PDF attached

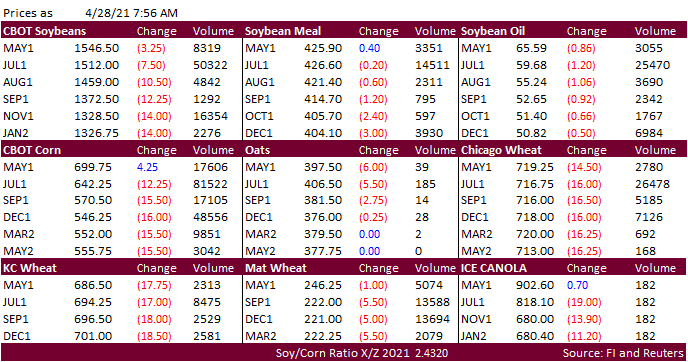

Profit

taking in CBOT markets after recent multi year highs and bull spreading are features this morning. Lower trade in other commodity markets are also weighing on US agriculture futures. The US should see improving crop weather but the demand story will not

go away. Several import tender developments populated overnight. The morning weather forecast showed not much change around the world. Argentina will see a good mix of rain and sunshine and the U.S. Northern Plains and Canada’s Prairies will continue to see

net drying. Look for another volatile session.