PDF attached

Day

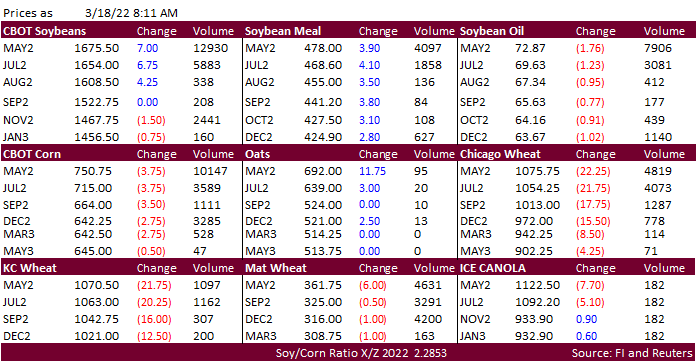

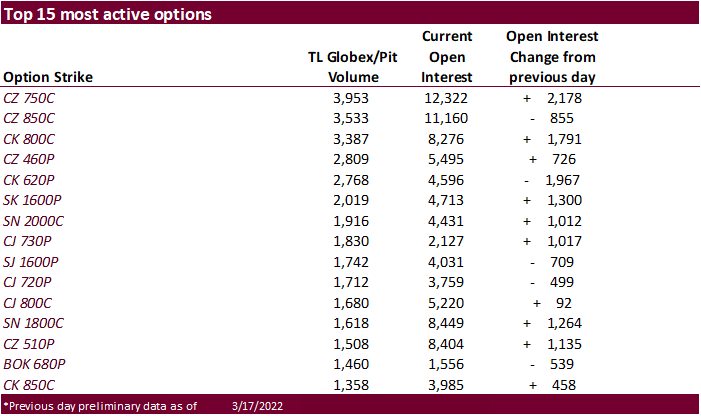

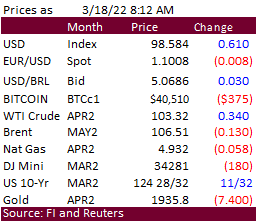

23. USD is higher this morning and WTI higher. Grains are lower on light selling while soybeans are catching a bid on Argentina product export concerns. Uncertainty over the Ukraine/Russia situation may keep some traders sidelined or shore up positions ahead

of the weekend. We did not see any export developments posted overnight.

![]()

WORLD

WEATHER HIGHLIGHTS FOR MARCH 18, 2022

- Rain

fell in U.S. hard red winter wheat areas Thursday with 0.20-0.60″ in central Kansas and local totals to 0.88 inch.

- central

Oklahoma had a very narrow band of 1.00 to 2.00 inches of rain - The

high plains region did poorly with moisture - A

new storm will bring 0.50 to 1.50 inches of rain to U.S. hard red winter wheat areas Sunday night through Tuesday

- some

heavy snow will fall from Colorado into south Dakota - locally

greater rainfall is expected as well - U.S.

central Plains wheat conditions should improve greatly from the precipitation, although the southwestern Plains will not receive nearly as much moisture as other areas and the need for drought busting rain will continue - West

and South Texas as well as the Texas Coastal Bend will continue too dry for the next ten days to two weeks - California

will continue to suffer from limited precipitation - U.S.

Delta, Tennessee River Basin and Ohio River Valley will be very wet early to mid-week next week with some flooding expected - U.S.

southeastern states will get timely precipitation - Week

two U.S. weather will bring a little more moisture to a part of the northern U.S. Plains and southern Canada’s Prairies - No

changes in South America Today - southwestern

Argentina will continue to receive limited precipitation and will slowly dry down, but subsoil moisture is still favorable for crop development - All

of Brazil will get rain at one time or another in the next two weeks, although central and northern Minas Gerais and Bahia will not get much moisture

- Minor

coffee and sugarcane areas in Minas Gerais and Bahia will need moisture soon, but key grain and oilseed areas are outside of the predicted driest regions and should still do well - Southwestern

Europe and northwestern Africa are still expecting rain routinely enough to improve crop and field moisture - Central

and eastern Europe and the western CIS will remain drier than usual, but until seasonal warming occurs the dryness is not likely to be a big issue

- limited

precipitation will continue for the next ten days, though - East-central

and southeastern China will be plenty wet in the next ten days - some

areas will likely be too wet in the Yangtze River Basin where some local flooding will be possible - India,

Australia and South Africa weather is expected to be favorable for crops - Africa

coffee, cocoa and sugarcane crop areas will experience favorable weather and the same is true for Southeast Asia crop areas

Source:

World Weather Inc.

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Monday,

March 21:

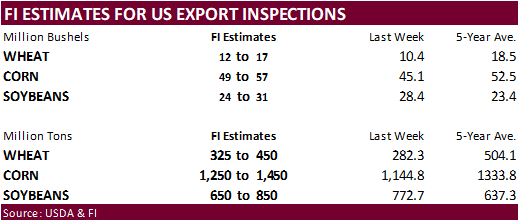

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals - Malaysia’s

March 1-20 palm oil export data - USDA

total milk production, 3pm - HOLIDAY:

Japan

Tuesday,

March 22:

- EU

weekly grain, oilseed import and export data

Wednesday,

March 23:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Pakistan

Thursday,

March 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef - Brazil’s

Unica may release cane crush, sugar output data - USDA

red meat production, 3pm - HOLIDAY:

Argentina

Friday,

March 25:

- ICE

Futures Europe weekly commitments of traders report, ~2:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-25 palm oil export data - U.S.

cattle on feed, poultry slaughter

Source:

Bloomberg and FI

Canadian

Retail Sales (M/M) Jan: 3.2% (est 2.4%; prev -1.8%)

Canadian

Retail Sales Ex Auto (M/M) Jan: 2.5% (est 2.2%; prev -2.5%)

Canada

Feb Retail Sales Most Likely Fell 0.5% – StatsCan Flash Estimate

Canada

Feb New Housing Prices +1.1Pct Vs +0.9Pct In Jan; +10.9Pct On Year

·

CBOT corn is

lower following weakness in wheat and higher USD.

·

A Agroconsult field crop survey suggested Brazil’s second corn crop at 92.2 million tons, same as a previous estimate and compares to 60.9 million tons last season. Total corn was pegged at 116.1 million tons, down from 116.5

million previous estimate.

·

A Ukraine official mentioned corn stocks are large enough to cover 1.5 years of consumption.

Export

developments.

-

No

fresh business we see on Friday. -

Results

awaited: On

Wednesday Iran opened a new import tender for corn, barley and soybean meal that was set to close March 16.

-

Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment. -

Results

awaited: Egypt’s GASC seeks a minimum 1,000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

·

CBOT soybeans are higher led by soybean meal (product reversal) on concerns over Argentina meal and soybean oil export taxes that may shift business to north America.

·

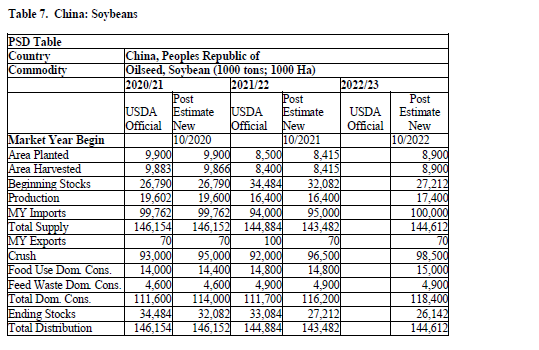

China is urging local governments to minimize the impact of Covid-19 to ensure spring plantings don’t get disrupted.

·

USDA’s Attaché sees China 2022-23 soybean imports at 100 million tons, a record if realized.

·

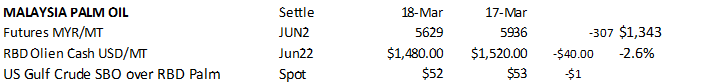

Malaysian palm oil futures overnight dropped more than 5%. Palm fell 16% for the week, mainly on demand destruction from high global vegetable oil prices and Indonesia reversing their stance to restrict exports over the short

term.

·

June Malaysian palm oil settled 307 ringgit lower to 5,629. Cash palm was down $40/ton to $1,480/ton (2.6%).

·

From this time yesterday morning Rotterdam meal from SA were mixed and vegetable oils 5-25 euros higher.

·

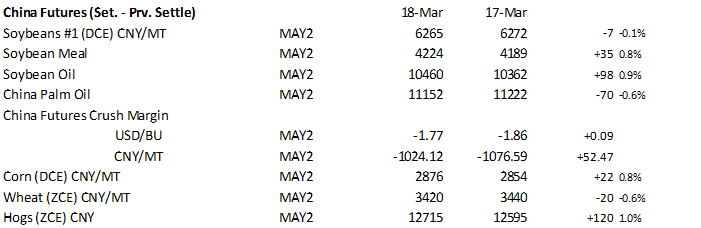

China May soybeans were down 0.1%, meal up 0.8%, soybean oil higher by 0.9% and palm down 0.6%.

·

Offshore values are leading SBO 147 points lower (355 lower for the week to date) and meal $3.50 short ton higher ($0.50 lower for the week).

·

A Agroconsult field crop survey suggested Brazil’s soybean production will reach 124.6 million tons, below a previous forecast of 125.8 million tons, and well below their 139.4 million ton forecast for 2020-21.

·

The Buenos Aires grains exchange warned the soybean, corn and sunflower harvest forecasts could be cut further due to lower yields than expected from poor weather. The current estimates include soybeans at 42 million tons, corn

at 51 million tons and sunflower harvest at 3.3 million tons. They are using 78 million tons for soybean exports.

-

Results

awaited: Iran’s GTC issued a tender (3/15) to buy about 30,000 tons of soyoil, set to close March 16. They are also seeking offers for sunflower oil and palm olein oil.

-

Results

awaited: Iran’s SLAL issued a tender (3/15) to buy about 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal, set to close March 16. -

Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

·

US wheat futures are lower Friday morning on technical selling ahead of the weekend and geopolitical headline trading.

·

French soft wheat ratings for the good and excellent categories were steady at 92 percent as of March 14 from the previous week (87% year ago). Spring barley was 90 percent planted.

·

May Paris wheat futures were down 6.00 euros or 1.6% to 361.75 euros earlier.

·

Algeria’s wheat supply is large enough to last until August.

·

Germany’s association of farm cooperatives estimated the 2022 wheat crop up 5.8% on the year to 22.61 million tons.

·

Results awaited: Iran’s GTC seeks 60,000 tons of milling wheat for shipment in April and May.

·

Jordan seeks 120,000 tons of barley on March 23. Possible shipment combinations are between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June. Two Philippine groups are in for a combined 270,000 tons of feed wheat. One tender seeks 215,000 tons in four consignments

for shipment between May 3 and Aug. 20. The second tender seeks at least 55,000 tons for July/October shipment.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.