PDF attached

Price ranges unchanged except for spring wheat (revised higher)

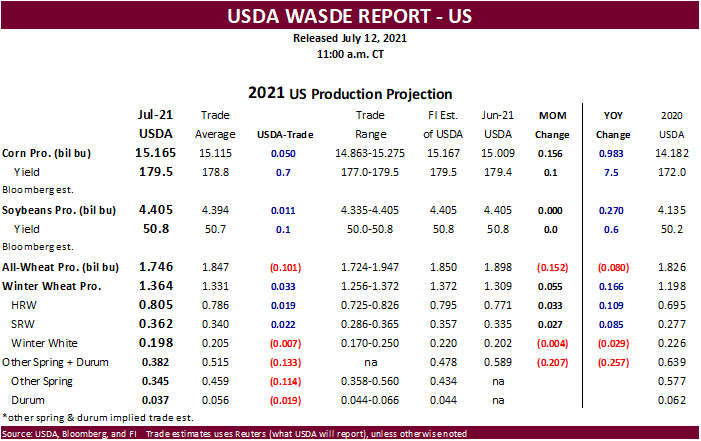

USDA released their July supply and demand outlook

Reaction: Bullish wheat. Corn and soybeans slight supportive.

USDA OCE Secretary Briefing

https://www.usda.gov/sites/default/files/documents/july-2021-wasde-lockup-briefing.pdf

USDA update.

The US other spring + durum production initial survey estimate by USDA was the largest surprise, in our opinion. Combined it came in at an extremely low 382 million bushels, 133 million below an average trade guess and 40 percent below 2020. Other spring of 345 million was 114 million bushels below a Reuters trade average, and if realized, lowest since 2002. Minneapolis wheat led the three markets higher post report. It’s possible wheat just entered a new bull market, at least for US futures. Outside the US wheat supplies are ample. New-crop world wheat was lowered 2MMT for production and stocks were down 5.1MMT. Australia was lifted 1.5 million tons. Ukraine was lifted 500,000 tons. Russia was lowered 1 million tons to 85, about in line with other trade guesses. EU wheat was taken up 700,000 tons. Back to the US, all-wheat US stocks are down 105 million for 2021-22 from the previous month. USDA was forced to reduce US exports by 25 and feed by 10.

There were no changes to the US corn and soybean yields. We expected that but most of the trade was looking for a lower corn yield. US corn production was reported at 15.165 billion bushels, 50 million above a trade average. US corn for feed was revised up 25 million for both crop years and stocks were taken up 75 million for new-crop. Old crop stocks were lowered 25 million (feed). We don’t read too much into the USDA changes for US corn. New-crop world corn production was taken up 5.0MMT, in large part to US output. 2020-21 Argentina corn production was upward revised 1.5MMT and soybeans lowered 0.5MMT. 2020-21 Brazil corn was lowered 5.5MMT to 93, still too high, in our opinion. Brazil soybeans were left unchanged at 137MMT. Looking at US corn exports that were lifted 50 million bushels to 2.500 billion bushels, they could still go higher in upcoming reports if USDA decides to revise the Brazil corn estimate further downward.

USDA’s adjustments to US and global soybeans balances were seen as neutral. Old crop US soybean stocks were unchanged and new-crop also unchanged. USDA did lower the crush by 5 million for 2020-21, exports by 10 million and imports by 15 million. New-crop US supply and demand were left unchanged. SBO for biofuel was lowered by 200 and food taken up 300 for 2020-21. The latest soybean oil for biofuel report showed SBO and other feedstocks use well below expectations. SBO imports for 2020-21 were taken down 50 million and exports were lowered 125 million pounds. New-crop soybean oil demand was left unchanged. 2020-21 US soybean meal domestic use was lowered 150,000 short tons. Production was lowered 200,000 short tons due to the lower crush and yield. The US soybean and product balances will not change our view of prices going forward. China old crop soybean imports were lowered 2 million tons to 98 million and new-crop was taken down 1 million to 102 million.

September corn is seen is a$4.50-$6.25 range.

December corn is seen in a $4.25-$6.00 range.

August soybeans are seen in a $12.75-$15.00 range; November $11.75-$15.00

August soybean meal – $330-$410; December $320-$425

August soybean oil – 60-66; December 46-67 cent range

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.75-$9.50 (up 25, up 50 from previous)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.