PDF attached.

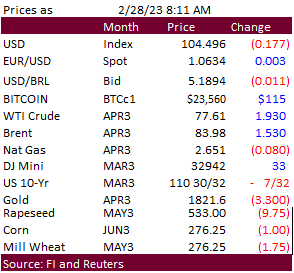

First notice day deliveries were heavier than expected. WTI crude oil earlier was $1.96 cents higher, natural gas lower, USD 15 points lower and US equities mixed. Lower trade in the soybean complex and grains this morning, in part to deliveries, improving US winter wheat conditions, follow through selling, and Brazil’s advancing soybean harvest. There were no major changes were seen for SA weather. The morning forecast improved for the US.

WORLD WEATHER HIGHLIGHTS FOR FEBRUARY 28, 2023

- More snow will fall in a part of the northern U.S. Plains and upper Midwest today and Wednesday resulting a greater snowpack across the Red River Basin

- Spring flood potentials may soon begin to rise due to the substantial snow that is piling up across the region

- Spring flooding is real possibility this year in southwestern Russia and immediate neighboring areas of Belarus where the ground is saturated beneath an impressive snowpack

- Northeastern parts of North Africa and areas from Italy into the Balkan Countries will receive rain for a few more days while other areas in Europe are relatively dry

- Some increase in precipitation is expected next week from France into the Baltic Plain while southern Europe dries down

- Western CIS crop areas will continue to experience frequent snow and rainfall during the next ten days maintaining wet field conditions

- China’s southern Sichuan to eastern Yunnan corridor will be wettest region for a while

- Net drying is expected in many other areas due to warmer than usual temperatures and limited precipitation

- India’s weather will continue to be drier biased through the weekend, but there will be a potential for “some” showers next week

- Resulting rainfall will be limited though

- Interior Eastern Australia’s dryland crops will continue to be stressed because of low soil moisture and limited rainfall

- South Africa will trend wetter again in its summer crop areas later this week into next week

- Argentina’s first week outlook is still not offering much drought relief in the central or south, but week two of the forecast still offers some potential for needed rain

- Brazil weather forecast has not changed much relative to that of Monday with periods of rain likely in much of the nation excluding the northeast where parts of Bahia, northeastern Minas Gerais and Espirito Santo will be dry until late in the second week when some rain will finally evolve

- U.S. central and eastern Midwest, Delta and Tennessee River Basin will be plenty moist over the next two weeks

- Cooling is likely in the central parts of North America during the second week of March

- U.S. hard red winter wheat areas will not get much precipitation for a while, although another disturbance is expected to impact parts of the region Thursday into Friday and again March 8-9

- Snow will fall in the northern Plains today

- Snow and rain will continue to impact California into Wednesday and again for a little while next week

- West and South Texas and many areas in the Gulf of Mexico coastal areas as well as Florida will be dry for the next ten days

Source: World Weather and FI

Tuesday, Feb. 28:

- Dubai Sugar Conference, day 2

- EU weekly grain, oilseed import and export data

- US agricultural prices paid, received, 3pm

- Malaysia’s Feb. palm oil export data

- Vietnam coffee, rice and rubber export data

- EARNINGS: Golden Agri

Wednesday, March 1:

- Dubai Sugar Conference, day 3

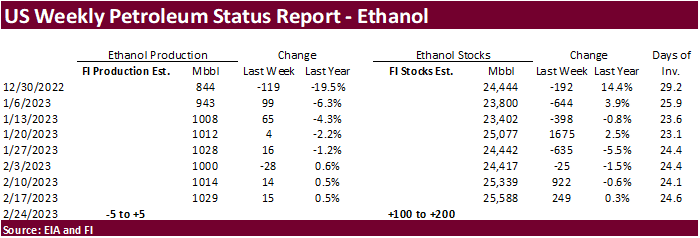

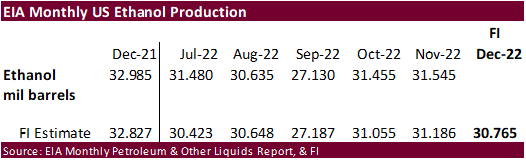

- EIA weekly US ethanol inventories, production, 10:30am

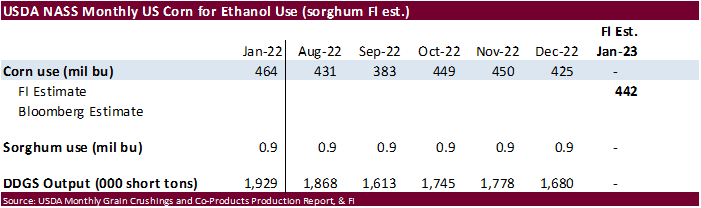

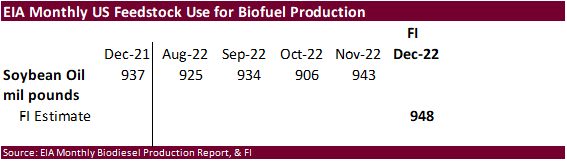

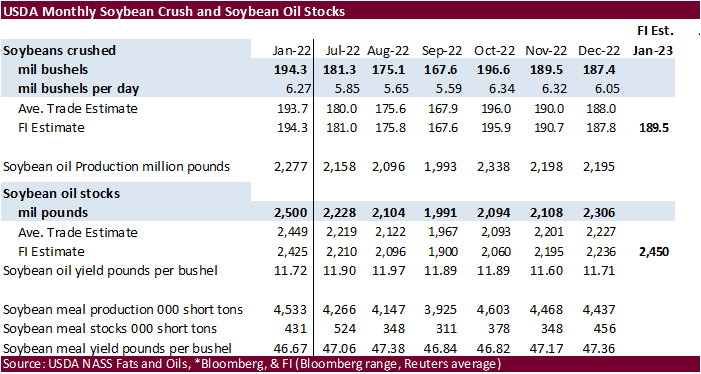

- USDA soybean crush, DDGS production, corn for ethanol, 3pm

- Global Grain and Animal Feed Asia 2023, Singapore, day 1

Thursday, March 2:

- Dubai Sugar Conference, day 4

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Global Grain and Animal Feed Asia 2023, day 2

Friday, March 3:

- FAO World Food Price Index, grains report

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

- Global Grain and Animal Feed Asia 2023, day 3

Source: Bloomberg and FI

USDA inspections versus Reuters trade range

Wheat 591,725 versus 250000-500000 range

Corn 572,622 versus 375000-750000 range

Soybeans 690,984 versus 850000-1700000 range

Macros

Canadian GDP (Y/Y) Dec: 2.3% (exp 2.7%; prev 2.8%)

GDP (M/M) Dec: -0.1% (exp 0.0%; prev 0.1%)

Quarterly Q4 Annualised: 0.0% (exp 1.6%; prevR 2.3%)

US Advance Goods Trade Balance (USD) Jan: -91.5B (exp -91.0B; prev -90.3B)

US Wholesale Inventories (M/M) Jan P: -0.4% (exp 0.1%; prev 0.1%)

Retail Inventories (M/M) Jan: 0.3% (exp 0.1%; prev 0.5%)

· Corn futures are lower from lack of fresh news and improving US weather ahead of planting season.

· Selected EU countries reported high inflation overnight, renewing concerns over a global economic slowdown.

· Germany reported another ASF case, this time in the eastern state of Brandenburg.

Export developments.

- South Korea’s NOFI bought an estimated 65,000 tons of feed corn from either the United States or South America for arrival around June 25 at $327.99 a ton c&f.

- South Korea’s KFA bought 66,000 tons of feed corn at an estimated $327.99 a ton c&f for arrival around June 5.

- South Korea’s MFG bought an estimated 64,000 tons of corn, optional origin, at an estimated $328.40 a ton c&f for arrival around June 30.

· CBOT soybeans, meal and soybean oil are trading lower on Brazil soybean harvest pressure, heavier than expected deliveries and lower grains. Losses are limited for SBO as WTI crude oil is seeing a good rebound.

· Indonesia set its March 1-15 crude palm oil reference price at $889.77 per ton, up slightly from $880.03 per ton Feb. 16-28. Indonesia’s crude palm oil export tax will adjust to $74 per ton and levy at $95 per ton.

· AmSpec reported Malaysian palm oil exports for the month of February fell 0.4% to 1.062MMT from 1.066MMT during January.

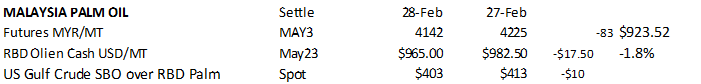

· Malaysia May palm futures were down 83 ringgit to 4,142 and May cash was down $17.50 at $965.00/ton.

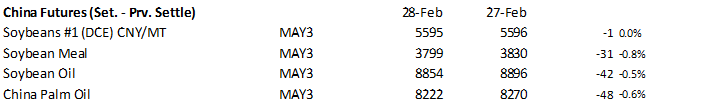

· China soybeans were near unchanged, meal down 0.8%, SBO down 0.50% and palm oil futures down 0.6%.

· Nearby Rotterdam vegetable oils were down 15-25 euros from this time yesterday morning and meal mostly lower by 1.00-3.00 euros.

· Offshore values were leading SBO higher by about 43 points this morning and meal $3.70 short ton lower.

· Argentina producers will launch a protest this week over taxes, exchange rates and financial support.

Export Developments

· Turkey’s state grain board TMO cancelled their 48,000 ton crude sunflower oil tender. Prices were too high.

· Today China planned to auction off 32,472 tons of soybean oil from state reserves.

Wheat

· US wheat futures are lower from follow through selling.

· US winter wheat crop conditions for KS decreased 2 points from the previous month to 19% but KS improved to 36% G/E from 17% from January 29 and Texas was up to 19% from 14% previous week (Feb 19).

· Traders are waiting for news over the Black Sea grain export deal.

· Paris May wheat was down 1.75 euros earlier at 276.25 per ton.

Export Developments.

· South Korean flour mills bought 85,000 tons of US and Canadian milling wheat. 50,000 tons was sought from the United States and 35,000 tons from Canada, both for shipment between May 1 and May 31.

- US soft white wheat of about 10% to 11% protein content bought at an estimated $304.96 a ton

- US soft white wheat of a maximum 8.5% protein bought at $306.06 a ton

- US hard red winter wheat of 11.5% protein bought at $359.53 a ton

- US northern spring/dark northern spring wheat of 14% protein bought at $363.48 a ton

- Canadian western red spring wheat (CWRS) of 13.5% protein bought in the low $340s a ton

· Jordan’s state grain buyer passed on 120,000 tons of optional origin milling wheat for shipment between Aug. 1-15 and Aug. 16-31.

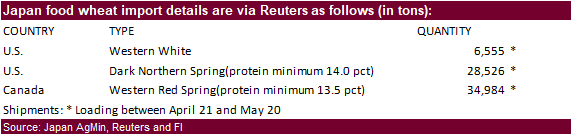

· Japan’s AgMin seeks 70,065 tons of food-quality wheat from the United States and Canada later this week.

· Jordan’s state grain buyer seeks 120,000 tons of optional origin feed barley for shipment between June 1-15, June 16-30, and July 1-15.

· Taiwan seeks 48,975 tons of US milling wheat on March 1 for PNW shipment between April 19 and May 3. Wheat types sought include dark northern spring, hard red winter and white wheat.

· Turkey seeks 440,000 tons of feed barley on March 2.

Rice/Other

· None reported

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |