PDF attached

Good morning. USDA report day.

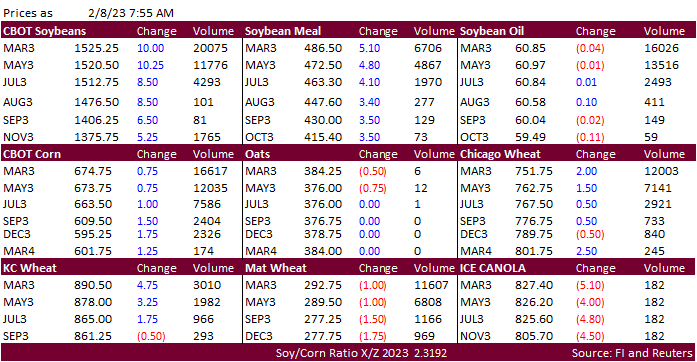

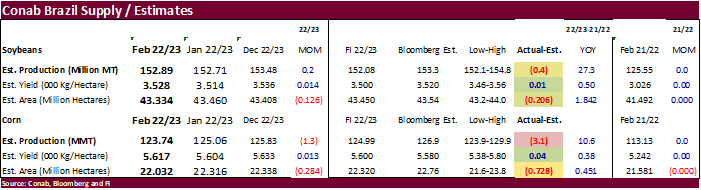

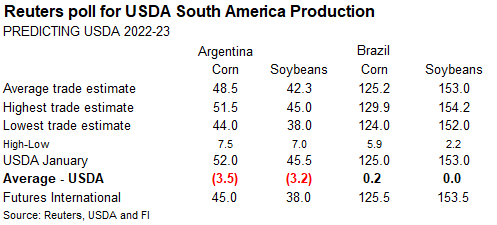

CBOT soybeans are higher led by a rebound in soybean meal from a reversal in product spreading. Conab raised their estimate of the Brail soybean crop by 200,000 tons to 152.9 million, 400,000 tons below trade expectations. Conab lowered their Brazil total corn crop estimate by 1.3 million tons to 123.74 million tons and below 113.13 million tons year ago. The 123.74 million tons came in 3.1 million tons below an average trade guess. This was a little surprising for the trade. There were no major changes to China’s corn and soybean balance outlooks for 2022-23. Look for positioning ahead of the February USDA S&D. Offshore values were leading SBO lower by about 95 points this morning and meal $4.70 short ton higher. A Bloomberg poll looks for weekly US ethanol production to be down 11,000 thousand barrels to 1017k (1000-1025 range) from the previous week and stocks up 572,000 barrels to 25.014 million.

![]()

Brazil’s Conab

WORLD WEATHER HIGHLIGHTS FOR FEBRUARY 8, 2023

- Brazil weather continues to look a little better as time moves along especially for Mato Grosso where the frequency and intensity of rainfall will slacken for a while

- This will help to firm the ground “in time” which will support better harvest and planting progress

- Argentina will get rain Monday into Wednesday of next week for many crop areas offering some relief to recent hot and dry weather

- The precipitation may be greatest in the northeast where it has been driest for the longest period of time

- Relief elsewhere is expected to temporary, but any moisture will be helpful for getting this year’s crops in better condition

- Frequent follow up rain is needed, but not very likely

- U.S. hard red winter wheat areas will see rain and some snow, but it will be greatest in eastern portions of the region over the next ten days

- Central and eastern Oklahoma and north-central Texas will be wettest while the high Plains region are driest

- Today’s forecast is a little wetter in the Texas Panhandle and neighboring areas Monday and in western Kansas, eastern Colorado and Nebraska Wednesday of next week

- Confidence is low and it would not be surprising to see lower precipitation potentials in the future

- U.S. weather will be wettest from eastern Texas into the central and eastern Midwest; including the Delta and interior southeastern states as well as the Tennessee River Basin

- U.S. northern Plains will be drier biased along with Canada for a while

- Europe will continue drier biased over the next week to ten days

- North Africa still needs greater rain, although a few showers will occur in the northeast part of Algeria and northern Tunisia over the next few days

- Southeastern China will be wet biased over the next ten days

- Australia rainfall is not likely to be very great in the next ten days leaving some dryland areas in Queensland needing significant moisture.

Source: World Weather and FI

Bloomberg Ag calendar

Wednesday, Feb. 8:

- USDA’s World Agricultural Supply & Demand Estimates (WASDE), 12pm

- China’s agriculture ministry (CASDE) releases monthly supply and demand report

- EIA weekly US ethanol inventories, production, 10:30am

- Brazil’s Conab issues production, area and yield data for corn and soybeans

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- RESULTS: Yara

Thursday, Feb. 9:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, Feb. 10:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- Malaysian Palm Oil Board’s January data on stockpiles, production and exports

- Brazil’s Unica to release sugar output, cane crush data (tentative)

- Malaysia’s Feb. 1-10 palm oil export data

Source: Bloomberg and FI

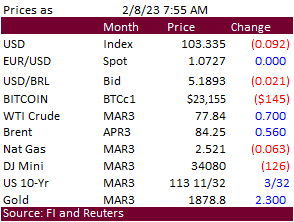

Macros

US MBA Mortgage Applications Feb 3: 7.4% (prev -9.0%)

US MBA 30-Yr Mortgage Rate Feb 3: 6.18% (prev 6.19%)

· CBOT corn is higher from a lower USD and higher soybeans. March corn traded above/below several key moving averages overnight. Some end users are still having a tough time sourcing cash corn across the ECB, where some cash prices topped $6.00 per bushel.

· Heavy rain is forecast from the southeastern Great Plains through the central Corn Belt over the next few days. The southeastern US will also see heavy rain.

· Conab lowered their Brazil total corn crop estimate by 1.3 million tons to 123.74 million tons and below 113.13 million tons year ago. The 123.74 million tons came in 3.1 million tons below an average trade guess. This was a little surprising for the trade. The corn area was lowered 284,000 hectares with Conab citing potential planting delays. Brazil’s second corn crop to total 94.9 million tons, down from 96.2 million tons in January.

· There were no major changes to China’s corn and soybean balance outlooks for 2022-23.

· Second day of the Goldman Roll.

· Mexico is expected soon to issue a new decree over GMO corn imports.

· China is looking to buy local pork for state reserves to prop up prices.

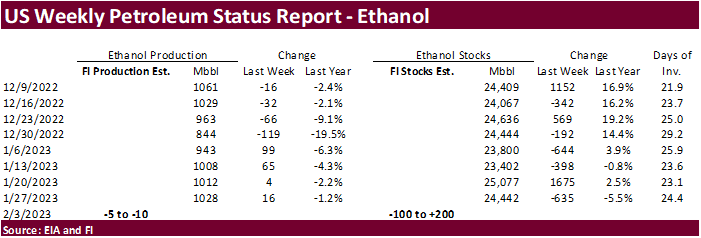

· A Bloomberg poll looks for weekly US ethanol production to be down 11,000 thousand barrels to 1017k (1000-1025 range) from the previous week and stocks up 572,000 barrels to 25.014 million.

Export developments.

· CBOT soybeans are higher led by a rebound in soybean meal from a reversal in product spreading. Soybean oil is near unchanged despite higher crude oil and palm trading at a one month high. Some economic forecasts call for a decent GDP expansion for India and China during 2023.

· Conab raised their estimate of the Brail soybean crop by 200,000 tons to 152.9 million, 400,000 tons below trade expectations.

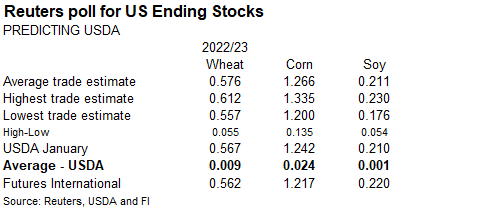

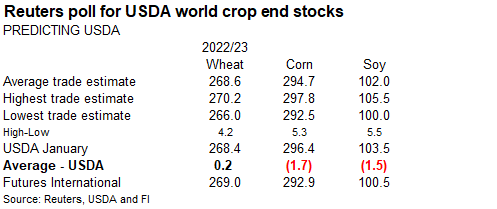

· Look for positioning ahead of the February USDA S&D. The trade should focus on Argentina soybean and corn production, global ending stocks, followed by changes to the US S&D’s, in that order. We think the average trade guesses for Argentina soybean and corn production are very conservative. We don’t see USDA making any significant changes to China demand.

· Bunge’s CEO warned Argentina’s soybean crop could end up in the mid-30MMT’s, down from 44 MMMT in 2022.

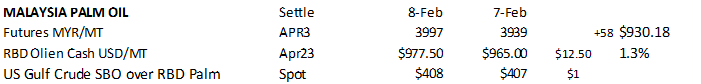

· Malaysia April palm futures were up 58 ringgit to 3997 and cash was up $12.50/ton to $977.50/ton.

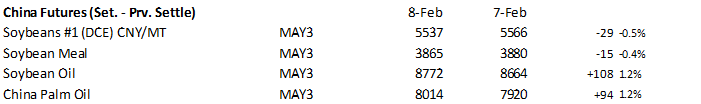

· China soybeans decreased 0.5%, meal down 0.4%, SBO up 1.2% and palm oil futures up 1.2%.

· Nearby Rotterdam vegetable oils were 3-10 euros higher from this time yesterday morning and meal was unchanged to 5.50 euros lower.

· Offshore values were leading SBO lower by about 95 points this morning and meal $4.70 short ton higher.

Export Developments

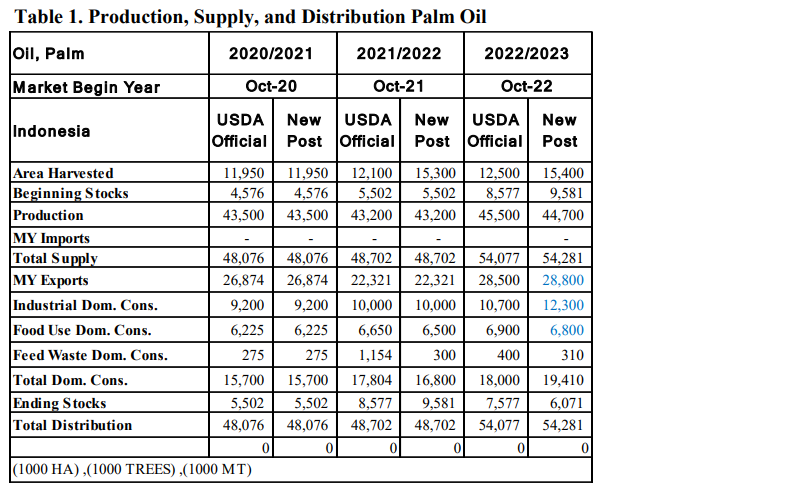

Indonesia: Attaché oilseeds update

· Chicago wheat is mostly higher along with KC and MN on from a lower USD, higher soybeans & corn, and persistent drought across the US Great Plains. Some rain is expected to fall across the southern GP during the 6-10 period.

· We don’t expect major changes in the US and global balance sheets when updated later today.

· Egypt is in talks to secure Serbian wheat. Up to 1 million tons could be bought. Egypt has been expanding origins to ensure long term grain supplies.

· China plans to auction off 140,000 tons of wheat from state reserves on February 15.

· Ukraine grain exports are down 29.2% so far in 2022-23 to 28.2 million tons, including 10.1 MMT wheat and 16.2 MMT corn.

· Paris March wheat was down 1.75 euros earlier at 292.75 per ton.

· French producers are driving tractors around Paris in protest against pesticide bans. No disruption to exports are expected.

Export Developments.

· Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons oof feed barley on Feb 15 for loading by May 31.

· Algeria started buying wheat and results are expected today. Initial prices for one of the two import tenders were thought to be $329/ton c&f for April shipment. They last bought wheat mid-January at $334.50/ton.

· Taiwan seeks 48,100 tons of milling wheat from the US on February 9 for March 29 and April 12 shipment.

Rice/Other

· Today South Korea seeks 79,439 tons of rice for May 1-Dec 31 arrival.

· Egypt seeks at least 25,000 ton of rice from optional origin April-May shipment.

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |