PDF Attached

Lower

trade on less threatening SA weather. Midday models were wetter for Brazil, bias late in the first week into the second week of the forecast. USDA export sales mostly fell short of expectations. Brazil will see improving rains across the central growing areas

and some of the southern regions. China will auction off 500,000 tons of wheat from auction directed to wheat flour processing companies on Jan 5.

WEATHER

EVENTS AND FEATURES TO WATCH

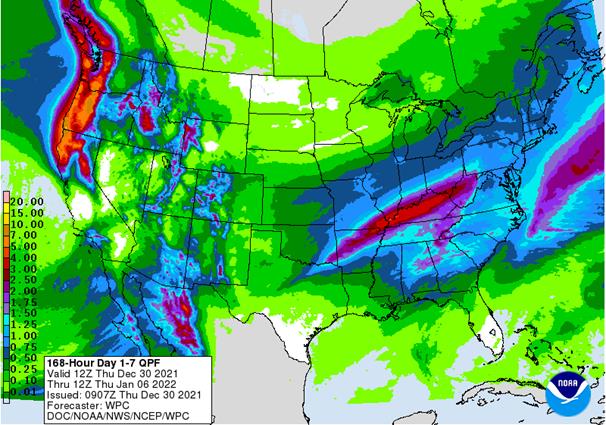

- U.S.

hard red winter wheat areas will get some snow Friday into Saturday to help protect winter wheat against a quick shot of bitter cold air expected Saturday and Sunday - Extreme

lows will fall to the negative and positive single digits Fahrenheit - There

is some concern that snowfall will be lighter than predicted for a few areas

- Drought

remains in the region and moisture availability will be low in the high Plains region - Snow

will still fall, but a close watch on its distribution is warranted to make sure there are no surprises - Today’s

forecast models have reduced some of the predicted snowfall and further reduction would not be surprising - With

all of that said, World Weather, Inc. is not expecting a serious issue for wheat losses

- Some

wheat damage may have occurred this week in South Dakota and Montana because of bitter cold and restricted snow cover in “some” areas, but any loss has been very light - The

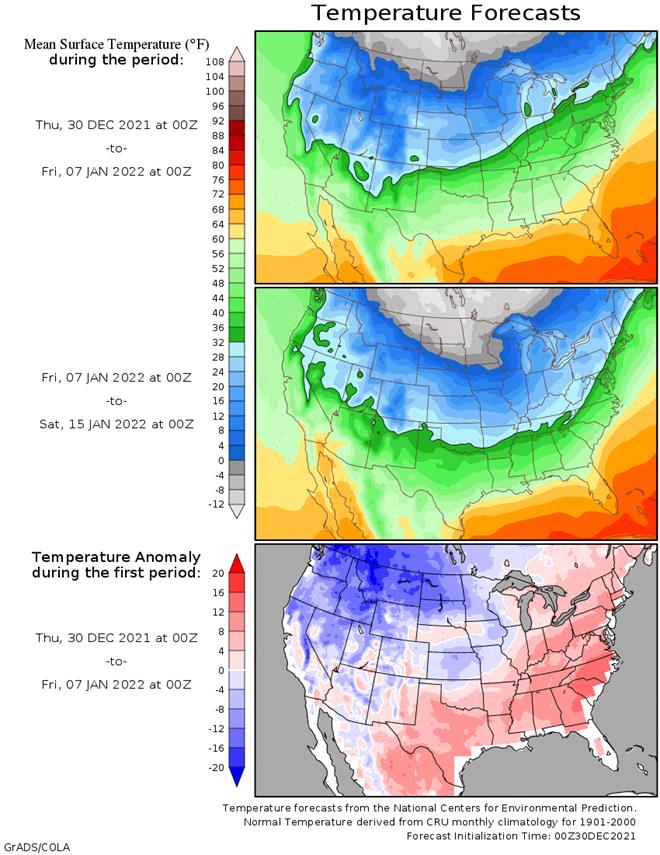

snow event in the U.S. Midwest for this weekend has been slightly reduced today relative to that advertised Wednesday, but there will still be some travel issues and livestock stress from Kansas and parts of Nebraska to the Great Lakes region - North

America Weather pattern not showing much signs of change - U.S.

hard red winter wheat production areas and most of the northwestern Plains will continue to receive less than usual precipitation through the first half of January - West

Texas cotton, corn and sorghum areas are quite dry and need rain, but not much moisture is expected for quite a while - Waves

of cold air will keep parts of Canada’s Prairies, the northern U.S. Plains and some areas in the western United States cold biased through the next two weeks - Cooling

will occur a little more significantly in the Plains and Midwest during the second week of January raising the potential for stronger heating fuel demand in the in those areas and more stormy weather in the eastern U.S.

- Canada

Prairie’s cold weather bias will continue through mid-January, despite warming this weekend and early next week - Soil

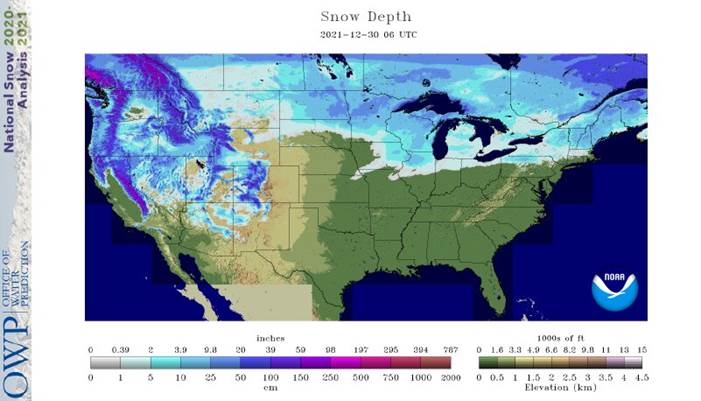

moisture remains critically low in a large part of western and central Saskatchewan and southern and east-central Alberta, Canada, although at this time of year that really does not matter much - California’s

snow water equivalency is now above average throughout the Sierra Nevada for this time of year

- Northern

areas are reporting 145% of normal snow water equivalency - Central

areas are reporting 162% of normal snow water equivalency - Southern

areas are reporting 167% of normal snow water equivalency - Relative

to the April 1st average peak of the snow season snow water equivalents are 50-56% of what they should be by that time - U.S.

Pacific Northwest snow water equivalency is 84-116% of normal with the exceptions of western and southern Oregon and south-central Idaho where it is 120 to 154% of normal - Nevada

snowpack is above average, too - Most

of the central and northern Rocky Mountains are also reporting near normal snowpack

- Dryness

remains in northeastern and north-central Wyoming, central Montana and in southeastern Colorado - The

greatest snow drought remains in some of the mountains of New Mexico - Eastern

U.S. weather may trend stormy in second week of January - Paraguay

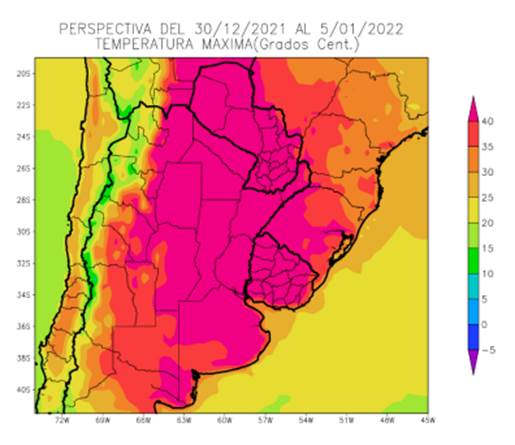

may end up suffering the greatest production cuts in 2021-22 because of poor rainfall and warm to hot temperatures - Rio

Grande do Sul, Brazil will be caught up in the lighter than usual rainfall pattern of Argentina and Paraguay during the month of January and more threats to summer crop yield are expected - Argentina’s

key summer crop areas are still dealing with good soil moisture and crop conditions, despite recent drying - The

next two weeks will be more challenging to crops from southern Cordoba to central Buenos Aires and in parts of San Luis, La Pampa and southern Santa Fe - Argentina’s

minor grain and oilseed areas in the north and east are too dry today, but showers expected late this week into next week will offer a short term bout of relief - Much

more rain will still be needed, though and a close watch on the rainfall and temperature outlook through January is warranted - World

Weather, Inc. anticipates lighter than usual rainfall and warm temperatures for much of the nation, but there will still be some timely showers - Brazil’s

is certainly being impacted by La Nina in a very traditional manner this year with dryness in the south and too much rain in the north - La

Nina is peaking now, but will be slow to abate and that will likely perpetuate some of these tendencies into late January - Dryness

in the south will not completely go away, but it will be eased in the first week of January - Below

average precipitation will continue during January, but there will be some timely rainfall continuing outside of Rio Grande do Sul, western Santa Catarina, southwestern Parana and southwestern Mato Grosso do Sul - The

wetter areas in January should be in parts of northern Sao Paulo, Minas Gerais, central and northern Goias, parts of Tocantins, southwestern Bahia and northeastern Mato Grosso - Some

delay to harvesting of soybeans is expected, but World Weather, Inc. expects the early soybean harvest to advance around the wettest conditions and planting of Safrinha crops will proceed as well - Field

progress will be slowed at times and there will be some crop quality issues in the wetter areas of the north - Southern

Brazil dryness relief in the coming week is expected to be somewhat limited near the Paraguay and Argentina border - Temporary

improvements are expected, but a big turnaround in the weather pattern is not likely until late January and more likely February into March - Safrinha

corn and cotton prospects in Brazil are still very good – at least from World Weather, Inc.’s perspective - A

tropical cyclone is expected to evolve in the next couple of days as a tropical low pressure center moves out of the Cape York Peninsula and over the western Pacific Ocean - The

storm produced heavy rain in the peninsula Thursday and will generate some additional rain today, but the system is moving far enough from land to begin reducing its influence

- The

storm will actually help suppress rainfall in eastern Australia during the coming week as it move southeast well off the east coast - Australia’s

weather will be unusually dry and warm to hot over the next week - Rapid

drying is expected and the need for rain will be steadily rising in livestock and summer crop areas of the east - The

hottest weather is expected in the west and it will persist longest in that region as well - Crop

moisture stress is already rising in western summer crop areas of both Queensland and New South Wales - Excellent

late season barley and wheat harvest conditions are expected in the south - East-central

Australia will get some needed rain next week, although it will be somewhat limited

- The

moisture will be welcome, but not widespread enough to benefit all of the dry areas - India’s

weather will trend dry or mostly dry through early next week and then another bout of rainfall is possible - Rain

that fell earlier this week was great for pre-reproductive winter crops - Rain

coming during the middle to latter part of next week will help further improve crop conditions and raise production potentials, but yields will be largely determined by February weather - La

Nina should favor a better than average production year for many crops - Harvesting

in southern India will continue to advance without much precipitation - North

Africa precipitation will continue restricted for the coming week - A

boost in precipitation is needed most in southwestern Morocco and northwestern Algeria, but precipitation would be welcome in all areas - The

second week of the outlook may bode better for rain in the drier areas - Southeast

Asia precipitation will continue to occur routinely in Indonesia, Philippines and Malaysia during the next two weeks, although precipitation intensity should decrease in Indonesia and Malaysia for a little while - Southern

Philippines rainfall will be heaviest in this first week of the outlook - Some

heavy rain already occurred Tuesday - Central

Vietnam coastal areas will experience frequent rain Thursday into early next week with some heavy precipitation in a few areas that might result in some flooding - China’s

weather will continue typical of this time of year with relatively dry and cool conditions in the north, some periodic snow in the far northeast while waves of rain and some snow fall in the Yangtze River Basin and areas southward - Russia’s

widespread snow cover will and frequent precipitation pattern in the next two weeks will leave winter crops adequately protected against any harsh weather that evolves and the same is true of Ukraine, Belarus and the Baltic States - Europe

weather will be relatively active during the next two weeks maintaining good field moisture for crop use in the spring - Temperatures

will be warmer than usual in most of the continent - There

is need for greater rain in parts of Spain, although some areas in the nation will get needed moisture in this coming week - South

Africa weather will be mostly well mixed over the next two weeks, although the western parts of summer crop country will be a little drier biased for a while - Temperatures

will be seasonable - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - Middle

East precipitation is expected to be a little better distributed over the next couple of weeks with western Iran getting the most significant rain along with parts of western Turkey - Other

areas will get mostly light and sporadic rainfall – all of which will be welcome, but more will be needed for better crop establishment - Portions

of the region are drier than usual - Northwestern

Mexico will get some welcome rain in northwestern parts of the nation in the late this week and into the weekend - The

precipitation will be welcome to some winter crops and for water supply, although much more will be needed over the winter to ensure the best winter crop performance - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - East-central

Africa rainfall is expected to be light to moderate with western Ethiopia, Uganda, southwestern Kenya and western Tanzania getting rain most often. - Some

western Ethiopia areas will be wettest relative to normal as will be some southern Uganda and southwestern Kenya locations - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillation Index was +12.88 and it was expected to move lower over the next few days. - New

Zealand rainfall will be lighter than usual during the coming week while temperatures are near to above normal - A

boost in rainfall is possible next week

Friday

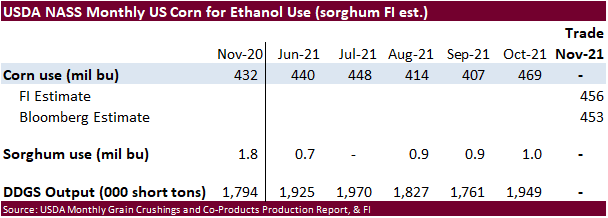

- EIA

biodiesel feedstock and month ethanol production - CFTC

Commitment of Traders

Russia’s

New Year holiday is from Dec. 31 to Jan. 9.

Source:

Bloomberg and FI

First

Notice Day Delivery estimates

Soybeans

zero

Soybean

oil 0-500

USDA

export sales

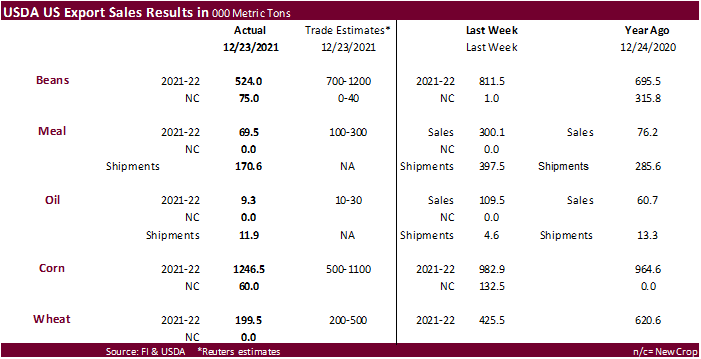

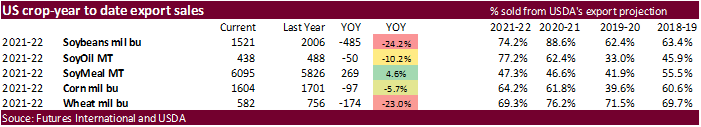

were below expectations for the soybean complex, above a Reuters trade guess for corn and slightly below a trade range for all-wheat. We see no bullish figures out of this report. Shipments of soybean products slowed but this is not uncommon for this time

of year. Sorghum sales were 182,900 tons and pork slowed to 3,200 tons.

·

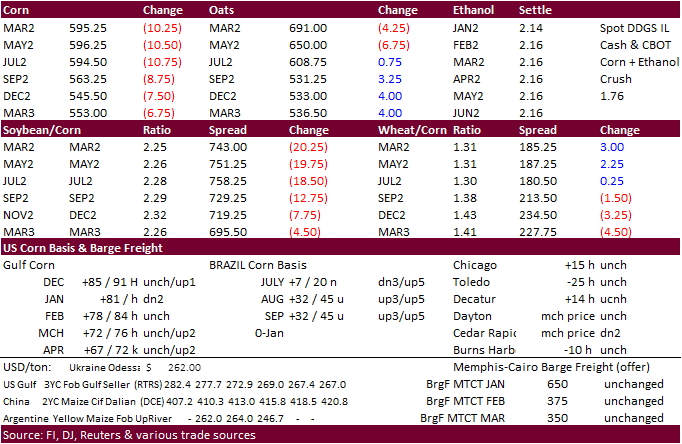

CBOT corn was lower on weakness in the soybean complex and long liquidation ahead of the end of the year. CME will be open for trading on Friday and trading hours will be normal. Many traders are still in holiday trading mode.

USDA export sales for the grains were lighter than expected.

·

New was light.

US-China

phase one tracker: China’s purchases of US goods

https://www.piie.com/research/piie-charts/us-china-phase-one-tracker-chinas-purchases-us-goods

IFES

2021: Farm Income Outlook for 2022

Schnitkey,

G., D. Lattz and K. Swanson. “IFES 2021: Farm Income Outlook for 2022.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 29, 2021.

Export

developments.

-

None

reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

The CBOT soybean complex extended losses on improving Sa weather and poor USDA export sales. Brazil’s weather forecast calls for improving rain for the second week of the outlook. Some longs, mainly funds, were exiting the market

ahead of year end.

·

Today was position day for the January contracts. We could see some soybean oil deliveries tonight.

Export

Developments

·

The CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

Updated

12/30/21

Soybeans

– March $12.00-$13.75 (up 25, unchanged back end of range)

Soybean

meal – March $345-$415 (up $15, unchanged)

Soybean

oil – March 51.00-59.00 (up 100, unch)

·

US wheat ended up trading lower for most of the day as US weather issues are easing and global demand slowed. Jordan passed on feed barley earlier today. China will release wheat stocks next month; an indication fresh import tenders

might be on hold after they bought a large amount of EU wheat earlier this quarter.

·

Argentina’s BA Grains Exchange noted their 21.5 million ton record Argentina wheat production estimate could be revised higher if yields continue to come in higher than expected. About 90 percent of the wheat crop had been harvested.

·

EU wheat basis the March position closed 2.25 euros lower at 280/ton.

·

Russia’s SovEcon raised its forecast for Russia’s 2021-22 wheat exports by 0.2 million tons to 34.1 million tons as the shipment pace increased, led by demand from Egypt and other traditional buyers. For the July-June 2020-21

season, they showed 38.052 million tons of wheat was exported. Last week SovEcon increased the outlook for the 2022 wheat crop to 81.3 million tons from an 80.7 million ton previous estimate. That’s up from 75.4 million tons for 2021.

·

Turkey’s cereal production fell 14.3% in 2021 to 31.9 million tons, including 17.7MMT of wheat, down 13.9%.

·

China plans to sell 50,000 tons of wheat from state reserves on January 5 to flour millers. The sold an estimated 891,938 tons of wheat from reserves in October.

·

Jordan cancelled their 120,000 ton import tender for feed barley. Possible shipments period were July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Yesterday Egypt’s GASC bought 300,000 tons of wheat for shipment Feb. 15 to Mar. 3. That included 60,000 tons of French wheat, 180,000 tons of Ukrainian wheat and 60,000 tons of Romanian wheat.

·

Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

·

Results awaited: Bangladesh

seeks 50,000 tons of non-basmati parboiled rice for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

USDA export sales

U.S. EXPORT SALES FOR WEEK ENDING 12/23/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

87.3 |

2,106.4 |

1,635.2 |

194.3 |

4,172.6 |

5,465.6 |

0.0 |

14.0 |

|

SRW |

29.0 |

738.5 |

507.6 |

17.5 |

1,572.9 |

1,062.2 |

0.0 |

34.5 |

|

HRS |

63.1 |

1,270.4 |

1,671.3 |

55.3 |

2,968.8 |

4,105.8 |

0.0 |

0.0 |

|

WHITE |

20.1 |

845.4 |

2,681.2 |

67.9 |

2,026.2 |

2,843.7 |

0.0 |

0.0 |

|

DURUM |

0.0 |

36.2 |

103.8 |

0.0 |

97.2 |

486.5 |

0.0 |

33.0 |

|

TOTAL |

199.5 |

4,996.8 |

6,599.2 |

335.0 |

10,837.7 |

13,963.9 |

0.0 |

81.5 |

|

BARLEY |

0.0 |

19.0 |

13.7 |

0.7 |

11.5 |

16.9 |

0.0 |

0.0 |

|

CORN |

1,246.5 |

27,073.1 |

28,967.0 |

921.4 |

13,667.7 |

14,228.5 |

60.0 |

1,512.0 |

|

SORGHUM |

182.9 |

3,746.5 |

3,188.5 |

174.1 |

1,538.7 |

1,899.7 |

0.0 |

0.0 |

|

SOYBEANS |

524.0 |

12,448.4 |

17,513.1 |

1,723.4 |

28,935.7 |

37,074.0 |

75.0 |

216.0 |

|

SOY MEAL |

69.5 |

3,181.3 |

2,853.3 |

170.6 |

2,913.6 |

2,972.7 |

0.3 |

35.9 |

|

SOY OIL |

9.3 |

287.5 |

293.6 |

11.9 |

150.3 |

194.0 |

0.1 |

0.2 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

1.0 |

166.7 |

234.8 |

1.6 |

580.7 |

732.3 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

6.3 |

16.4 |

0.0 |

2.9 |

12.5 |

0.0 |

0.0 |

|

L G BRN |

0.4 |

4.0 |

9.6 |

0.2 |

26.8 |

22.0 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

68.4 |

61.3 |

0.2 |

15.2 |

34.0 |

0.0 |

0.0 |

|

L G MLD |

16.0 |

94.4 |

84.5 |

1.7 |

344.5 |

269.7 |

0.0 |

0.0 |

|

M S MLD |

52.1 |

104.6 |

182.1 |

27.6 |

176.4 |

190.3 |

0.0 |

0.0 |

|

TOTAL |

69.5 |

444.3 |

588.7 |

31.2 |

1,146.6 |

1,260.8 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

192.2 |

7,518.2 |

6,131.7 |

162.2 |

2,931.9 |

5,253.4 |

24.4 |

1,070.2 |

|

PIMA |

7.1 |

234.9 |

223.7 |

7.0 |

137.6 |

329.9 |

0.0 |

4.4 |

This

summary is based on reports from exporters for the period December 17-23, 2021.

Wheat: Net sales of 199,500 metric tons (MT) for 2021/2022 were down 53 percent from the previous week and 43 percent from the prior 4-week average. Increases primarily for Taiwan (110,000 MT), Guatemala (35,600 MT, including 31,600

MT switched from unknown destinations), Nicaragua (30,000 MT), Haiti (27,500 MT switched from unknown destinations), and Mexico (19,100 MT, including decreases of 3,000 MT), were offset by reductions primarily for unknown destinations (70,600 MT). Exports

of 335,000 MT were up 76 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily to Japan (90,300 MT), Colombia (45,200 MT), Mexico (43,300 MT), South Korea (30,000 MT), and Nigeria (27,500 MT).

Corn: Net sales of 1,246,500 MT for 2021/2022 were up 27 percent from the previous week, but down 2 percent from the prior 4-week average. Increases were primarily for Japan (385,800 MT, including 160,900 MT switched from unknown

destinations and decreases of 2,000 MT), Canada (200,100 MT, including decreases of 200 MT), unknown destinations (163,800 MT), Mexico (149,100 MT, including and decreases of 11,900 MT), and Guatemala (94,600 MT). Total net sales of 60,000 MT for 2022/2023

were for Japan. Exports of 921,400 MT were down 16 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Mexico (278,300 MT), China (277,000 MT), Japan (189,800 MT), Canada (64,000 MT), and Costa Rica

(27,600 MT).

Optional Origin Sales: For 2021/2022, options were exercised to export to unknown destinations (60,000 MT) from the United States. The current outstanding balance of 441,000 MT is for unknown destinations (369,000 MT), Italy (63,000

MT), and Saudi Arabia (9,000 MT).

Barley: No net sales were reported for the week. Exports of 700 MT were down 16 percent from the previous week and 10 percent from the prior 4-week average. The destination was to Japan.

Sorghum: Net sales of 182,900 MT for 2021/2022 were down 57 percent from the previous week and 46 percent from the prior 4-week average. Increases were reported for China (124,900 MT, including decreases of 208,500 MT) and unknown

destinations (58,000 MT). Exports of 174,100 MT were down 45 percent from the previous week and 13 percent from the prior 4-week average. The destination was primarily to China (173,900 MT).

Rice: Net sales of 69,500 MT for 2021/2022 were down 13 percent from the previous week, but up 43 percent from the prior 4-week average. Increases were primarily for Japan (28,700 MT), South Korea (22,000 MT), Haiti (15,000 MT),

Canada (1,300 MT), and Honduras (1,000 MT). Exports of 31,200 MT were down 25 percent from the previous week and 50 percent from the prior 4-week average. The destinations were primarily to Japan (26,100 MT), Canada (1,900 MT), Mexico (1,800 MT), Costa Rica

(300 MT), and Hong Kong (200 MT).

Exports for Own Account: For 2021/2022, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans: Net sales of 524,000 MT for 2021/2022–a marketing-year low–were down 35 percent from the previous week and 56 percent from the prior 4-week average. Increases primarily for China (432,800 MT, including 394,000 MT switched

from unknown destinations and decreases of 9,300 MT), Turkey (119,500 MT, including 116,000 MT switched from unknown destinations), the Netherlands (83,900 MT, including 80,000 MT switched from unknown destinations and decreases of 2,100 MT), Thailand (77,400

MT, including 66,000 MT switched from unknown destinations), and the United Kingdom (66,000 MT, including 60,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (494,500 MT). Net

sales of 75,000 MT for 2022/2023 were for unknown destinations (66,000 MT) and Japan (9,000 MT). Exports of 1,723,400 MT were down 7 percent from the previous week and 19 percent from the prior 4-week average. The destinations were primarily to China

(944,600 MT), Turkey (119,500 MT), the Netherlands (83,900 MT), Thailand (82,900 MT), and the United Kingdom (66,000 MT).

Export for Own Account: For 2021/2022, the current exports for own account outstanding balance is 34,600 MT, all Canada.

Export Adjustments: Accumulated exports of soybeans to the Netherlands were adjusted down 64,931 MT for week ending December 2, 2021. The correct destination for this shipment is Germany.

Soybean Cake and Meal: Net sales of 69,500 MT for 2021/2022–a marketing-year low–were down 77 percent from the previous week and 63 percent from the prior 4-week average. Increases primarily for El Salvador (25,500 MT, including

decreases of 200 MT), Mexico (23,900 MT, including decreases of 300 MT), Honduras (13,700 MT), Costa Rica (5,000 MT), and Japan (5,000 MT), were offset by reductions primarily for Canada (16,300 MT) and the Philippines (2,100 MT). Net sales of 300 MT for

2022/2023 resulting in increases for the Netherlands (800 MT), were offset by reductions for Japan (500 MT). Exports of 170,600 MT were down 57 percent from the previous week and 41 percent from the prior 4-week average. The destinations were primarily to

the Philippines (47,300 MT), Mexico (45,300 MT), Canada (11,500 MT), Panama (10,000 MT), and the Dominican Republic (9,000 MT).

Optional Origin Sales: For 2021/2022, the current outstanding balance of 50,000 MT is for Venezuela.

Soybean Oil: Net sales of 9,300 MT for 2021/2022 were down 92 percent from the previous week and 79 percent from the prior 4-week average. Increases were primarily for Mexico (5,300 MT), Canada (2,000 MT), Nicaragua (1,200 MT),

the Dominican Republic (400 MT), and Guatemala (300 MT, including decreases of 6,000 MT). Total net sales of 100 MT for 2022/2023 were for Canada. Exports of 11,900 MT were up noticeably from the previous week, but down 48 percent

from the prior 4-week average. The destinations were to Guatemala (7,800 MT), Mexico (2,700 MT), and Honduras (900 MT).

Cotton: Net sales of 192,200 RB for 2021/2022 were down 21 percent from the previous week and 40 percent from the prior 4-week average. Increases were primarily

for China (69,300 RB), Turkey (38,000 RB, including decreases of 2,700 RB), Indonesia (30,000 RB, including 2,700 RB switched from Japan), Pakistan (18,100 RB), and Vietnam (15,200 RB, including 200 RB switched from Japan), were offset by reductions for Japan

(2,300 RB). Net sales of 24,400 RB for 2022/2023 reported for Pakistan (25,100 RB), were offset by reductions for China (700 RB). Exports of 162,200 RB were up 24 percent from the previous week and 45 percent from the prior 4-week average. The destinations

were primarily to China (45,600 RB), Vietnam (42,200 RB), Pakistan (15,600 RB), Turkey (15,300 RB), and Mexico (6,500 RB). Net sales of Pima totaling 7,100 RB were up 9 percent from the previous week and 37 percent from the prior 4-week average. Increases

were primarily for China (4,300 RB), India (1,500 RB), Thailand (900 RB), and South Korea (300 RB). Exports of 7,000 RB were up 55 percent from the previous week and 16 percent from the prior 4-week average. The destinations were primarily to China (2,200

RB), Honduras (1,700 RB), India (1,300 RB), and Peru (1,000 RB).

Optional Origin Sales: For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports for Own Account: For 2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Export Adjustments: Accumulated exports of upland cotton to Indonesia were adjusted down 352 RB for week ending December 16, 2021. This export was reported in error.

Hides and Skins: Net

sales of 52,100 pieces for 2021 were down 79 percent from the previous week and 82 percent from the prior 4-week average. Increases primarily for China (47,900 whole cattle hides, including decreases of 22,300 pieces), South Korea (8,100 whole cattle hides,

including decreases of 9,000 pieces), Mexico (2,200 whole cattle hides, including decreases of 1,000 pieces), Vietnam (1,800 whole cattle hides), and Canada 700 whole cattle hides, including decreases of 700 pieces), were offset by reductions primarily for

Taiwan (4,700 pieces) and Thailand (3,400 pieces). Net sales of 258,200 pieces for 2022 were primarily for China (146,800 whole cattle hides), South Korea (30,200 whole cattle hides), Brazil (27,700 whole cattle hides), and Thailand (18,400 whole cattle hides). In

addition, total net sales of 1,800 calf skins were reported for Italy. Exports of 319,100 pieces were down 27 percent from the previous week and 18 percent from the prior 4-week average. Whole cattle hide exports were primarily to China (218,300 pieces),

South Korea (33,500 pieces), Thailand (28,800 pieces), and Taiwan (17,500 pieces).

Net sales reductions of 45,300 wet blues for 2021 were down noticeably from the previous week and from the prior 4-week average. Decreases were primarily for Vietnam (21,400 unsplit), Italy (6,900 unsplit

and 6,700 grain splits), China (8,600 unsplit), and Hong Kong (1,000 unsplit). Net sales of 310,300 wet blues for 2022 resulting in increases for Hong Kong (108,000 unsplit), China (87,100 unsplit), Italy (45,400 unsplit and 6,500 grain splits), Vietnam (40,000

unsplit), and Thailand (22,400 unsplit), were offset by reductions for India (2,400 grain splits). Exports of 75,500 wet blues were down 45 percent from the previous week and 41 percent from the prior 4-week average. The destinations were primarily to Italy

(24,400 unsplit and 13,500 grain splits), Vietnam (16,800 unsplit), China (10,200 unsplit), Thailand (5,200 unsplit), and Taiwan (2,400 unsplit). Net sales reductions of 104,800 splits resulting in increases for Vietnam (13,500 pounds), were more than offset

by reductions for China (118,300 splits). Net sales of 117,400 splits for 2022 resulting in increases for China (120,400 pounds) and Vietnam (3,000 pounds), were offset by reductions for South Korea (6,100 pounds). Exports of 647,800 pounds were primarily

to Vietnam (437,600 pounds).

Beef: Net sales of 6,300 MT for 2021 were down 48 percent from the previous week and 55 percent from the prior 4-week average. Increases primarily for Japan

(2,600 MT, including decreases of 300 MT), South Korea (1,800 MT, including decreases 500 MT), China (1,000 MT, including decreases of 300 MT), Mexico (300 MT), and Indonesia (200 MT), were offset by reductions for Taiwan (300 MT) and Canada (100 MT). Net

sales of 6,000 MT for 2022 were primarily for Japan (2,400 MT), South Korea (1,300 MT), Taiwan (900 MT), Hong Kong (400 MT), and China (300 MT). Exports of 17,000 MT were down 5 percent from the previous week and 2 percent from the prior 4-week average. The

destinations were primarily to South Korea (5,200 MT), Japan (3,500 MT), China (2,800 MT), Taiwan (1,700 MT), and Mexico (1,400 MT).

Pork: Net sales of 3,200 MT for 2021 were down 89 percent from the previous week and 90 percent from the prior 4-week average. Increases primarily for Mexico (14,700 MT, including decreases of 500 MT), Japan (2,500 MT, including

decreases of 1,100 MT), Nicaragua (100 MT, including decreases of 100 MT), the Dominican Republic (100 MT), and the Netherlands (100 MT), were offset by reductions primarily for China (9,500 MT), Australia (2,500 MT), and Colombia (1,000 MT). Net sales of

35,900 MT for 2022 primarily for China (18,600 MT), Mexico (5,000 MT), South Korea (3,600 MT), Australia (2,500 MT), and Colombia (1,900 MT), were offset by reductions for Nicaragua (100 MT). Exports of 30,900 MT were down 3 percent from the previous week

and 6 percent from the prior 4-week average. The destinations were primarily to Mexico (15,900 MT), Japan (4,200 MT), China (3,100 MT), South Korea (2,300 MT), and Canada (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.