PDF Attached

USDA released their June Acreage and Grain Stocks reports

Reaction: Bullish soybeans as plantings came in well below expectations, were 2.6 million below March Intentions, and with a reduction in harvested area, implied production using USDA’s current yield would suggest production falls short of the June USDA’s S&D by 133 million bushels. USDA may reduce new-crop soybean exports in the July S&D but look for stocks to tighten at least 50 million bushels. We believe wheat and corn acreage was slightly negative for new-crop corn and current year wheat futures. Implied corn production would suggest 43 million additional bushels and all wheat an addition of 27 million bushels. The higher wheat supply is due to a higher-than-expected spring and durum wheat area. The winter wheat area was downward revised. Total acreage for the main 8 crops (grains/oilseeds, rice, and cotton) were 251.9 million acres, 2.3 million below March Intentions. It appears higher input costs such as fuel and fertilizer, coupled with poor planting weather for selected parts of the country, impacted US producer planting decisions.

Grain stocks at the beginning of June were near expectations for all three major commodities, which was surprising as the national cash prices for all the major commodities are near multi-year highs. However, looking at corn, March 1 corn stocks were downward revised a large 94 million bushels, and implies corn use was better than expected last quarter. This leaves us to question summer quarter feed demand, which is seen weaker from last quarter. USDA could cut or leave unchanged their feed use for 2021-22 US corn balance sheet when updated July 11.

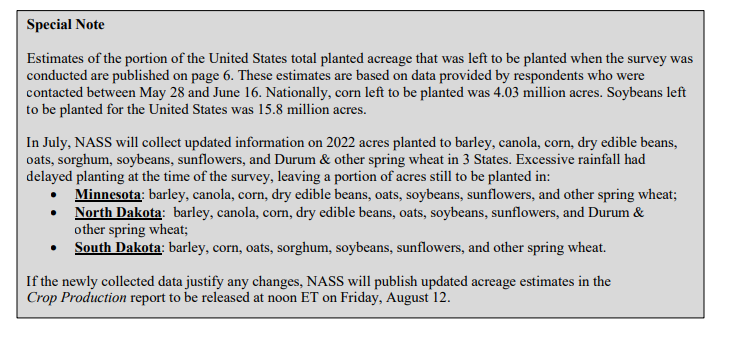

We like Aug soybean / November bear spreads, and September / December small size bear spreads. With USDA revisiting planted area for some northern states, there is a potential NASS could revise the spring wheat and durum area, and trim corn and to a lessor extend soybeans.

USDA NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

Attached PDF includes FI snapshot and supply projections

Price outlook: (nearby corn and wheat revised lower)

September corn is seen in a $5.50 and $7.50 range

December corn is seen in a wide $5.75-$8.25 range

Soybeans – August $14.00-$16.00

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – August $380-$440

Soybean oil – August 66.00-70.00

Chicago – September $8.50 to $10.00 range, December $8.00-$11.00

KC – September $8.75 to $11.00 range, December $8.50-$12.00

MN – September $9.00‐$11.25, December $8.00-$12.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.