PDF Attached

USDA released their September Grain Stocks and Small Grains Summary reports

Reaction: Bearish soybeans, bearish (lessor extent corn), and bullish wheat

USDA NASS Recap

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2021/09-30-2021.pdf

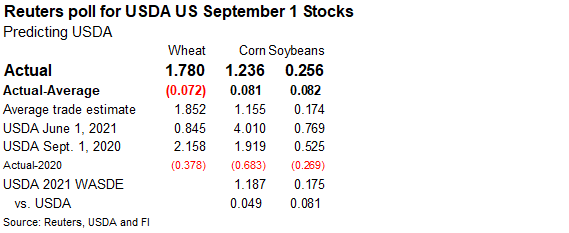

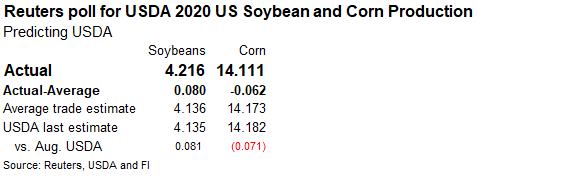

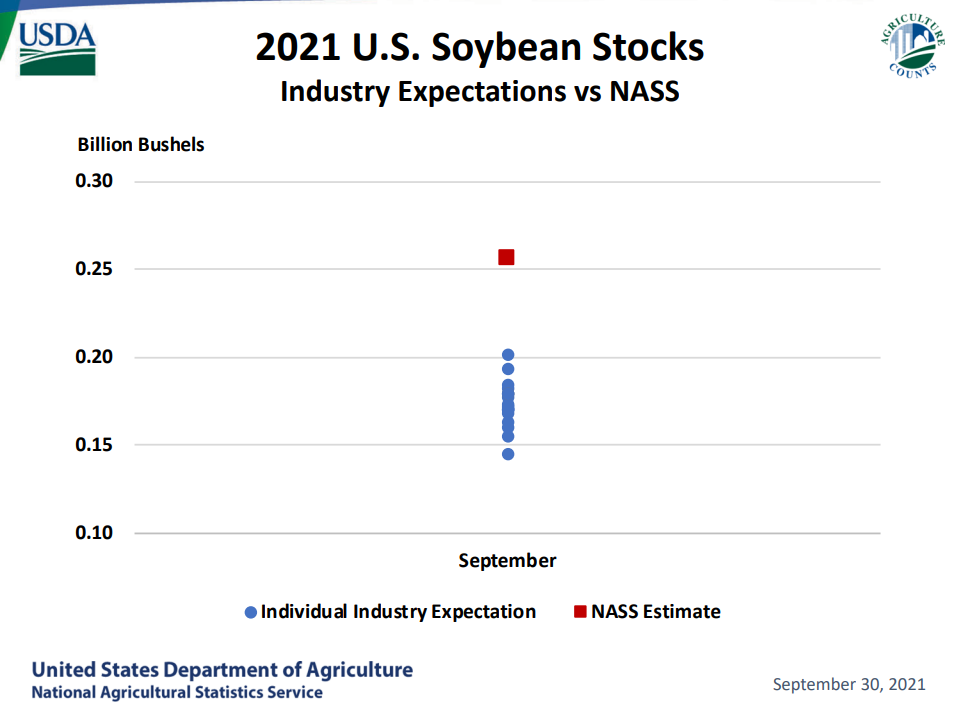

September one US soybean stocks were reported at 256 million bushels versus USDA’s S&D outlook of 175 million, a huge difference, and 82 million above an average trade guess. The trade was about stop on with the September 1 stocks estimate, it was an upward revision to the 2020 US soybean crop that inflated the USDA number. 2020 US soybean production was taken up 81 million bushels to 4.216 billion. Trade was looking for only an 8-million-bushel increase. Regardless how one interprets it, stocks are higher than expectations and that should reflect lower prices for the 2021-22 crop year. Note we recently cut exports, so when we adjust out balance for US 2021-22, look for a 300 million plus carryout.

2020 US corn production was downward revised 71 million bushels to 14.111 billion. September 1 stocks were reported at 1.236 billion bushels, 49 million above USDA’s latest S&D carryout and 81 million above an average trade guess. Note USDA revised previous quarter June one corn stocks upward by 101 million bushels, so the discrepancy in the trade outlook for summer feed demand was not that bad as expected. The trade missed feed/residual demand by roughly 20 million bushels, in our opinion.

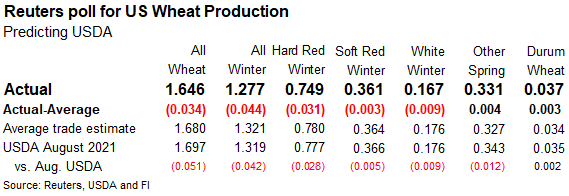

US wheat production came in lower than the trade estimate by 34 million bushels to 1.646 billion led by a surprise downward revision to winter wheat by 42 million bushels to 1.277 billion (44 million below trade expectations). HRW was lowered 28 million, SRW down 5, and winter white down 9 million. Wheat stocks came in below trade expectations by 72 million at 1.780 billion bushels, implying a potential 30 to 50 million-bushel downward revision to USDA’s feed demand in the upcoming supply and demand report. USDA could reduce US wheat exports for the crop year could be reduced by at least 25 million bushels in the upcoming USDA S&D report after they raise their average domestic cash price outlook.

Price projections revised below.

Price outlook:

December corn is seen in a $4.80-$5.45 range (down 15 cents)

March corn is seen in a $5.00-$5.80 range. (unch)

Soybeans – November $12.00-$13.50 range (down 15, unch), March $12.00-$14.00 (unch)

Soybean meal – December $305-$360 (down $15, unch), March $300-$3.80 (unch)

Soybean oil – December 54-62 cent range, March 54-64 (unchanged for both)

December Chicago wheat is seen in a $7.00‐$7.75 range (up 20, up 25), March $6.50-$7.75 (unch)

December KC wheat is seen in a $6.95‐$7.80 (up 20, up 20), March $6.75-$8.00 (up 25 for both)

December MN wheat is seen in a $8.65‐$9.75 (up 25, up 25), March $8.50-$9.75 (unch)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.