PDF Attached

Private

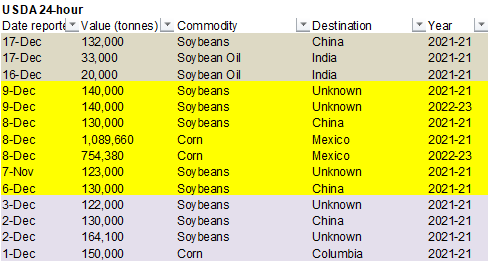

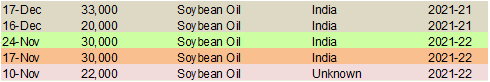

exporters reported the following activity:

132,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

33,000

metric tons of soybean oil for delivery to India during the 2021/2022 marketing year

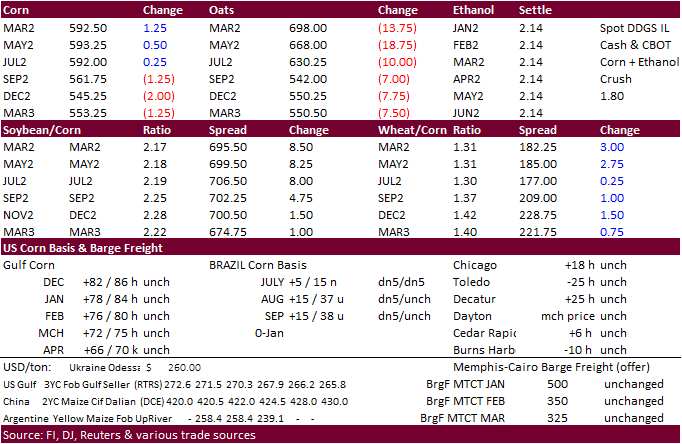

CME

Holiday Schedule

https://www.cmegroup.com/tools-information/holiday-calendar.html

Soybeans

rallied in part to fresh record high in nearby rapeseed meal and sharply higher soybean meal. Soybean oil traded lower on product spreading and weakness in US energy markets. Corn ended higher in the nearby contracts and lower in the back months. KC wheat

was higher, Chicago higher in the font months and MN lower.

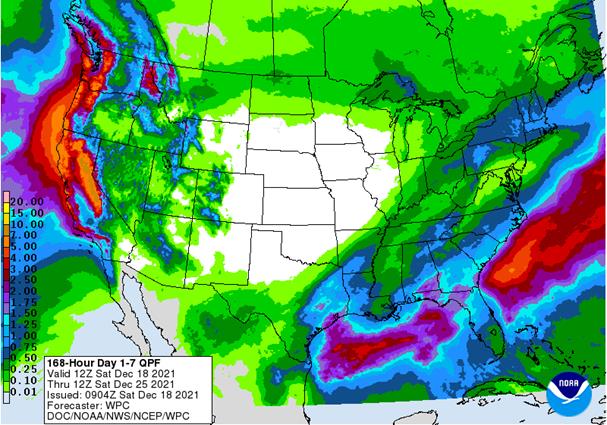

WEATHER

EVENTS AND FEATURES TO WATCH

- Warm

to hot temperatures in Argentina’s summer crop areas this weekend into early next week will accelerate drying rates and add stress to the driest crops in the central, north and eastern production areas - The

European model run today has added moisture to central and southern Argentina for mid- to late week next week, but the north stays dry - A

close watch on next week’s precipitation pattern is warranted - World

Weather, Inc. looks for some showers and thunderstorms, but the resulting rainfall may not be as great as advertised in as many areas and that could leave a larger part of the nation in need of more rain - Cooling

is expected next week in the central and southeast and that will help to reduce some of the crop moisture stress - The

best crop conditions in Argentina over the next ten days will remain in Cordoba, southern Santa Fe, northeastern La Pampa and from northwest into central parts of Buenos Aires where soil moisture is most abundant today - This

region will also dry down over the next five days, but next week’s showers should slow the decrease in soil moisture and prevent much stress from evolving in these areas - Brazil’s

crop moisture stress is mostly confined to western Parana, southern Mato Grosso do Sul, southeastern Paraguay and in a few areas of Rio Grande do Sul today - These

areas will continue to receive less than usual rainfall over the next ten days to two weeks, although they will not be completely dry

- Crop

moisture stress will continue, although it will vary with the rainfall - Some

warming is expected briefly in southern Brazil this weekend into early next week, but relief is expected during the middle to latter part of next week reducing the higher level of stress that will evolve during the warmer days - The

precipitation expected with the cooling trend should lead to much a further reduction in crop stress, but only temporarily

- Additional

drying is expected late this month in southern Brazil keeping the pressure on for some of the corn, late season soybeans and rice.

- Center

west, northern parts of center south and northeastern Brazil crop areas will get frequent rainfall over the next two weeks maintaining good crop development for soybeans, corn, citrus, sugarcane, cotton, coffee and other crops - There

is some concern over potential flooding in Tocantins, northern Goias, Bahia and northern northernmost Minas Gerais later this month and the situation will be closely monitored - The

biggest threat would be if the wet bias remains in January when harvesting of soybeans is under way - Cooling

in eastern Europe and the western CIS over the next couple of weeks is not expected to bring any threat to winter wheat, barley or rye because of adequate snowfall ahead of the colder conditions - Those

areas that remain snow free should not see any threatening cold - Western

Europe will experience drier biased weather for a while; however Portugal and western Spain may begin to see some needed rain late next week - Some

of the rain in southwestern parts of the Iberian Peninsula will expand across a larger part of southern and western Europe in the second week of the forecast benefiting winter crops that are dormant or semi-dormant - Northern

Africa will see some needed rain arrive in Morocco late next week - The

precipitation should spread to the east across northern Algeria and northern Tunisia in the last week of the this month improving wheat and barley conditions after a relatively dry planting season in western Algeria and parts of Morocco - India’s

weather will be relatively quiet for a while, but some showers will develop in the central and north during the second week of the forecast.

- The

precipitation would be welcome and beneficial for all winter crops, although early indications suggest most of the rain will be quite light initially - China

weather is expected to be relatively tranquil for a while - Winter

crops are dormant or semi-dormant and most are suspected of being favorably established - Rapeseed

should be in better shape than either of the past two autumns - Eastern

Australia is expected rain to begin ramping up once again. - Southeastern

Queensland and northeastern New South Wales will become wettest next week and into the latter days of this month - Some

areas in east-central Australia were just beginning to dry out enough to improve crop and field conditions after November’s heavy rainfall - None

of the expected rain will have much impact on unharvested winter crops in these areas since most of them were already reduced to feed grain quality - Southern

Australia wheat and barley harvesting should be advancing extremely well and little change is likely over the next ten days - South

Africa will continue to receive an excellent mix of rain and sunshine over the next two weeks

- Corn,

soybeans, sunseed, cotton, rice, groundnuts and sorghum planting should be advancing quite favorably after recent rain and establishment should advance quite well also

- Typhoon

Rai moved through the southern Philippines Thursday and was expected move across Palawan today before reaching the South China Sea - The

storm produced torrential rain and excessive wind in the southern Visayan islands and in a few northern Mindanao locations Thursday

- At

0900 GMT today, the center of the storm was 297 miles south southwest of Manila, Philippines near 10.4 north, 117.8 east moving westerly at 16 mph and producing maximum sustained wind speeds of 104 mph. - Typhoon

force wind was occurring out 35 miles from the center of the storm while tropical storm force wind was occurring out 130 miles - Typhoon

Rai will move very near to the southern half of the Vietnam central coast this weekend bringing some heavy rain and windy conditions to coastal areas. The storm is expected to turn to the north and eventually to the northeast just before moving inland which

should spare the nation’s coffee and other crops produced along the central coast - Very

little property damage is expected along the coast as long as the storm does not move over the coast - The

storm may brush the south coast of Hainan, China early next week before turning to the east and suffering significant wind shear and weakening due to the strong northeast monsoon flow that is expected at that time - U.S.

weather Thursday was relatively quiet - Light

precipitation fell in the lower Midwest and northern Delta Thursday with moisture totals less than 0.80 inch

- Light

rain and mountain snow fell in the far western states - Temperatures

very warm in the eastern and south=central parts of the nation and quite cold in the north-central states - Temperatures

this morning in the far northern Plains were below zero Fahrenheit while high temperatures Thursday in southern Texas, southern Louisiana and Florida were in the 80s.

- U.S.

weather outlook is mostly unchanged from that of Thursday - Most

of hard red winter wheat country will be dry for the next ten days to two weeks - Waves

of rain and mountain snow will continue periodically in the far western states - Portions

of the Delta, Tennessee River Basin, lower and eastern Midwest and southeastern states will receive periodic precipitation maintaining status quo soil conditions - Northern

Plains will get some periodic snowfall along with the northern Midwest - West

Texas will remain mostly dry - Bitter

cold will remain along the Canada border in the northern Plains - Temperatures

in the central and southern Plains, Midwest, Delta and eastern states will be warmer than usual during much of the next two weeks, although not nearly as anomalously warm as that of this week - West-central

Africa rainfall is expected to be confined to coastal areas only - Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas - Ethiopia

rainfall will be minimal over the next seven days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 26 - Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks with some heavy amounts and local flooding in western Java and along the upper west coast of Sumatra - Philippines

rainfall will lighten up after Typhoon Rai exits the southwest part of the region today - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain later this week and into the weekend - North-central

and northeastern Mexico will get some precipitation Saturday into Monday - Resulting

rainfall will be light - Today’s

forecast models reduced additional precipitation from impacting northwestern Mexico in the next two weeks and this change was needed - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Rain

is expected in northern Iraq and western Iran periodically over the next week improving soil moisture for those areas - Other

areas may see a boost in precipitation during the following week - Western

Colombia and Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Tuesday’s

Southern Oscillational Index was +13.00 and it was expected to move erratically for a while.

- New

Zealand rainfall will be lighter than usual during the next ten days except along the west coast of South Island where it will be near normal - Temperatures

will be seasonable

Friday,

Dec. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

FAS issues world coffee report, with supply-demand data

Saturday,

Dec. 18:

- China’s

2nd batch of Nov. trade data, including imports of cotton, corn, wheat, and sugar

Monday,

Dec. 20:

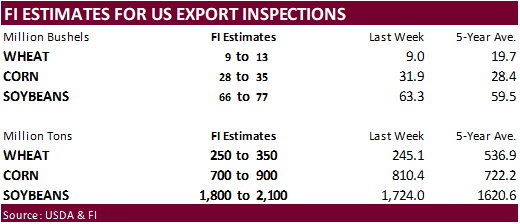

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysia’s

Dec. 1-20 palm oil exports - USDA

total milk production, 3pm - Ivory

Coast cocoa arrivals

Tuesday,

Dec. 21:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction

Wednesday,

Dec. 22:

- EIA

weekly U.S. ethanol inventories, production - U.S.

cold storage data for poultry, pork and beef; poultry slaughter, 3pm

Thursday,

Dec. 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - U.S.

cattle on feed, 3pm - USDA

hogs & pigs inventory and production, red meat output, 3pm

Friday,

Dec. 24:

- No

Commitment of Traders reports given holidays in U.S. and U.K. CFTC and ICE releases will be out on Monday, Dec. 27

Source:

Bloomberg and FI

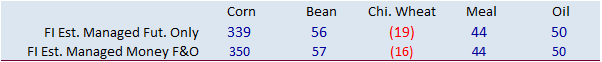

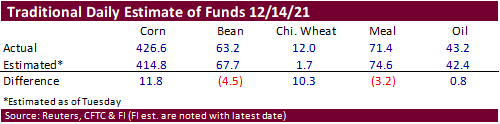

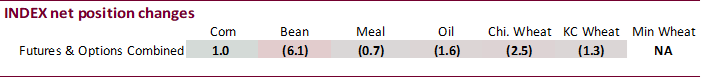

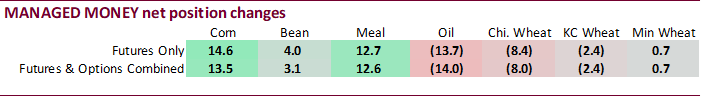

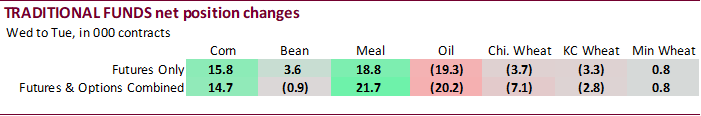

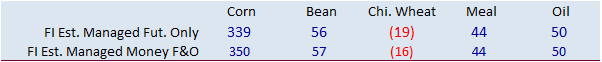

CFTC

Commitment of Traders

Funds

were more long than estimated for corn and wheat, and less long for soybeans and meal. Oil was near expectations. We see no price implication from this week’s report, although some trades may see the net long corn position as slightly bullish.

CFTC

COT Snapshot

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

256,397 13,419 426,816 1,035 -648,643 -13,057

Soybeans

16,920 3,420 177,120 -6,135 -155,806 2,032

Soyoil

-2,102 -19,571 119,009 -1,633 -119,410 22,996

CBOT

wheat -26,832 -5,455 114,177 -2,501 -81,571 7,032

KCBT

wheat 27,276 -1,902 57,586 -1,260 -88,013 3,259

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

345,980 13,480 268,121 27 -648,338 -13,337

Soybeans

40,975 3,093 143,619 -2,503 -165,817 2,765

Soymeal

40,534 12,636 87,400 -1,851 -181,517 -21,056

Soyoil

44,783 -14,045 94,136 -1,683 -127,247 23,720

CBOT

wheat -7,303 -8,024 68,172 452 -64,841 5,714

KCBT

wheat 57,164 -2,411 26,717 -1,439 -75,045 4,300

MGEX

wheat 13,210 666 1,035 -21 -27,335 311

Total

wheat 63,071 -9,769 95,924 -1,008 -167,221 10,325

Live

cattle 82,254 2,404 81,977 147 -165,407 -2,274

Feeder

cattle 4,793 -204 3,559 -13 -653 281

Lean

hogs 48,492 1,287 57,617 -648 -97,425 -1,370

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

68,806 1,226 -34,569 -1,396 1,757,032 32,849

Soybeans

19,457 -4,041 -38,234 685 767,185 -24,394

Soymeal

27,644 9,074 25,939 1,197 434,693 16,542

Soyoil

-14,175 -6,199 2,502 -1,793 451,435 25,974

CBOT

wheat 9,747 935 -5,774 923 444,225 3,494

KCBT

wheat -11,989 -355 3,153 -97 239,385 -8,131

MGEX

wheat 8,110 123 4,980 -1,079 79,137 -446

Total

wheat 5,868 703 2,359 -253 762,747 -5,083

Live

cattle 20,335 100 -19,158 -377 354,885 4,725

Feeder

cattle -300 202 -7,400 -265 46,885 -299

Lean

hogs 8,768 825 -17,452 -93 273,487 -12,297

Source:

Reuters, CFTC and FI

Macros

UK

Reports Another Record Number Of Daily Covid Cases: 93,045 (prev 88,376)

77

Counterparties Take $1.705 Tln At Fed Reverse Repo Op. (prev $1.658 Tln, 78 Bids)

·

CBOT corn was lower to start but traded higher following strength in soybeans. The front three month contracts ended higher and back months lower. Strength in soybean meal added to the positive undertone. March corn traded above

its Wednesday high of $5.9650/bu and during the session reached its highest level since March 12. It closed at $5.9325.

·

Funds bought an estimated net 3,000 corn contracts.

·

WTI was down $2.09 at $70.29/barrel.

·

China November corn imports fell to their lowest level in 19 months after taking in 790,000 tons, down 36% from year earlier. But year to date imports of 27 million tons are up nearly 200 percent from same period in 2020.

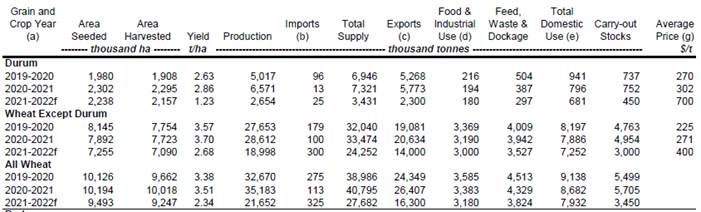

·

Argentina’s government on Friday capped the volume of corn and wheat exports for the 2021-22 crop year. The corn export limit was set at 41.6 million tons and wheat at 12.5 million tons. These limits are high and not eventful,

in our opinion. Last season Argentina had registered exports of 39.8 million tons of corn and 11.2 million tons of wheat. Argentina registered 15.5 million tons of 2021/22 corn exports and 9.1 million tons of wheat. This season Argentina is expected to see

a record wheat production of at least 21 million tons and corn output around 57 million tons.

·

AgRural: Brazil corn production 114.4 million tons, down 1.1 million form previous and well below USDA’s current 118 MMT estimate.

·

IHS Markit: Brazil first crop corn 28.3 million tons, down from 29.5 MMT previous.

·

February CME lean hogs gained against the April position amid market expectations for tightening hog supplies when updated by USDA in the quarterly Hogs and Pigs report, due for release on Dec. 23.

·

Bulgaria reported an outbreak of bird flu at a duck farm in the southern village of Malak Dol .

Export

developments.

·

None reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

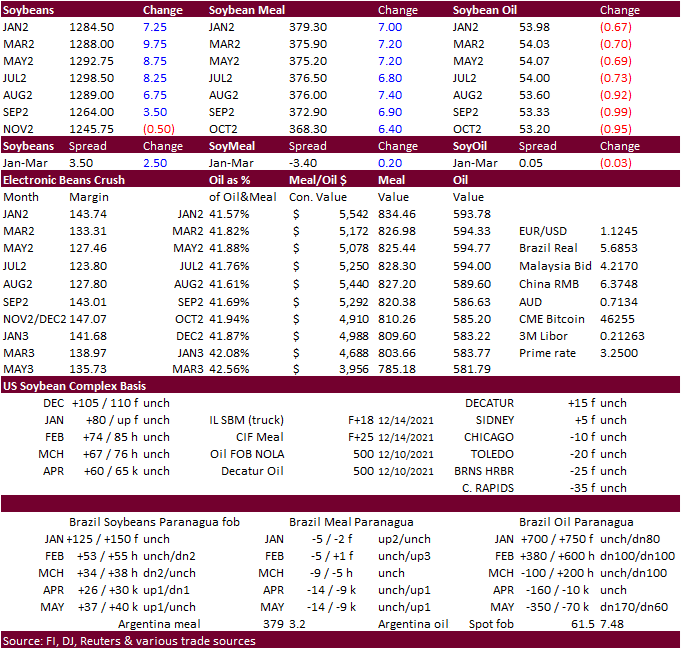

Soybeans ended higher from a rally in canola & rapeseed prices, and strength in soybean meal. Soybean oil ended lower on weakness in US exports prices despite India buying another 33,000 tons of SBO.

·

Funds bought an estimated net 4,000 soybeans, bought 5,000 soybean meal and sold an estimated 4,000 soybean oil.

·

January soybean oil short term support is seen at 51 cents. Today it closed 77 points lower at 53.88 cents.

·

Paris rapeseed traded 7.00 euros higher to a new record of 729 euros. This supported ICE canola. Most-active March canola jumped $17 to close at $1,002.70 per ton.

·

IHS Markit: Brazil soybean crop 145 million tons, unchanged from previous.

·

China crush margins on our analysis was last $1.87/bu ($1.79 previous) versus $1.95 at the end of last week and compares to $1.23 a year ago.

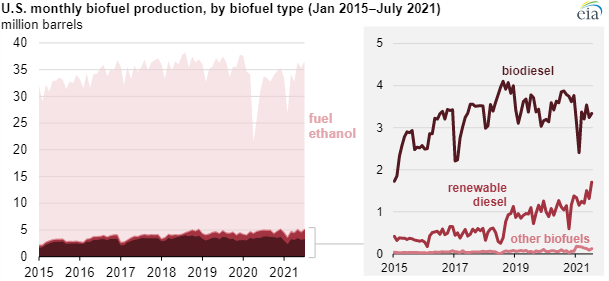

The

renewable biofuel situation

is gaining attention and there are a lot of unknowns when it comes to US prices and the balance sheets. We think the markets will eventually get hairy for a while until several issues are sorted out.

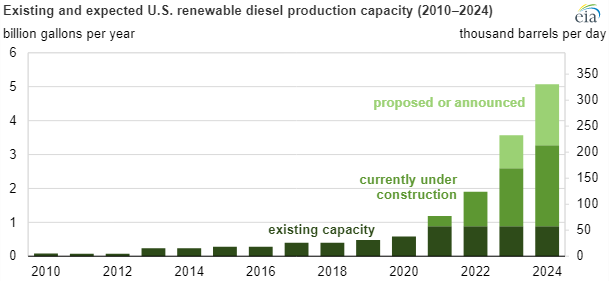

The

trade should start to see a highly noticeable shift in soybean oil supply (soybean area expansion) and demand in 2023. Many of the larger renewable fuel plants will go online during the 2023-2024 period. Marathon Petroleum’s refinery in Martinez, California,

plans to start producing renewable diesel in 2022 and could reach its full production capacity of 730 million gal/y (48,000 b/d) in 2023. Phillips 66’s Rodeo Renewed project in San Francisco, California, plans to produce 800 million gal/y (52,000 b/d) of renewable

fuels when completely converted in 2024. If realized, this project would be the world’s largest facility of its kind (EIA).

When

all the US renewable biodiesel expansion is complete, some traders are concerned the US will not have enough fats and vegetable oils for food and biofuel consumption, or US total domestic use. Speculating long term US supply and demand is going to get harder.

So, to help better understand what changes may come, we look at what happened in the past.

The

US ethanol boom, around 2007 resulted in corn acres increasing from 78.3 million acres in 2006 to 93.5million in 2007, and ever since then the US planted area remained above 85 million acres. US corn plantings in the 1990’s average 77 million acres. Feed use

initially eroded. Corn for feed use eroded for 5 consecutive years starting with the 2008-09 season until 2012-13. Since then, it has recovered but never reached back to the record 6.135 billion used for feed during the 2004-15 season. This crop year we project

5.650 billion bushels. Exports also eroded, from 2.436 billion in 2007-08, and stayed under that level until it recovered by 2017-18. China demand over the past five years has kept a firm undertone in US corn exports. The point I’m making is that it took

3-5 years for the demand categories to sort out total domestic use.

The

US will need to expand the soybean area, in our opinion, for the 2023 growing season. For soybean oil, consumption will obviously increase. On the demand side, we think the increase for feedstock will hit the US soybean oil export market first, followed by

an increase in Canadian canola oil imports. For this year we are forecasting soybean oil export below USDA in part to a rise in industrial demand.

Back

in 2006-07 when biodiesel production started to increase, food users expanded to other oils, canola especially and changed all their labels to vegetable oils vs specific oil. One major brand canola, another candy company adopted palm oil.

When

renewable biodiesel increases here in the US, we look for canola acres to expand in Canada and US imports of Canadian canola will increase. For the 2023-2026 period, we look for the US soybean oil market to become a totally domestic market. China may have

to go elsewhere for soybeans. Ukraine may likely be the spot for expansion and other countries in the Black Sea region. Brazil will keep expanding their soybean crop, so we don’t see any major deficiencies over the next 3-5 years for soybeans, just a major

shift in global trade flows. Keep in mind soybean oil will not be the on only feedstock for renewable biodiesel production. The US makes an abundant amount of corn oil, and some ethanol plants have the capability to increase corn oil production by upgrading

facilities. Forecasting the major fats and oils use for renewable will be difficult at first, but after a couple years we think the industry will figure it out.

Oil

Share 2003-present

Monthly

Oil Share…2008-2013 was a wild ride

2004-2008

also a rocky period of user transition

Interesting

article on soybeans and biodiesel below.

Marrying

Soybeans and Renewable Diesel

Export

Developments

·

USDA reported private exporters sold 33,000 tons of soybean oil to India for 2021-22 delivery and 132,000 tons of soybeans to China for 2021-22.

Updated

12/14/21

Soybeans

– January $12.35 to $13.05 range, March $11.75-$13.50

Soybean

meal – January $350 to $400, March $330-$415

Soybean

oil – January 49.50 to 57.00, March 50.00-59.00

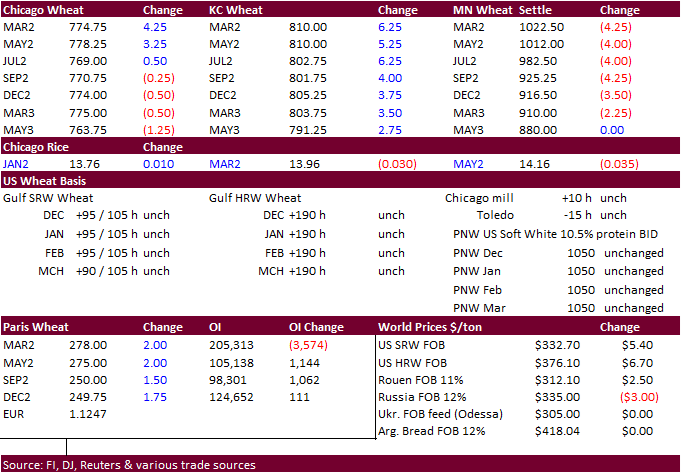

·

US wheat saw follow through buying led by high protein contracts after harsh US weather occurred earlier this week across the Great Plains. Taiwan seeking US wheat added support.

·

Funds bought an estimated net 2,000 soft red winter wheat contracts.

·

Paris March wheat futures was 2.00 euros higher at 278.50/ton.

·

China is back buying French wheat and barley after global prices eased. Reuters noted about 10 large vessels were booked for both commodities. Some put it at 4-6 feed wheat and 4-5 barley cargoes. Shipment was thought to be for

Q1 2022. China may have also bought Argentine barley. Prior to these deals China bought about 2 million tons of French wheat.

·

Russian Agriculture Ministry’s will propose to set its wheat export quota at 8 million tons for the February through June 30 period. Barley will be set at 3 million tons.

·

Australian feed wheat prices have been on the defensive this month on large production prospects.

Agricultural

Industry Market Information System (AIMIS)

Export

Developments.

·

Taiwan Flour Millers’ Association seeks 110,000 tons of grade 1 milling wheat to be sourced from the United States on Dec. 23 for shipment between Feb 1-15 and the second between Feb. 8-22 and second cargo for shipment for some

time in 2022.

·

Turkey seeks about 320,000 tons of 12.5% and 13.5% protein content milling wheat on December 21 for shipment between February 1 and February 28.

·

Jordan seeks 120,000 tons of feed barley on December 23 for shipment sometime between June 16-30, July 1-15, July 16-31 and Aug. 1-15.

Rice/Other

·

Results awaited: South Korean Agro-Fisheries & Food Trade Corp. seeks 22,000 tons of rice from the US, set to close Dec 16.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.