PDF attached

Good

morning and happy USDA report day!

93.2

million corn and 90 million soybeans are the two estimates traders will be most focused on this morning, but remember stocks for soybeans, corn and wheat will be important for old crop as it will indicate demand during the Dec-Feb quarter.

The

CBOT soybean complex was higher this morning on technical buying and to a lesser extent a slightly weaker USD and near unchanged WTI crude oil. SK bought SA soybean meal. Palm oil traded 40 points higher (good exports during late March) overnight and cash

was up $5.00/ton. China SBO and palm fell 3% and 2.4%, respectively. Argentina’s

oilseed workers union SOEA threatened to strike in Rosario if the company Buyatti fails comply with union demands from the recent dismissal of workers. ANEC sees Brazil soybean exports for March at a record 16.1 million tons and soybean meal exports at 1.23

million tons. CBOT corn was mixed and US wheat mostly lower. Weather looks good for the US for FH April but keep an eye on net drying for the Great Plains.

Bloomberg

estimates

Reuters

estimates

World

Weather Inc.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Weather

conditions in Argentina and Brazil will be mostly good for a while. The only concern is over Safrinha corn in interior southern Brazil because of late planting and a forecast of normally ending monsoonal rainfall. There is also concern over U.S. weather that

might trend drier biased later this year. These may be some of the reasons why corn has been in a trading range with favorable support.

South

Africa corn and sorghum is still expected to yield well. India weather during the winter was favorable, although not quite as good as last year. Southeast Asia corn in Thailand is slow getting started, but a boost in rainfall in April should improve the situation.

China is expected have a good start to planting and U.S. planting is also expected to go swiftly because of warm temperatures and lighter biased rainfall at times.

Overall,

today’s weather may help keep corn and soybean futures prices in a trading range.

MARKET

WEATHER MENTALITY FOR WHEAT: Limited winterkill in Russia, Europe and China and a mostly good India crop coupled with recent improving U.S. hard red winter wheat crops will maintain some weakness in daily trade, but the influence of weather on the marketplace

may be beginning to run out. Hard red winter wheat areas will dry down for a while especially in the west and concern about dryness remains in the northern U.S. Plains.

Canada

Prairies received some needed moisture earlier this week and has some potential for additional precipitation in coming weeks, but it will be a slow process of recovery from drought.

Weather

today will produce a mixed influence on market weather mentality.

Source:

World Weather inc.

Bloomberg

Ag Calendar

Wednesday,

March 31:

- EIA

weekly U.S. ethanol inventories, production - USDA

stocks and prospective planting – corn, wheat, soy, barley, sorghum - EIA

monthly ethanol and biodiesel / renewable / biodiesel fuel reports - Malaysia’s

March palm oil export data - Unica

report on cane crush and sugar production in Brazil (tentative) - U.S.

agricultural prices paid, received, 3pm

Thursday,

April 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Australia

commodity index - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - HOLIDAY:

Mexico, Argentina and several other Latin American countries

Friday,

April 2:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Good Friday holiday across most of Europe, Africa, Americas and parts of Asia

Source:

Bloomberg and FI

Macro

US

ADP Employment Change Mar: 517K (est 550K; prevR 176K; prev 117K)

Canadian

GDP (M/M) Jan: 0.7% (est 0.5%; prev 0.1%)

Canadian

GDP (Y/Y) Jan: -2.3% (est -2.6%; prev -3.0%)

7:32:07

AM livesquawk Canadian Industrial Product Price (M/M) Feb: 2.6% (est 2.5%; prev 2.0%)

Canadian

Raw Materials Price Index (M/M) Feb: 6.6% (prev 5.7%)

- CBOT

corn was mixed early. US and SA weather was largely unchanged. NA will see warmer temperatures 2nd half this week into next week. The Great Plains and WCB will see net drying. Keep an eye on net drying bias western crop areas during FH April.

- Today

we could continue to see end of month and end of quarter positioning ahead of the USDA report.

- Today

President Joe Biden is expected to announce details for a $2 trillion infrastructure plan.

- Funds

on Tuesday sold an estimated net 25,000 corn contracts, most since March 15.

- A

Bloomberg poll looks for weekly US ethanol production to be up 12,000 barrels (910-950 range) from the previous week and stocks up to 62,000 barrels to 21.871 million.

-

None

reported

- CBOT

soybeans, meal and oil are all higher on technical rebound and positioning ahead of the USDA report. May soybeans could see their first monthly decline since mid-2020. Some of the selling yesterday was said to be overdone, but the favorable weather forecast

for the US has not changed that much. Malaysian palm oil fell to a five-week low but rebounded to close higher on good exports during late March. South Korea bought a couple of soybean meal cargoes this week (one from SA).

- AgriCensus

noted yesterday that Argentina’s oilseed workers union SOEA threatened to strike in Rosario if the company Buyatti fails comply with union demands from the recent dismissal of workers.

- Funds

on Tuesday sold an estimated net 16,000 soybean contracts, were flat in soybean meal and sold an estimated 18,000 soybean oil.

- ANEC

sees Brazil soybean exports for March at a record 16.1 million tons and soybean meal exports at 1.23 million tons.

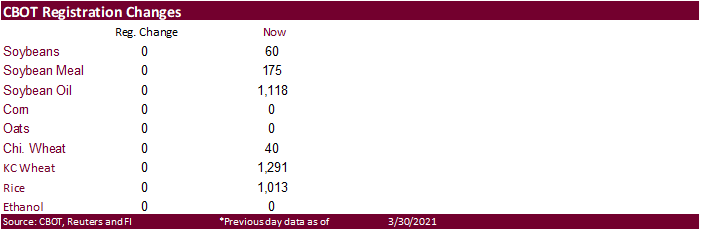

- There

were no changes to CBOT registrations. - Rotterdam

vegetable oil prices were 5-30 euros lower for the nearby positions from this time yesterday morning. Rotterdam meal was mostly 1-2 euros lower.

- Offshore

values were leading CBOT SBO 167 points higher and meal $1.00 short ton lower.

- China

cash crush margins on our analysis were 167 (171 previous) vs. 169 cents late last week and compares to 207 cents year earlier.

- AmSpec

reported Malaysian palm exports during March totaled 1.277 million tons, 27.6% above 1.001 million during February. ITS reported a 26.8% increase to 1.270 million tons.

China

futures:

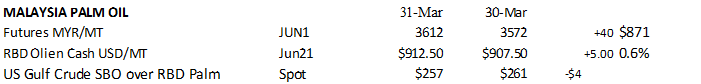

Malaysian

palm oil: (uses settle price)

Export

Developments

-

South

Korea’s NOFI bought 60,000 tons of South America soybean meal at an estimated $479.35 a ton c&f for arrival in South Korea around Sept. 25. Yesterday AgriCensus noted South Korea’s KFA bought 57,000 tons of soybean meal at $479.29/ton CFR for July 12-Aug

16 shipment. -

The

USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4-liter cans and 70 tons in 4 liter plastic bottles/cans) on April 6 for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

- US

wheat turned mostly lower by the electronic close on lack of direction ahead of the USDA reports. Thailand passed on optional origin wheat. Keep an eye on the US Prairies over the next two weeks as net drying from warm temperatures could start to impact

crop development. - EU

May milling wheat was up 0.50 at 210.25 euros as of 7:30 am CT. - Funds on Tuesday sold an estimated net 10,000 CBOT SRW wheat contracts.

- Ukrainian wheat export prices fell to a 5-month low according to APK-Inform, to $251-$256 per ton FOB Black

Sea, down $23 from the beginning of the previous week. Spot demand is weak. Ukraine’s grain exports have fallen by nearly 23.3% to 35.06 million tons so far this season.

- Ukraine from April will ban imports of wheat, sunflower oil from Russia.

- Thailand passed on 504,000 tons of optional origin feed wheat for shipment by end of 2021. Offers were said to be around $280 a ton c&f.

- South Korea millers bought US and Canadian wheat for shipment between July 1 and July 31.

- 21,900 tons of soft white wheat of 9.5% to 10.5% protein bought at an estimated $245.71 a ton

- 2,200 tons of soft white wheat of a maximum 8.5% protein bought at $249.39

- 10,530 tons of hard red winter of a minimum 11.5% protein bought at $251.59 a ton

- 15,370 tons of northern spring wheat of 14% minimum protein bought at $267.30 a ton

- 30,000 tons of Canadian western red spring wheat with a minimum 13.5% protein at $272 to $273 a ton FOB.

- Algeria seeks at least 50,000 tons of milling wheat on Wednesday for May shipment.

- Ethiopia seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because

of contractual disagreements.

Rice/Other

·

Pakistan lifted a nearly two-year old ban on Indian sugar and cotton imports.

·

3/30 Iraq seeks 30,000 tons of rice on April 5, valid until April 8.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.