PDF attached

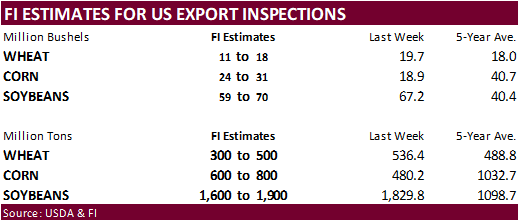

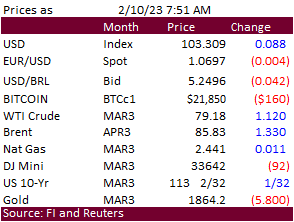

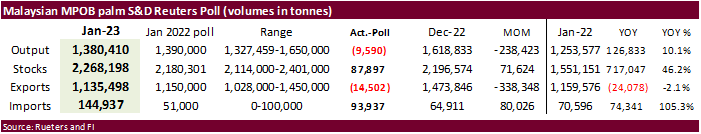

USD is up 9 points and US equities are lower. Nearby CBOT corn hit its lowest level in 3 weeks before rebounding to trade higher on strength in wheat and outside markets. WTI crude oil rallied after Russia announced they plan to cut oil production by 500,000 barrels or 5% next month. Fourth day of the Goldman Roll. South Korea’s KFA bought 64,000 tons of optional origin corn. CBOT soybeans are higher bias nearby contracts. Meal is lower and soybean oil higher on profit taking in product spreads. Malaysian palm oil stocks at the end of January increased 3.3% to 2.268 million tons, first time in three months, in large part from an 80,000-ton increase in imports from December to 144,937 tons, largest since August. Stocks came in 87,897 tons above expectations. Malaysia April palm futures were down 42 ringgit and cash was down $10.00/ton. Russia’s “special operation” escalated in Ukraine with fresh attacks, including Kyiv. This is underpinning US wheat futures.

![]()

WORLD WEATHER HIGHLIGHTS FOR FEBRUARY 10, 2023

- Rain was reduced in southern Argentina for the weekend into next week

- U.S. hard red winter wheat areas still have a couple of weak weather systems that will produce rain and snow in the high Plains, but no serious change in drought status or crop conditions will result

- U.S. weather will continue wettest in the Delta, Tennessee River Basin and southeastern states during the next two weeks, although some precipitation will also impact the Midwest

- A mid-week snow event is possible in the northern U.S. Plains and neighboring areas of the upper Midwest and Canada’s Prairies

- Brazil will get some welcome rain in the south next week

- Nearly all of Brazil will get rain at one time or another

- Europe will continue drier biased for the next ten days

- Western CSI crop areas will get brief bouts of light precipitation over the next ten days

- Chin will continue to receive waves of rain

- India will continue dry biased

- Eastern Australia still needs greater rainfall

- South Africa will experience greater rainfall in the east

- North Africa precipitation will continue restricted over the next couple of weeks

- Australia still needs greater rainfall in eastern unirrigated summer crop areas

Source: World Weather and FI

Bloomberg Ag calendar

Friday, Feb. 10:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- Malaysian Palm Oil Board’s January data on stockpiles, production and exports

- Brazil’s Unica to release sugar output, cane crush data (tentative)

- Suspended – CFTC commitments of traders weekly report on positions for various US futures and options

- Malaysia’s Feb. 1-10 palm oil export data

Monday, Feb. 13:

- USDA export inspections – corn, soybeans, wheat, 11am

Tuesday, Feb. 14:

- France farm ministry’s report on output in 2022 and winter plantings in 2023

- New Zealand food prices

- EU weekly grain, oilseed import and export data

Wednesday, Feb. 15:

- EIA weekly US ethanol inventories, production, 10:30am

- Malaysia’s Feb. 1-15 palm oil export data

- FranceAgriMer’s monthly grains balance sheet report

Thursday, Feb. 16:

- International Grains Council’s monthly report

- USDA weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Russia Grain Conference, Sochi

Friday, Feb. 17:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

Source: Bloomberg and FI

Macros

Russia to cut oil production half million barrels per day (out this morning) or 5% next month.

US December CPI Revised To +0.1% (prev -0.1%)

US December CPI Ex-Food/Energy Revised To +0.4% (prev +0.3%)

– CPI Revisions Reflect Updated Seasonal Adjustment Factors

Canadian Unemployment Rate Jan: 5.0% (est 5.1%; prev 5.0%)

Canadian Net Change In Employment Jan: 150.0K (est 15.0K; prevR 69.2K)

Canadian Full Time Employment Change Jan: 121.1K (prevR 70.9K)

Canadian Part Time Employment Change Jan: 28.9K (prevR -1.7k)

Canadian Participation Rate Jan: 65.7% (est 65.4%; prevR 65.4%)

· Nearby CBOT corn hit its lowest level in 3 weeks before rebounding to trade higher on strength in wheat and outside markets. WTI crude oil rallied after Russia announced they plan to cut oil production by 500,000 barrels or 5% next month.

· The US has given Mexico until February 14 to respond to the US request to explain the science behind Mexico’s planned ban on GMO corn and glyphosate herbicide imports. A dispute settlement process under the US-Mexico-Canada Agreement (USMCA) on trade is not off the table.

· Ukraine’s grain harvest was 97% or 53.7 million tons, including 26.4 million tons of corn (93% of the expected area).

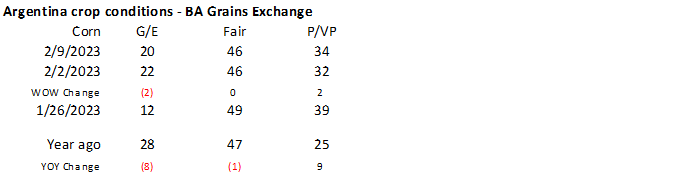

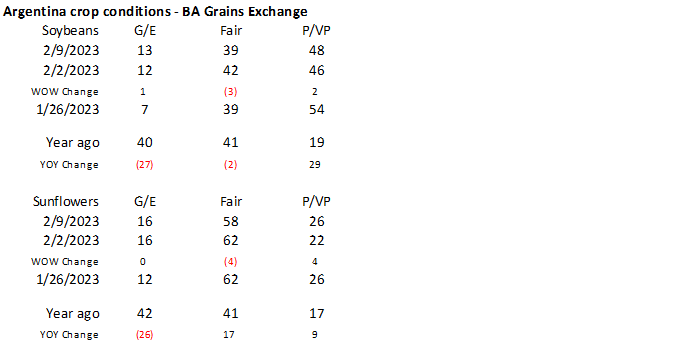

· Argentina corn crop conditions declined 2 points for the good category to 20 percent from the previous week, and poor category increased 2 points to 34 percent.

· Argentina’s BA Grains left its estimate for the Argentina corn crop at 44.5 million tons, down from 52 million year earlier.

· Fourth day of the Goldman Roll.

Export developments.

- South Korea’s KFA bought 64,000 tons of optional origin corn at $335.48/ton c&f for arrival around May 20. It excludes Russia and Ukraine ports of origin.

- Yesterday SK’s MFG and FLC bought US and SA corn, one cargo each.

· CBOT soybeans are higher bias the nearby contracts. Meal is lower and soybean oil higher on profit taking in product spreads. Offshore values were leading SBO higher and meal lower earlier this morning. Look for the trade to monitor the rains expected to fall across Argentina over the next 3-4 days.

· There were a total of 198 soybean registrations cancelled yesterday evening, leaving 599 left.

· The Argentina soybean crop condition for the good category increased one point to 13 percent and poor increased 2 points to 48 percent from the previous week.

· Argentina’s BA Grains Exchange lowered its soybean production estimate to 38 million tons from 41 MMT previous. Argentina’s Rosario Grains exchange is at 34.5 million tons.

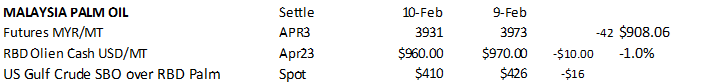

· Malaysian palm oil stocks at the end of January increased 3.3% to 2.268 million tons, first time in three months, in large part from an 80,000 ton increase in imports from December to 144,937 tons, largest since August. Stocks came in 87,897 tons above expectations and are up 46 percent from a year ago. Exports of 1.135 million tons were slightly below expectations and down 338,348 tons from what was exported during December, a 23 percent decline. Cargo surveyors, for comparison, estimated palm exports during January fell 26-27 percent. January Malaysian palm oil production fell nearly 15 percent to 1.38 million tons, lowest level in 11 months.

· Malaysia April palm futures were down 42 ringgit to 3931 and cash was down $10.00/ton to $960/ton. Palm oil was up 2% for the week.

· AmSpec reported February 1-10 Malaysia palm oil export increased 32.51% to 312,092 tons from 235,529 tons shipped during Jan 1-10.

· Indonesia set their February 16-28 CPO reference price at $880.03/ton for February 16-28, up from $879.31 during February 1-15. That puts Indonesia’s CPO export tax at $74 per ton and export levy at $95 per ton.

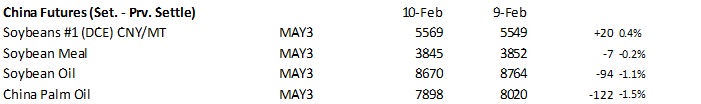

· China soybeans increased 0.4%, meal down 0.2%, SBO down 1.1% and palm oil futures down 1.5%.

· Nearby Rotterdam vegetable oils were mostly 13 to 15 euros lower from this time yesterday morning and meal was mostly higher.

· Offshore values were leading SBO higher by about 48 points this morning (81 higher for the week to date) and meal $7.80 short ton lower ($5.90 lower for the week).

Export Developments

· Russia’s “special operation” escalated in Ukraine with fresh attacks, including Kyiv. This is underpinning US wheat futures.

· Russia said they are having a hard time exporting grain as part of the Black Sea grain deal. Currently Ukraine, Turkey, and other countries are negotiating to extend the deal set to expire soon.

· Meanwhile, IKAR agriculture consultancy expects Russia’s wheat exports for the 2022-23 season to end up at a record 46 million tons.

· Ukraine’s backlog of boats waiting for either inspection and for arrival prompted the AgMin to advise slightly larger vessels should be used to load grain and vegetable oils going forward.

· Paris March wheat was up 3.25 euros earlier at 295.00 per ton.

Export Developments.

Rice/Other

· Results awaited: Egypt seeks at least 25,000 ton of rice from optional origin April-May shipment.

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |