46, still above a strong 54.00 cent support level.

·

We are hearing Brazil soybean meal premiums firmed this week. Spot offers for Argentina soybean meal and soybean oil are thin in part to forward export bookings of products, poor crush margins and limited farmer selling.

·

Keep an eye on global soybean oil import demand which is increasing. The product is still favored by India over palm oil imports.

·

A Bloomberg survey for Brazil Conab crop supply calls for the soybean production to be 2.5 million tons higher from November and corn production to be up 2.0 million tons.

·

D6 RINs rallied from yesterday and were around 95 cents earlier in the day.

·

EPA proposed advanced biofuel at 5.2 billion for 2021 and 5.77 billion for 2022 (a new high). Some traders were looking for a higher 2022 RVO. The 2020 & 2021 is more in line with actual blending volumes. They rejected all small

refinery exemptions.

Export

Developments

·

Private exporters report sales of: 130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year

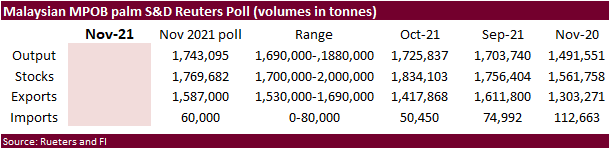

November

MPOB estimates via Reuters

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range, March $11.75-$13.50

Soybean

meal – January $320-$370, March $315-$380

Soybean

oil – January 54.00-59.00, March 54.00-62.00

·

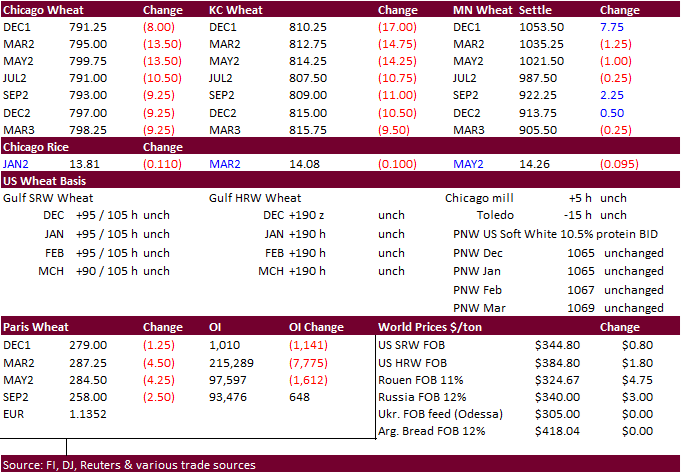

US wheat traded lower in a risk off trade ahead of the USDA report due out on Thursday. The US will see light precipitation across the central Great Plains over the coming week. Snow recently fell across the far western Great

Plains, improving conditions. With a warmup across the US over the next week, that may improve winter wheat conditions ahead of dormancy.

·

For the USDA report, traders are looking for an increase in global ending stocks after Australia’s government projected a record wheat crop.

·

Argentina’s Rosario grains exchange increased their wheat production estimate at 22.1 million tons, up from 20.4 million previously.

·

Funds sold an estimated net 8,000 Chicago soft red winter wheat contracts.

·

We hear China resumed buying of western coast Canadian wheat, which is firming up the wheat spreads.

·

Australia weather looks good through the next ten days.

·

Farm office FranceAgriMer lowered its non-EU French soft wheat exports from 9.4 to 9.2 million tons, still 24% above the volume last season. Soft wheat shipments within the EU were projected at 7.8 million tons, unchanged last

month.

·

Syria closed coastal ports due to bad weather.

Export

Developments.

·

Bangladesh’s lowest offer for wheat was $404.11/ton CIF.

·

Jordan bought 60,000 tons of barley at $303.70/ton c&f for FH July 2022 shipment.

·

Japan in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley on December 15 for arrival by March 10.

·

South Korean flour mills bought 50,000 tons of milling wheat from the US and another 50,000 tons from Australia, for February and April shipment, respectively.

U.S. wheat

-

soft

white wheat 11% protein bought low $390s a ton -

soft

white wheat of 9% protein bought in the low $540s a ton -

hard

red winter wheat of 11.5% protein bought in the mid $380s a ton -

northern

spring/dark northern spring wheat of 14% protein bought in the mid $420s a ton

Australian wheat

-

Australian

standard white (ASW) bought in the mid $360s -

Australian

hard wheat grade AH2 in the low $390s (Reuters)

·

The Philippines seeks 125,000 tons of feed barley and 300,000 tons of feed wheat on December 9 for Feb-Jun arrival.

·

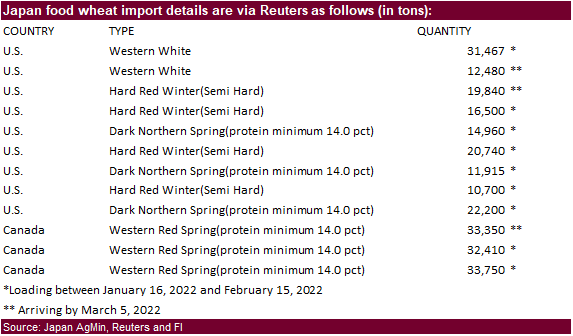

Japan seeks 260,312 tons of food wheat from the US and Canada.

·

Jordan seeks another 120,000 tons of wheat on Dec 9 and seeks 120,000 tons of barley on Dec 8.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.