PDF attached

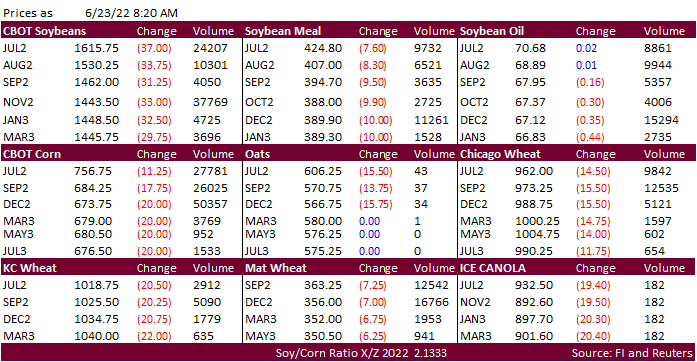

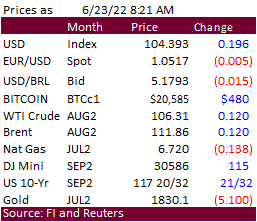

US easing inflation ideas but increasing recession fears are hammering the ag markets again. The raw material market might be a key to watch for inflation momentum. Ag news was very light. EIA ethanol production is due out today. Export sales delayed until Friday. Look for a choppy trade with outside markets influencing CBOT prices.

![]()

WORLD WEATHER HIGHLIGHTS FOR JUNE 23, 2022

- Argentina has potential for rain in a part of its winter wheat region early next week, but the east will be favored

- Portions of Cordoba, Santa Fe, northern Buenos Aires and Entre Rios will get 0.20 to 0.75 inch and locally more

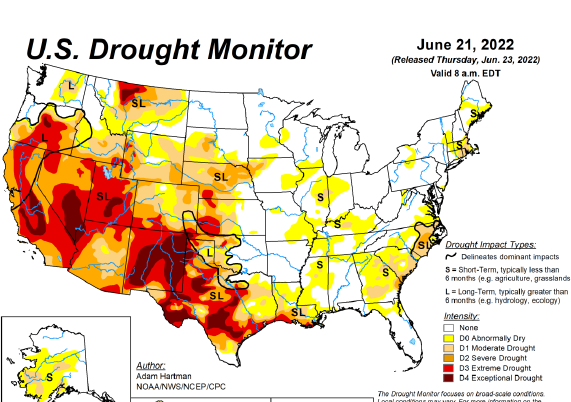

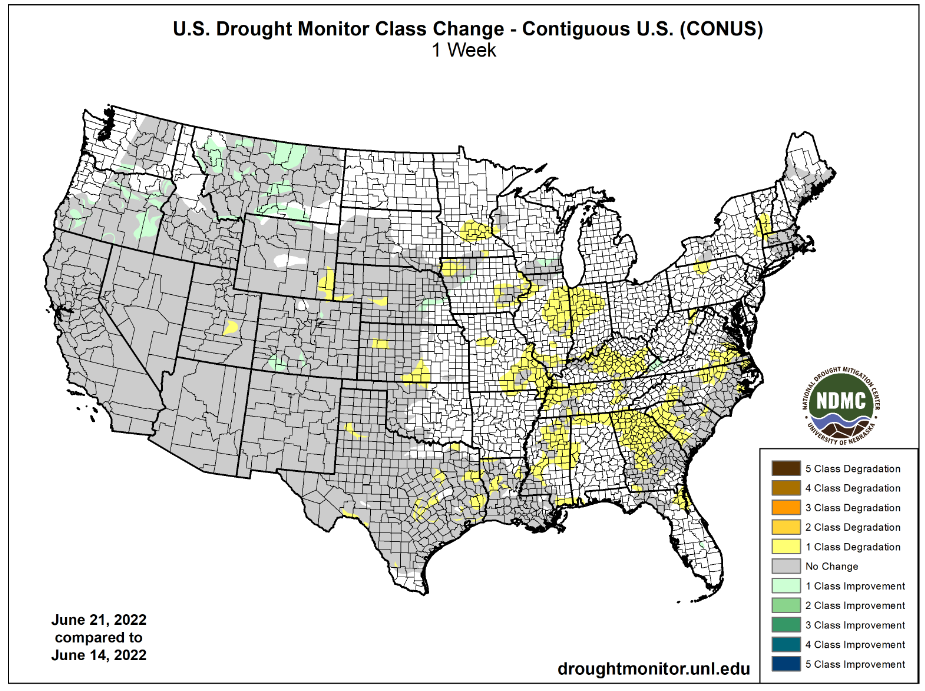

- U.S. Outlook in week 1 continues to be drier biased in eastern and central Midwest and parts of the Delta; Despite a few showers most of these areas will experience net drying

- Rain falls in the upper Midwest and from eastern Nebraska through Iowa to western and northern Wisconsin Friday into early Sunday offering continued favorable conditions for some areas and improving conditions in others

- Extremely important week two weather in the U.S. includes a rain event for the eastern and lower Midwest that will support the start of pollination

- Most of the best rain occurs July 1-2, but follow up rain will be very important and the GFS has suggested it may occur July 4-5 in a part of Nebraska, Iowa, Missouri and Illinois, but the moisture dissipates as a late second week ridge of high pressure evolves

- The GFS may have too much rain in this second week of the outlook

- North America high pressure ridge that shifts to the west this weekend and next week returns to the Plains July 2-7 and the European Ensemble allows the system to expand enough to include a part of the west-central and southwestern Corn Belt in warmer and drier conditions

- The bottom line for the U.S. is still worrisome in this first week of the outlook with parts of the Delta and central and eastern Midwest still drying down, but the second week of the outlook brings at least one and possibly two opportunities for rain that would be supportive of pollination even though the amounts may be light in some areas. The best crop weather still looks to be in parts of Iowa, southeastern Nebraska and from the eastern Dakotas to western Wisconsin

- West Texas gets some scattered showers Sunday through Tuesday of next week and again July 2-4

- Both events produce erratic rainfall with some counties and parts of counties getting some beneficial moisture while others are either missed or only get a teasing amount of moisture

- The events will at least take the edge of stress off of corn, sorghum, cotton and other summer crops, but dryland production areas will need much more moisture

- GFS 06z model run ended this morning with a new ridge of high pressure over the heart of the Midwest

- This feature is likely overdone and too far to the east

- The European Ensemble is preferred and it keeps the ridge mostly in the Plains with some influence on the western Corn Belt as noted above

- Germany, France and the U.K. get rain over the coming week to ten days improving soil moisture after recent hot and dry weather

- Net drying occurs from Poland into Hungary and northwestern Romania during the first ten days of the outlook and then get some rain

- Western Ukraine and parts of the lower Danube River Basin will also be dry biased for the next ten days

- Eastern Ukraine and western parts of Russia’s Southern Region will get rain Friday through the weekend and into early next week offering some relief, but the lower Volga River Basin does not get rain nor does western Kazakhstan

- China’s central Yellow River Basin and North China Plain received rain Wednesday and more will linger early today and then a second wave of moisture will come to the region Sunday into Tuesday

- Relief from dryness has occurred and more is expected – at least into mid-week next week

- Southern China is still advertised to dry down after horrific flooding earlier this month

- India’s rainfall is still expected to increase over the next two weeks, although it will be a slow process

- GFS model has backed off of the Queensland, Australia rain event for the second week of the forecast today joining the European model in a drier biased outlook through day ten

- Recent rain in South Africa has been a boon for winter wheat, barley and canola establishment

Source: World Weather INC

Bloomberg Ag Calendar

Thursday, June 23:

- EIA weekly U.S. ethanol inventories, production, 11am

- US cold storage data for beef, pork and poultry, 3pm

- USDA world coffee report

- International Grains Council’s monthly report

- USDA red meat production, 3pm

Friday, June 24:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- FranceAgriMer weekly update on crop conditions

- Brazil’s Unica to release cane crush and sugar output data (tentative)

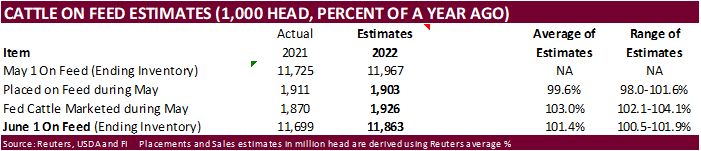

- US cattle on feed, poultry slaughter

- HOLIDAY: New Zealand

Source: Bloomberg and FI

US Initial Jobless Claims Jun 18: 229K (est 226K; prev 229K)

– Continuing Jobless Claims Jun 11: 1315K (est 1320K; prev 1312K)

US Current Account Balance (USD) Q1: -291.4B (est -275.0B; prev -217.9B)

Canada Wholesales Rose 2% M/M In May – Statcan Flash Estimate

– Factory Sales Fall 2.5% In May

Canada’s Factory Sales Drop In May Led By Car Shipments – Statcan

US Unemployment Insurance Weekly Claims Report, June 18 – DOL

· Corn futures are lower on easing inflation fears and fund selling.

· The International Grains Council (IGC) raised its forecast for 2022-23 global corn by six million tons to 1.190 billion tons. Wheat was unchanged at 769 million tons.

· The USDA Broiler Report showed eggs set in the US up 2 percent from a year ago and chicks placed up 2 percent. Cumulative placements from the week ending January 8, 2022 through June 18, 2022 for the United States were 4.49 billion. Cumulative placements were up slightly from the same period a year earlier.

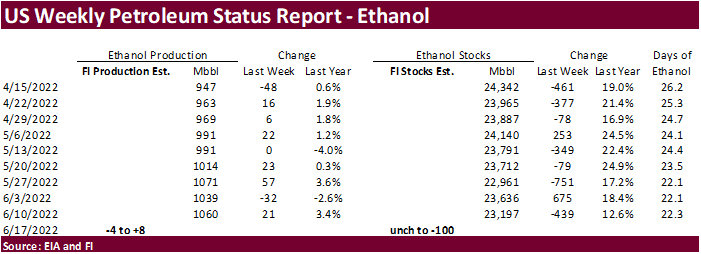

· A Bloomberg poll looks for weekly US ethanol production to be down 5,000 barrels to 1054 thousand (1041-1074 range) from the previous week and stocks down 15,000 barrels to 23.182 million.

Export developments.

Due out Friday

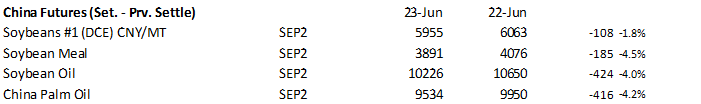

· CBOT soybeans are sharply lower despite a reversal in product spreading. Soybean oil was mixed by the electronic session and meal sharply lower. China meal and vegetable oil futures plunged overnight, sparking widespread global agriculture commodity selling. China soybean meal inventories have tripled, according to Reuters., to over 1 million tons. Improving hag margins are expected to chip away at those stocks.

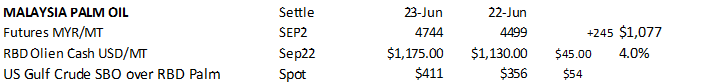

· Palm futures in Malaysia rebounded but prices are still way off from week ago levels.

· Two sunflower oil tanks at a terminal in Ukraine’s Black Sea port of Mykolaiv were seriously damaged in a Russian rocket attack (Reuters).

· MPOA Malaysia Palm oil production June 1-20

Pen Msia (+) 19.38%

East Msia (+) 9.64%

Sabah (+) 10.16%

Sarawak (+) 8.21%

Malaysia (+) 15.90%

· September Malaysia palm oil.

· China futures.

· Rotterdam vegetable oils were unchanged to 35 euros lower, and meal mixed.

· Offshore values are leading SBO about 217 points higher and meal $7.30 lower.

Export Developments

· China will be back late this week selling a half a million tons of soybeans out of reserves but note over the past few weeks a small amount had been sold from what was offered.

· US wheat futures are lower on easing inflation concerns and favorable global weather.

· Turkey is investigating if Ukraine graine was stolen by Russia. Russia denies it.

· Paris September wheat was down 7.25 euro earlier at 363.25 euros per ton.

· Saudi Arabia seeks 480,000 tons of wheat for Nov-Jan shipment.

· Algeria bought up to 660,000 tons of wheat, reportedly. Algeria was in for at least 50,000 tons of wheat for August shipment.

· Pakistan seeks 500,000 tons of wheat on July 1, optional origin, for Aug/FH Sep shipment.

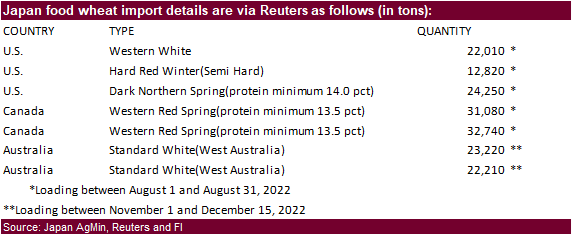

· Japan bought 168,330 tons of food wheat. Original details below

· Bangladesh seeks 50,000 tons of wheat on July 5 for shipment within 40 days.

Rice/Other

· None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.