PDF Attached

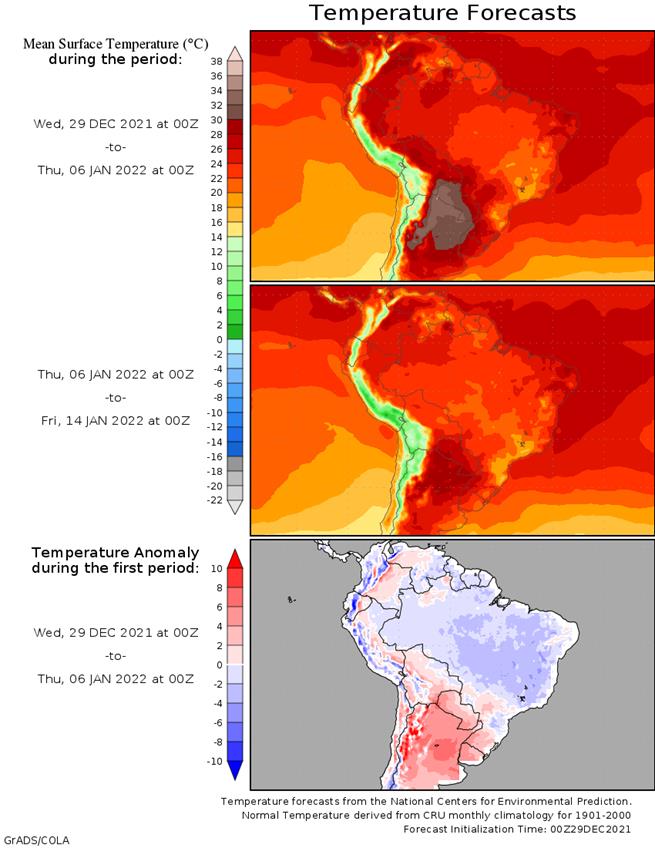

Egypt bought 300,000 tons of wheat. The ag markets saw a two-sided trade on lack of direction and uncertainty over SA production prospects. Regardless of weather, SA is still expected to see large crops. There are showers showing up in the lang term model projections for southern Brazil and Argentina, but accumulated amounts might be countered by hot temperatures.

Weather

Thursday

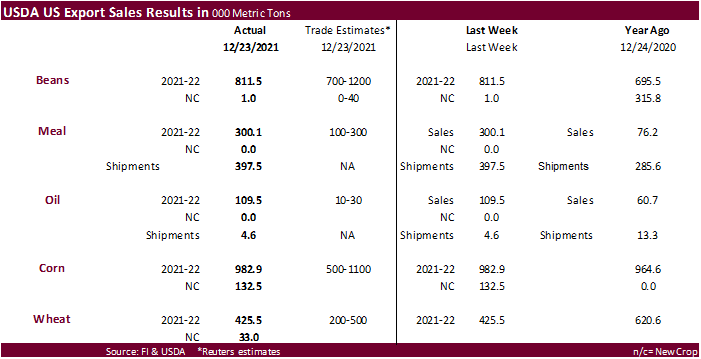

- USDA export sales

Friday

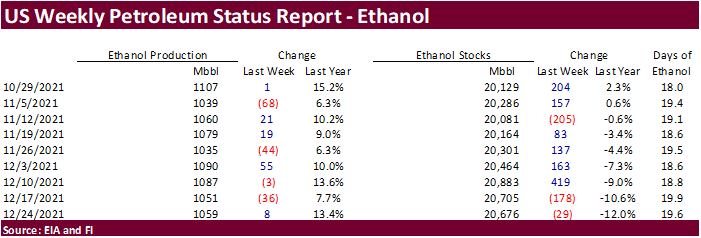

- EIA biodiesel feedstock and month ethanol production

- CFTC Commitment of Traders

Russia’s New Year holiday is from Dec. 31 to Jan. 9.

Source: Bloomberg and FI

First Notice Day Delivery estimates

Soybeans zero

Soybean oil 0-250

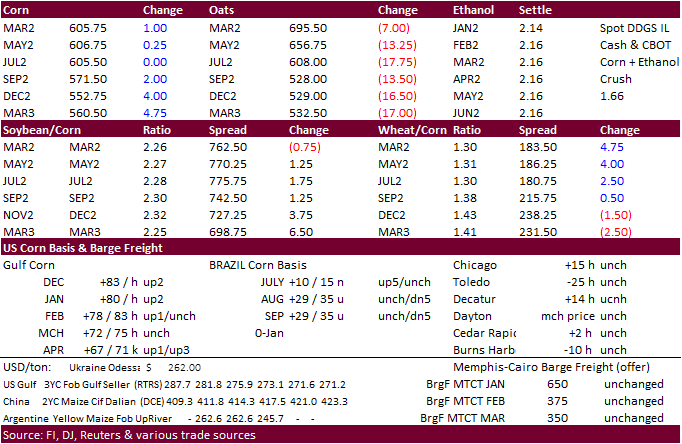

· CBOT corn ended higher on lack of news, technical buying and questionable SA production prospects. La Nina conditions are certainly a concern for Brazil’s corn production prospect as some analysts have trimmed production on unfavorable weather.

· Holiday trading has increased market fluctuations.

· Global import developments remain light.

Export developments.

· None reported

Updated 12/9/21

March corn is seen in a $5.50 to $6.20 range

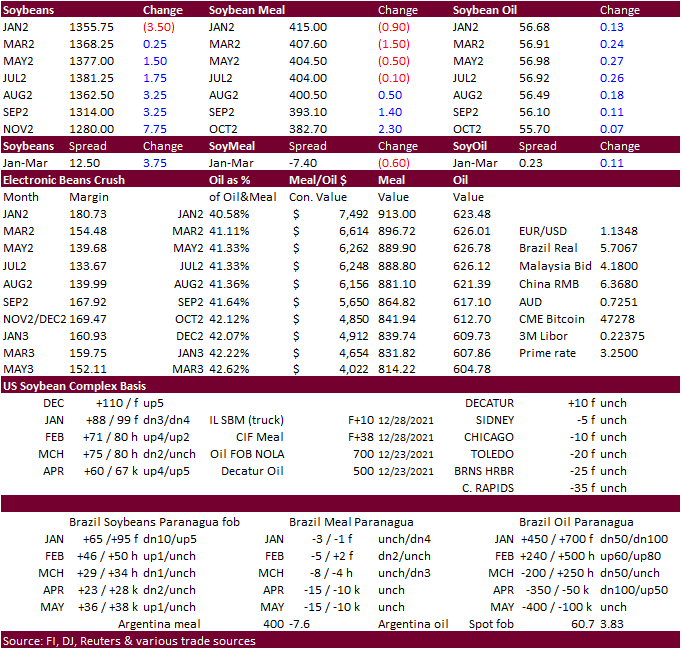

· Soybeans closed mostly higher with bear spreading in focus. News was very light.

· South American production for soybeans have been lowered by many analysts in recent days. We think a ten million ton decrease drop in South American soybean production, compared to USDA, is a drop in the bucket, but noticeable by the trade. US exports have been slow and in a couple weeks the season should come to an end with Brazil supplies coming online.

· Argentina may see a sub 47.5 MMT soybean crop and Brazil 135-138 MMT, well below USDA expectations, but large enough to counter US export competition.

Export Developments

· The CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

Updated 12/22/21

Soybeans – March $11.75-$13.75

Soybean meal – March $330-$415

Soybean oil – March 50.00-59.00

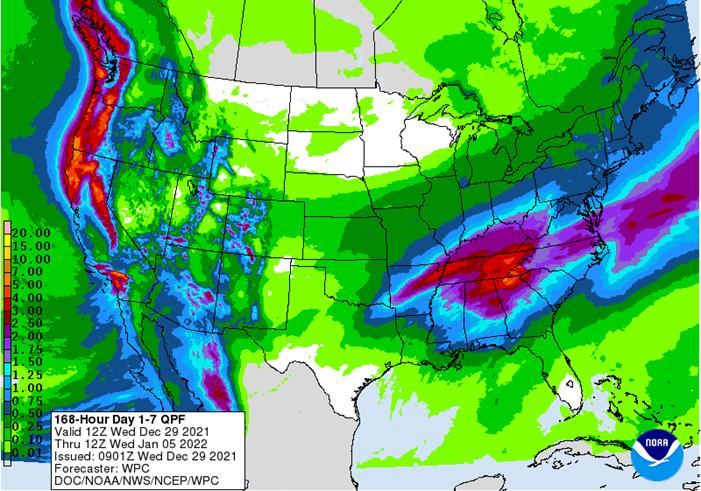

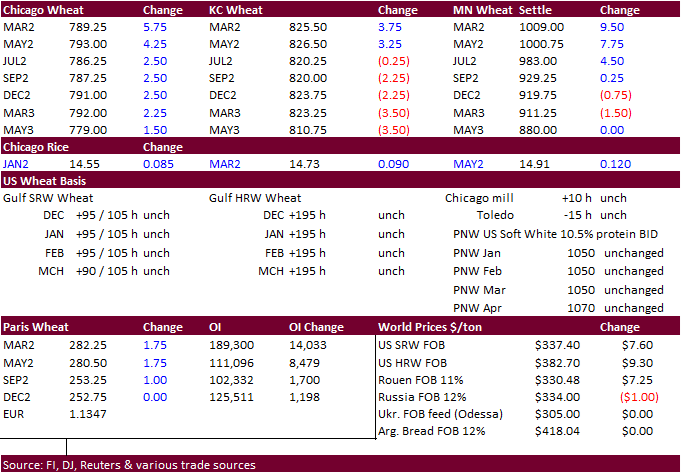

· US wheat traded two sided on technical selling and lack of US interest for wheat. Prices ended mixed with KC back months lower in part to expanding precipitation projected by weather models for the key winter wheat areas. US weather maps are indicating an expansion of precipitation for the dry areas of the Great Plains although not all areas will see rain/snow over the next week. Snowfall coverage across the central US could double by this time early next week with a significant storm occurring Sat into Sunday across the central US.

· We caution US bull wheat traders as Black Sea and French wheat supplies remain most attractive by major importers.

· Egypt’s GASC bought 300,000 tons of wheat for shipment Feb. 15 to Mar. 3. That included 60,000 tons of French wheat, 180,000 tons of Ukrainian wheat and 60,000 tons of Romanian wheat.

· Jordan bought 60,000 tons of hard milling wheat at $327.00/ton for shipment in the first half of August 2022.

· Jordan seeks 120,000 tons of feed barley on December 30. Possible shipments period included July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

· Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

· Bangladesh seeks 50,000 tons of non-basmati parboiled rice on December 30 for delivery 50 days from contract award and letter of credit opening.

Updated 12/9/21

Chicago March $7.40 to $8.60 range

KC March $7.55 to $9.00 range

MN March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.