PDF Attached

Attached

is our updated US soybean oil balance sheet. We adjusted the 2022-23 SBO yield lower. Higher trade in the soybean complex from a lower USD and unfavorable weather forecasts for Argentina. Some of the weather models turned drier for Argentina’s two rain events.

Corn and wheat ended higher. Gains in Chicago wheat were limited as a major winter storm will sweep across the US Great Plains and Midwest starting Wednesday. We look for March soybeans to test their recent contract high of $14.9725 by the end of the week

if Argentina misses out on some of their rains. The US will see a large winter storm starting Wednesday. Temperatures will be extremely cold well into next week before trending above average for the second week of the forecast. Livestock stress and unfavorable

travel conditions are expected through Friday.

Weather

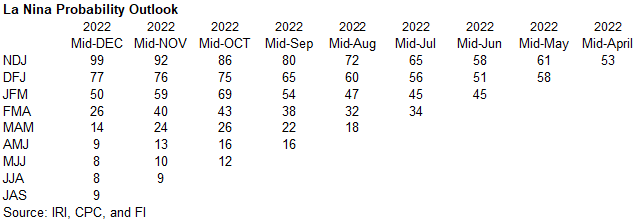

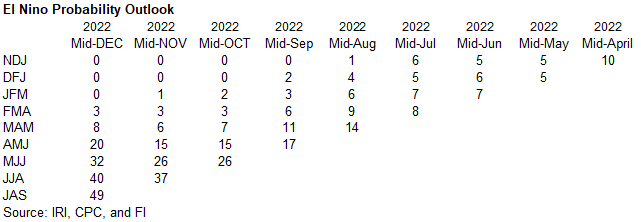

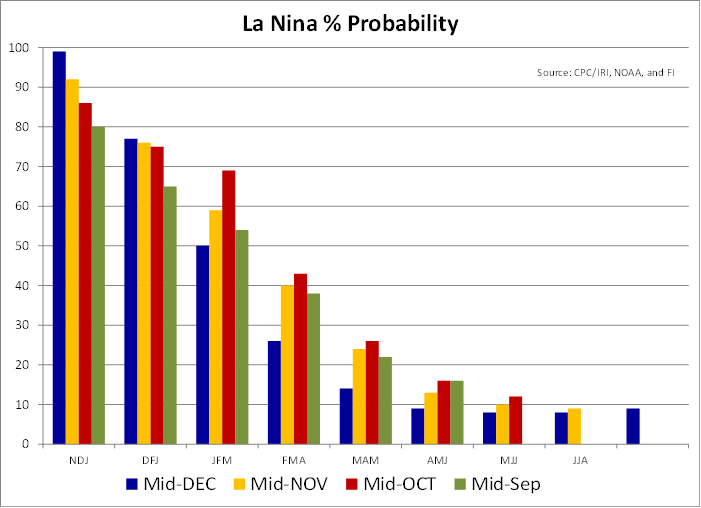

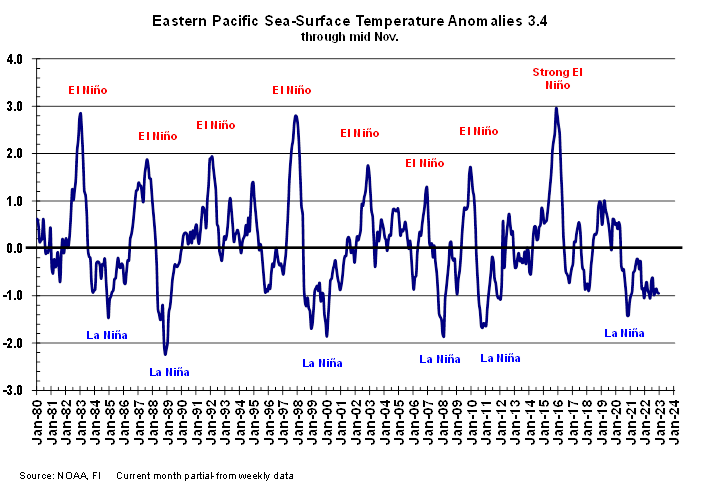

La

Nina is

predicted to stick around but fad away by US planting season. We see this as an indicator for a normal North American growing season. South American crop production will be monitored.