PDF attached

US

crop concerns are supporting corn and soybeans. Funds are thought to be getting back into the long side of the market, especially for corn. Wheat is mixed with Chicago higher and KC lower. The US Midwest weather outlook still calls for below normal rainfall

over the next ten days. The decline of three points in US soybean and corn ratings are supportive, despite the fact it is early in the crop season. However, the sharp early declines in G/E conditions is kicking up memories from the 2012 crop year. EPA is

set to release mandates either today or tomorrow. We don’t expect any fireworks from this announcement but a less than expected advanced volume could trigger short-term selling in soybean oil. Remember economics will drive production. See EPA’s December announcement

here. https://www.epa.gov/renewable-fuel-standard-program/news-notices-and-announcements-renewable-fuel-standard

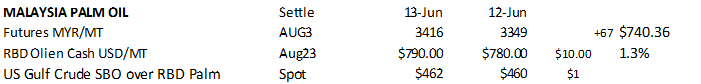

August Malaysia palm futures traded 67 ringgit higher to 3416 and Aug. cash increased $10/ton to $790/ton. Offshore values were leading SBO higher by 97 points this morning and meal $0.70 higher.

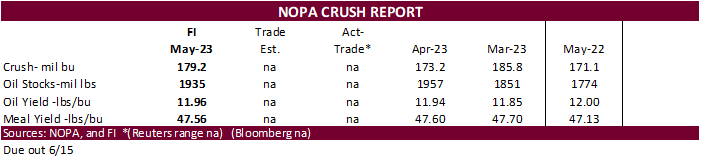

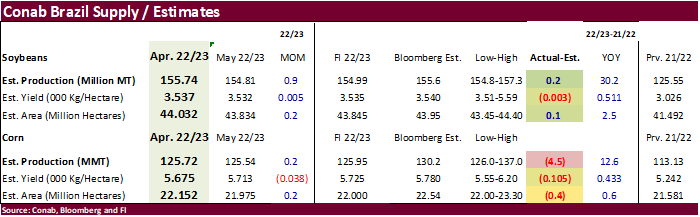

No

surprises for Conab Brazil supply

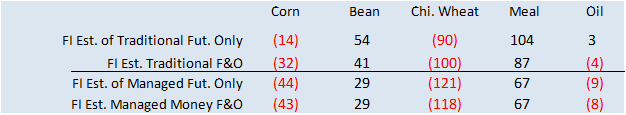

Fund

estimates as of June 12 (net in 000)

WORLD

WEATHER HIGHLIGHTS FOR JUNE 13, 2023

- No

excessive heat is likely in U.S. Midwest, although the region will trend a little warmer later this week and stay seasonably warm into next week - U.S.

Midwest precipitation remains limited for many areas in the coming week, although showers and thunderstorms do occur - Western

and central Midwest will remain driest with an ongoing need for greater rain - U.S.

high pressure ridge never becomes very strong, but it will be over a part of the Midwest from late this week through the first half of next week before shifting to the Plains and staying weak during the final days of the second week outlook - Alberta,

Canada is still expecting relief from chronic dryness later this week with some follow up moisture in the following week - Saskatchewan

and portions of Manitoba, Canada also get some beneficial rainfall, although its distribution is not as good as in Alberta, especially not in Manitoba - U.S.

hard red winter wheat areas see a good mix of weather next ten days - West

Texas will remain in a drying mode for the next ten days - U.S.

Delta and southeastern states will experience some heavy rainfall periodically over the next ten days - Northern

U.S. Plains and upper Midwest will get some timely rainfall Friday into the weekend, although more may be needed in some areas - Northern

Europe rainfall will slowly improve this weekend and especially next week - Eastern

Russia New Lands and northern Kazakhstan will receive a restricted amount of Rainfall during the next ten days; temperatures will be mild to cool - Some

dryness expansion from eastern Inner Mongolia to the northern Yellow River Basin is expected over the next few weeks - Rainy

weather will continue in far southern China resulting in flooding for rice and sugarcane areas - Tropical

Cyclone Biparjoy will move through northwestern Gujarat, India and southeastern Sindh, Pakistan late this week before moving across northern India producing heavy rain that should be of use to the planting of summer crops once flooding subsides - Little

change in Australia, South Africa or the tropics

Source:

World Weather, INC.

Tuesday,

June 13:

- France

agriculture ministry’s report on field crops - IGC

grains conference, London, day 2 - EU

weekly grain, oilseed import and export data - Brazil’s

Conab issues production, area and yield data for corn and soybeans

Wednesday,

June 14:

- FranceAgriMer

monthly grains balance sheet - New

Zealand food prices - EIA

weekly US ethanol inventories, production, 10:30am

Thursday,

June 15:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

June 16:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

US

CPI was near expectations. A rate hike is unlikely.

·

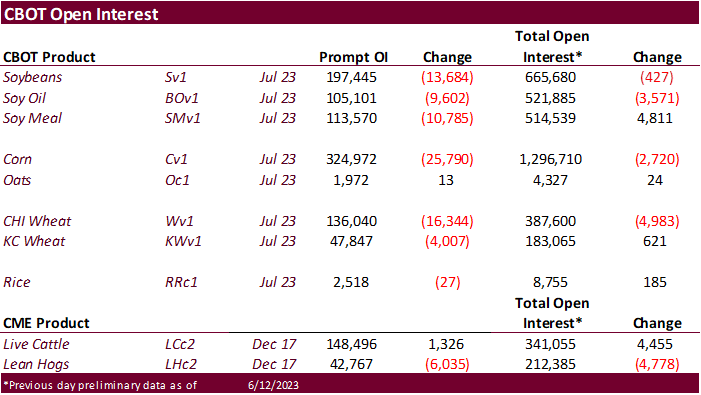

US weather remains a concern and that is reflected in the early morning as funds are starting to get back into building a net long position. Note as of last night money managers were thought to still hold a net short position,

so there is upside potential for the corn market if the US weather pattern does not improve.

·

USDA rated 61% of the U.S. corn crop in good-to-excellent condition in its weekly crop progress report on Monday, down 3 percentage points from a week ago and below the average of estimates in a Reuters poll. (Reuters)

·

Final day of the Goldman roll.

Export

developments.

-

Iran

seeks 120,000 tons of soybean meal and 120,000 tons of corn on June 14. -

Algeria

passed on 35,000 tons of soybeans meal.

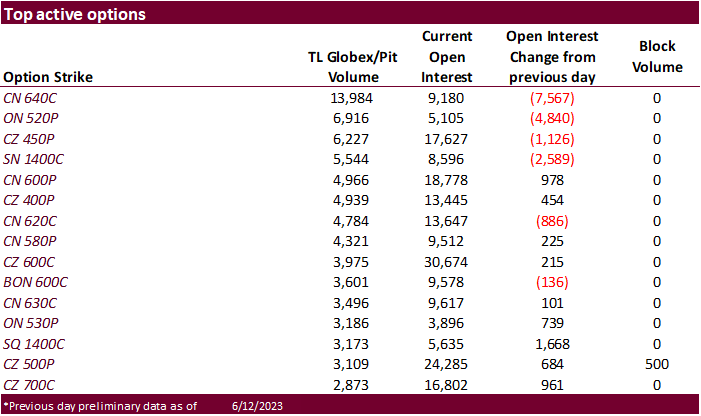

·

CBOT soybeans are higher from a sharp 3 point decrease in the US soybean G/E rating. At 59 percent, this was one point below expectations and well below average for this time of year. Products are higher in part to strong soybean

oil ahead of EPA’s mandate announcement and higher palm oil futures.

·

Expect nearby spreads to chop around headed into first notice day delivery. We have a bias for soybean spreads to firm if crush margins hold onto high levels.

·

August Malaysia palm futures traded 67 ringgit higher to 3416 and Aug. cash increased $10/ton to $790/ton.

·

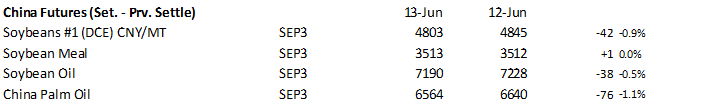

China September soybean futures were down 0.9%, meal up 0.1%, SBO down 0.5% and palm oil futures down 1.1%.

·

Nearby Rotterdam vegetable oils were mixed from this time yesterday morning and meal mixed.

·

Offshore values were leading SBO higher by 97 points this morning and meal $0.70 higher.

-

Egypt

saw offers as low as $926 per ton c&f for 6000 tons of sunflower oil and $1075 per ton for 30000 soybean oil for arrival between August 20 and September 15.

They

are also in for a small amount of local vegetable oils. -

Iran

seeks 120,000 tons of soybean meal and 120,000 tons of corn on June 14.

·

Chicago wheat is higher on light fund buying from a rally in corn and soybeans. KC wheat is lower after HRW wheat conditions have started to stabilize over the past two weeks. We see little by class US production changes in the

next USDA report if conditions remain near current levels.

·

September Paris wheat futures are down 1.00 euro earlier at 237.25 per ton.

Export

Developments.

·

Japan seeks 60,000 tons of feed wheat and 20,000 tons of barley.

·

Morocco seeks 500,000 tons of feed barley on June 14.

·

Taiwan seeks about 56,000 tons of US wheat from the US on June 14 for July 31-August 14 shipment off the PNW.

Rice/Other

·

Results awaited: South Korea seeks about 62,200 tons of rice, 44,400 tons from China and rest from Vietnam, on June 8, for arrival between September 1-30.

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |