PDF Attached

CBOT

agriculture markets are closed Thursday night/Fri dec 24th . Re-open Sunday night dec 26th regular time.

https://www.cmegroup.com/tools-information/holiday-calendar.html

Due

to the Federal holiday observed on Friday, December 24, the weekly Commitments of Traders report will be released on Monday, December 27 at 3:30pm.

The

open on Sunday night will be important as any major changes in South America’s weather outlook could have a major impact on CBOT prices. This weekend we see the long holiday week for SA comparable to the US 4th of July holiday weekend, a time when

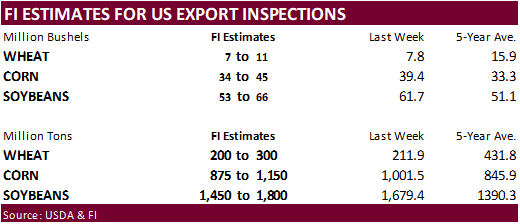

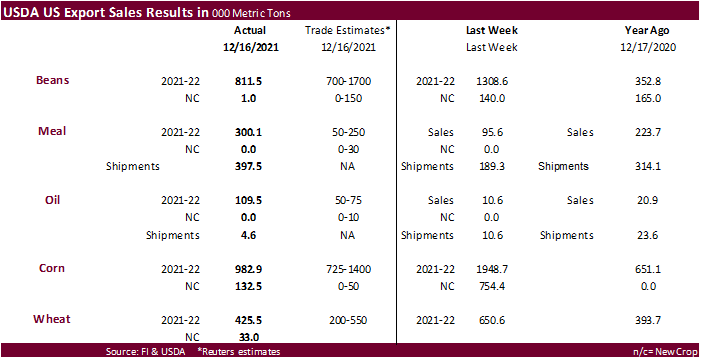

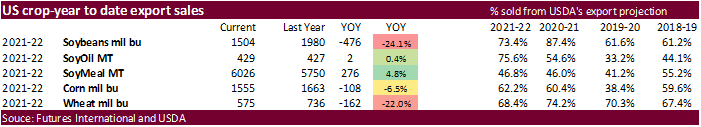

crops are about 1-2 months away from maturity. Argentina and Southern Brazil weather is still unfavorable over the next ten days but early January there is an opportunity for rain. USDA export sales were within expectations for soybeans, corn and all-wheat,

and exceeded expectations for meal and oil. Sorghum sales were excellent.

![]()

WEATHER

EVENTS AND FEATURES TO WATCH

-

Bitter

cold occurred in portions of Russia and Ukraine again this morning, but snow fell ahead of the cold and protected winter crops -

Additional

bouts of cold are expected from eastern Europe through the western parts of Russia and Ukraine in the next ten days, but snow will be present to protect crops.

-

Eastern

Australia rain expected this weekend into next week will raise topsoil moisture for some grain and cotton areas in Queensland and far northeastern New South Wales -

Rain

was reduced overnight for central New South Wales relative to the forecasts of Wednesday -

This

reduction was needed and will help protect summer crops from too much moisture and help with any late season winter crop harvesting that is lingering in the region -

Southern

Australia wheat and barley harvest weather will be ideal through the coming week to ten days with very little rain expected and seasonably warm temperatures -

Argentina

is expecting additional drying and warm weather over the next ten days and perhaps longer in portions of northern, central and east-central crop areas -

Completely

dry weather may not occur, but the rain expected will fail to counter evaporative moisture losses resulting in ongoing net drying -

Western

Argentina summer crop areas will get some timely rainfall over the next couple of weeks which may not counter evaporation in all areas, but it will help to keep crop conditions favorable -

The

best crop and soil conditions in Argentina today are in Southern Cordoba, southern Santa Fe, northwestern through central Buenos Aires and northeastern La Pampa -

Conditions

will stay favorable in these areas, despite net drying in the coming week -

Follow

up rain will be necessary in early January to ensure favorable soil moisture and crop development prevails.

-

Uruguay,

southern Paraguay and southern Brazil will remain in a net drying trend for the next two weeks, despite some shower activity in parts of the region -

Below

average precipitation from southern and western Mato Grosso do Sul, southwestern Sao Paulo and western Parana into western Rio Grande do Sul and Uruguay coupled with warm temperatures will lead to more crop stress and declining soil moisture -

Any

showers that occur in these areas will be brief and light -

Below

average precipitation may also dominate the month of January -

Northern

Brazil rain frequency will remain high and there is potential for areas of flooding -

Eastern

Mato Grosso do Sul, Tocantins, northern Goias, northern Minas Gerais and Bahia will be wettest -

The

ground is already saturated, and any heavy rainfall will raise the potential for flooding

-

Some

areas will get 3.00 to 6.00 inches of rain and local totals of 9,00 inches in this coming week with more in the following week -

Early

season harvest weather for soybeans will be best from southern and western Mato Grosso through Mato Grosso do Sul to Parana and Sao Paulo which is a large part of the early crop region -

Safrinha

corn and cotton planting will follow the soybean harvest and there will be need for greater rainfall in some of the southern corn production areas -

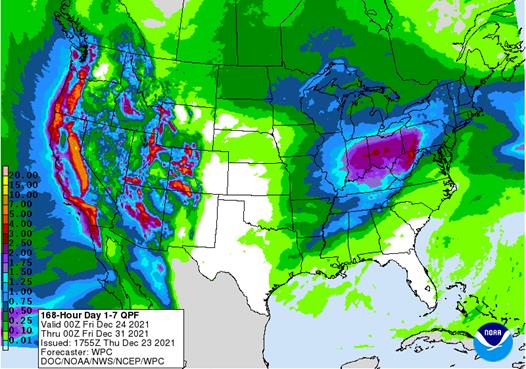

U.S.

weather is expected to become more active with storms bringing frequent bouts of rain and snow to all areas except hard red winter wheat production areas which are expected to be drier than usual -

Waves

of light snow will impact the northern Plains -

Net

drying is expected in the southeastern states during this first week of the forecast with some beneficial rain expected in the following week -

West

Texas will be dry over the coming week with a few showers possible in the last days of December and early January -

California,

the Great Basin, Pacific Northwest and Rocky Mountain region will experience frequent precipitation in the coming week with less moisture in the second week of the outlook -

U.S.

Midwest crop areas will see frequent bouts of rain in the central and south and increasing amounts of snow in the north -

Florida

precipitation will be limited over the next two weeks -

Bitter

cold that is locked into western Canada will expand to the south into the western and north-central United States this weekend and next week -

The

cooling trend will bring some increased demand for heating fuel, but only in low-populated areas of the west and north-central states -

Very

little of the bitter cold will advance farther to the south than the central Plains and Midwest during the next two weeks leaving the Atlantic Coast States, southern Plains, lower Mississippi River Basin and interior southeastern states in a warm weather mode

for a while -

Most

of the U.S. was dry Thursday -

China

weather is expected to be relatively tranquil for a while -

Winter

crops are dormant or semi-dormant and most are suspected of being favorably established -

Rapeseed

should be in better shape than either of the past two autumns -

Precipitation

will occur periodically in east-central parts of the nation maintaining good soil moisture for over-wintering crops -

A

little snow will fall in Sichuan and immediate neighboring areas this weekend causing travel delays and stressing some livestock -

Temperatures

will be cooler than usual in the northeast and seasonable to slightly warmer biased elsewhere -

Cooling

is expected in central and northern China during the second half of this week and into the coming weekend -

Warming

will occur in many areas next week with another round of cooling possible late next week -

South

Africa weather over the next two weeks will be mostly good for summer crop development -

Sufficient

rain is expected to support crops, although the second half of this week through the weekend and into early next will be a period of net drying in the western summer crop areas -

Eastern

summer crop areas will continue to have the best soil moisture and highest dryland crop yield potentials -

Recent

reports of too much rain have been received from north-central parts of North West through central Free State to parts of western and Central Natal, although the situation is not a big concern -

Temperatures

in this first week will be cooler than usual which will help to conserve soil moisture through slower evaporation rates -

Next

week will be warmer biased -

Europe

precipitation over the next two weeks will be favorably mixed with seasonable to slightly warmer than usual temperatures supporting good winter crop conditions -

Cooling

is expected in northeastern parts of the continent late this week and during the weekend -

North

Africa precipitation will be erratic over the next week to ten days -

Any

precipitation that falls will be welcome -

Drought

remains serious in southwestern Morocco, but there is a chance for “some” showers there -

Northern

Morocco will be wettest during the coming week -

Northwestern

Algeria still needs greater rainfall -

West-central

Africa rainfall is expected to be confined to coastal areas only -

Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas -

Ethiopia

rainfall will be restricted over the next seven days resulting in net drying conditions which are not unusual at this time of year -

Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through January 4 -

Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks with all areas getting rain at one time of another -

Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain early this week and again next week -

Mexico

precipitation will be restricted during the next ten days -

Seasonable

drying is expected, but there is need for greater rain in northern parts of the nation -

Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica -

Middle

East weather has been a little dry east of Turkey -

Recent

rain has offered some temporary relief in northern Iraq and western Iran -

Showers

will occur in some of these areas today and again at the end of next week into the following weekend -

Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected -

Today’s

Southern Oscillation Index was +9.60 and it was expected to move erratically over the next several days -

New

Zealand rainfall will be lighter than usual during the next week -

Temperatures

will be seasonable with a slight cooler bias

Thursday,

Dec. 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - U.S.

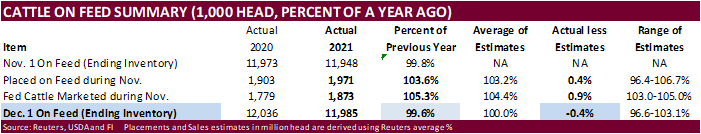

cattle on feed, 3pm - USDA

hogs & pigs inventory and production, red meat output, 3pm

Friday,

Dec. 24:

- No

Commitment of Traders reports given holidays in U.S. and U.K. CFTC and ICE releases will be out on Monday, Dec. 27

Source:

Bloomberg and FI

USDA

export sales

Macros

76

Counterparties Take $1.578 Tln At Fed Reverse Repo Op. (prev $1.699 Tln, 82 Bids)

US

Univ. Of Michigan Sentiment Dec F: 70.6 (est 70.4; prev 70.4)

–

Conditions: 74.2 (prev 74.6) – Expectations: 67.3 (prev 67.8) – 1-Year Inflation: 4.8% (est 4.9%; prev 4.9%) – 5-10 Year Inflation: 2.9% (prev 3.0%)

US

Personal Income Nov: 0.4% (exp 0.4%; prev 0.5%)

–

Personal Spending Nov: 0.6% (exp 0.6%; R prev 1.4%)

–

Real Personal Spending Nov: 0.0% (exp 0.2%; prev 0.7%)

US

Initial Jobless Claims Dec-18: 205K (exp 205K; R prev 205K)

–

Continuing Claims Dec-11: 1859K (exp 1835K; R prev 1867K)

US

Durables Goods Orders Nov P: 2.5% (exp 1.8%; prev -0.4%)

–

Durables Ex-Transportations Nov P: 0.8% (exp 0.6%; R prev 0.3%)

–

Cap Goods Orders Nondef Ex-Air Nov P: -0.1% (exp 0.7%; R prev 0.9%)

–

Cap Goods Ship Nondef Ex-Air Nov P: 0.3% (exp 0.6%; prev 0.4%)

US

PCE Core Deflator (M/M) Nov: 0.5% (exp 0.4%; R prev 0.5%)

–

PCE Core Deflator (Y/Y) Nov: 4.7% (exp 4.5%; R prev 4.2%)

–

PCE Deflator (M/M) Nov: 0.6% (exp 0.6%; R prev 0.7%)

–

PCE Deflator (Y/Y) Nov: 5,7% (exp 5.7%; R prev 5.1%)

Canadian

GDP (M/M) Oct: 0.8% (exp 0.8%; prev 0.1%)

–

GDP (Y/Y) Oct: 3.8% (exp 3.6%; prev 3.4%)

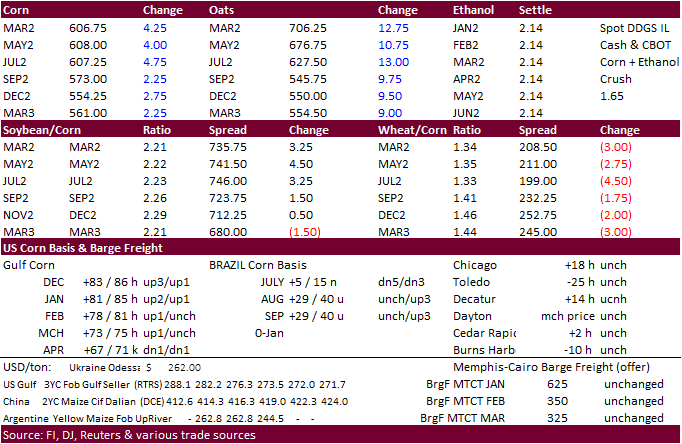

·

CBOT corn ended higher in a two-sided trade, near a 6-month high on late fund buying and rebound in soybean meal. Argentina and Southern Brazil weather is unfavorable over the next ten days but early January there is an opportunity

for rain. Sunday weather model changes should dictate the CBOT open that evening. News was light in the pre-holiday trade. Higher WTI crude and Iran buying more than expected amount of corn, although origin was thought to be Brazil, was supportive. USDA export

sales were ok for corn but a marketing year high for sorghum (China).

·

Funds bought an estimated net 4,000 corn contracts.

·

South Korea banned imports of Canadian beef after BSE case was reported in an 8-1/2-year-old beef cow in the province of Alberta. The cow did not enter the food or animal feed chain.

·

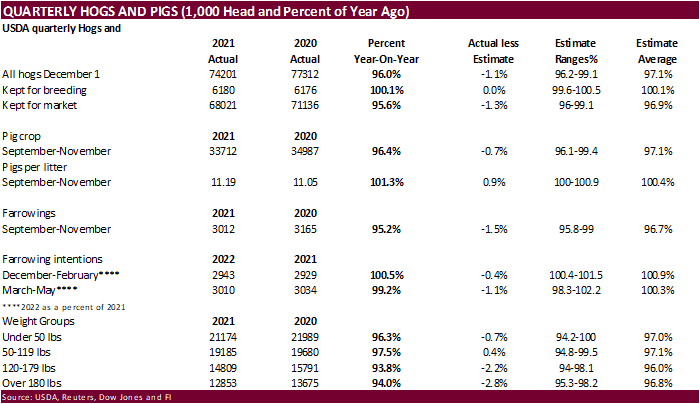

USDA’s Hogs and Pigs report was seen supportive for the back months as farrowing intentions for the March through May period were less than expected. December 1 pig crop was also 1.1 percentage points below expectations. This

report is seen slightly bearish soybean meal and corn for feed demand. December 1 all hogs were 74.201 million, 96.0% of a year ago, and lowest for the Dec 1 period since 2017.

Export

developments.

·

Iran’s SLAL bought 300,000 tons of corn (more than expected) from Brazil and may have passed on 60,000 tons of animal feed barley.

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

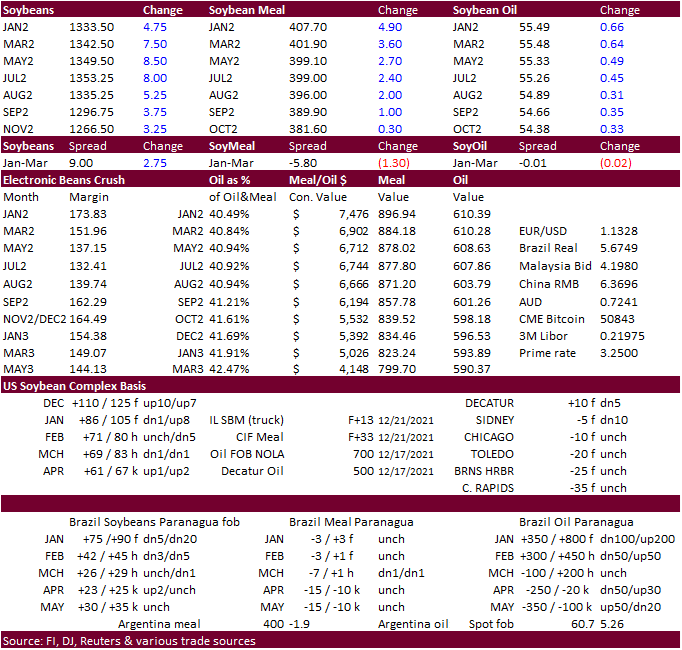

Soybeans, soybean meal and soybean oil traded two-sided to end higher with a late session rally in soybean meal and soybeans. The La Nina pattern countries to generate a stir among traders as SA weather maps continue to suggest

warmer and drier conditions over the next ten days but some of 10-15 day maps do indicate light at the end of the tunnel during the first weekend of January.

·

USDA export sales for the soybean products were very good and soybeans within expectations.

·

Funds bought an estimated net 2,000 soybeans, bought 2,000 soybean meal and bought 2,000 soybean oil.

·

February rapeseed was 9.75 euros higher at 756.50, a fresh record high.

·

China crush margins on our analysis was last $1.77/bu ($1.79 previous) versus $1.87 at the end of last week and compares to $1.07 a year ago.

Export

Developments

·

Iran’s SLAL bought 240,000 tons of soybean meal, for shipment between January and February 2022.

Updated

12/22/21

Soybeans

– January $12.75 to $13.50 range, March $11.75-$13.75

Soybean

meal – January $370 to $410, March $330-$415

Soybean

oil – January 52.00 to 56.00, March 50.00-59.00

·

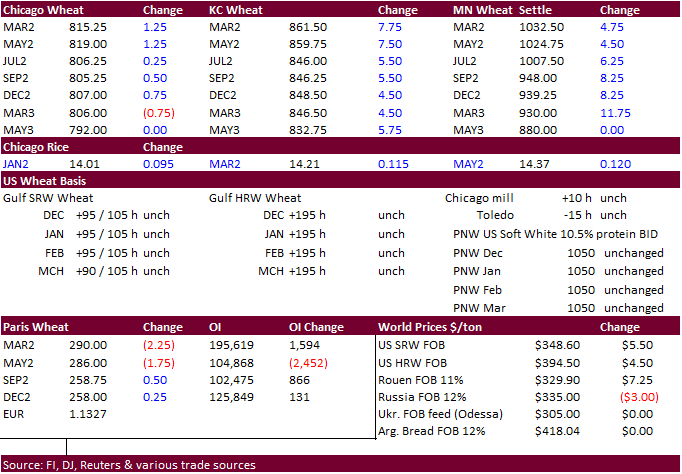

US wheat ended mixed in Chicago and higher in KC and MN. Iran bought more than expected milling wheat and Algeria secured 200,000-250,000 tons of durum from Canada and Mexico.

·

Funds were even on Thursday for SRW wheat contracts.

·

December US weather is on track to see its warmest month on record for the Great Plains.

·

Paris March wheat futures was 2.25 euros lower, at 290.75/ton.

·

Argentina’s 2021-22 wheat crop was estimated by the BA Grains Exchange at a record 21.5 million tons, up from 21.0 million tons previously. The Argentine wheat harvest is 78.3% complete. Dry weather during December facilitated

harvest progress.

·

Ukraine’s trade union said there is no need for the government to set a limit on milling wheat exports in FH 2022. Ukraine has exported 15.6 million tons of wheat so far in the 2021/22 season (July-June), up 27% year on year.

·

(Reuters) – Russia harvested 120.7 million tons of grain after drying and cleaning in 2021, including 75.9 million tons of wheat, the statistics service said on Thursday, citing preliminary data. In 2020, Russia’s grain crop totaled

133.5 million tons, including 85.9 million tons of wheat.

·

Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

·

Iran’s GTC bought 240,000 tons of milling wheat, unknow origin, for an unknow shipment period. Volume was more than expected.

·

Yesterday Algeria bought 200,000 to 250,000 tons of durum wheat (from Canada and Mexico) for shipment in February. Traders estimated prices from $700 to between $715 to $720 a ton c&f for large bulk carriers and around $5-$6 a

ton more for smaller vessels.

·

Taiwan Flour Millers’ Association bought 110,000 tons of grade 1 milling wheat to be sourced from the United States for shipment between Feb 1-15 and the second between Feb. 8-22 and second cargo for shipment for some time in

2022. It was of various classes.

·

Jordan bought 60,000 tons of feed barley at an estimated $305.24 a ton, cost and freight (c&f) included, for shipment in the first half of August 2022.

·

Jordan seeks 120,000 tons of milling wheat on December 29 for shipment sometime between June 16 and 30, July 1 and 15, July 16 and 31 and Aug. 1 and 15.

Rice/Other

·

Bangladesh seeks 50,000 tons of non-basmati parboiled rice on December 30 for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

USDA export sales

U.S. EXPORT SALES FOR WEEK ENDING 12/16/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

95.6 |

2,213.3 |

1,660.9 |

77.2 |

3,978.3 |

5,407.7 |

0.0 |

14.0 |

|

SRW |

60.2 |

727.0 |

496.2 |

18.9 |

1,555.3 |

1,038.0 |

0.0 |

34.5 |

|

HRS |

142.9 |

1,262.7 |

1,595.7 |

63.8 |

2,913.5 |

3,922.5 |

0.0 |

0.0 |

|

WHITE |

126.3 |

893.2 |

2,632.7 |

30.5 |

1,958.2 |

2,699.4 |

0.0 |

0.0 |

|

DURUM |

0.3 |

36.2 |

128.1 |

0.0 |

97.2 |

461.5 |

33.0 |

33.0 |

|

TOTAL |

425.4 |

5,132.4 |

6,513.5 |

190.4 |

10,502.6 |

13,529.0 |

33.0 |

81.5 |

|

BARLEY |

0.0 |

19.7 |

15.0 |

0.9 |

10.7 |

15.5 |

0.0 |

0.0 |

|

CORN |

982.9 |

26,748.1 |

29,342.1 |

1,101.4 |

12,746.3 |

12,888.9 |

132.5 |

1,452.0 |

|

SORGHUM |

422.1 |

3,737.6 |

3,305.9 |

315.4 |

1,364.6 |

1,738.0 |

0.0 |

0.0 |

|

SOYBEANS |

811.5 |

13,647.8 |

19,256.1 |

1,854.7 |

27,277.2 |

34,635.6 |

1.0 |

141.0 |

|

SOY MEAL |

300.0 |

3,282.4 |

3,062.7 |

397.4 |

2,743.0 |

2,687.0 |

-1.9 |

35.6 |

|

SOY OIL |

109.5 |

290.2 |

246.1 |

4.6 |

138.3 |

180.7 |

0.0 |

0.1 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

20.0 |

167.3 |

272.9 |

2.0 |

579.1 |

687.1 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

6.3 |

17.3 |

0.0 |

2.9 |

11.6 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

3.8 |

10.9 |

0.7 |

26.6 |

20.6 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

68.5 |

61.3 |

0.2 |

15.1 |

33.9 |

0.0 |

0.0 |

|

L G MLD |

38.8 |

80.1 |

88.8 |

17.8 |

342.8 |

229.5 |

0.0 |

0.0 |

|

M S MLD |

21.1 |

80.0 |

181.5 |

21.1 |

148.9 |

187.0 |

0.0 |

0.0 |

|

TOTAL |

80.2 |

406.0 |

632.7 |

41.8 |

1,115.3 |

1,169.8 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

243.9 |

7,488.2 |

6,118.9 |

131.1 |

2,770.1 |

4,978.4 |

49.4 |

1,045.9 |

|

PIMA |

6.5 |

234.7 |

223.9 |

4.5 |

130.6 |

314.5 |

0.4 |

4.4 |

This

summary is based on reports from exporters for the period December 10-16, 2021.

Wheat: Net

sales of 425,400 metric tons (MT) for 2021/2022 were down 35 percent from the previous week, but up 11 percent from the prior 4-week average. Increases primarily for Japan (130,500 MT), the Philippines (105,500 MT), Mexico (35,000 MT, including decreases

of 11,600 MT), South Korea (35,000 MT), and unknown destinations (31,700 MT), were offset by reductions for Italy (500 MT). Total net sales of 33,000 MT for 2022/2023 were for unknown destinations. Exports of 190,400 MT were down 31 percent from the previous

week and 28 percent from the prior 4-week average. The destinations were primarily to Mexico (68,800 MT), South Korea (55,000 MT), Nigeria (21,100 MT), Italy (19,500 MT), and the Dominican Republic (12,100 MT).

Export

Adjustments:

Accumulated exports of white wheat to Indonesia were adjusted down 1,300 MT for week ending November 25th. These exports were reported in error.

Corn:

Net sales of 982,900 MT for 2021/2022 were down 50 percent from the previous week and 29 percent from the prior 4-week average. Increases primarily for Japan (345,700 MT, including 126,000 MT switched from unknown destinations and decreases of 1,600 MT),

Mexico (258,000 MT, including decreases of 3,300 MT), Canada (216,700 MT, including decreases of 1,300 MT), Colombia (99,600 MT, including 23,700 MT switched from unknown destinations and decreases of 22,300 MT), and Jamaica (23,200 MT, including decreases

of 9,000 MT), were offset by reductions for unknown destinations (14,100 MT). Net sales of 132,500 MT for 2022/2023 reported for Japan (76,700 MT) and Mexico (60,000 MT), were offset by reductions for Costa Rica (4,200 MT). Exports of 1,101,400 MT were up

1 percent from the previous week and 14 percent from the prior 4-week average. The destinations were primarily to Mexico (349,900 MT), China (208,800 MT), Japan (207,400 MT), Canada (97,900 MT), and South Korea (68,300 MT).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 900 MT were reported for Italy. The current outstanding balance of 501,000 MT is for unknown destinations (429,000 MT), Italy (63,000 MT), and Saudi Arabia (9,000 MT).

Barley:

No net sales were reported for the week. Exports of 900 MT were up 1 percent from the previous week and 47 percent from the prior 4-week average. The destination was to Japan.

Sorghum:

Net sales of 422,100 MT for 2021/2022–a marketing-year high–were up 27 percent from the previous week and 57 percent from the prior 4-week average. Increases were reported for China (412,100 MT, including 121,000 MT switched from unknown destinations and

decreases of 1,500 MT) and unknown destinations (10,000 MT). Exports of 315,400 MT–a marketing-year high–were up noticeably from the previous week and up 81 percent from the prior 4-week average. The destination was primarily to China (314,700 MT).

Rice:

Net

sales of 80,200 MT for 2021/2022 were up 55 percent from the previous week and 70 percent from the prior 4-week average. Increases were primarily for Haiti (36,700 MT), Japan (13,000 MT), Mexico (11,200 MT, including decreases of 100 MT), Jordan (6,000 MT),

and Costa Rica (5,500 MT). Exports of 41,800 MT were down 31 percent from the previous week and 45 percent from the prior 4-week average. The destinations were primarily to Haiti (15,300 MT), Japan (13,000 MT), Jordan (6,000 MT), Canada (3,100 MT), and Mexico

(2,400 MT).

Exports

for Own Account:

For 2021/2022, exports for own account totaling 100 MT to Canada were applied to new or outstanding sales. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 811,500 MT for 2021/2022–a marketing-year low–were down 38 percent from the previous week and 42 percent from the prior 4-week average. Increases primarily for China (730,400 MT, including 330,000 MT switched from unknown destinations and decreases

of 3,300 MT), Mexico (95,100 MT, including 47,500 MT switched from unknown destinations, decreases of 1,600 MT, and 32,700 MT – late), Egypt (94,000 MT), Indonesia (85,000 MT, including 55,000 MT switched from unknown destinations and decreases of 100 MT),

and Saudi Arabia (71,100 MT, including 66,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (571,800 MT). Total net sales of 1,000 MT for 2022/2023 were for Japan. Exports of 1,854,700 MT were down 3

percent from the previous week and 17 percent from the prior 4-week average. The destinations were primarily to China (1,050,600 MT), Egypt (122,000 MT), Mexico (112,700 MT), Saudi Arabia (71,100 MT), and Turkey (69,300 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 34,600 MT, all Canada.

Late

Reporting:

For 2021/2022, net sales totaling 32,700 MT of soybeans were reported late to Mexico.

Soybean

Cake and Meal:

Net sales of 300,000 MT for 2021/2022 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for the Philippines (186,400 MT, including 45,000 MT switched from unknown destinations), Thailand (50,000 MT), Ireland

(25,300 MT, including 24,000 MT switched from unknown destinations), the Dominican Republic (19,500 MT), and Mexico (15,500 MT, including decreases of 2,000 MT), were offset by reductions primarily for Japan (28,600 MT). Net sales reductions of 1,900 MT for

2022/2023 were reported for Canada (800 MT), Japan (700 MT), and the Netherlands (400 MT). Exports of 397,400 MT–a marketing-year high–were up noticeably from the previous week and up 54 percent from the prior 4-week average. The destinations were primarily

to the Philippines (166,100 MT), Mexico (40,000 MT), Ecuador (32,400 MT), Canada (29,300 MT), and Ireland (25,300 MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 50,000 MT is for Venezuela.

Soybean

Oil:

Net sales of 109,500 MT for 2021/2022–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for India (53,000 MT), South Korea (17,000 MT), Colombia (15,400 MT), Jamaica (10,500 MT),

and Mexico (7,700 MT). Exports of 4,600 MT were down 57 percent from the previous week and 82 percent from the prior 4-week average. The destinations were to Colombia (4,000 MT), Canada (400 MT), and Mexico (200 MT).

Cotton:

Net sales of 243,900 RB for 2021/2022 were down 15 percent from the previous week and 21 percent from the prior 4-week average. Increases were primarily for China (68,700 RB, including 2,200 RB switched from Vietnam and decreases of 8,800 RB), Vietnam (32,700

RB, including 600 RB switched from South Korea and decreases of 100 RB), Turkey (29,000 RB), Pakistan (23,500 RB, including 300 RB switched from the United Arab Emirates), and Mexico (22,800 RB), were offset by reductions for South Korea (1,700 RB), Malaysia

(400 RB), and the United Arab Emirates (300 RB). Net sales of 49,400 RB for 2022/2023 reported for Mexico (42,900 RB), Pakistan (4,400 RB), Vietnam (1,400 RB), and Indonesia (1,200 RB), were offset by reductions for China (500 RB). Exports of 131,100 RB

were unchanged from the previous week, but up 27 percent from the prior 4-week average. The destinations were primarily to China (58,300 RB), Vietnam (17,900 RB), Mexico (10,300 RB), Turkey (10,200 RB), and Pakistan (8,400 RB). Net sales of Pima totaling

6,500 RB were up noticeably from the previous week, but down 20 percent from the prior 4-week average. Increases primarily for Thailand (2,600 RB), India (1,400 RB), Pakistan (900 RB), Japan (900 RB), and China (700 RB), were offset by reductions for Egypt

(900 RB). Total net sales of 400 RB for 2022/2023 were for Egypt. Exports of 4,500 RB were down 47 percent from the previous week and 30 percent from the prior 4-week average. The destinations were to China (2,200 RB), India (1,700 RB), Pakistan (400 RB),

and Turkey (200 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the

current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 248,300 pieces for 2021 were down 6 percent from the previous week and 25 percent from the prior 4-week average. Increases primarily for China (157,900 whole cattle hides, including decreases of 6,400 pieces), Mexico (37,500 whole cattle hides,

including decreases of 300 pieces), South Korea (32,100 whole cattle hides, including decreases of 1,600 pieces), Thailand (16,900 whole cattle hides, including decreases of 900 pieces), and Vietnam (2,400 whole cattle hides, including decreases of 1,800 pieces),

were offset by reductions primarily for Italy (1,500 pieces), and Indonesia (900 pieces). Net sales of 92,000 pieces for 2022 were primarily for China (51,400 whole cattle hides), Thailand (30,600 whole cattle hides), and Mexico (9,500 whole cattle hides).

In addition, total net sales of 8,400 kip skins were reported for Belgium. Exports of 435,600 pieces were up 16 percent from the previous week and 18 percent from the prior 4-week average. Whole cattle hide exports were primarily to China (300,400 pieces),

South Korea (47,800 pieces), Mexico (29,900 pieces), Indonesia (18,900 pieces), and Thailand (14,900 pieces).

Net

sales of 137,400 wet blues for 2021 were up 42 percent from the previous week and 71 percent from the prior 4-week average. Increases primarily for China (54,600 unsplit), Italy (43,200 grain splits), Thailand (26,300 unsplit), and Vietnam (14,500 unsplit,

including decreases of 9,800 unsplit), were offset by reductions for Japan (900 grain splits), the Dominican Republic (200 unsplit), and Italy (100 unsplit). Net sales reductions of 11,400 wet blues for 2022 resulting in increases for Vietnam (9,400 unsplit),

were offset by reductions for Italy (20,800 unsplit). Exports of 137,400 wet blues were down 1 percent from the previous week, but up 14 percent from the prior 4-week average. The destinations were primarily to Vietnam (41,200 unsplit), China (39,700 unsplit),

Italy (13,700 unsplit and 8,300 grain splits), Thailand (9,500 unsplit), and Japan (9,100 grain splits).

Net

sales of 1,358,300 splits were primarily for Vietnam (1,356,000 pounds, including decreases of 9,400 pounds). Net sales of 853,700 splits for 2022 primarily for Vietnam (603,600 pounds), were offset by reductions for China (400 pounds). Exports of 805,400

pounds were primarily to Vietnam (597,100 pounds).

Beef:

Net sales of 12,000 MT for 2021 were down 30 percent from the previous week and 23 percent from the prior 4-week average. Increases primarily for China (3,800 MT, including decreases of 300 MT), Japan (3,700 MT, including decreases of 400 MT), South Korea

(2,800 MT, including decreases of 1,500 MT), Mexico (700 MT), and Taiwan (500 MT, including decreases of 500 MT), were offset by reductions for Hong Kong (300 MT) and Chile (100 MT). Net sales of 8,100 MT for 2022 were primarily for South Korea (3,200 MT),

China (2,400 MT), Taiwan (900 MT), Japan (700 MT), and Hong Kong (500 MT), were offset by reductions for Vietnam (200 MT). Exports of 17,900 MT were down 3 percent from the previous week, but up 3 percent from the prior 4-week average. The destinations were

primarily to South Korea (5,400 MT), Japan (4,600 MT), China (3,100 MT), Mexico (1,800 MT), and Taiwan (1,300 MT).

Pork:

Net sales of 28,800 MT for 2021 were down 8 percent from the previous week, but up 5 percent from the prior 4-week average. Increases primarily for Mexico (14,000 MT, including decreases of 700 MT), South Korea (7,100 MT, including decreases of 600 MT), Japan

(3,800 MT, including decreases of 2,300 MT), Canada (1,600 MT, including decreases of 400 MT), and Nicaragua (900 MT), were offset by reductions for China (300 MT), Australia (200 MT), and Chile (100 MT). Net sales of 7,000 MT for 2022 were primarily for

Japan (2,800 MT), Mexico (1,600 MT), Canada (1,600 MT), Colombia (1,300 MT), and the Philippines (600 MT), were offset by reductions for South Korea (2,300 MT). Exports of 32,000 MT were up 6 percent from the previous week, but down 1 percent from the prior

4-week average. The destinations were primarily to Mexico (14,500 MT), Japan (5,100 MT), China (4,500 MT), South Korea (2,000 MT), and Canada (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.