PDF attached

NOPA crush is due out at 11 am CT.

Private exporters reported sales of 101,000 metric tons of soybeans for delivery to Mexico. Of the total, 53,500 metric tons is for delivery during the 2021/2022 marketing year and 47,500 metric tons is for delivery during the 2022/2023 marketing year.

Some Russian troops were returned to base, easing fears of an invasion of Ukraine. Global equities are higher, USD 36 points lower, crude oil sharply lower (down $3.44), and gold weaker. This news also pressured wheat and corn overnight. Some traders remain cautious over the recent headline trading. Soybeans are down for the second consecutive day as traders weight in on South American supplies.

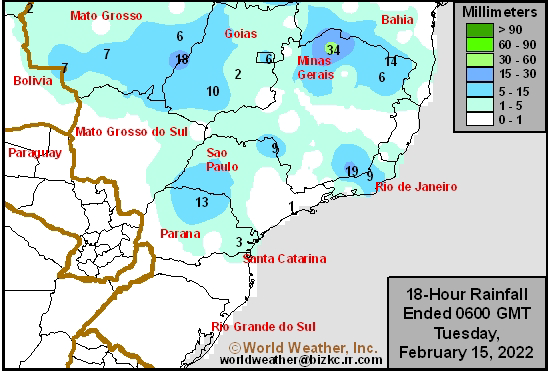

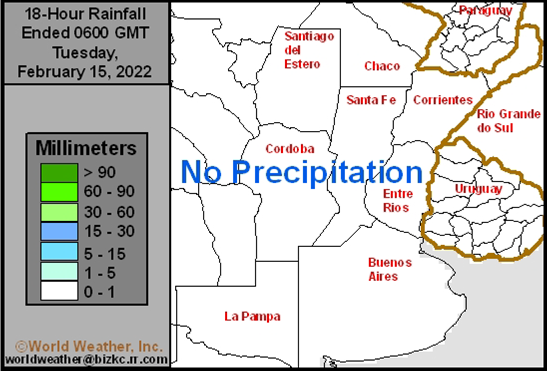

WORLD WEATHER HIGHLIGHTS FOR February 15, 2022

- Not much change was noted overnight.

- Argentina still has 8-9 days of restricted rainfall in central and eastern parts of the nation where net drying and crop stress is expected to prevail, despite a few showers.

- Western Rio Grande do Sul, Brazil and southernmost Paraguay will also be caught up in these same conditions.

- Drying in interior southern Brazil may be stressful, but not to the same degree of intensity as that of early January and the impact on production should not be nearly as great either.

- Some change toward more unsettled weather is expected during the final days of February and into early March for both Argentina and southern Brazil’s driest areas.

- Rain frequency and intensity in northern Brazil will continue greatest into the weekend and then decrease enough for improved field working opportunities.

- In the United States, two storm systems – one Wednesday into early Friday and another about one week later – will bring some welcome moisture to the driest areas of hard red winter wheat areas offering a boost in topsoil moisture that might give crops a little better chance to begin improving for a while in March especially with possible follow up systems.

- But be careful, the hard red winter wheat region will trend dry and warm later in the spring to bring back plant stress.

- A significant snow and rain event will impact the heart of the Midwest during mid-week this week producing heavy rain and severe thunderstorms to the southeastern Plains and Delta and rain and snow to the lower eastern Midwest and northeastern states.

- Dryness will continue in California and the southwestern states this week, but the region could get a little moisture briefly next week.

- West Texas will continue in need of significant moisture. Elsewhere in the world conditions are about the same.

- The northern Plains and upper Midwest may get some greater precipitation next week, although light amounts will occur briefly this week

- Spain, Portugal and northwestern Africa are still dealing with dryness over the coming ten days

- India’s weather will be tranquil for the next ten days with very little precipitation

- Much of Europe outside of the southwest will see waves of rain and some snow and in the western CIS snow will fall most frequently with some rain in the south which is no different from that of previous days’ forecasts

- China will stay wet from the Yangtze River southward to the coast

- Eastern Australia will receive some needed rain in dryland areas of Queensland and New South Wales this weekend and especially next week which is an increase over that advertised Monday

- South Africa rainfall should slowly increase during the coming week to ten days

Source: World Weather Inc.

Source: World Weather Inc.

Bloomberg Ag Calendar

- EU weekly grain, oilseed import and export data

- Malaysia’s Feb. 1-15 palm oil exports

- Malaysia crude palm oil export tax for March (tentative)

- New Zealand global dairy trade auction

Wednesday, Feb. 16:

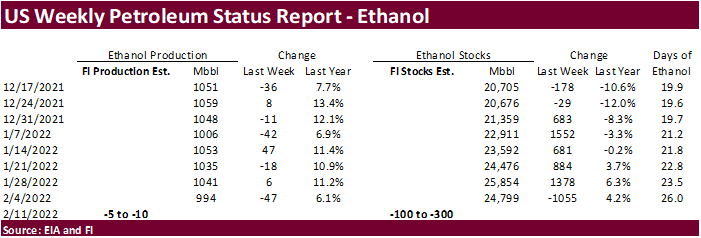

- EIA weekly U.S. ethanol inventories, production

- FranceAgriMer report; monthly grains outlook

- HOLIDAY: Thailand

Thursday, Feb. 17:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- International Grains Council monthly report

Friday, Feb. 18:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly crop condition report

Source: Bloomberg and FI

USDA inspections versus Reuters trade range

Wheat 435,188 versus 200000-550000 range

Corn 1,455,106 versus 950000-1400000 range

Soybeans 1,154,958 versus 1000000-1500000 range

US PPI Final Demands (M/M) Jan: 1.0% (est 0.5%; prev 0.2%; prevR 0.3%)

– PPI Ex Food And Energy (M/M) Jan: 0.8% (est 0.5%; prev 0.5%)

– PPI Final Demand (Y/Y) Jan: 9.7% (est 9.1%; prev 9.7%)

– PPI Ex Food And Energy (Y/Y) Jan: 8.3% (est 7.9%; prev 8.3%)

7:32:05 AM livesquawk US Empire Manufacturing Feb: 3.1 (est 12.0; prev -0.7)

Canadian Existing Home Sales (M/M) Jan: 1.0% (est -1.5%; prev 0.2%)

· March corn is lower in a risk off session as Ukraine/Russia concerns ease.

· The highly lethal bird flu case (H5N1) in Fulton County, Kentucky, affected about 240,000 chickens. In 2015 about 50 million poultry perished across the US from several outbreaks.

· Yesterday Brazil’s Rio Grande do Sul local forecaster, Emater, lowered their estimate for corn production for the state to 2.77 million tons from 6.11 million from their initial projection due to drought. This is below Conab’s 2.98 million ton estimate (4.4 MMT for 2020-21).

· USDA US corn export inspections as of February 10, 2022 were 1,455,106 tons, above a range of trade expectations, above 1,065,018 tons previous week and compares to 1,314,984 tons year ago. Major countries included China for 413,562 tons, Mexico for 345,702 tons, and Japan for 291,636 tons.

Export developments.

· None reported

· Soybeans are down for the second consecutive day as traders weight in on South American supplies. There were rumors China may release bulk agriculture products out of reserves. Yesterday we heard China washed out at least five Brazilian soybean cargoes over the past week, and two may have been switched to the US. Today we are hearing up to 12 boats were washed.

· South America’s weather situation still calls for mostly dry weather across drought areas for the balance of the week before rain develops during the second week of the outlook.

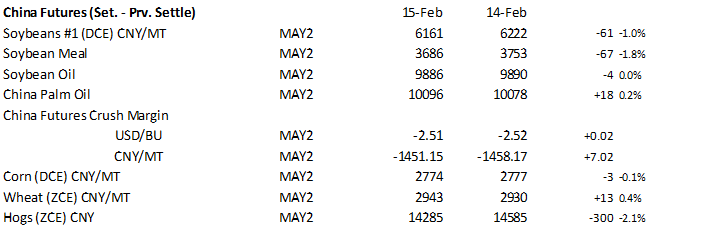

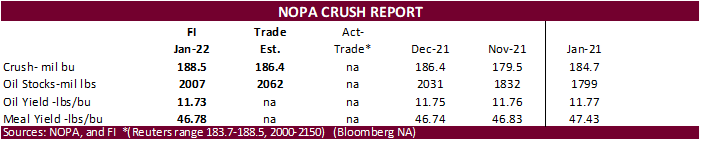

· NOPA is due out at 11 am CT. estimates are below.

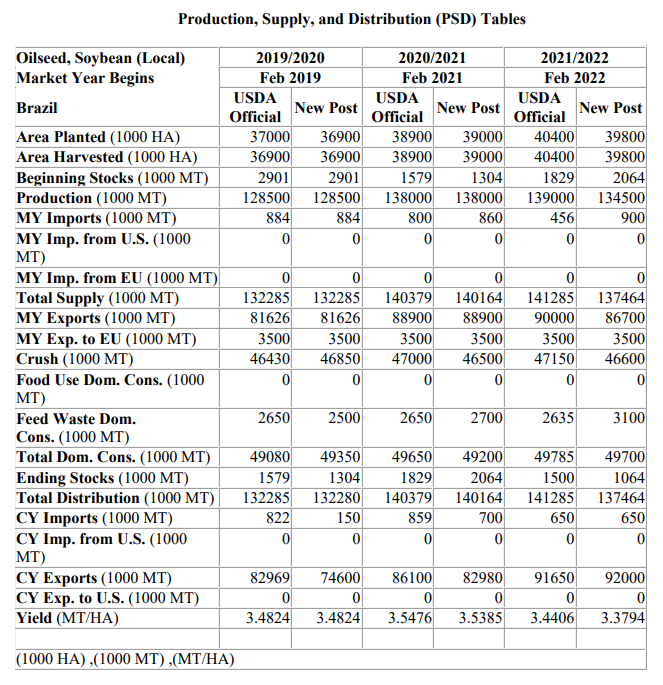

· USDA Attaché updated their Brazil soybean supply and demand projections. They lowered 2021-22 Brazil soybean production to 134.5 million tons and exports to 86.8 MMT. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds%20and%20Products%20Update_Brasilia_Brazil_01-31-2022

· Offshore values are leading SBO 22 points lower and meal $1.50 short ton higher.

· Rotterdam meal and oil values were lower from this time yesterday.

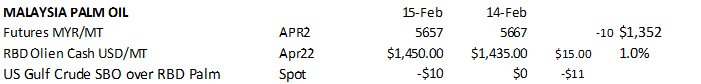

· February 1-15 Malaysian palm oil exports were reported by AmSpec at 496,983 tons, up 23.6 percent from 402,243 tons during the Jan 1-15 period. This is an improvement from the Feb 1-10 period. ITS reported Feb 1-15 palm oil exports up 18.8 percent to 506,183 tons from 426,111 tons previous month period.

· April Palm futures were down 10 MYR, just off its record high, and cash was up $15.00/ton at $1,450/ton.

· China soybean and meal futures lost 1.0-1.8% and vegetable oils were near unchanged.

Most recent Brazil soy estimates:

Pátria Agronegócios 122

Conab 125.5 million tons

AgRural 128.5 million tons

USDA 134 million tons

USDA last year 138

· USDA US soybean export inspections as of February 10, 2022 were 1,154,958 tons, within a range of trade expectations, below 1,240,499 tons previous week and compares to 923,993 tons year ago. Major countries included China for 507,611 tons, Italy for 124,027 tons, and Mexico for 111,167 tons.

· We see a record January NOPA crush when updated Tuesday and are at the high side of a range of expectations. There were a couple plants that saw unexpected downtime in the WCB, but January was running full out for many crushing plants taking advantage of good margins. Soybean oil stocks are seen by FI declining from December. Recall SBO stocks at the end of December were unusually high, especially when you compare them to the NASS crush report that came out at the beginning of the month.

· The Reuters trade guess for NOPA January crush came in at 186.7 million bushels, above 186.4 million for December and up from 184.7 year earlier. The range was 183.7-188.5 million. Many analysts expect a build in soybean oil stocks to 2.062 billion pounds from 2.031 billion pounds at the end of December and compares to 1.799 billion year earlier. If realized US soybean oil stocks would be up seven consecutive months. End of January NOPA US soybean oil stocks ranged from 2.000 to 2.150 billion pounds. We are at 2.007 billion pounds.

- Private exporters reported sales of 101,000 metric tons of soybeans for delivery to Mexico. Of the total, 53,500 metric tons is for delivery during the 2021/2022 marketing year and 47,500 metric tons is for delivery during the 2022/2023 marketing year.

- Egypt’s GASC seeks vegetable oils on February 16 for April 5-25 arrival. They seek a minimum 10,000 tons of sunflower oil and 30,000 tons of sunflower oil. They are also seeking local vegetable oils of at least 3,000 tons of soyoil and 1,000 tons of sunflower oil for arrival April 1-20.

· Some Russian troops were returned to base, easing fears of an invasion of Ukraine. This news pressured wheat futures. Some traders remain cautious over the recent headline trading.

· EU wheat futures are trading down 5.50 euros at 268.50 euros per ton at the time this was written.

· SovEcon raised its forecast for Russia’s 2022 wheat crop by 3.6 million tons to 84.8 million toes, citing favorable weather.

· Egypt said they have enough wheat strategic reserves to last 4.2 months.

· Egypt plans to increase strategic stores of supply commodities to 8-9 months.

· This week a major US winter storm expected during mid to late week was pushed southward and is not as large than that of Friday. Abundant rain is seen near and south of the Ohio River and into the Delta and mid-south region Wednesday and Thursday with a band of snow coming out of the southern Plains into the lower eastern Midwest.

· The northern Plains and upper Midwest may get some greater precipitation next week.

· South Korean flour mills seek 50,000 tons of wheat from the US and 32,000 tons from Canada on Wednesday.

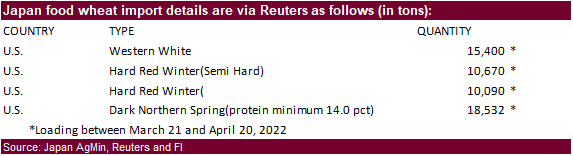

· Japan seeks 54,692 tons of food wheat from the US this week.

· Results awaited: The Philippines seek 45,000 tons of feed wheat on Tuesday. Shipment is sought in June and July.

· Results awaited: Syria seeks 200,000 tons of wheat on February 14, open for 15 days. Algeria seeks 50,000 tons of milling wheat on Feb 16, open until Feb 17, for April shipment. They last bought wheat on Jan 26, paying around $375/ton.

· Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

· Taiwan seeks 54,920 tons of US wheat on February 18, for April 4-18 shipment if off the PNW.

·

· Turkey seeks 255,000 tons of feed barley on February 22. Shipment is sought for March 1-31.

· Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

Rice/Other

· None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.