PDF Attached

We hope everyone had a safe and happy holiday.

Opening calls:

Soybeans 5-9 higher

Meal $0.50-1.00 higher

SBO 35-55 points higher

Corn 2-5 higher

Wheat 3-6 cents higher bias KC to upside.

WTI is lower and USD slightly higher

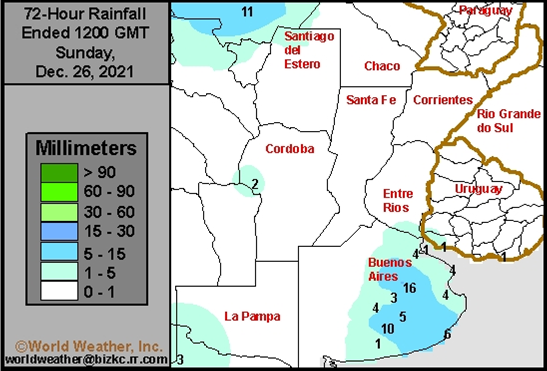

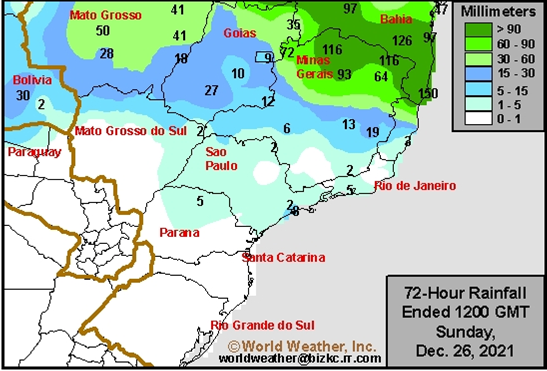

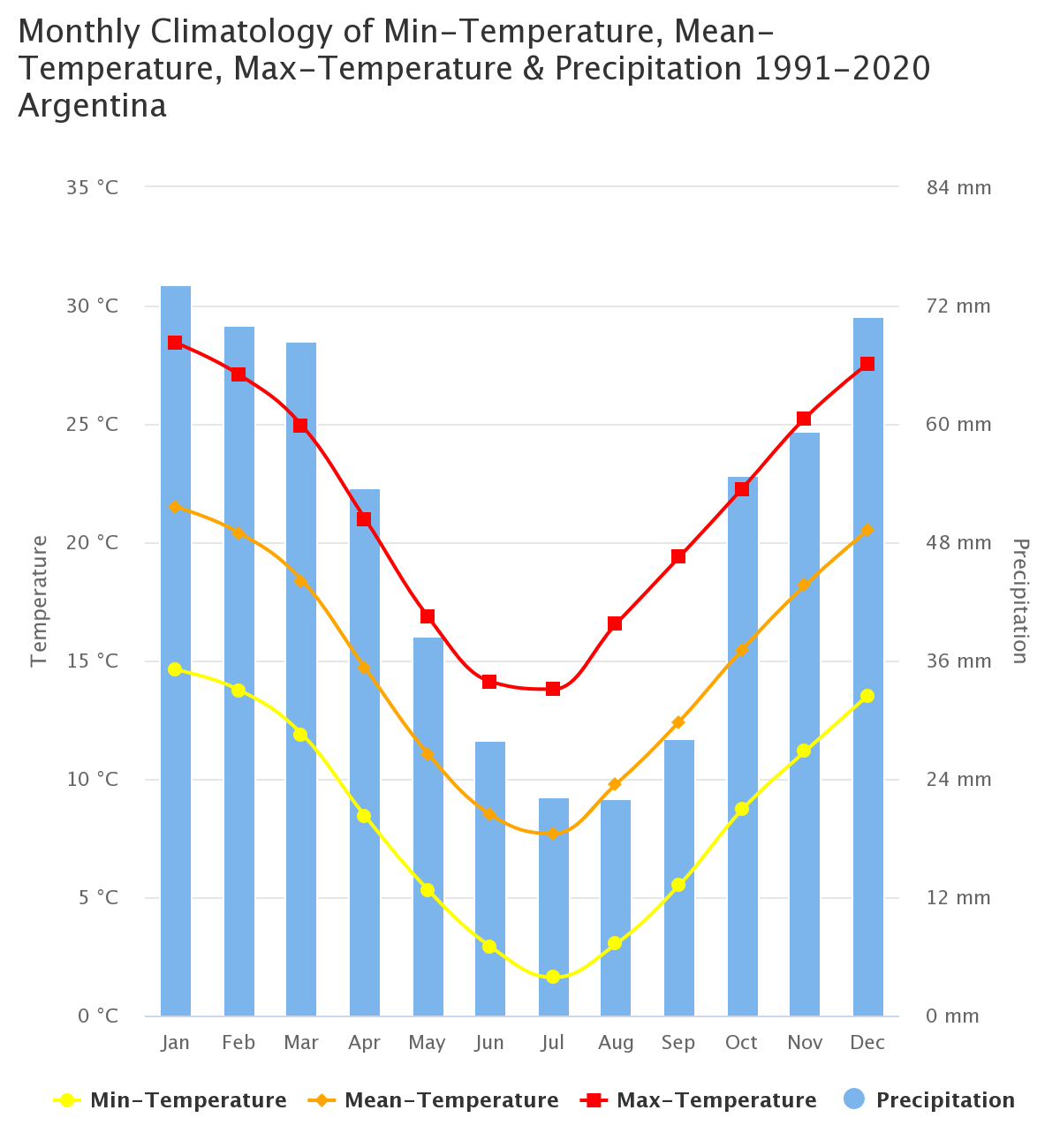

The South American weather situation is still seen supportive for soybeans and corn. Argentina and central through southern Brazil and Paraguay saw net drying over the weekend. Eastern Argentina will be dry through Friday of this week until showers develop Saturday into Sunday will produce 0.15 to 0.75 inch of rain. Additional rain is possible Monday and Tuesday. Western Argentina will receive periodic showers Friday of this week through Wednesday of next week. Brazil’s weather outlook has not changed much. Rain expected in the interior south Wednesday into Thursday and again early next week, but more rain will be needed for crop development. Rio Grande do Sul will be driest in Brazil during the next two weeks. Northern Brazil will remain active raising concern over harvest delays for early soybeans. US precipitation was minimal for the central and southern Great Plains over the weekend and restricted precipitation is expected in hard red winter wheat areas and the west half of Texas. US temperatures will be very cold over the next ten days in the north-central and northwestern states.

For the soybean products, we see SBO gaining over meal. On Friday Malaysian March palm oil futures increased 171 ringgit to 4649 and cash was up $35/ton to $1,162.50/ton. ITS reported Malaysian December 1-25 palm oil exports at 1.306 million tons, a 2.6% decrease from the same period month earlier. On Friday China futures were down 0.4% for soybeans, up 1.5% for meal and up 0.9% & 1.8%, respectively for soybean oil and palm oil. The Rosario Grain Exchange estimated Argentina soybean exports at 7.3 million tons, up nearly 33 percent from the previous season of 5.5 million tons. AgriCensus noted the 5-year average is 6.7 million tons. Domestic use was estimated at 38.5 million tons, down from 39.5 million tons year earlier. Ukraine’s local fat and oils association noted Ukraine sunflower oil exports during the September and November period decreased 15 percent to 1.35 million tons. India has slowed imports from the previous season. Russia’s AgMin will increase its corn export tax effective December 29 through January 11 by a large $14/ton to $69/ton. Paris March wheat traded on Friday, settling 0.50 euro lower, or 0.2%, at 290.25 euros ($328.53) a ton. Russia will increase its wheat export tax by $0.90/ton to $94.90/ton effective December 29-January 11. Barley will decrease $1.30/ton to $83.50/ton.

![]()

Due to the Federal holiday observed on Friday, December 24, the weekly Commitments of Traders report will be released Monday at 3:30pm.

Argentina normally sees their highest precipitation, and hottest temperatures, during the December and January months.

Source: The Climate Change Knowledge Portal (CCKP)

https://climateknowledgeportal.worldbank.org/country/argentina/climate-data-historical

US 7-day calls for heavier precipitation than that of Thursday for the central ECB and central to upper Delta.

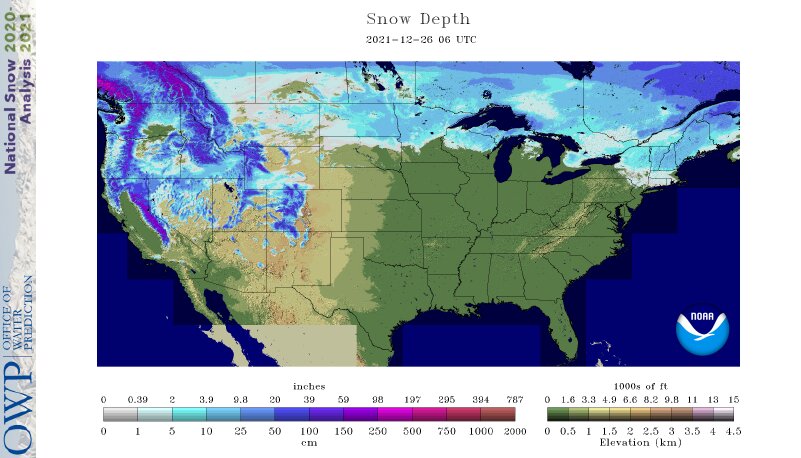

Snow still lacks across the majority of the US Great Plains

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.