US

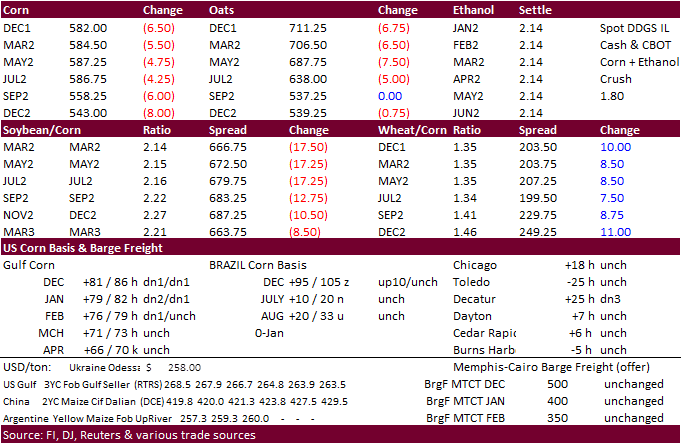

balance sheets attached. Lower start to the week in the soybean complex and corn. Chicago and KC wheat ended higher and MN mixed. Global demand for wheat remains very strong. US soybean inspections slowed from the previous week while wheat and corn were near

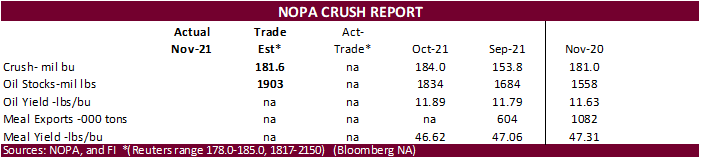

unchanged. We see no major weather problems across South America. The next major report we will see is the NOPA crush on Wednesday. We look for a record daily crush for the month of November and very high soybean oil yield. Egypt’s GASC seeks roughly 30,000

tons of soybean oil and about 10,000 tons of sunflower oil on Tuesday for February 5-25 arrival.

Algeria and Turkey are in for wheat.

WEATHER

EVENTS AND FEATURES TO WATCH

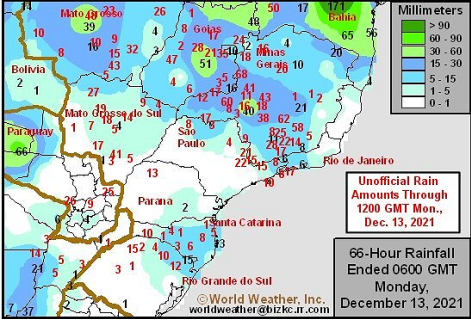

- Southern

Brazil will receive some important rainfall early this week - Rain

will fall early to mid-week this week and possibly again during mid-week next week

- The

early week rainfall this week is advertised a little better distributed than that of Friday with some rain already falling in northern Rio Grande do Sul Sunday - The

rain event for next week looks weak and may not impact all areas as desired - No

heavy or generalized rain of significance is expected, but enough coverage and amounts will occur early this week to reduce some of the region’s crop stress temporarily - Greater

rain will still be needed - Rainfall

early to mid-week this week in southern Brazil will vary 0.30 to 1.00 inch and a few 1.00- to 2.00-inch amounts - The

greater rainfall will be localized and most of it will occur through Tuesday afternoon - Next

week’s rain will be brief and more sporadic - The

moisture may not be great enough to seriously alter the drying trend - The

bottom line for the next ten days to two weeks will remain one of concern because of less than usual rainfall, but if timely precipitation can continue it will help to curb potential production losses especially while temperatures are not excessively warm - Temperatures

should remain seasonable during the next two weeks - Center

west through northeastern Brazil, including northern portions of center south Brazil will get routinely occurring rainfall over the next two weeks maintaining a good generalized outlook for summer crop development - Some

heavy rainfall is being advertised for a part of these areas which may induce local flooding, but most of the heavier rainfall should be spread out over time to help reduce some of the potential impact of excessive rain - Nevertheless,

a decrease in rain intensity may eventually be needed - Brazil

weekend rainfall through dawn today scattered in many areas - Rainfall

varied from 0.05 to 0.60 inch in northern Rio Grande do Sul and Santa Catarina and 0.05 to 0.71 inch in Mato Grosso do Sul with local totals over 1.00 inch (although southeastern parts of the state was dry) - Rainfall

in Minas Gerais increased Sunday night with total coverage for the weekend now near 80% and rain amounts in the south were 0.40 to 2.43 inches - Mato

Grosso reported 0.10 to 0.60 inch with a few totals to nearly 2.00 inches - Central

and northern Goias, Bahia and Tocantins were wettest with many areas reporting 0.60 to 2.50 inches - One

location in central Bahia reported 6.73 inches - Dry

or mostly dry weather occurred in central and southern Rio Grande do Sul, in much of Parana, Sao Paulo, central parts of Minas Gerais and southern Goias

- Brazil

highest weekend temperatures were in the 80s and lower 90s with a few extremes to 100 in far western Mato Grosso do Sul and central and northern parts of Paraguay - Argentina

weather outlook has not changed greatly from that of late last week; There will be a few showers and thunderstorms in eastern parts of the nation early this week - Rainfall

is still advertised to be more limited during the second half of this week through most of next week - Crop

moisture stress will resume as some areas dry out over time - None

of the crop stress in Argentina thus far this season has been so overwhelming to seriously cut into yield potentials, but some crop areas are walking a fine line between serious stress and good crop development and any warm to hot weather without a good soaking

of rain falling first in northern or eastern parts of the nation could lead to yield reductions - Argentina

rainfall was concentrated from southeastern through central to northwestern Buenos Aires, Cordoba, northeastern La Pampa and Santa Fe Friday through Sunday afternoon - Rainfall

varied from 0.30 to 2.00 inches in Buenos Aires, La Pampa and Cordoba and mostly less than 0.88 inch in Santa Fe - Other

showers were sporadically distributed leading to net drying - Argentina’s

highest temperatures during the weekend were in in the 80s and lower 90s Fahrenheit except in far northern cotton areas where some readings in the upper 90s to over 100 degrees were noted.

- Some

ridge building aloft over Argentina late this week and into early next week will bring on warmer temperatures and help to block precipitation from reaching far southern Brazil and immediate neighboring areas of Uruguay and southern Paraguay - This

event limits rain for Argentina and southern Brazil to the first half of this week - Crop

moisture stress in Parana, Brazil and immediate neighboring areas in Paraguay and Mato Grosso do Sul has already occurred over the past week and it will be eased with the early to mid-week rainfall, but World Weather, Inc. believes the relief will be temporary

and more stress will evolve later this month - U.S.

weather during the weekend was stormy in several areas - Snowfall

of 3 to 10 inches occurred in southern South Dakota Friday with local totals to 12 inches at Mission, SD and in a couple of locations east southeast of Sioux Falls, S.D.

- Snowfall

from southern Minnesota to upper Michigan ranged from 4 to 12 inches with local totals to 15 inches in upper Michigan and parts of northern Wisconsin while the Minneapolis, MN area reported 15 to 21 inches - Snow

also fell lightly in central and eastern Nebraska central and northern Iowa and a apart of interior southern Wisconsin where amounts varied from a dusting to 4 inches - Rain

was widespread from eastern Texas and the Delta into the southeastern states and from those areas northward through the central and eastern Midwest - Moisture

totals varied from 0.75 to nearly 2.00 inches from the Tennessee River Basin and a few areas in the interior southeastern states north into the southern Great Lakes region

- An

outbreak of severe thunderstorms was noted in the Midwest from southeastern Missouri to central Illinois, parts of Indiana and northwestern Ohio as well as from northeastern Arkansas through northwestern Tennessee to central Kentucky - Considerable

property damage occurred with some loss of life, especially in the band from Arkansas to Kentucky.

- Temperatures

were unusually warm Friday and Saturday from the southern Plains into the southeastern states with highs in the 70s and 80s - In

contrast highs were in the 20s and 30s in the upper Midwest and central Plains Friday and Saturday with some warming in these areas Sunday - Subzero

degree low temperatures occurred in eastern Colorado, western Nebraska, Wyoming and near Grand Forks, ND - Stormy

weather has begun in northern California and western portions of Washington and Oregon and the stormy conditions will shift southward through the heart of California today with the storm diminishing Tuesday - A

follow up storm is expected late Wednesday and Thursday producing additional moisture in California, the Great Basin and a few areas in western Washington and Oregon - Moisture

totals in coastal areas will range from 2.00 to more than 5.00 inches - Moisture

totals in the Sierra Nevada will vary from 4.00 to more than 6.00 inches with snowfall to vary in the range of 1 to 3 feet.

- Moisture

totals from the Yakima Valley through the heart of Oregon and the Snake River region will vary from 0.20 to 0.75 with a few totals over 1.00 inch - The

lightest precipitation will fall in the Snake River Valley of Idaho and the Yakima Valley in Washington where more moisture will be needed - The

early week storm in the western United States this week will move across the northern Plains Wednesday into Thursday producing high wind speeds, rain and snow - Blizzard

or near blizzard conditions are expected in the northern Plains and upper Midwest

- Heavy

snow is possible in a part of Minnesota and the eastern Dakotas once again - Strong

thunderstorms will return again to the Midwest as much colder air moves into the region late this week behind the rainfall

- The

risk of severe weather will be greatest late Thursday and Friday in the same areas impacted by severe weather during the weekend (i.e. northeastern Arkansas to Kentucky) - The

mid-week storm system coming into California and the great Basin this week will dissipate as it moves through the Rocky Mountains, but its energy will gather again over the lower Midwest and Delta this coming weekend producing another storm system with rain

and snow likely - Some

of this storm’s energy will impact the southern Plains with a wintry mix of precipitation types possible in a part of north-central Texas and southern Oklahoma

- U.S.

weather may be similar in the second week of the outlook with weakening storms coming into the western U.S. that will redevelop in the Delta, Tennessee River Basin lower and eastern Midwest and northeastern states.

- Another

storm or two may evolve in the northeastern Plains and upper Midwest while hard red winter wheat areas are left dry - U.S.

temperatures will be well above average in this first week of the outlook in the central and eastern states, but colder in the western states

- Next

week’s weather will bring additional cooling to the west and north-central parts of the nation while warm weather shifts farther to the southeast - U.S.

hard red winter wheat areas will not be getting enough precipitation over the next two weeks in areas that need it most to make much difference to crop or field conditions - California’s

big precipitation event expected this week will greatly improve mountain snowpack and soil moisture, but it is expected to only scratch the surface of the region’s moisture deficits and more rain and snow will have to fall over the winter to more fully replenish

water supply - West

Texas precipitation this week will be limited and brief, but with much of the harvest done there the impact will be low - West

Texas like much of the southwestern Plains needs moisture for soil improvements ahead of planting in the spring - Late

next week will be the earliest that a change can take place - Australia

winter crop harvest weather improved and will continue more favorably through the next ten days

- No

more crop quality concerns are expected through at least Dec. 20, despite some shower activity infrequently.

- Australia

summer crop conditions are also improving after abundant to excessive rain ended recently - China’s

weather will continue rather tranquil through the next ten days to two weeks with brief periods of precipitation and more sunshine

- Temperatures

will be non-threatening to wheat, rapeseed and livestock - Southern

India weather has been improving recently and this trend will continue for a while - Too

much rain in November hurt the quality of some late season crops and raised the need for replanting of many winter crops - Absolute

dryness is not likely, but rain expected should be brief and light enough to allow some crop development and farming activity to advance relatively well.

- The

driest weather is expected in the Dec. 15-24 period - Central

and northern India weather will remain good for winter crop planting and establishment. - Most

winter crops are likely in the ground and are establishing well - Early

planted wheat and other small grains may be in the vegetative to early joint stage of development - Harvest

progress for summer crops has advanced well recently and little change is expected - Precipitation

expected late next week in the far north will be good for some winter crops, although the event is too far out to have high confidence in its occurrence - Morocco

and northwestern Algeria remain too dry and significant rain must fall soon to get crops planted and established properly - Soil

moisture and rainfall have been sufficient in northeastern and north-central Algeria and far northern Tunisia, but greater rain is needed in interior crop areas - Rain

prospects for the drier areas are not very good for the next ten days - Europe’s

weather is expected to be tranquil during the next ten days - Romania

and Spain are the two driest countries in the continent today, although some rain fell in parts of Romania during the weekend - Spain

is expected to remain dry biased for an extended period of time - Soil

moisture elsewhere in Europe has been and will continue to be favorable for winter crops which are dormant or semi-dormant in many areas - Very

little rain will fall in western Europe for the next seven days and perhaps longer - Western

parts of Russia, Belarus and central and western Ukraine will get periods of rain and snow through the next ten days maintaining favorable soil moisture for use in the spring - No

crop threatening cold is expected in any winter crop region, although cooling is expected this weekend into next week and that should bring snow to many areas deep into Ukraine and Russia’s Southern Region - Temperatures

may turn cold enough to threaten crops next week, but the snow should provide adequate protection against the cold - South

Africa summer crops will experience a good mix of rain and sunshine over the next ten days supporting additional planting and establishment - Production

potentials are good this year especially with La Nina prevailing - West-central

Africa rainfall is expected to be confined to coastal areas only - Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas - Ethiopia

rainfall will be minimal over the next seven days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 17 - Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks, but its intensity should be lighter than usual

- The

only exception will be in the central and southern Philippines where a tropical cyclone is expected to pass later this week - Tropical

Depression 28W has evolved southeast of Yap Island in the far western Pacific Ocean and it will move to the Philippines later this week as a typhoon

- The

storm will bring heavy rain, strong wind and some potential flooding to central and southern portions of the nation Wednesday into Friday - Some

crop and property damage will be possible - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain later this week and into the weekend - Ontario

and Quebec weather will see improved weather until Wednesday into Thursday of this week and again next week when some snow and rain will be possible.

- Northern

Mexico will get some precipitation Friday into the Monday of next week - The

moisture will be beneficial for winter crops, although more rain will be needed - Showers

elsewhere will be erratic and mostly light over the next ten days - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Not

much change is expected through mid-week this week - Rain

late this week and into the following weekend may impact a few northern Iraq and western Iran locations while other areas from Syria to Jordan and Israel will remainder biased through most of next week - Colombia

and Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillational Index was +11.46 and it was expected to move erratically over the coming week - New

Zealand rainfall is expected to be wet this week in North Island and northern parts of South Island while southern parts of South Island receive a restricted amount of moisture - Temperatures

will be seasonable

Monday,

Dec. 13:

- Monthly

MARS bulletin on crop conditions in Europe - USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals

Tuesday,

Dec. 14:

- Australia

Agricultural Commodity Statistics 2021 - Vietnam’s

customs dept to release November commodity trade data - EU

weekly grain, oilseed import and export data - New

Zealand Food Prices

Wednesday,

Dec. 15:

- EIA

weekly U.S. ethanol inventories, production - U.S.

Green Coffee Association releases monthly inventory data, 3pm - Brazil’s

Unica publishes cane crush, sugar output data (tentative) - Malaysia’s

Dec. 1-15 palm oil exports

Thursday,

Dec. 16:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Bangladesh

Friday,

Dec. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

FAS issues world coffee report, with supply-demand data

Saturday,

Dec. 18:

- China’s

2nd batch of Nov. trade data, including imports of cotton, corn, wheat, and sugar

USDA

inspections versus Reuters trade range

Wheat

245,090 versus 150000-400000 range

Corn

810,395 versus 700000-1200000 range

Soybeans

1,723,970 versus 1900000-2300000 range

China

corn and soybean shipments were ok. 841k soybeans to China are down from 1.46MMT week earlier. Corn shipments to China this week were 375,350 tons versus 136,513 tons week ago.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 09, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/09/2021 12/02/2021 12/10/2020 TO DATE TO DATE

BARLEY

0 73 0 10,010 17,751

CORN

810,395 774,958 924,246 10,205,976 12,092,888

FLAXSEED

0 0 0 124 437

MIXED

0 0 0 0 0

OATS

0 0 998 300 2,593

RYE

0 0 0 0 0

SORGHUM

119,720 169,626 199,093 1,233,684 1,728,068

SOYBEANS

1,723,970 2,334,121 2,458,271 25,447,765 32,325,343

SUNFLOWER

0 0 0 432 0

WHEAT

245,090 246,257 263,440 11,393,958 13,739,984

Total

2,899,175 3,525,035 3,846,048 48,292,249 59,907,064

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

Saudi

Energy Minister: Global Oil Output Could Fall By 30M Bpd By 2030

80

Counterparties Take $1.6 Tln At Fed Reverse Repo Op. (prev $1.507 Tln, 77 Bids)

·

USDA US corn export inspections as of December 09, 2021 were 810,395 tons, within a range of trade expectations, above 774,958 tons previous week and compares to 924,246 tons year ago. Major countries included China for 275,350

tons, Mexico for 256,847 tons, and Japan for 151,077 tons.

·

US energy markets were lower by the time the ag markets closed.

·

Spot basis bids for corn were steady to weak at processors, elevators and river terminals in the eastern U.S. Midwest early on Monday (Reuters).

·

There are no major weather issues with South America and Argentina will see favorable precipitation this week, which should provide some relief for producers holding out on planting corn in order to minimize risks for crop loss.

Export

developments.

·

China bought a large amount of Ukrainian corn last week.

Argentina

7-day accumulated precipitation (through Sunday)

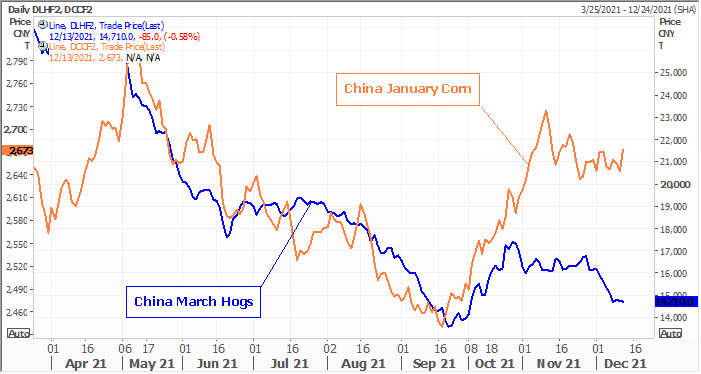

China

hog prices have been trending lower

Source:

Reuters and FI

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

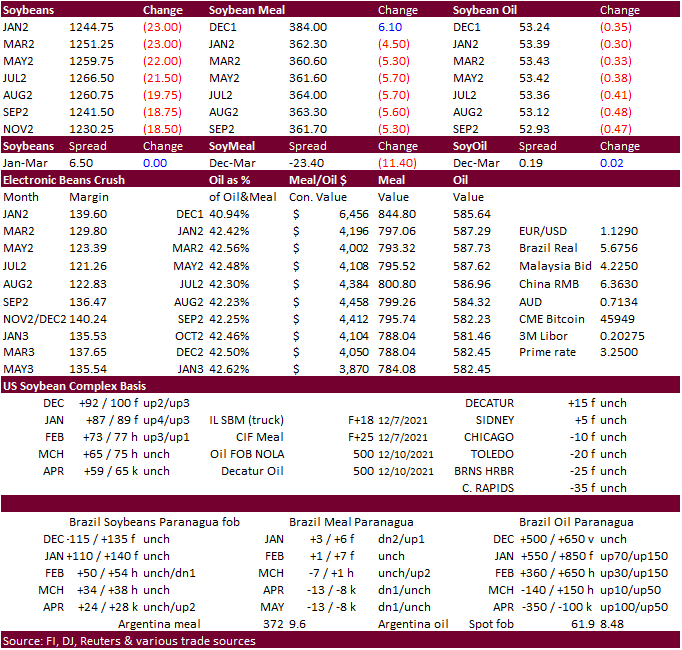

Soybean prices ended sharply lower on slowing USDA export inspections to China and talk of big South American crop. No major weather problems are seen across South America. South Brazil and Argentina will turn drier following

a short blast of rains this week. Rainfall early to mid-week this week in southern Brazil will vary 0.30 to 1.00 inch and a few 1.00- to 2.00-inch amounts, according to World Weather, Inc.

·

January soybeans closed 23.50 cents lower at $12.5075, nearly at its 50-day MA.

·

January soybean meal traded below its 200-day MA of $363.80 and closed $4.70 lower at $362.10/short ton.

·

January soybean oil settled 34 points lower at 53.35. We see support around 52 cents.

·

The price declines in soybean oil may attract some export business this week.

·

We raised our US SBO yield to 11.72 and compares to USDA’s recently revised (higher) 11.75 and 11.73 pounds per bushel for 2020-21. The record was 11.82 during the 2012-13 season.

·

India rejected a deadline extension to allow GM soybean meal imports out to March 31, beyond current end of January.

·

Brazil is nearly complete with soybean plantings. 96 percent had been planted as of late last week. Some replanting was noted across parts of RGDS. AgRural also noted some stress to the soybean and corn crops across western Parana.

·

India vegetable oil imports increased 11% from a year earlier to 1.17MMT. Soybean oil imports were more than double from year ago at 474,160 tons. Crude palm oil imports were only 477,160 tons versus 589,268 tons year ago.

·

The next major report we will see is the NOPA crush on Wednesday. We look for a record daily crush for the month of November and very high soybean oil yield.

Export

Developments

·

Egypt’s GASC seeks roughly 30,000 tons of soybean oil and about 10,000 tons of sunflower oil on Tuesday for February 5-25 arrival.

Updated

12/10/21

Soybeans

– January $12.00 to $13.05 range, March $11.75-$13.50

Soybean

meal – January $330 to $375, March $315-$380

Soybean

oil – January 52.00 to 59.00, March 52.00-60.00

·

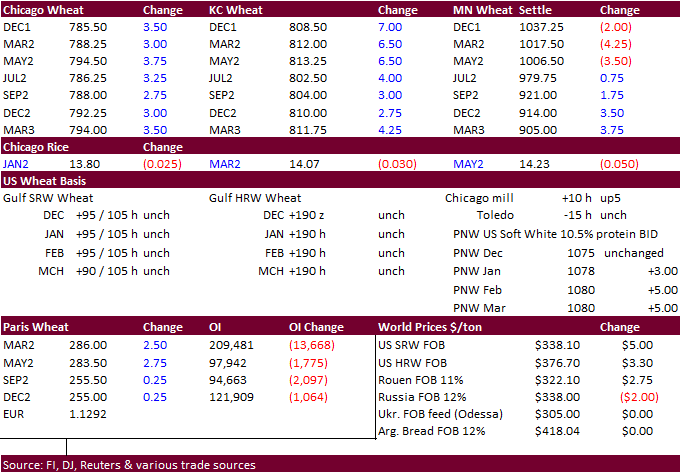

US Chicago and KC wheat rallied on strong global import demand. MN ended mixed with nearby contracts lower. Turkey and Algeria floated import tenders. Matif wheat was up 2.50 euros at 286.25.

·

USDA US all-wheat export inspections as of December 09, 2021 were 245,090 tons, within a range of trade expectations, below 246,257 tons previous week and compares to 263,440 tons year ago. Major countries included Japan for 63,109

tons, Nigeria for 47,767 tons, and Taiwan for 28,528 tons.

·

Russian wheat export fob prices 12.5% protein at the end of last week was around $334/ton, down $3.00/ton previous week (IKAR). SovEcon reported a $2/ton decline to $338/ton.

·

IKAR sees the 2021 Russian wheat crop at 75.5-76.7MMT and total grain crop at 121.7-122.7MMT.

·

Russia customs: 26.8MMT of wheat had been exported versus 29.3MMT during the same period year ago. The crop year starts July 1.

·

Ukraine grain exports since July 1 were 28.3MMT, up 21% from year earlier. That included 15 million tons of wheat, 5 million tons of barley and 7.9 million tons of corn.

·

Australia winter crop harvest weather improved and will continue more favorably through the next ten days

Export

Developments.

·

Japan in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley on December 15 for arrival by March 10.

·

Algeria seeks at least 50,000 tons of milling wheat on Tuesday, open until Wednesday, for LH Jan through February shipment.

·

Jordan seeks 120,000 tons of wheat on December 16.

·

Jordan seeks 120,000 tons of feed barley on December 15.

Rice/Other

·

South Korean Agro-Fisheries & Food Trade Corp. seeks 22,000 tons of rice from the US, set to close Dec 16.

March

Matif wheat

Source:

Reuters and FI

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.