PDF Attached

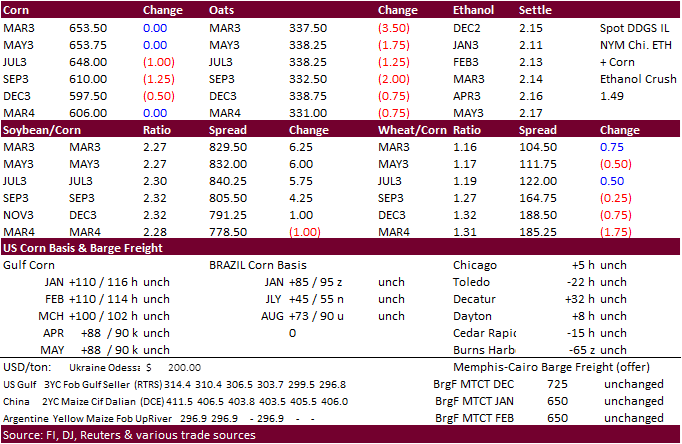

Soybeans ended higher from strength in soybean meal over ongoing Argentina crop concerns. Soybean oil was lower from weakness in US energy prices. Corn ended moderately lower.

That market was in limbo from higher soybeans and lower wheat.

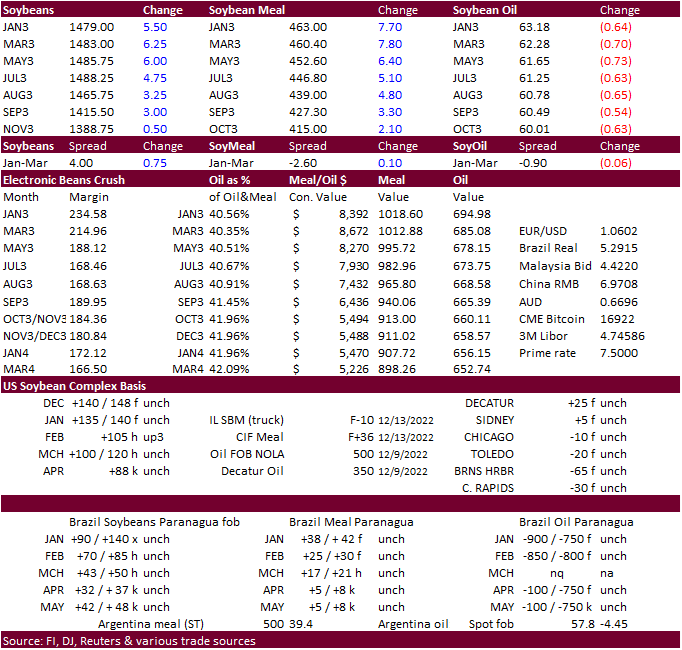

Argentina

may see light rain across Cordoba and western La Pampa through Saturday. Rains next week will be limited. Most of Brazil will see rain bias central and northern areas. Most of the US will be on the dry side over the next week. US snow coverage could be better

across the central Great Plains after temperatures turned colder.

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Argentina

rain chances will improve late next week with some unsettled weather possible in the Dec. 25-28 period - The

improvements will be welcome, but “normal” rain is still unlikely and that will maintain concern over the long term outlook - With

that said, though, there will be some periodic showers that might offer a little more support for slow crop development during that second week of the forecast

- Dramatic

changes are unlikely, though - Argentina

temperatures will warm up for a little while this weekend and early next week and then cool down once again - Oppressive

heat like last week is not likely - Southern

Brazil and Paraguay will be in a net drying model for the next ten days and possibly two weeks - Completely

dry weather is not likely, but the rain that falls will often be light and offer only a temporary break from the drying trend - Northeastern

Brazil will see abundant to heavy rain for a while next week which may lead to local flooding - Most

crops will handle the situation relatively well - Brazil

temperatures will continue to be cooler biased for a while - U.S.

weather will continue snowy in the northern Plains and upper Midwest today and in the northern Midwest Saturday - A

small northern Atlantic Coast storm will impact New England, Pennsylvania and a few other areas today into the weekend with heavy snow inland and rain changing to snow on the coast - Snowfall

of 6-15 inches will be possibly in the interior of the northeastern U.S. and 4 to 10 inches in southeastern Canada - This

week’s snowstorm in the northern Plains has produced upwards to 28 inches of snow in south-central South Dakota, 26 inches in southeastern North Dakota, 29 inches in northeastern Minnesota and 48 inches in the Black Hills of southwestern South Dakota - Reports

of snow drifts between 5 and 10 feet have been received from South Dakota - Another

snow and rain event will develop in the southeastern U.S. Plains and a part of the southwestern Corn Belt early next week bringing snow down to the Tennessee River Basin and lower Midwest

- Moisture

totals from snow and rain in the Delta and southeastern states will vary from 0.30 to 1.00 inch with a few 1.00 to 2.00-inch totals - Snow

may fall significantly from eastern Kansas and Missouri into the lower Ohio River Valley and parts of Oklahoma and Arkansas.

- Snow

may reach the Tennessee River Basin briefly during mid-week next week - Bitter

cold air coming into the central U.S. this weekend through most of next week will be very impressive

- Extreme

lows in the -30s and -20s Fahrenheit will impact the northern Plains with -20s and negative teens into western Nebraska and negative teens and negative single digits possible in the central Plains – although confidence is low because the cold is too far out

in the forecast to get more specific - Freezes

may impact the central Gulf of Mexico coast including sugarcane areas and Florida could see some freezes, but most of that is still a week to ten days away leaving plenty of time for change - U.S.

hard red winter wheat production areas will not likely receive significant precipitation for a while, although some light snow will be possible - Most

of the forecast models are trying to generate at least a little snow before the bitter cold arrives, but the situation will be closely monitored - Western

North America will be warming up Dec. 24-29 - Europe

temperatures will be trending warmer this weekend and especially next week - Northwestern

Europe may trend a little stormier for a while next week as warming evolves - East-central

Europe into western Russia will receive significant snow through the weekend with deep accumulations likely - Some

areas will get 12 to 20 inches of new snow and the region is already deeply buried in previous snow - Flood

potentials could be high in the spring if the deep snow cover remains in southwestern Russia since the ground underneath it is excessively wet - India

and China weather will be relatively quiet over the next couple of weeks with limited precipitation - Australia

weather will continue to support good late season wheat, barley and canola harvest progress, although a few more periodic showers will pop up at times in the coming week - Interior

Queensland and north-central New South Wales need significant rain to improve topsoil moisture in support of unirrigated summer crops - The

situation is not a crisis, though precipitation would help ensure the best early season crop development - South

Africa crop weather is expected to be very good over the next two weeks with alternating periods of rain and sunshine likely supporting aggressive crop development and support some periodic fieldwork - Southeast

Asia will continue to experience periodic rainfall and some periods of sunshine supporting most crops throughout the region - Mainland

areas of Southeast Asia will experience the driest conditions and that is normal for this time of year - North

Africa weather will continue to include an erratic rainfall distribution. - Greater

precipitation is still needed - West-central

Africa temperatures have not been very warm this season and there have been no seriously strong Harmattan Wind speeds noted protecting coffee, cocoa and sugarcane from any adversity. - East-central

Africa rain will continue routinely supporting coffee and cocoa - Today’s

Southern Oscillation Index was +8.95 today and it will move erratically over the next few days

Source:

World Weather INC

Bloomberg

Ag Calendar

- China’s

second batch of November trade data, including corn, pork and wheat imports

Monday,

Dec. 19:

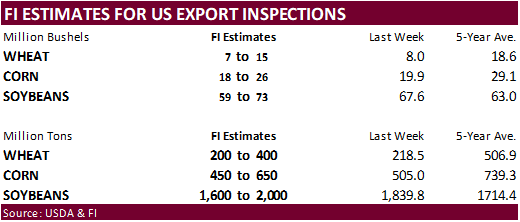

- USDA

export inspections – corn, soybeans, wheat, 11am - MARS

monthly report on EU crop conditions - USDA’s

total milk production, 3am

Tuesday,

Dec. 20:

- China’s

third batch of November trade data, including soy, corn and pork imports by country - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Malaysia’s

Dec. 1-20 palm oil exports

Wednesday,

Dec. 21:

- EIA

weekly US ethanol inventories, production, 10:30am

- Weekly

USDA Broiler Report

Thursday,

Dec. 22:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - US

cold storage data for beef, pork and poultry, 3pm - US

red meat production, poultry slaughter, 3pm - Port

of Rouen data on French grain exports - Sugar,

cane and ethanol production data by Brazil’s Conab (tentative)

Friday,

Dec. 23:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - USDA

hogs and pigs inventory, cattle on feed, 3pm

Monday,

Dec. 26:

- HOLIDAY:

US, UK, Australia, Hong Kong, Singapore, several other countries - CBOT

hard open for nighttime session

Tuesday,

Dec. 27:

- Malaysia

Dec. 1-25 palm oil exports - HOLIDAY:

UK, Australia, Hong Kong

Wednesday,

Dec. 28:

- Weekly

USDA Broiler Report

Thursday,

Dec. 29:

- EIA

weekly US ethanol inventories, production, 10:30am - Vietnam’s

general statistics department releases monthly coffee, rice and rubber export data

Friday,

Dec. 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - ICE

Futures Europe weekly commitment of traders report, 1:30pm (6:30pm London)

Saturday,

Dec. 31:

- Malaysia’s

Dec. 1-31 palm oil export data by cargo surveyor AmSpec

Source:

Bloomberg and FI

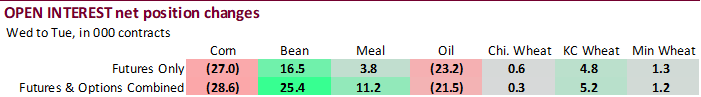

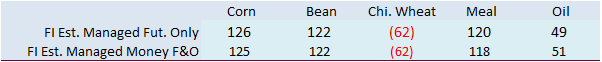

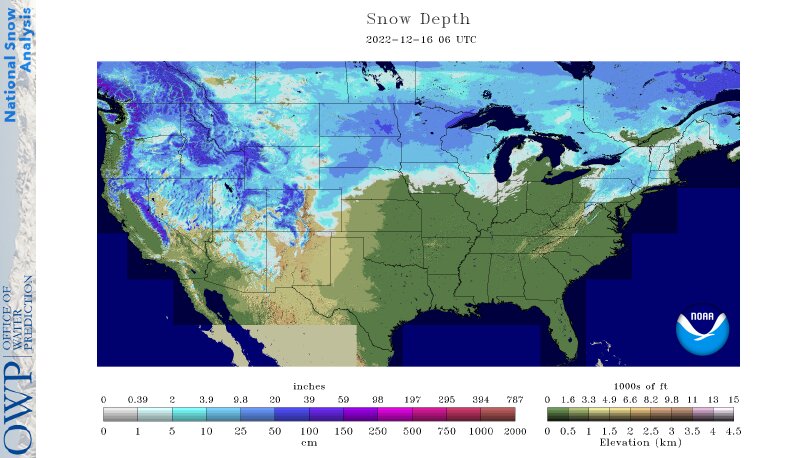

CFTC

Commitment of Traders

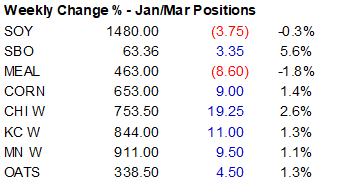

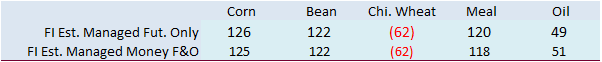

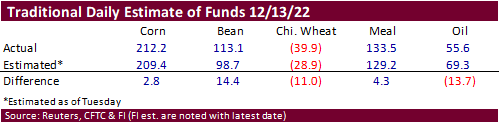

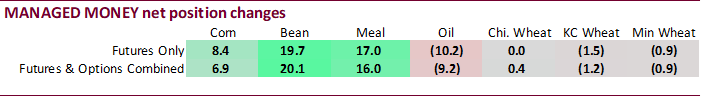

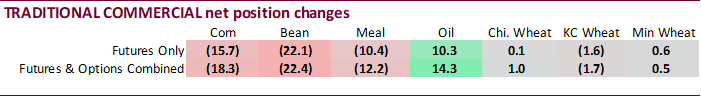

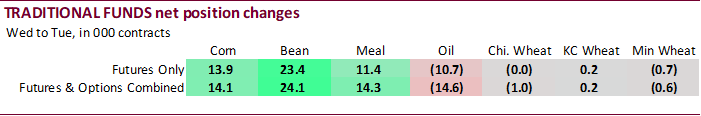

Funds

and commercials changed their tune for the week ending December 13, exception soybean oil and wheat. There were no major surprises to the fund positions. For soybeans, traditional funds were a little more long than expected and Chicago wheat 11,000 contracts

more short than what the trade estimated.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

53,133 20,369 346,837 -11,666 -365,732 -12,867

Soybeans

77,962 24,279 124,630 4,607 -169,282 -27,166

Soyoil

18,835 -14,031 98,911 -365 -130,984 14,068

CBOT

wheat -71,197 574 98,062 -1,764 -25,284 1,223

KCBT

wheat -9,888 401 46,317 -169 -35,497 -1,772

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

127,106 6,892 229,535 -7,096 -367,770 -11,156

Soybeans

119,580 20,126 76,275 4,591 -160,124 -26,963

Soymeal

114,486 15,977 78,699 -1,830 -231,434 -10,418

Soyoil

53,349 -9,235 84,357 3,923 -150,651 10,360

CBOT

wheat -63,004 378 64,729 823 -20,231 220

KCBT

wheat 8,540 -1,191 34,736 -372 -36,776 -1,366

MGEX

wheat -3,922 -874 1,761 2 1,521 460

———- ———- ———- ———- ———- ———-

Total

wheat -58,386 -1,687 101,226 453 -55,486 -686

Live

cattle 66,919 7,602 53,186 -2,026 -122,356 -4,293

Feeder

cattle -747 2,499 2,733 -126 4,020 -1,092

Lean

hogs 40,116 -9,638 46,853 2,051 -68,702 5,212

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

45,369 7,195 -34,239 4,165 1,457,563 -28,616

Soybeans

-2,421 3,967 -33,310 -1,720 744,707 25,365

Soymeal

19,286 -1,645 18,961 -2,084 438,398 11,245

Soyoil

-292 -5,377 13,237 329 464,030 -21,520

CBOT

wheat 20,088 -1,388 -1,582 -33 405,051 346

KCBT

wheat -5,567 1,389 -933 1,540 165,081 5,221

MGEX

wheat 2,651 272 -2,011 140 49,229 1,192

———- ———- ———- ———- ———- ———-

Total

wheat 17,172 273 -4,526 1,647 619,361 6,759

Live

cattle 10,570 -1,268 -8,319 -16 354,855 8,184

Feeder

cattle -1,978 -760 -4,028 -523 57,281 372

Lean

hogs -8,164 1,732 -10,104 643 256,091 -6,516

Macros

100

Counterparties Take $2.127 Tln At Fed Reverse Repo Op (prev $2.124 Tln, 98 Bids)

Fed’s

Mester Says She Expects Fed To Raise Rates By More Than Its Median Forecast – BBG TV

–

Says Her Rate Forecast Is ‘A Little Higher Than Median Dot’

–

Rate Path Is ‘A Little Stronger’ Than Median Path In 2023

–

Once Rate Hikes Done, Fed Will Need To Maintain Rates For An Extended Period

Fed’s

Mester: Seeing Tentative Signs Inflation Rises Are Stabilizing, ‘Not Calling A Peak’

–

Have Not Seen Improvement On Service-Price Inflation

–

Volatility In Inflation Numbers Expected

Fed’s

Mester: Expects It Will Take Time For Inflation To ‘Ebb’

Fed’s

Mester: Timing Of Rate Cuts Isn’t Tied To A Calendar, Is Tied To Evidence Of Slower Inflation

–

Will Need To Keep Funds Rate Above 5% Next Year

Fed’s

Mester Says She Sees Growth Slowing But Doesn’t Forecast ‘Negative Activity’

Fed

Officials Reinforce Hawkish Message On Need For Higher Rates – BBG

·

CBOT corn futures were

near unchanged at the electronic close and settled moderately lower. Prices were caught between lower wheat and higher soybeans. There were no export developments.

·

Mexico and two US agencies look for an agreement over GMO corn imports. Mexico imports about 17 million tons of corn from the US a year. The USTR and USDA will review proposals when those are formally presented.

·

Southern Brazil corn crop prospects are falling. StoneX estimated Brazil’s southern state of RGDS corn crop at 4.51 million tons (early crop), down from 5.38 million previous. Recall Conab cut corn production for several southern

states, for the first crop, in their latest supply update.

·

Argentina’s BA Exchange reported 43% of the corn crop was planted against 57 % last year. The Argentina corn crop was rated 18% G/E.

·

India is looking to soon boost its ethanol blend to 20 percent from current 10 percent.

Updated 12/6/22

March

corn $6.00-$7.15 range. May

$5.80-$7.10

·

CBOT soybeans ended higher from strength in soybean meal. Soybean oil was lower on weakness in WTI crude oil, down more than $1.80 by late afternoon trading. We understand there is good export demand for soybeans out of the Great

Lakes. At least one panamax in Ontario is/will be loading soybeans.

·

The soybean meal market continues to be supported by the poor weather in Argentina and good global demand. Earlier this week there was talk of US export interest out of the Gulf.

·

January soybean meal is only $11.40 off its contract high of $474.40. We think meal could take out the contract high sometime before First Notice Day deliveries.

·

Board soybean crush was active Friday, including new-crop.

·

Argentina producer selling of soybeans has been slower during the second rollout of the “soybean dollar” relative to the September program. Producers like holding inventory as a hedge for inflation and anticipation of rising domestic

prices if a short crop from drought conditions occurs. Another reason to hold onto the soybean crop is for hopes another support initiative would be rolled out this spring.

·

There is uncertainty over the size of the Argentina soybean crop for next season. Oil World had a low 39.5 million tons while the highest estimate we have seen is 49.5 million tons by USDA. We think USDA will slash Argentina

soybean production by 3.5+ million tons in their January update. We are gravitating more towards a 40 million ton estimate given the weather forecast calling for below than normal precipitation over the next 30 days.

·

Argentina’s BA Exchange reported 51% of soybeans are planted and rated 19% G/E (11% last week).

·

WTI crude oil for the January contract is hovering around $74.30/barrel, up from $71 that traded a week ago. Support could be seen at $70, a level that would entice the US to replenish the SPR (reserves).

https://www.qcintel.com/article/us-will-buy-back-spr-crude-at-low-70s-b-biden-energy-advisor-10010.html

·

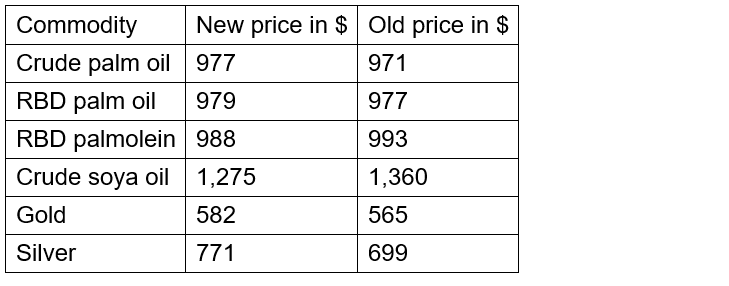

Indonesia plans to roll out B35 on January 1, 2023, up from current B30. India raised the import base price of palm oil.

·

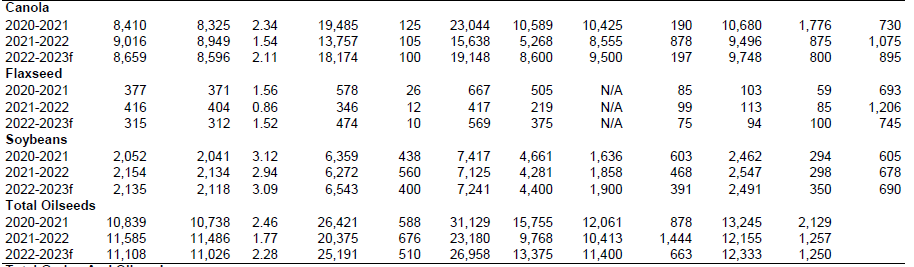

Offshore values earlier this morning were leading SBO lower by about 37 points earlier this morning (off 352 points for the week to date) and meal $6.20 short ton higher.

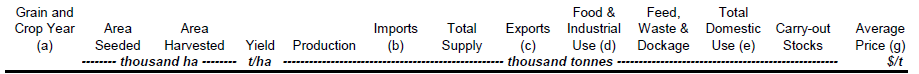

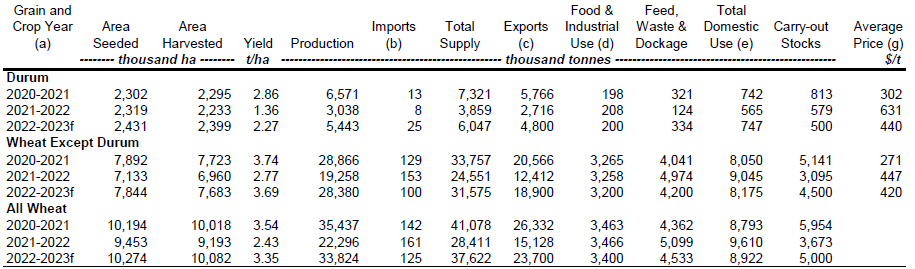

Canada:

Outlook for Principal Field Crops

Updated 12/16/22

Soybeans

– January $14.50-$15.10,

March $14.15-$15.25

Soybean

meal – January $445-$485,

March $4.00-$500

Soybean

oil – January 61.00-65.50 range,

March 55.00-70.00

·

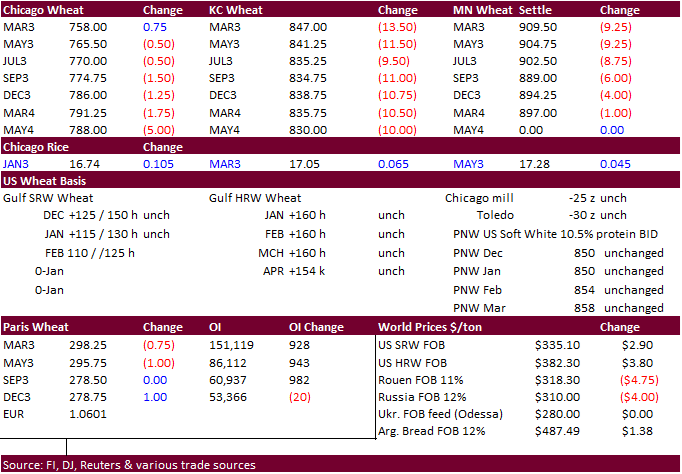

US wheat futures traded lower led by the KC wheat contract technical selling, higher USD and weaker outside related commodity markets.

·

Part of Ukraine’s capital lost power from additional Russian strikes. Ongoing Black Sea shipping concerns may limit losses.

·

Paris March wheat was lower 0.75 euro at 297.50 euros a ton, near a nine month low.

Paris

wheat was down 1.7% for the week.

·

Russia will increase their wheat export taxes for the December 21-27 period. Table is attached.

·

A Reuters article warned insurance companies with annual (Jan-Dec) contracts with shipping and airline companies that sail and fly in and out of Ukraine may not renew them for 2023. They have already lost money. Reinsurers “are

particularly concerned about the loss of planes owned by aircraft leasing companies which are stuck in Russia and have already generated $8 billion in legal claims.”

·

India planted 28.65 million hectares of wheat (70.8 million acres) since Oct. 1, up nearly 3% from a year ago.

Canada:

Outlook for Principal Field Crops

·

Iraq seeks 50,000 tons of milling wheat on Sunda, December 18.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 83,672 tons of rice from the United States for arrival in South Korea in 2023 between Feb. 1 and June 30.

·

India’s Bulog plans to import 500,000 tons of rice from now through February 2023. 200,000 tons have already been secured for the month of December arrival.

·

Bangladesh seeks 50,000 tons of rice on December 21 for shipment with 40 days of contract signing.

·

Bangladesh also seeks 50,000 tons of rice on December 27.

Updated 12/16/22

Chicago

– March $7.00 to $8.50

KC – March

8.00-$9.50

MN – March

$8.50 to $10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.