PDF Attached

US

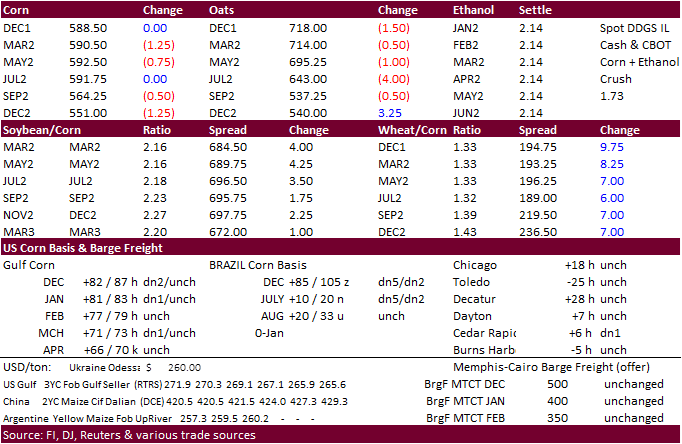

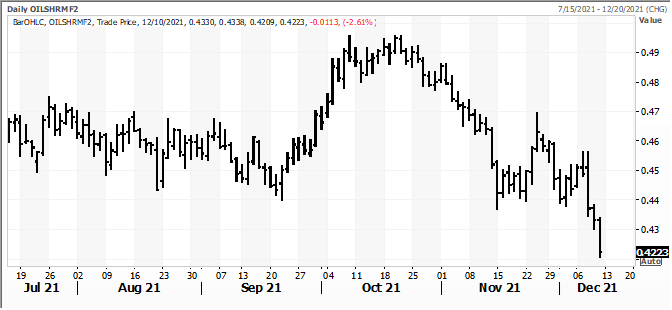

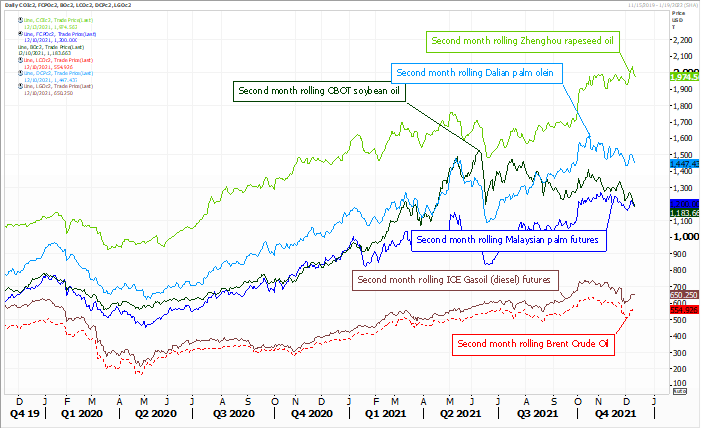

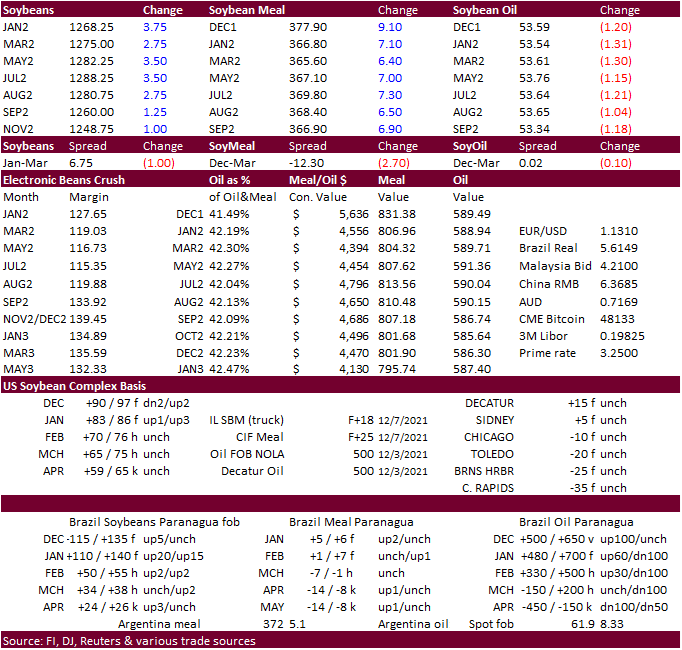

CPI inflation report came in near expectations. Soybeans were higher led by soybean meal. Jan soybean oil traded and settled below a strong support level of 54 cents.

Corn ended lower and Chicago wheat rallied on oversold conditions.

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

-

Ridge

building over Argentina next week will bring on warmer temperatures and help to block precipitation from reaching far southern Brazil and immediate neighboring areas of Uruguay and southern Paraguay -

This

event limits rain to the period from Sunday into Tuesday and after that mostly dry weather is expected

-

Rainfall

Sunday through Tuesday will be distributed relatively well, but amounts will be a little light for a lasting boost in soil moisture.

-

Moisture

totals of 0.25 to 0.75 inch with a few 1.00 to 2.00-inch amounts will be welcome, but the greater amounts may not be widespread enough to fix all crop moisture shortage issues -

Crop

moisture stress in Parana, Brazil and immediate neighboring areas in Paraguay and Mato Grosso do Sul has already been occurring this week and it will be a concern through the weekend -

Relief

is expected Sunday into Tuesday, although it is still debatable how significant that may or may not be -

World

Weather, Inc. believes the relief will be temporary and more stress will evolve later this month -

Portions

of Rio Grande do Sul, Brazil will also experience a mostly dry scenario for much of the next two weeks resulting in slowly rising crop stress -

Rain

will occur late this weekend and early next week, but it will not be enough to restore ideal soil moisture and the following full week should be dry with seasonable temperatures -

Yield

potentials could be threatened eventually, but conditions remain mostly favorable today -

Center

west through northern parts of center south and northeastern Brazil will continue to experience frequent rainfall that will maintain a good long term outlook for soybean, corn, rice and other crop development -

Some

areas in northern Minas Gerais, southern Bahia and southern Tocantins might turn a little too wet for a brief period, but no damage is expected to crops -

Argentina

has some potential for warmer weather next week especially in the north and if that occurs there will be an acceleration in drying rates -

Some

crop stress may begin to evolve since topsoil moisture is already a little restricted -

Subsoil

moisture in Argentina is still rated favorably and will carry crops into next week with a limited amount of concern over dryness -

Timely

rain will become more important to Argentina’s drier areas as we move through the second half of this month -

Northern

and east-central parts of the nation are driest today -

California,

the Great Basin and portions of the Rocky Mountain region will encounter stormy weather this weekend through next week

-

Significant

snowfall will accumulate in the Sierra Nevada and some of the mountains to the east in the Rocky Mountain States -

Significant

rainfall is also expected along the coast and in the central valleys -

Some

strong wind will also occur in coastal areas -

Snowpack

will improve in the mountains -

U.S.

hard red winter wheat production areas will not likely see much “significant” precipitation for the next ten, although a few showers may occur briefly late next week -

A

couple of weather disturbances coming from California and the southwestern desert region may pass through a part of the central and southern Plains Dec. 18-25 that may offer a little relief to dryness in wheat production areas -

Confidence

is low, but there is potential for at least “some” precipitation during that week -

The

high Plains region will be most disfavored for significant moisture -

Today’s

forecast models have removed rain from the wheat region and that change was needed -

Snow

is falling from northern Nebraska and far southern South Dakota through southern Minnesota and Wisconsin to upper Michigan today and tonight -

Snow

accumulations of 3 to 8 inches are expected in southern South Dakota and northern Nebraska with a few amounts to 10 inches in southeastern South Dakota -

Snowfall

of 6 to 12 inches and locally more than 14 inches will occur from southern Minnesota to upper Michigan

-

Travel

delays should be expected and some stress to livestock is anticipated -

As

of dawn today south-central South Dakota was reporting 8-10 inches of snow and the southern Black Hills had 15 inches on the ground -

U.S.

eastern and southern Midwest will be impacted by rain today and again during the second half of next week and into the following weekend

-

A

larger winter storm “may” impact the northern U.S. Plains, upper Midwest and eastern Canada’s Prairies Wednesday into Thursday -

Significant

snow and some rain may accompany the event -

Near

blizzard conditions are possible -

The

storm is a little weaker today than advertised Thursday and that change was needed -

Rain

will also occur from this system in the central and eastern Midwest, Delta and interior southeastern states – mostly during the second weekend of the forecast -

Another

large storm “may” impact the Midwest early in the week of Dec. 20 -

This

event has been relocated to the southeast of where the forecast models were advertising it to be earlier this week.

-

The

change was needed and should verify -

West

Texas may get some needed moisture late next week and into the following weekend, but dry conditions are likely until then

-

U.S.

southeastern states will see a mix of rain and sunshine during the next two weeks with more sunshine than rain -

U.S.

temperatures will be much warmer than usual during the next ten days in the central and eastern portions of the nation -

Cooling

is still expected in the last ten days of December, but mostly in the north-central and western parts of the nation – at least initially. -

Australia

winter crop harvest weather has improved and will continue more favorably through the next ten days

-

No

more crop quality concerns are expected through at least Dec. 20. -

Australia

summer crop conditions are also improving after abundant to excessive rain recently -

China’s

weather will continue rather tranquil through the next ten days to two weeks with brief periods of precipitation and more sunshine

-

Temperatures

will be non-threatening to wheat, rapeseed and livestock -

Southern

India weather has been improving this week and this trend will continue for a while -

Too

much rain in November hurt the quality of some late season crops and raised the need for replanting of many winter crops -

Absolute

dryness is not likely, but rain expected should be brief and light enough to allow some crop development and farming activity to advance relatively well.

-

The

driest weather is expected in the Dec. 15-22 period -

Central

and northern India weather will remain good for winter crop planting and establishment. -

Most

winter crops are likely in the ground and are establishing well -

Early

planted wheat and other small grains may be in the vegetative to early joint stage of development -

Harvest

progress for summer crops has advanced well recently and little change is expected -

Morocco

and northwestern Algeria remain too dry and significant rain must fall soon to get crops planted and established properly -

Soil

moisture and rainfall have been sufficient in northeastern and north-central Algeria and far northern Tunisia, but greater rain is needed in interior crop areas -

Rain

prospects for the drier areas are not very good for the next ten days -

Europe’s

weather is expected to become more tranquil during the next ten days -

Romania

and Spain are the two driest countries in the continent today and some relief should come to Romania in this coming week while the heart of Spain may be left dry for a while -

Soil

moisture elsewhere in Europe has been and will continue to be favorable for winter crops which are dormant or semi-dormant in many areas -

Western

parts of Russia, Belarus and central and western Ukraine will get periods of rain and snow through the next ten days maintaining favorable soil moisture for use in the spring -

No

crop threatening cold is expected in any winter crop region -

Limited

precipitation will continue in the lower half of the Volga River Basin, far eastern Ukraine and Russia’s Southern Region for a while -

South

Africa summer crops will experience a good mix of rain and sunshine over the next ten days supporting additional planting and establishment -

Production

potentials are good this year especially with La Nina prevailing -

West-central

Africa rainfall is expected to be greatest in Liberia and Sierra Leon during the next ten days -

Coastal

areas of Ivory Coast will also be wet biased while most other coffee, cocoa, sugarcane, rice and cotton areas in the region will be left dry

-

Favorable

harvest conditions will prevail outside of the wettest areas -

Ethiopia

rainfall will be minimal over the next seven days resulting in net drying conditions which are not unusual at this time of year -

Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 17 -

Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks, but its intensity should decrease from west to east over the coming week -

Some

flooding may evolve, although western parts of Luzon Island and a part of Mindanao will only receive light precipitation -

The

second week of the forecast may trend drier in western parts of Indonesia -

A

tropical cyclone will evolve south of Guam this weekend and move toward the Philippines.

-

The

storm will bring heavy rain, strong wind and some potential flooding to a part of the nation during the middle to latter part of next week -

Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain

-

One

last wave of heavy rain is expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia this weekend

-

Delays

in the loading and shipping of some goods and services may result due to flooding, but the worst of the stormy pattern may be passing -

Frequent

rain could still induce some delays -

Friday

through the weekend coming up will be the next stormy period -

Next

week’s weather will improve with much less storminess expected -

Ontario

and Quebec weather will improve briefly after this weekend, but another storm system will bring significant moisture to the region late next week and/or in the following weekend. -

Mexico

precipitation will be limited to the east coast over the next ten days with areas from Tamaulipas to Veracruz and Chiapas most impacted -

Resulting

rainfall will rarely bolster soil moisture for very long -

Net

drying is expected in most other areas -

Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica -

Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

-

Not

much change is expected through mid-week next week -

Rain

late next week and into the following weekend may impact a few northern Iraq and western Iran locations while other areas from Syria to Jordan and Israel will remainder biased through most of next week -

Colombia

and Venezuela precipitation is expected to occur periodically in coffee and sugarcane production areas during the next ten days, but no excessive rain is expected -

Today’s

Southern Oscillational Index was +11.80 and it was expected to move a little lower over the next few days -

New

Zealand rainfall is expected to be turn wetter than usual over the coming week with greatest rain in North Island and northernmost parts of South Island -

Temperatures

will be seasonable

Friday,

Dec. 10:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board’s data on November palm oil reserves, output and exports - Malaysia’s

Dec. 1-10 palm oil exports - HOLIDAY:

Thailand

Monday,

Dec. 13:

- Monthly

MARS bulletin on crop conditions in Europe - USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals

Tuesday,

Dec. 14:

- Australia

Agricultural Commodity Statistics 2021 - Vietnam’s

customs dept to release November commodity trade data - EU

weekly grain, oilseed import and export data - New

Zealand Food Prices

Wednesday,

Dec. 15:

- EIA

weekly U.S. ethanol inventories, production - U.S.

Green Coffee Association releases monthly inventory data, 3pm - Brazil’s

Unica publishes cane crush, sugar output data (tentative) - Malaysia’s

Dec. 1-15 palm oil exports

Thursday,

Dec. 16:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Bangladesh

Friday,

Dec. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

FAS issues world coffee report, with supply-demand data

Saturday,

Dec. 18:

- China’s

2nd batch of Nov. trade data, including imports of cotton, corn, wheat and sugar

Source:

Bloomberg and FI

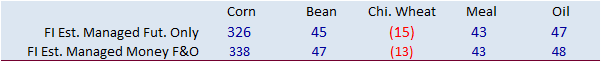

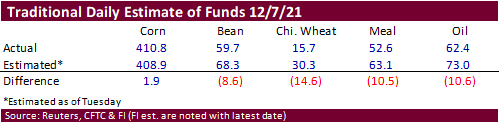

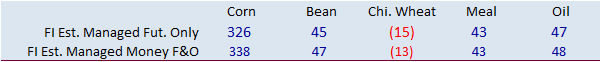

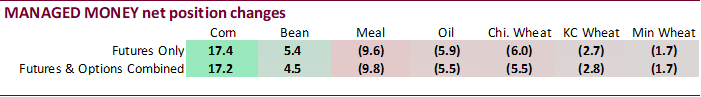

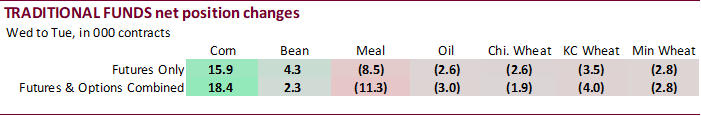

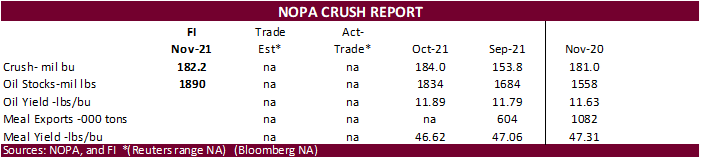

Funds

were buyers of corn and soybeans for the week ending 12/7 while they sold Chicago wheat, soybean meal and soybean oil. Funds were less long beans, wheat, and the products. For corn they were, for a change, near expectations. The managed money net long position

for soybean oil was down 23,600 contracts to 58,800 contracts since November 23.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

242,978 21,334 425,782 -5,261 -635,586 -28,904

Soybeans

13,500 6,946 183,256 -8,256 -157,837 -1,219

Soyoil

17,470 839 120,642 -7,632 -142,406 6,108

CBOT

wheat -21,377 718 116,678 -3,685 -88,604 2,304

KCBT

wheat 29,177 -4,027 58,846 476 -91,272 1,551

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

332,501 17,232 268,095 -2,402 -635,001 -28,826

Soybeans

37,882 4,457 146,122 -2,972 -168,583 -1,829

Soymeal

27,898 -9,783 89,251 -3,450 -160,461 16,327

Soyoil

58,828 -5,532 95,821 -2,780 -150,966 5,126

CBOT

wheat 721 -5,480 67,720 -843 -70,555 2,070

KCBT

wheat 59,575 -2,793 28,156 408 -79,345 1,582

MGEX

wheat 12,545 -1,659 1,056 -289 -27,646 1,324

———- ———- ———- ———- ———- ———-

Total

wheat 72,841 -9,932 96,932 -724 -177,546 4,976

Live

cattle 79,850 1,333 81,830 1,134 -163,132 -1,618

Feeder

cattle 4,998 92 3,572 -267 -934 532

Lean

hogs 47,204 -9,168 58,265 980 -96,055 4,798

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

67,578 1,165 -33,173 12,831 1,724,182 42,788

Soybeans

23,499 -2,185 -38,919 2,529 791,580 700

Soymeal

18,569 -1,549 24,742 -1,545 418,151 -12,166

Soyoil

-7,977 2,501 4,295 685 425,461 -11,057

CBOT

wheat 8,812 3,589 -6,697 665 440,731 -8,799

KCBT

wheat -11,634 -1,198 3,249 2,001 247,516 -3,863

MGEX

wheat 7,987 -1,129 6,059 1,753 79,583 259

———- ———- ———- ———- ———- ———-

Total

wheat 5,165 1,262 2,611 4,419 767,830 -12,403

Live

cattle 20,234 -920 -18,782 72 350,160 -19,220

Feeder

cattle -501 -505 -7,135 148 47,184 1,647

Lean

hogs 7,943 1,234 -17,358 2,157 285,784 -3,454

Macros

US

CPI (M/M) Nov: 0.8% (est 0.7%; prev 0.9%)

CPI

(Y/Y) Nov: 6.8% (est 6.8%; prev 6.2%) CPI Ex Food And Energy (M/M) Nov: 0.5% (est 0.5%; prev 0.6%) CPI Ex Food And Energy (Y/Y) Nov: 4.9% (est 4.9%; prev 4.6%)

Canadian

Capacity Utilization Rate Q3: 81.4% (est 83.0%; prev 82.0%)

·

CBOT corn ended lower after trading two-sided. Eventually wheat/corn spreading and soybeans easing off contract highs influenced prices. China buying Ukrainian corn this week over US origin is bearish.

China bought an unknown amount of Ukraine corn for January through April shipment, according to Rueters.

·

March corn ended up 1.0% for the week.

·

Fund were even in corn today.

·

Canadian corn imports have surged in the western part of the country due to high wheat feed wheat prices.

·

Argentina plans to loosen restrictions on beef exports.

Export

developments.

·

China bought a large amount of Ukrainian corn this week.

EIA:

The Brent crude oil price decline on November 26 was among the largest in years

https://www.eia.gov/todayinenergy/detail.php?id=50618&src=email

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

Soybeans ended higher from strength in soybean meal. Renewed concerns over US supply shortages of dry lysine drove meal higher. January soybean meal hit buy stops after trading through its 200-day MA

of $363.80/short ton. Soybean oil fell on meal/oil spreading and technical selling. January soybean oil fell to its lowest level since mid-June. Some of the selling was technical. January soybean oil traded through its 54-cent strong support level. It hit

a low of 53.94. A close below 54 in coming days suggests the next level of support at 52.00 cents.

·

Funds bought an estimated net 3,000 soybean contracts, bought 7,000 soybean meal, and sold 4,000 soybean oil.

·

US soybean oil is still favored over palm oil when imported into India. At the cash fob level, but the trade needs to see export developments to turn soybean oil futures around.

·

Meal over soybean oil today pulled the January oil share below 42.50 percent, lowest since June.

·

Malaysian palm oil futures traded up 22 ringgit and cash was unchanged at $1,192.50/ton. The contract was up 3% for the week.

·

AmSpec reported December 1-10 Malaysian palm shipments at 544,059 tons, up slightly from 543,944 tons November 1-10. ITS reported a 0.2% increase to 572,689 tons from the comparable period month ago.

·

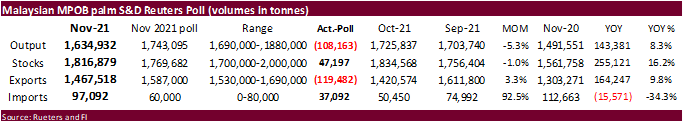

MPOB Malaysian palm data was not very supportive as end of November stocks came in 47,200 tons above expectations and exports fell short by 119,500 tons. However, production was less than expected and

imports far exceeded the average trade guess, leaving some to figure domestic use was near expectations.

November

MPOB versus Reuters estimates

·

Japan said there is a 60 percent chance of La Nina lasting through the winter (NH).

·

China crush margins on our analysis was last $1.95 ($2.02 previous) versus $2.22 at the end of last week and compares to $0.93 a year ago.

Export

Developments

·

None reported

Source:

Reuters and FI

Updated

12/10/21

Soybeans

– January $12.00 to $13.05 range, March $11.75-$13.50

Soybean

meal – January $330 to $375, March $315-$380

Soybean

oil – January 52.00 to 59.00, March 52.00-60.00 (down 200 both ends of the range)

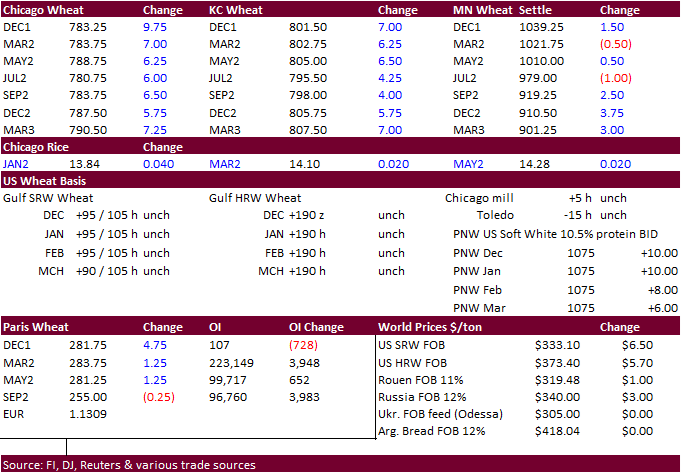

·

US wheat was higher in Chicago and KC and mixed in Minneapolis. Oversold conditions and higher Matif wheat kicked off the buying. The selling pressure in Minneapolis limited gains in Chicago. MN could

have been under pressure after Reuters noted China this week booked at least several hundred thousand tons of French wheat and barley, several thousand tons of Australian wheat, and also purchased Ukrainian corn and barley. This story did support March Paris

wheat (settled up 1.25 euros at 283.50/ton) but we think its bearish for US wheat as they didn’t participate. China was thought to have bought 6 to 10 cargoes of French wheat for January through March shipment. About 4 cargoes of French barley and up to 10

cargoes of Ukraine barley were booked for July through August next year.

·

Funds bought an estimated net 4,000 Chicago soft red winter wheat contracts.

·

For the week CBOT SRW was down 2.3%, K.C. HRW was down 2.6% and MGEX spring wheat was flat (Reuters)

·

Britain wheat exports during October slowed to 119,332 tons from 159,953 tons, bringing Jul-Oct exports to 751,300 tons vs. 925,500 previous season for that period.

·

Egypt said they have enough wheat reserves to cover 5.1 months of consumption.

·

Russia’s export duty on wheat will increase to $91 per ton from $84.90 per ton as of December 15. Barley will rise to $78.70 per ton from $75.10 per ton, and on corn to $54.40 per ton from $54.30 per

ton. The new duty rates will be valid until December 21.

·

Iraq plans to import 500,000 tons of wheat in January after securing funds from the Economic Ministerial Council.

·

Central and western Ukraine are expected to see showers this week, improving soil moisture for wheat, according to Maxar. (Bloomberg)

·

Australia weather looks good through the next week.

Export

Developments.

·

South Korea’s MFG bought 60,000 tons of Indian feed wheat at $351/ton c&f for Jan 20-Feb 15 shipment.

·

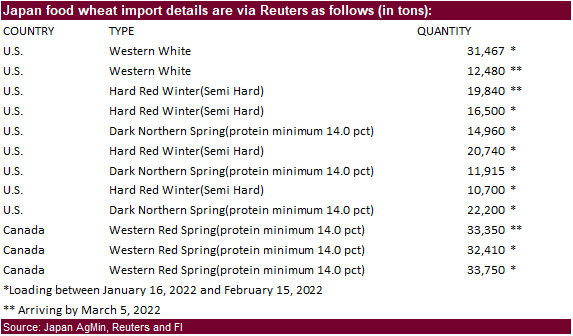

Japan bought 260,312 tons of food wheat from the US and Canada. Original tender details:

·

Japan in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley on December 15 for arrival by March 10.

·

Jordan seeks 120,000 tons of feed barley on December 15.

Rice/Other

·

South Korean Agro-Fisheries & Food Trade Corp. seeks another 22,000 tons of rice from the US, set to close Dec 16.

·

Results awaited but no purchase was believed: South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.