PDF attached

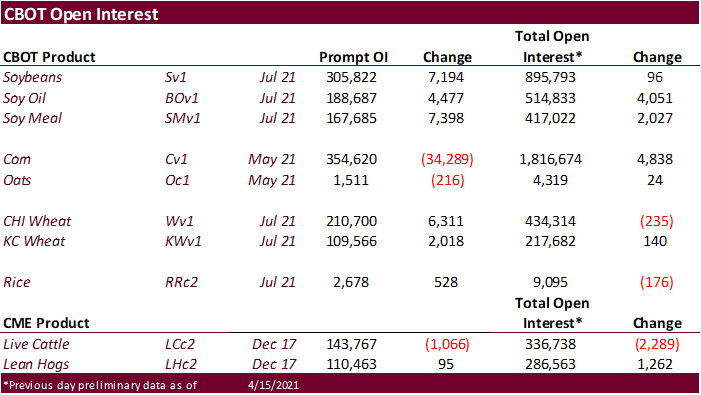

Higher

trade for the end of the week in most CBOT agricultural contracts (meal lower). Corn is on track to the end the week three consecutive weeks higher and Chicago wheat two consecutive weeks higher. Soybean oil is near a three week high while meal is near its

lower end of a short-term trading range and soybeans middle of a medium-term trading range.

Next

7 days

6-10

temps

World

Weather Inc.

Source:

World Weather Inc. & FI

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Sunday,

April 18:

- China

customs to publish trade data, including imports of corn, wheat, sugar and pork - Boao

Forum in Hainan, China, day 1

Monday,

April 19:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton, 4pm - Boao

Forum in Hainan, China, day 2 - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

April 20:

- China

customs to release trade data, including country breakdowns for commodities such as soybeans - China

farm ministry’s CASDE outlook conference, day 1 - New

Zealand global dairy trade auction - Boao

Forum in Hainan, China, day 3 - Malaysia’s

April 1-20 palm oil export data from SGS - Platts

Agriculture Week conference, day 1 - Brazil’s

Conab releases cane, sugar and ethanol production data (tentative) - AB

Sugar interim results

Wednesday,

April 21:

- EIA

weekly U.S. ethanol inventories, production - China

farm ministry’s CASDE outlook conference, day 2 - Platts

Agriculture Week conference, day 2 - Boao

Forum in Hainan, China, day 4 - USDA

Milk Production, 3pm - HOLIDAY:

Brazil, India

Thursday,

April 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Platts

Agriculture Week conference, day 3 - USDA

red meat production - EARNINGS:

Suedzucker, Barry Callebaut

Friday,

April 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, Poultry Slaughter 3pm - U.S.

cold storage – pork, beef, poultry

Source:

Bloomberg and FI

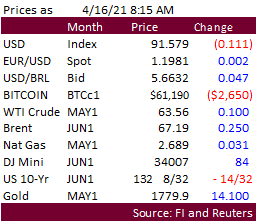

Macro

US

Housing Starts Mar: 1739K (exp 1613K; prev 1421K)

–

Housing Starts (M/M) Mar: 19.4% (exp 12.5%; prev -10.3%)

–

Building Permits Mar: 1766K (exp 1750K; R prev 1720K)

–

Building Permits (M/M) Mar: 2.7% (exp 1.7%; R prev -8.8%)

Canadian

International Securities Transactions (CAD) Feb: 8.52B (prev 1.27B)

Canadian

Wholesale Trade Sales (M/M) Feb: -0.7% (exp -0.4%; prev 4.0)

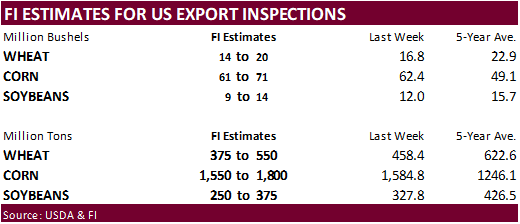

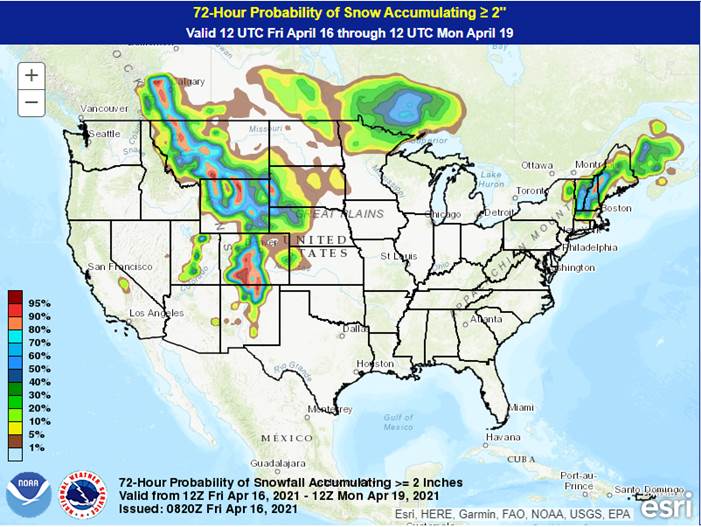

- CBOT

corn

is higher this morning from follow through buying amid weather concerns. Snow is projected to track across the far WCB this weekend, delaying fieldwork activity. CBOT nearby corn is on track to the end the week three consecutive weeks higher. South Korea

bought a cargo of US corn. - Yesterday

Argentina’s BA Grains Exchange increased their Argentina corn production estimate by 1 million tons to 46 million. - Funds

on Thursday sold an estimated net 2,000 corn contracts.

Export

developments.

-

South

Korea’s KOCOPIA bought 55,000 tons of US corn at $293.79/ton c&f for March 20-April 30 loading for arrival around July 20.

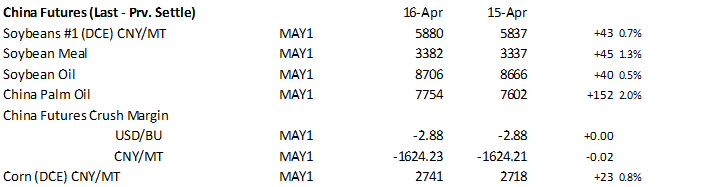

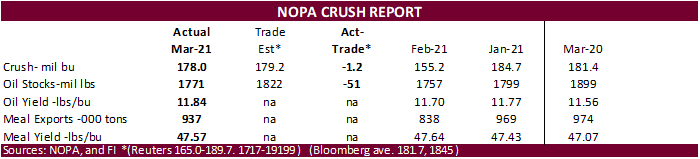

- CBOT

soybeans

are higher with good China crush margins driving soybean arrivals to record levels for the March through May period. China’s Q1 pork production was +32%. Offshore products are leading the CBOT meal and soybean oil markets higher. Malaysian palm climbed about

3 percent overnight. NOPA March US crush was slightly bearish for soybeans and a little friendly for the products, but traders are looking ahead to the summer months were some end users may have a tough time sourcing US soybeans.

- There

were no changes to CBOT soybean complex receipts. - China’s

first-quarter pork production rose 31.9% from a year earlier to 13.69 million tons. China’s pig herd increased to 415.95 million head at the end of March, a 29.5% rise on the year, and up from 406.5 million at the end of December, via National Bureau of Statistics.

(Reuters). Pork prices via Reuters fell more than 40% since the start of the year. - Indonesia

Palm Oil Association (GAPKI) reported Indonesia exported 1.99 million tons of palm oil during February, down from 2.54 million tons year ago. Indonesia produced 3.38 million tons of palm oil and kernel oils in February, down from a month earlier. Stocks were

4.04 million tons. (Reuters) - Funds

on Thursday bought an estimated net 2,000 soybean contracts, bought 2,000 soybean meal and bought an estimated 4,000 soybean oil.

- Offshore

values were leading CBOT SBO 13 points higher (30 higher for the week) and meal $4.10 short ton higher ($5.40 higher for the week).

- Rotterdam

vegetable oil values were 10-20 eros higher from this time previous session and Rotterdam meal 3-11 euros higher.

- China

cash crush margins on our analysis were 175 (179 previous) vs. 179 cents late last week and compares to 197 cents year earlier.

- China:

- US

wheat is higher form ongoing weather concerns and light technical buying ahead of the weekend. News was fairly light. Chicago wheat is on track to end two consecutive weeks higher. Indonesia bought around 120,000 tons of Black Sea wheat this week and the

Philippines passed on 380,000 tons of wheat. - As

of April 12, French soft wheat crop conditions fell one point for the combined good and excellent categories to 86 percent. French winter barley was down 2 and spring barley down 4. Our US crop progress estimates below.

- Funds

on Thursday bought an estimated net 4,000 CBOT SRW wheat contracts. - There

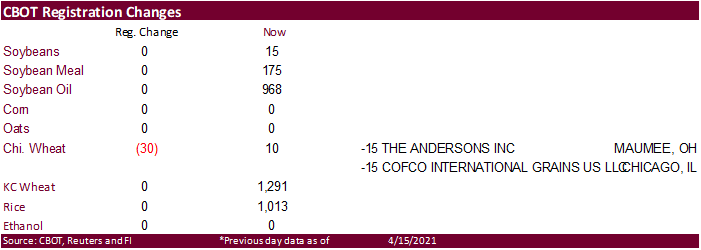

were 30 CBOT Chicago wheat receipts canceled out of Chicago and Maumee, OH.

- September

Paris wheat was up 2.00 euros at 208.50 euros.

- The

Philippines passed on 240,000 tons of wheat and 140,000 tons of animal feed barley for June through September shipment.

- Indonesia

bought around 120,000 tons of Black Sea wheat this week for June shipment.

- Japan

bought a small amount (380 tons) of feed wheat this week under its SBS import system.

- Results

awaited: Ethiopia seeks 30,000 tons of wheat on April 16. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

- Jordan

seeks 120,000 tons of feed barley on April 21.

Rice/Other

·

Results awaited: Mauritius

seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.