PDF attached

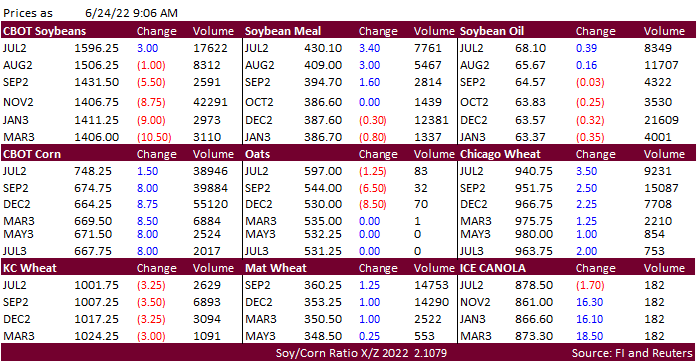

Bull

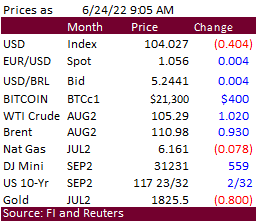

spreading a feature in the CBOT soybean complex. The USD is trading lower and WTI higher. This seems to be an all-around reversal from yesterday. Corn is higher led by the back months and wheat higher with funds driving Chicago.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 24, 2022

- Not

much change overnight - Two

rain events will move through the U.S. Midwest offering relief from dryness in the eastern crop areas and areas south into a part of northern Texas, the Delta and Tennessee River Basin during the next two weeks

- A

first event is expected Sunday into Monday, but with the Gulf of Mexico Closed as a moisture source during this event resulting rainfall is expected to be disappointing - A

second rain event expected in the first days of July offers the most important rain event for the drier areas of the Midwest and early indications suggest partial relief is expected, but some areas will not do as well as they need to - No

excessive heat is expected in key U.S. crop areas, but a short term bout of warmer than usual conditions are expected during the middle to latter part of next week ahead of the June 1-3 precipitation event

- Cooling

is expected this weekend into early next week in the Plains and Midwest - West

Texas will get rain Sunday into Tuesday and again in the early days of July

- Locally

great rainfall is possible, but most of the precipitation will be light - Dryland

production areas of corn, cotton, sorghum and peanuts will not see enough rain to seriously change the bottom line - Canada’s

Prairies will see a good mix of weather as will the U.S. Northern Plains and Upper Midwest - Western

Europe is expecting more rain to benefit crops in France, Germany and the U.K. while eastern Europe dries down over the next week to ten days - Portions

of Russia’s Southern Region and Ukraine will get some dryness relief as showers occur into early next week

- More

rain may be needed in parts of both regions - Recent

relief in the North China Plain will be followed up with another bout of rain this weekend into early next week

- The

Moisture will improve many dryland summer crops, although timely rain will still be needed in July to support the improving trend - India’s

Monsoon has performed a little better, but it has not been ideal - The

increasing precipitation trend will continue into July, though - Queensland,

Australia may get some rain late next week, but key winter crop areas may miss some of the precipitation

- Most

of Australia’s winter crop areas are experiencing a good mix of weather for planting and establishment of wheat, barley and canola - A

part of Argentina’s winter wheat region that has been dry will get rain early next week and possibly again in the following weekend, July 1-2

Source:

World Weather INC

Bloomberg

Ag Calendar

Friday,

June 24:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions - Brazil’s

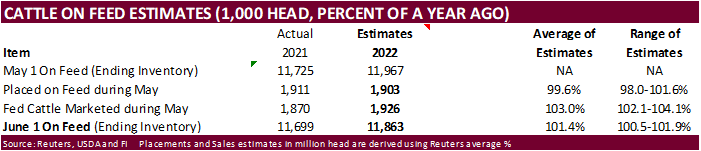

Unica to release cane crush and sugar output data (tentative) - US

cattle on feed, poultry slaughter - HOLIDAY:

New Zealand

Monday,

June 27:

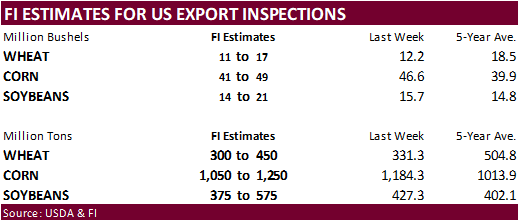

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for spring and winter wheat, corn, soybeans and cotton; harvest progress for winter wheat, 4pm - HOLIDAY:

Chile

Tuesday,

June 28:

- EU

weekly grain, oilseed import and export data - Malaysian

Palm Oil Board’s Transfer of Technology seminar

Wednesday,

June 29:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - OECD-FAO

agriculture outlook report - Vietnam’s

general statistics dept releases June coffee, rice, rubber export data - USDA

hogs & pigs inventory, 3pm

Thursday,

June 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

quarterly stockpile data for wheat, barley, corn, oat, soy and sorghum, noon - US

acreage for corn, soybeans and wheat - US

agricultural prices paid, received, 3pm - Malaysia’s

June palm oil export data

Friday,

July 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Monthly

coffee exports from Costa Rica and Honduras - International

Cotton Advisory Committee releases monthly world outlook report - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions - Australia

commodity index - HOLIDAY:

Canada, Hong Kong

Source:

Bloomberg and FI

US

Building Permits May: 1.695M (prev 1.695M)

·

Corn futures

are higher led by the back months from uncertainty over global supplies following the Ukraine situation. US weather should limit new-crop downside.

·

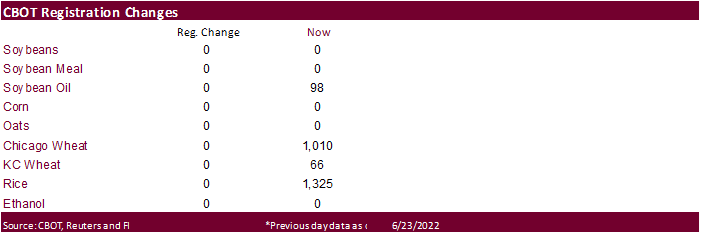

First Notice Day for deliveries are a week away. We see no corn deliveries at the moment. There could be Chicago and KC wheat deliveries, and some rice. Soybean oil could be 0-100. No meal and no soybeans.

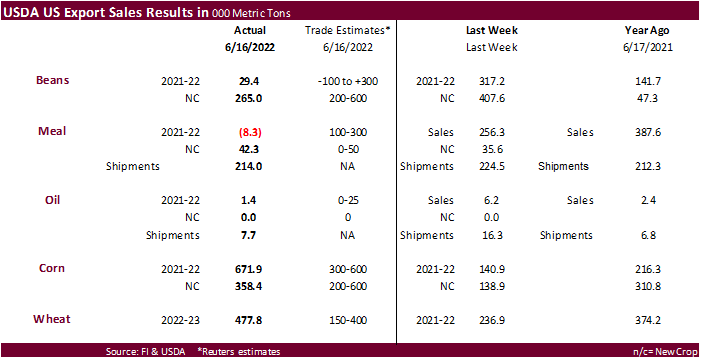

Export

developments.

Due

out Friday, this afternoon

·

CBOT soybeans are seeing bull spreading, contrary to recent action. Products are following the price reaction.

·

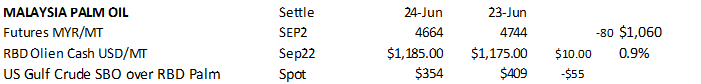

September Malaysia palm oil.

·

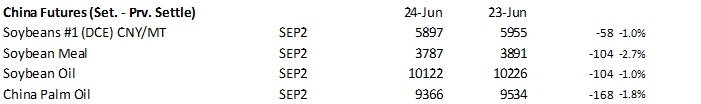

China futures.

·

Rotterdam vegetable oils were down 40-50 euros, and meal 1-6 lower.

·

Offshore values are leading SBO about 200 points higher (234 higher for the week) and meal $4.20 higher ($10.80 lower for the week).

Export

Developments

·

China will be back late next week selling a half a million tons of soybeans out of reserves

·

US wheat futures are mixed with trader assessing good global weather versus recession fears.

·

Paris September wheat was dup 0.25 euro earlier at 359.25 euros per ton, still a two-month low.

·

Saudi Arabia seeks 480,000 tons of wheat for Nov-Jan shipment.

·

Pakistan seeks 500,000 tons of wheat on July 1, optional origin, for Aug/FH Sep shipment.

·

Bangladesh seeks 50,000 tons of wheat on July 5 for shipment within 40 days.

Rice/Other

·

None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.