USDA released their December S&D report

Reaction: Slightly supportive soybeans as USDA lowered global stocks by 1.8 million tons to 102 million, 2.1 million tons below an average trade guess. Both corn and wheat world wheat stocks were reported 1.0 and 1.9 million tons above an average trade guess, which was seen bearish. Prices sold off post report but some markets rebounded shortly afterwards.

USDA NASS executive summary

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

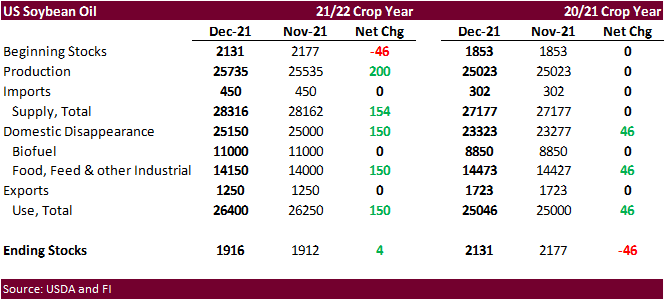

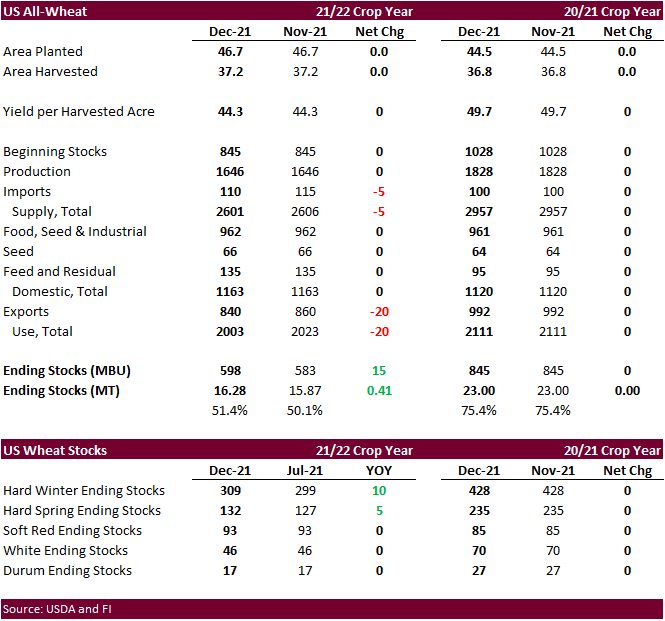

We thought the USDA reported was a little supportive soybeans as USDA lowered global stocks by 1.8 million tons to 102 million, 2.1 million tons below an average trade guess. Both corn and wheat world wheat stocks were reported 1.0 and 1.9 million tons above an average trade guess, which was seen bearish. USDA made no changes to its US corn and soybean balances. They took US wheat stocks 15 million bushels higher by lowering imports by 5 million and exports by 20 million bushels. The report was seen benign for the US balances, with exception to soybean oil, which they made several adjustments, including revising the 2021-22 SBO yield higher from 11.66 to 11.75, resulting in an increase of 200 million pounds to the production side. Domestic disappearance for US soybean oil was up 150 million pounds. 2020-21 ending stocks were revised lower by 46 million pounds as USDA increased the food use category by 46 million pounds. We were a little surprised 2020-21 biofuel use was not adjusted. There were no changes to the US soybean meal balance sheet. Back to the US soybean balance, we are surprised USDA did not adjust crush higher and lower exports. Perhaps next month after December 1 stocks are reported.

World corn production was lifted 4.1 million tons to 1.209 billion, 7.7% above 2020-21. EU corn was taken up 2.5 million to 70.4 million. Argentina and Brazil were left unchanged. Global soybean production fell 2.2 million tons to 381.8 million, 4.2% above 2020-21. China production was lowered 2.6 million tons to 16.4 MMT (following direction of CASDE report) and Paraguay was lowered 0.5 million tons to 10 MMT. USDA left soybean production unchanged for Argentina and Brazil. World wheat production was raised 2.6 million tons. Australia was lifted 2.5 MMT to 34 million and Russian wheat production was taken up 1.0 to 75.5 MMT. Canada was raised 600,000 to 21.7 MMT.

Price projections revised below.

Price outlook:

Updated 12/9/21

March corn is seen in a $5.50 (up 25) to $6.20 (down 5 cents) range

Soybeans – January $12.00 (up 25 cents) to $13.05 (up 5 cents) range, March $11.75-$13.50

Soybean meal – January $330 (up $10) to $375 (up $5), March $315-$380

Soybean oil – January 52.00 (down 200) to 59.00, March 54.00-62.00

Chicago March $7.40 (down 10 cents) to $8.60 (down 15 cents) range

KC March $7.55 (down 20 cents) to $9.00 (down 25) range

MN March $9.50‐$11.00 (unch, down 50 cents)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.