PDF Attached

(daily estimate of funds will be sent out later or in the morning)

Soybean

meal/oil spreading dominated the market action. Soybeans were up sharply. Corn traded two-sided and wheat fell on follow through selling.

Some

of the reasons for the strength in meal and weakness in soybean oil:

-

Strong

soybean meal end user buying ahead of holidays -

Lysine

shortages -

Jan

soybean meal contract outside day higher -

Jan

SBO chart technically bearish, low on the day 52.01 cents -

NOPA

end of Nov soybean oil stocks over 1.9 billion pounds -

Oil

share selling/correction

Correction

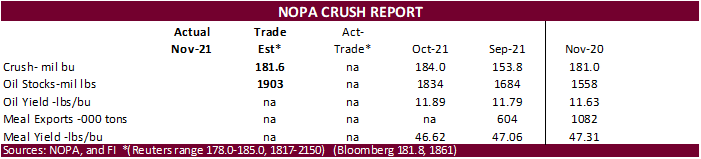

to NOPA rankings: NOPA is due on Wednesday and the average trade guess for the November crush is 181.64 million bushels, above 181.02 million during November 2020 and down from 184 million crushed during October 2021.

If realized, the daily adjusted crush would be 4th largest in history. Record was established October 2020, not November as previously reported.

WEATHER

EVENTS AND FEATURES TO WATCH

- Tropical

Storm Rai was still expected to move through the central Philippines Wednesday into Friday. - The

storm will produce very heavy rain and flood conditions across the Visayan Islands and produce very strong wind speeds - Rainfall

of 5.00 to 15.00 inches and local totals to 20.00 inches will be possible - Wind

speeds will be greater than 100 mph when the storm begins its trek across the archipelago - Damage

to crops and property will be possible. - The

storm will end up over the South China Sea late this week and during the weekend where it may dissipate - A

close watch on its movement will be needed since it could pose a threat to Vietnam - Southern

Brazil received some welcome rainfall Monday and early today - Southern

rice and corn areas were wettest with 0.35 to more than 2.00 inches were noted

- Central

Rio Grande do Sul reported 0.20 to 0.60 inch while the north reported no more than 0.30 inch - Beneficial

rain also occurred in Sao Paulo and a few far northwestern Parana locations of interior southern Brazil Monday with moisture totals of 0.20 to 0.72 inch and a few amounts of 1.00 to 2.15 inches - The

bulk of Parana, southern Mato Grosso do Sul, southeastern Paraguay and Santa Catarina, Brazil were dry again Monday - Crop

stress is rising in these areas - Some

rain is expected to fall over the next couple of days offering a short-term bout of relief, but greater rain must occur to more seriously improve soil moisture for long term crop development.

- A

ridge of high pressure is still expected to build over Argentina briefly late this week into early next week

- Much

warmer temperatures, suppressed rainfall and rising crop moisture stress will resume - Showers

are expected as the ridge breaks down next week, but it is unclear how significant resulting rainfall will be in easing moisture stress - No

additional excessive heat is expected, but extreme highs in the 90s to over 100 degrees Fahrenheit are expected for a few days while the ridge is in place - Recent

rain has much of Argentina’s Buenos Aires, Cordoba, Santa Fe and La Pampa crop areas in mostly good condition from a moisture perspective, but areas to the north and east are still dry and need rain.

- Classic

La Nina conditions will prevail in South America for the next few weeks resulting in less than usual rain in eastern Argentina, Uruguay, southern Brazil and southern Paraguay - Timely

rain can still support crops, but it will be imperative that the rain occurs routinely especially if it is going to be lighter than usual - Some

yield reduction seems likely, but how serious that reduction will be determined by temperatures and the timeliness of what rainfall evolves - Northern

Brazil will continue to receive frequent rain during the next couple of weeks with a few areas of heavy rain and local flooding - No

serious impact is expected on crops from too much rain right now, but concern remains for at least some harvest delay in January if the wet weather pattern prevails as it may - U.S.

hard red winter wheat areas will be mostly dry for the next two weeks - Some

of this dry bias will also impact a part of the western U.S. Corn Belt - Very

warm temperatures and strong, drying, wind speeds are likely to evolve over the next two days with excessive wind expected Wednesday that will induce some blowing dust and property damage - Wind

gusts of 60-80 mph will be possible in a part of the region Wednesday - Temperature

extremes will reach above 80 degrees Fahrenheit briefly Wednesday - Very

low humidity is expected over the next couple of days, but especially Wednesday resulting in a further loss in soil moisture - Cooling

is expected later this week, but the dry bias will prevail - U.S.

lower Midwest, northern Delta and Tennessee River Basin will be vulnerable to another round of strong to severe thunderstorms Friday into Saturday - Heavy

rainfall is expected and possible local flooding - Rainfall

of 1.00 to 3.00 inches and local totals to 4.00 inches will be possible near and south of the Ohio River and in the northernmost Delta - Intense

weather will occur in the upper U.S. Midwest Wednesday into Thursday with strong wind speeds, unusually warm temperatures initially and then much colder temperatures, a risk of thunderstorms and then some heave snow and blizzard conditions - These

conditions are most likely in Minnesota, the eastern Dakotas and a few areas in northwestern Iowa and northeastern Nebraska - California’s

central valleys received 1.00 to 3.00 inches of rain Monday while impressive snowfall in the Sierra Nevada - The

precipitation will continue significantly today, ease up for a while tonight and Wednesday and then resume again Wednesday night into Thursday - The

moisture will improve runoff and water reservoir levels in the spring when the mountain snow melts - Some

increase in reservoir levels will occur prior to that time because of the heavy rain that has been occurring - The

drought is far from being over, but any rain and snow is welcome - U.S.

southeastern states and Delta get a mix of rain and sunshine during the next two weeks maintaining a favorable moisture balance, although parts of the southeastern states will need greater rain prior to spring - Unusual

warmth in the eastern half of the United States over the next few days will minimize heating fuel demand - Bitter

cold air in Canada’s Prairies over the next few days may seep into a part of the northern U.S. Plains, but is not poised to come any farther south for now - West

Texas precipitation will be limited over the next two weeks, but with much of the harvest done there the impact will be low - West

Texas like much of the southwestern Plains needs moisture for soil improvements ahead of planting in the spring - Late

next week will be the earliest that a change can take place - Excessive

wind in the region Wednesday may cause some damage and could blow unharvested cotton out of some bolls.

- Australia

winter crop harvest weather has been good recently and will continue more favorably through the next ten days

- No

more crop quality concerns are expected through at least Dec. 26, despite some shower activity infrequently.

- Australia

summer crop conditions are also improving after abundant to excessive rain ended recently - China’s

weather will continue rather tranquil through the next ten days to two weeks with brief periods of precipitation and more sunshine

- Temperatures

will be non-threatening to wheat, rapeseed and livestock - Southern

India weather has been improving recently and this trend will continue for a while - Too

much rain in November hurt the quality of some late season crops and raised the need for replanting of many winter crops - Absolute

dryness is not likely, but rain expected should be brief and light enough to allow some crop development and farming activity to advance relatively well.

- Central

and northern India weather will remain good for winter crop planting and establishment. - Most

winter crops are likely in the ground and are establishing well - Early

planted wheat and other small grains may be in the vegetative to early joint stage of development - Harvest

progress for summer crops has advanced well recently and little change is expected - Precipitation

expected late next week in the far north will be good for some winter crops, although the event is too far out to have high confidence in its occurrence - Morocco

and northwestern Algeria remain too dry and significant rain must fall soon to get crops planted and established properly - Rain

potentials are improving for next week, although no general soaking rain is expected - Soil

moisture and rainfall have been sufficient in northeastern and north-central Algeria and far northern Tunisia, but greater rain is needed in interior crop areas - Europe’s

weather is expected to be tranquil during the next ten days - Romania

and Spain are the two driest countries in the continent today, although some rain fell in parts of Romania recently - Spain

is expected to remain dry biased for an extended period of time - Soil

moisture elsewhere in Europe has been and will continue to be favorable for winter crops which are dormant or semi-dormant in many areas - Very

little rain will fall in western Europe for the next seven days and perhaps longer - Western

parts of Russia, Belarus and central and western Ukraine will get periods of rain and snow through the next ten days maintaining favorable soil moisture for use in the spring - No

crop damaging cold is expected in any winter crop region, although cooling is expected this weekend into next week and that should bring snow to many areas deep into Ukraine and Russia’s Southern Region - Temperatures

may turn cold enough to threaten crops next week, but the snow should provide adequate protection against the cold - South

Africa summer crops will experience a good mix of rain and sunshine over the next ten days supporting additional planting and establishment - Production

potentials are good this year especially with La Nina prevailing - West-central

Africa rainfall is expected to be confined to coastal areas only - Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas - Ethiopia

rainfall will be minimal over the next seven days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 17 - Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks, but its intensity should be lighter than usual

- The

only exception will be in the central and southern Philippines where a tropical cyclone is expected to pass later this week - Tropical

Storm Rai was 72 miles north of Palau Island southeast of the Philippines and will move across the central Philippines as a typhoon Wednesday into Friday

- The

storm will bring heavy rain, strong wind and some potential flooding to central and southern portions of the nation Wednesday into Friday - Rainfall

of 5.00 to 15.00 inches and local totals to 20.00 inches is expected - Wind

speeds over 100 mph will accompany the storm across a few of the island - Some

crop and property damage will be possible - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain later this week and into the weekend - Northeastern

Mexico will get some precipitation Saturday into the Monday - The

moisture will be beneficial for winter crops, although more rain will be needed - Showers

elsewhere will be erratic and mostly light over the next ten days - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Not

much change is expected through mid-week this week - Rain

late this week and into the following weekend may impact a few northern Iraq and western Iran locations while other areas from Syria to Jordan and Israel will remainder biased through most of next week - Colombia

and Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillational Index was +11.77 and it was expected to move erratically over the coming week - New

Zealand rainfall has been heavy recently and it will linger for a little while longer followed by dry weather next week - North

Island and northern parts of South Island have been and will continue to be wettest - Temperatures

will be seasonable

Tuesday,

Dec. 14:

- Australia

Agricultural Commodity Statistics 2021 - Vietnam’s

customs dept to release November commodity trade data - EU

weekly grain, oilseed import and export data - New

Zealand Food Prices

Wednesday,

Dec. 15:

- EIA

weekly U.S. ethanol inventories, production - U.S.

Green Coffee Association releases monthly inventory data, 3pm - Brazil’s

Unica publishes cane crush, sugar output data (tentative) - Malaysia’s

Dec. 1-15 palm oil exports

Thursday,

Dec. 16:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Bangladesh

Friday,

Dec. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

FAS issues world coffee report, with supply-demand data

Saturday,

Dec. 18:

- China’s

2nd batch of Nov. trade data, including imports of cotton, corn, wheat, and sugar

Soybeans

and Corn Advisory:

2021/22

Brazil Soybean Estimate Unchanged at 144.0 Million Tons

2021/22

Brazil Corn Estimate Lowered 1.0 mt to 116.0 Million

2021/22

Paraguay Soybean Estimate Lowered 1.0 mt to 9.5 Million Tons

2021/22

Argentina Soybean Estimate Unchanged at 50.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 53.0 Million tons

Macros

Canada

Factory Prices Rose 0.8% M/M In November – StatsCan Flash

US

PPI Final Demand (M/M) Nov: 0.8% (est 0.5%, prev 0.6%)

PPI

Final Demand (Y/Y) Nov: 9.6% (est 9.2%, prev 8.6%)

US

PPI Ex Food And Energy (M/M) Nov: 0.7% (est 0.4%, prev 0.4%)

PPI

Ex Food And Energy (Y/Y) Nov: 7.7% (est 7.2%, prev 6.8%)

US

PPI For Final Demand Advances 0.8% In November; Services Rise 0.7%, Goods Increase 1.2%

·

March CBOT corn settled 5.25 cents lower on weakness in wheat and outside energy markets. South American weather still looks good.

·

A couple late Black Sea corn trades were conducted. 200 March Black Sea traded against 80 March CBOT corn. Another 100 February Black Sea corn traded against 40 March CBOT corn.

·

USD was 20 points higher and WTI crude $0.76 lower as of around 1 pm CT.

·

Conab reported Brazil corn plantings reached 80.6% complete, a 2.7 percentage points advance from last week and compares to 78.1% year ago.

·

The Baltic Dry Index fell 8.8% to 2,932 points.

·

There are no major weather issues with South America and Argentina will see favorable precipitation this week.

Rainfall

early to mid-week this week in southern Brazil will vary 0.30 to 1.00 inch and a few 1.00- to 2.00-inch amounts, according to World Weather, Inc.

Export

developments.

·

None reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

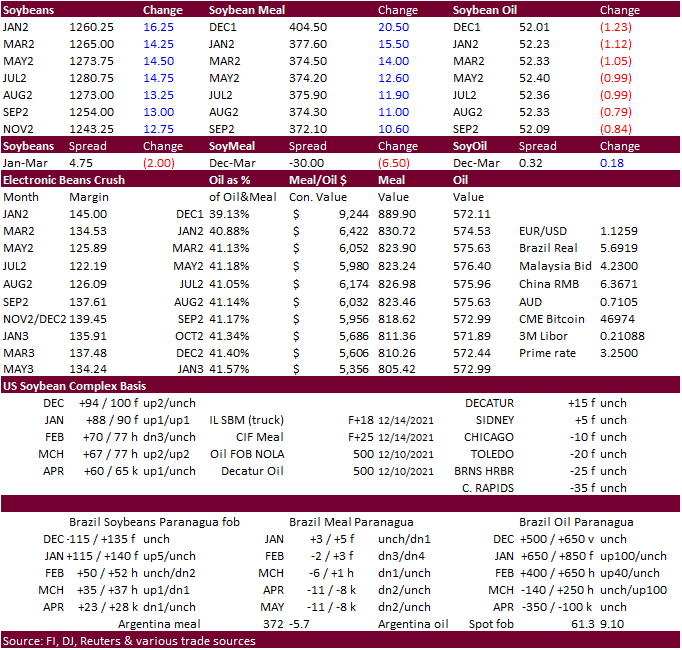

Soybeans rallied on strength in soybean meal. Meal/oil spreading was a major feature. Earlier during the session January soybeans reached a December 2 low before sharply rebounding higher. January soybean settled 15.50 cents

higher.

·

January soybean meal saw an outside day higher, settling sharply higher by $14.80 higher. The January contract hit its highest level since July 1.

·

January soybean oil traded more than 130 points lower, nearly at 52 cents, lowest level since June 18, 2021. We think a close below 52 cents this week could trigger additional selling with support around 49.50 cents. If realized,

this would be a big move in recent weeks, prior to First Notice Day deliveries due out in a couple weeks. Note the absolute contract high was 65.86 back on June 10. The market during that time broke to 51.19 in a matter of 8 days.

·

Egypt bought 69,000 tons of international vegetable oils but that didn’t support the SBO market. Egypt said they have enough vegetable oils to last 6.5 months.

·

January soybean oil share fell to its lowest level since May 2021. 40.58% was logged during the day before rebound back to around 41%.

·

US soybean meal end user buying is strong amid lysine shortages and stockpiling ahead of the US holidays. Note lysine prices have come down after peaking around the second week of November.

·

NOPA is due on Wednesday and the average trade guess for the November crush is 181.64 million bushels, above 181.02 million during November 2020 and down from 184 million crushed during October 2021.

If realized, the daily adjusted crush would be 4th largest in history. Record was established October 2020, not November as previously reported. Soybean oil stocks average 1.903 billion pounds, highest since April 2020, and if realized up

for the fifth consecutive month.

·

The Buenos Aires grains exchange warned weather for Argentina’s crops in the coming months poses a “big challenge.” The Buenos Aires exchange expects a record corn harvest of 57 million tons and soybean production of 44 million

tons, according to a Reuters article.

·

Abiove via Reuters headlines:

-

Brazil

2022 SOYBEAN OUTPUT AT 144.8 MLN TNS VS 144.1 MLN TNS IN PREVIOUS FORECAST -

BRAZIL

SOY CRUSHERS GROUP ABIOVE PROJECTS 2022 SOYBEAN EXPORTS AT 93.4 MLN TNS VS 92.1 MLN TNS IN PREVIOUS FORECAST -

BRAZIL

SOY CRUSHERS GROUP ABIOVE PROJECTS 2022 SOYBEAN CRUSH AT 48 MLN TNS VS 48 MLN TNS IN PREVIOUS FORECAST -

BRAZIL

SOY CRUSHERS GROUP ABIOVE PROJECTS 2021 SOYBEAN OUTPUT AT 138.3 MLN TNS VS 138 MLN TNS IN PREVIOUS FORECAST -

BRAZIL

SOY CRUSHERS GROUP ABIOVE PROJECTS 2021 SOYBEAN CRUSH AT 46.5 MLN TNS VS 46.5 MLN TNS IN PREVIOUS FORECAST -

BRAZIL

SOY CRUSHERS GROUP ABIOVE PROJECTS 2021 SOYBEAN EXPORTS AT 86 MLN TNS VS 86 MLN TNS IN PREVIOUS FORECAST -

BRAZIL

SOY CRUSHERS GROUP ABIOVE SAYS DOMESTIC CONSUMPTION OF SOYOIL AFFECTING OVERALL SOY CRUSH PROJECTIONS -

BRAZIL

SOY CRUSHERS GROUP ABIOVE SAYS ASIAN COUNTRIES BUYING MORE SOY MEAL FROM BRAZIL THAN EUROPE FOR THE FIRST TIME -

ABIOVE

SAYS SOY CRUSH INDUSTRY PRACTICALLY STAGNATED GIVEN BRAZIL’S PROCESSING POTENTIAL OF ALMOST 57 MLN TNS -

ABIOVE

SAYS INDIA, AMONG OTHER COUNTRIES, MAY START BUYING MORE SOY OIL FROM BRAZIL AS DOMESTIC CONSUMPTION LOWERS DUE TO CHANGES IN MANDATORY BIODIESEL BLEND

·

Conab reported Brazil soybean plantings reached 96.6% complete as of December 11, compared to 94.2% year ago.

·

Malaysian palm oil futures traded down 93 ringgit and cash was off $15.00 at $1,172.50/ton.

·

The Southern Peninsula Palm Oil Millers’ Association (SPPOMA) estimated production during Dec. 1-10 fell 2.8% from the same period in November.(Reuters)

·

India’s 2021-22 Rapeseed production was estimated between 10 and 11 million tons from 8.5 million tons year ago, according to the Central Organization for Oil Industry and Trade.

Export

Developments

·

Egypt’s GASC bought 69,000 tons of international vegetable oils today and 37,000 tons of local vegetable oils (106,000 tons combined). Of the 69,000 international that included 30,000 tons of soybean oil and 39,000 tons of sunflower

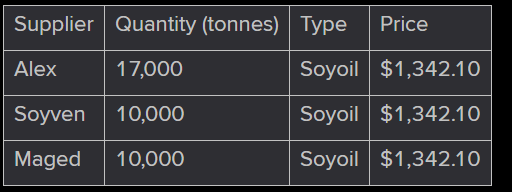

oil for February 5-25 arrival. On the local level, all of the 37,000 tons was soybean oil. Rueters provided the following:

International-

Local-

In

comparison, they bought international SBO at $1,468/ton on November 23 (30k) and 12k international sunflower oil at $1,425/ton on November 16 (lowest $ that day).

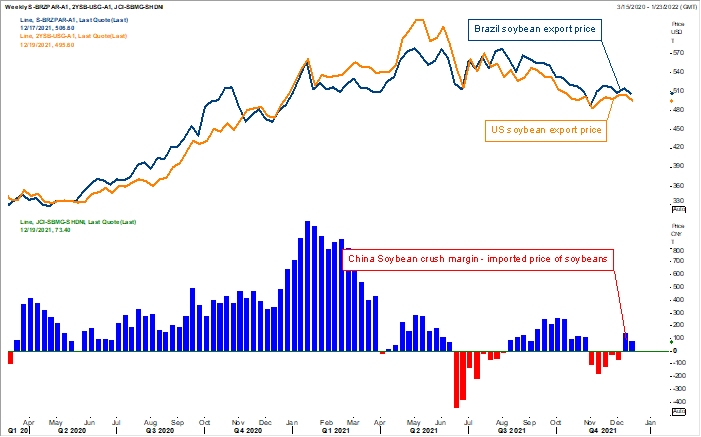

China

crush margins are slightly positive

Source:

Reuters and FI

Updated

12/14/21

Soybeans

– January $12.35 to $13.05 range (up 35, unch),

March $11.75-$13.50 (unch)

Soybean

meal – January $350 to $400 (up $20, up $25), March $330-$415 (up $15, up $35)

Soybean

oil – January 49.50 to 57.00 ( revised down 250, down 200), March 50.00-59.00 (down 200, down 100)

·

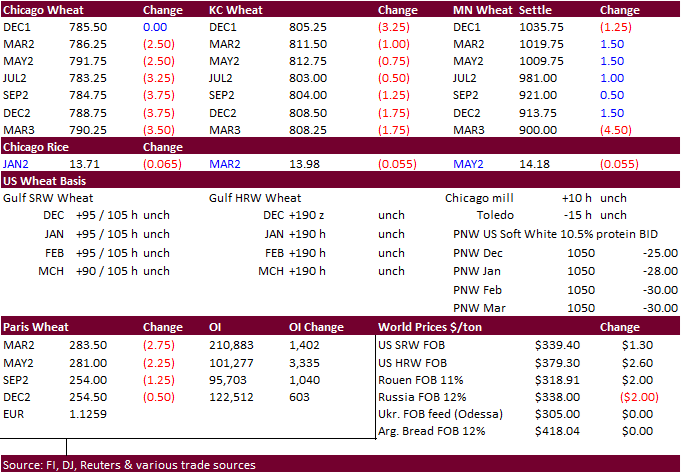

US wheat traded lower for most of the day before recovering into the close on follow through selling and higher USD (up 20 points as of around 1 pm CT). Losses were limited on strong global demand and sharply higher soybeans.

After trading choppy during the last fifteen minutes of the session, Chicago ended 1.75-3.25 cents lower and KC mixed/ mostly lower. MN gained over Chicago, settling 0.50-1.50 cents higher. Traders are awaiting results for the Algerian wheat import tender.

·

EU MARS noted EU crops are in good shape after favorable weather over the past month.

·

Paris wheat was 2.75 euros lower basis March position at 284.25 euros per ton.

·

USDA reported PNW 10.5% protein wheat bids dropped about 25 to 30 cents from yesterday ($10.50-$11.25 range).

Export

Developments.

·

The Philippines seek 120,000 tons of animal feed wheat on for shipment in 2022 between March and May. The wheat can be sourced optionally from Australia, the United States, Canada, European Union and Black Sea region.

·

Another group from the Philippines seeks up to 220,000 tons of animal feed wheat on Dec. 16 for March 15 to May 31, 2022, shipment. Origins include Australia, Europe or the Black Sea region.

·

Iran’s GTC seeks 180,000 tons of milling wheat on Dec. 15 for shipment in January and February 2022.

·

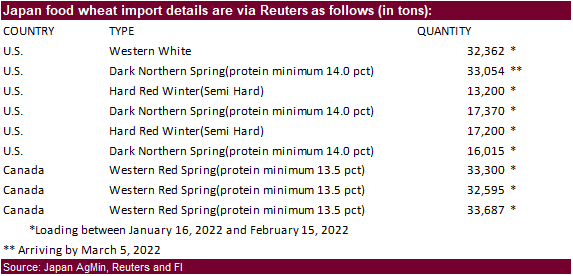

Japan’s Ministry of Agriculture, Forestry and Fisheries(MAFF) is seeking to buy a total of 228,783 tons of food-quality wheat from the United States and Canada in regular tenders that will close on Thursday.

·

Jordan seeks 120,000 tons of feed barley on December 15.

·

Japan in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley on December 15 for arrival by March 10.

·

Jordan seeks 120,000 tons of wheat on December 16.

·

Turkey seeks about 320,000 tons of 12.5% and 13.5% protein content milling wheat on December 21 for shipment between February 1 and February 28.

Rice/Other

·

South Korean Agro-Fisheries & Food Trade Corp. seeks 22,000 tons of rice from the US, set to close Dec 16.

·

(Reuters) – Vietnam’s coffee exports in November were up 8.3% from October at 107,473 tons, while rice exports for the same period fell 8.4% against the preceding month, government customs data released on Tuesday showed. For

the first 11 months of 2021, Vietnam exported 1.4 million tons of coffee, down 2.3% from a year earlier, Vietnam Customs said in a statement.

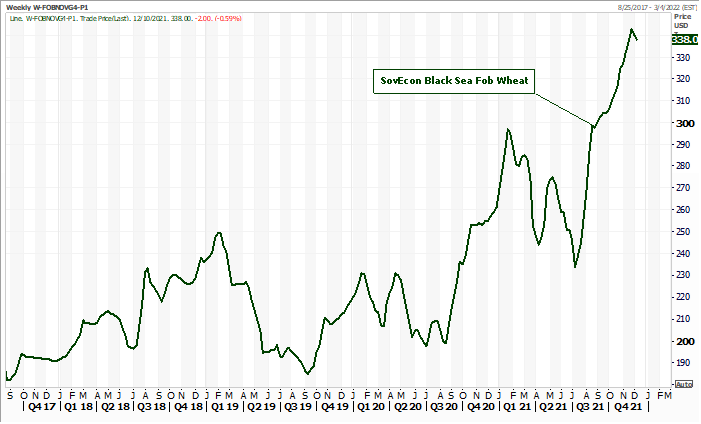

Black

Sea Wheat

Source:

Reuters and FI

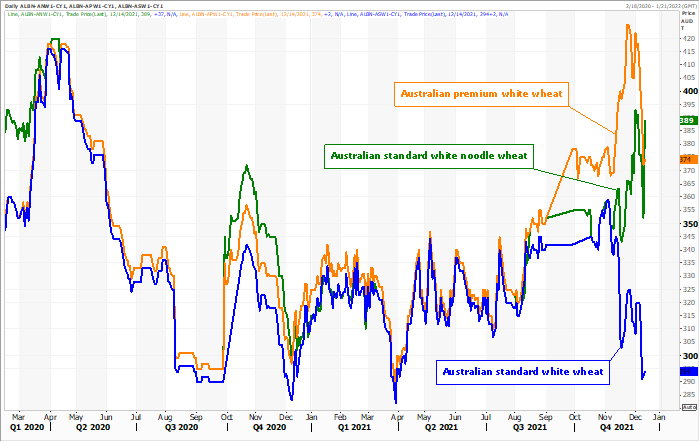

Australian

wheat

Source:

Reuters and FI

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.