PDF attached

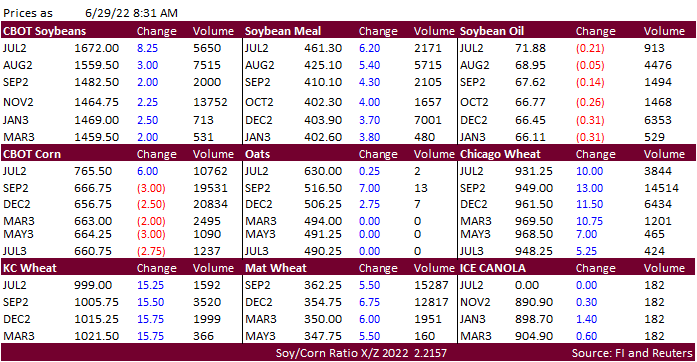

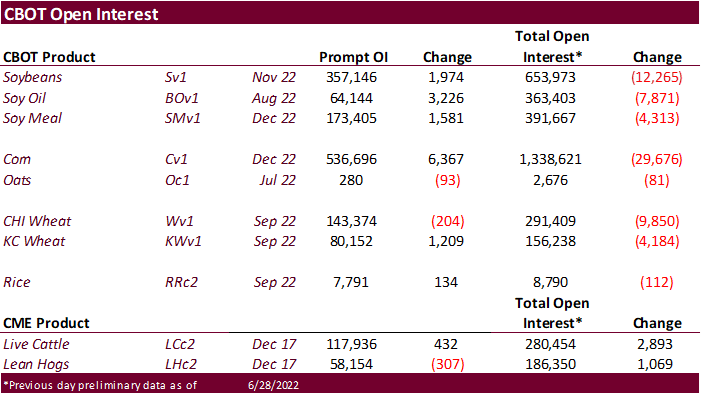

CBOT

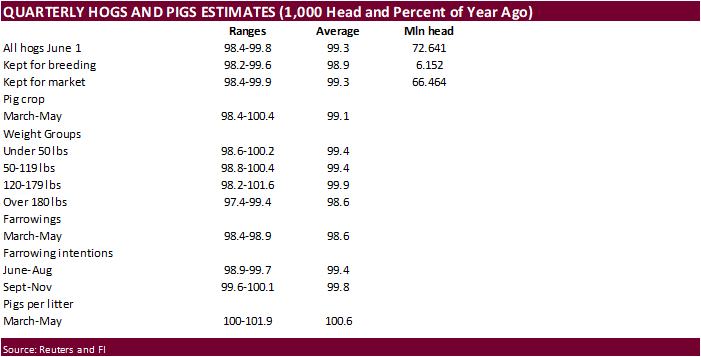

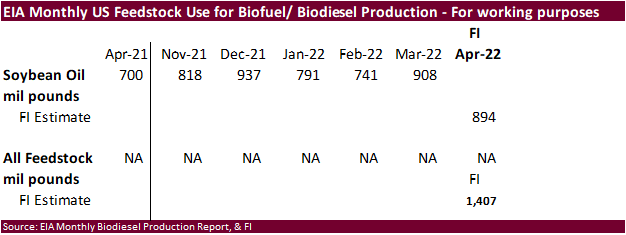

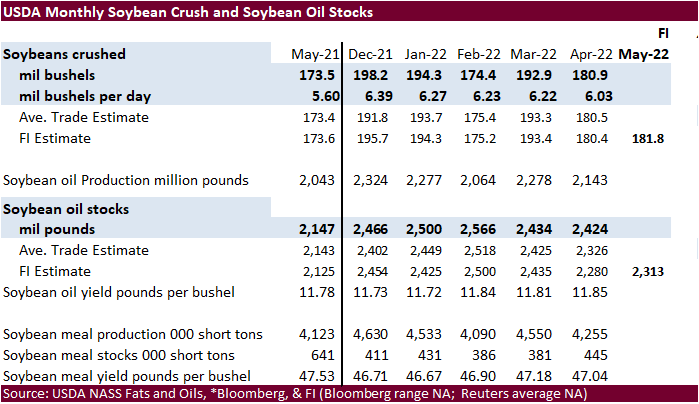

agriculture commodities are mixed at the start of the day session ahead of Thursday’s USDA June Acreage and Grain Stocks report (position day). In addition to the quarterly reports, USDA hogs and pigs are due out today, followed by monthly EIA numbers Thursday

and NASS grind/crush on Friday. WTI crude oil futures are up more than $1.00 and the USD was slightly higher while US equities turned mixed. Grains are supported by global import demand. Soybeans are higher following a lead in soybean meal. Soybean oil was

mixed earlier this morning, but losses were limited from higher energy markets. Look for positioning today. Rain was about expected across the US Midwest and Great Plains over the past day and forecast is mostly unchanged. The Midwest will see showers in the

northern areas through Thursday and west central areas Friday. Eastern NE, eastern ND and MN will see showers today and western GP will see rain this weekend. EIA will update two weeks of ethanol data later this morning.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 29, 2022

- Low

soil moisture remains in parts of the U.S. Midwest and timely rain will be extremely important over the next couple of weeks

- Most

forecast models are offering some timely rain, but its distribution may not be ideally suited leaving some areas drier biased while others get a little boost in moisture - Second

week rainfall potentials seem higher than those in this first week - No

excessive heat is expected in the heart of the U.S. Midwest for the next couple of weeks, but some hot weather will occur briefly in the Plains and far western Corn Belt today and Thursday briefly

- Extreme

highs in the 90s to 105 Fahrenheit will occur in South Dakota today while other 90-degree heat occurs elsewhere to the south

- The

heat does not get very far into the Corn Belt and is quick to abate - Most

longer range forecasting models for North America are still keeping the ridge of high pressure moving around between the high Plains and the Mississippi River and its frequent movement and change in intensity will help provide a variety of weather in key crop

areas - West

Texas cotton, corn and sorghum areas do not get good rainfall during the next ten days to two weeks and dryness will prevail - A

good mix of rain and sunshine is expected in the U.S. Delta and southeastern states during the next ten days - Tropical

Low off the Texas coast will bring significant rain to some of the Coastal Bend crop areas later this week and into the weekend - Tropical

Depression Two will continue interacting with northern Venezuela today and Thursday before turning toward Nicaragua and Costa Rica this weekend

- Torrential

rain will impact Central America resulting in some flooding, but damaging wind should be limited - Tropical

Cyclones may also impact southern China, Taiwan, western Japan and the Korean Peninsula in this coming week

- Heavy

rain and windy conditions will accompany each storm, but none of these will be strong enough to induce serious damage – at least not based on recent data - Western

Luzon Island, Philippines will also be impacted by heavy rain associated with a storm evolving in the South China Sea the next few days - Europe

Rainfall will be greatest from northern Italy and Austria to the Baltic States, Belarus and Poland over the coming week - Dryness

in Europe is greatest from Hungary and extreme southwestern Ukraine into Romania and Bulgaria and limited relief is expected in the southern part of the region - Russia’s

Southern Region and eastern Ukraine are expected to stay drier biased for the next two weeks, but temperatures will be mild to cool through the first week which may help conserve soil moisture and protect production potentials

- Warming

late next week could heighten some concern for the region - China’s

weather will be favorably mixed for a while with no dryness issues. Much of the nation is wet and would benefit from drying especially in the northeast and south - India’s

monsoon will continue to expand and intensify over the next week to ten days

- Some

needed rain will reach Gujarat and Rajasthan over time - Central

and eastern Queensland, Australia and northeastern New South Wales will get rain Thursday into the weekend stalling fieldwork and saturating the ground - Argentina

will stay dry through the next two weeks in key wheat areas

Source:

World Weather INC

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production, 10:30am - OECD-FAO

agriculture outlook report - Vietnam’s

general statistics dept releases June coffee, rice, rubber export data - USDA

hogs & pigs inventory, 3pm

Thursday,

June 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA’s

quarterly stockpile data for wheat, barley, corn, oat, soy and sorghum, noon - US

acreage for corn, soybeans and wheat - US

agricultural prices paid, received, 3pm - Malaysia’s

June palm oil export data

Friday,

July 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Monthly

coffee exports from Costa Rica and Honduras - International

Cotton Advisory Committee releases monthly world outlook report - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions - Australia

commodity index - HOLIDAY:

Canada, Hong Kong

Source:

Bloomberg and FI

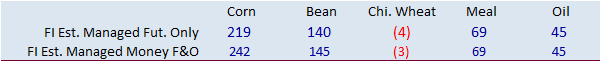

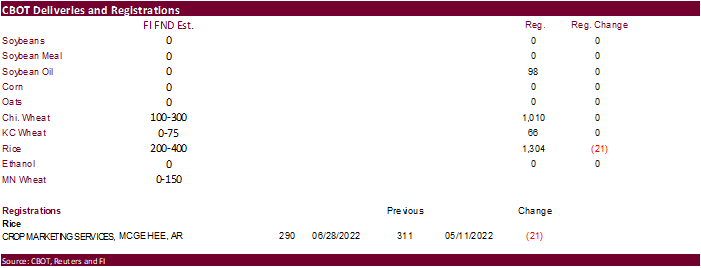

FI

First Notice Day Delivery estimates

US

GDP Annualized (Q/Q) Q1 T: -1.6% (est -1.5%; prev -1.5%)

US

Personal Consumption Q1 T: 1.8% (est 3.1%; prev 3.1%)

US

GDP Price Index Q1 T: 8.2% (est 8.1%; prev 8.1%)

US

Core PCE (Q/Q) Q1 T: 5.2% (est 5.1%; prev 5.1%)

German

CPI (Y/Y) Jun P: 7.6% (est 7.9%; prev 7.9%)

German

CPI (M/M) Jun P: 0.1% (est 0.4%; prev 0.9%)

German

CPI EU Harmonized (M/M) Jun P: -0.1% (est 0.4%; prev 1.1%)

German

CPI EU Harmonized (Y/Y) Jun P: 8.2% (est 8.8%; prev 8.7%)

·

Corn futures

were mostly higher as Asian demand for the commodity picked up this week but turned lower at the day session start. Look for a two-sided trade.

·

Midwest rains were about expected over the past day and forecast is mostly unchanged.

·

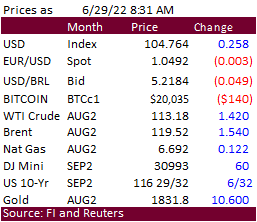

WTI crude oil was $1.35 higher at 8:12 am CT.

·

Brazil was projected to see less than expected corn exports during June by Anec at 1.683 million tons versus 1.758 million previous.

·

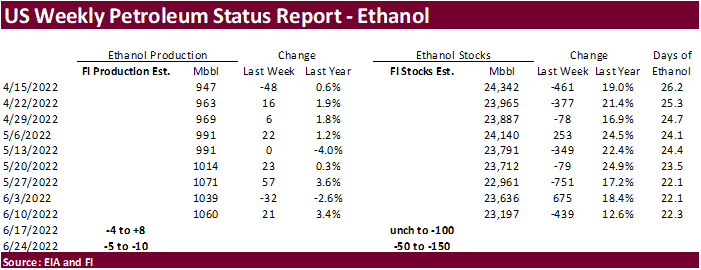

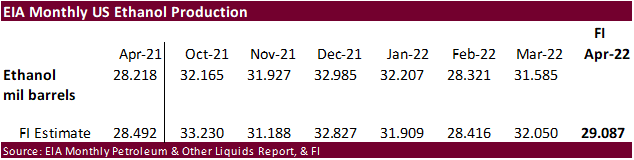

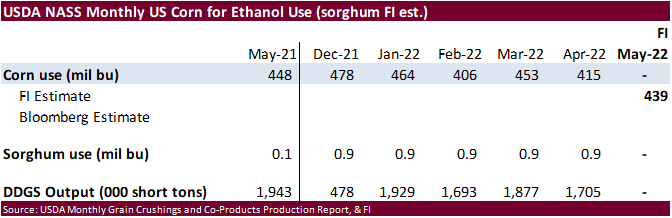

EIA will update two weeks of ethanol data later this morning and a Bloomberg poll looks for weekly US ethanol production to be down 5,000 barrels to 1055 thousand from June 10 and stocks down 288,000 barrels to 22.209 million

from two weeks ago. FI estimates below.

EIA:

U.S. refinery capacity decreased during 2021 for second consecutive year

https://www.eia.gov/todayinenergy/detail.php?id=52939&src=email

·

Taiwan’s MFIG bought 55,000 tons of corn from South Africa at 243.79 cents over the CBOT December contract for shipment between September 9 and September 28. The purchase was a couple cents premium over the lowest offer presented

by Argentina. No US offers were reported.

Due

out Wednesday

·

CBOT soybeans are higher following a lead in soybean meal. US soybean meal interior premiums remain firm from tight spot soybean supplies, bias eastern Corn Belt. Soybean oil was mixed earlier this morning, but losses were limited

from higher energy markets. Look for positioning today.

·

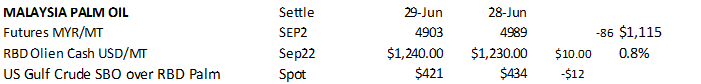

Malaysian palm oil futures were down 86 MYR and cash was up $10 to $1240. Yesterday at a Malaysian palm oil conference a research group estimated palm prices could dip below $1000/ton sometime during second half 2022.

·

China soybean complex futures were up 0.4% to 0.6%.

·

Anec sees June Brazil soybean exports at 10.154 million tons versus 10.795 million previous week.

·

September Malaysia palm oil.

·

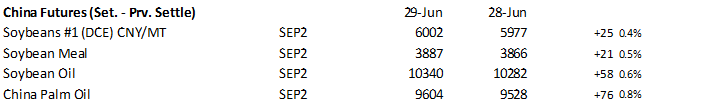

China futures.

·

Rotterdam vegetable oils were unchanged to 25 euros higher, and meal 5-9 euros lower.

·

Offshore values were leading SBO about 100 points lower and meal $1.30 short ton lower.

·

The European Union reported soybean import licenses since July 1 at 14.394 million tons, below 15.109 million tons a year ago. European Union soybean meal import licenses are running at 16.158 million tons so far for 2021-22,

below 16.974 million tons a year ago. EU palm oil import licenses are running at 4.764 million tons, below 5.373 million tons a year ago, or down 11 percent. European Union rapeseed import licenses since July 1 were 5.269 million tons, below 6.509 million

tons from the same period a year ago.

Export

Developments

·

South Korea’s NOFI group seeks 120,000 tons of soybean meal, optional origin, for October 25-November 5 arrival.

·

China will be back late this week selling a half a million tons of soybeans out of reserves

·

US wheat futures are higher on strong global import demand.

·

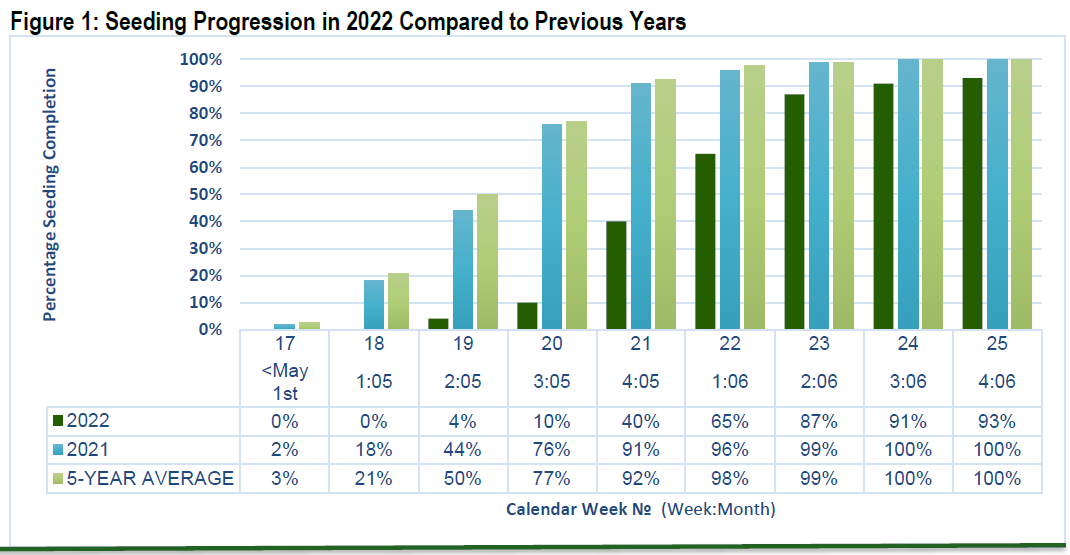

Parts of Canada are still struggling to get spring wheat and other summer grains into the ground. Manitoba could lose as much as 700,000 hectares this year. Plantings are running at 93 percent complete versus 100 percent average.

Heavy rain and extreme weather was noted by the local government.

·

Argentina is still too dry in parts of wheat country to kick off the growing season. We could see another cut in the area by the Exchanges soon if drought continues to hamper early crop development. One Exchange said this is one

of the worst planting seasons in 12 years.

·

Russia said they are ready to export tens of millions of grain if the West lifts their bans.

·

Russia’s wheat export duty will increase to $146.10 on June 29 from current $142.00 per ton set on June 22.

·

SovEcon sees a record high 42.6 million tons of Russian wheat exports for 2022-23, up 300,000 tons from their previous estimate.

·

Ukraine June to date grain exports are down 36.5 percent to 1.26 MMT from a year ago – AgMin.

·

The World Bank loaned $130 million to Tunisia to finance wheat imports.

·

Georgia banned wheat and barley exports for a year to protect their domestic market.

·

Paris September wheat was up 6.00 euros earlier at 362.75 euros per ton.

·

The European Union granted export licenses for 170,000 tons of soft wheat exports, bringing cumulative 2021-22 soft wheat export commitments to 27.144 million tons, up from 25.604 million tons committed at this time last year,

a 6 percent decrease. Imports are up 21% from year ago at 2.419 million tons. The European Union granted imports licenses for 15,000 tons of corn imports, bringing cumulative 2021-22 imports to 5.754 million tons, 15 percent above same period year ago.

Manitoba

planting progress

·

Egypt seeks wheat for Sep and/or Oct shipment. Lowest offer was believed to be $397.47 a ton FOB sourced from France.

·

Taiwan flour millers bought 40,000 tons of various class US PNW wheat for August 9-23 shipment. It included 28,620 tons of US dark northern spring wheat of 14.5% minimum protein content bought at $436.88 a ton FOB. Another 8,650

tons of hard red winter wheat of a minimum 12.5% protein bought at $430.38 a ton FOB and 2,730 tons of soft white wheat of a maximum 10.0% protein content bought at $400.13 a ton FOB. (Reuters)

·

Jordan passed on barley. Earlier they saw 6 participants for their 120,000 ton barley import tender for Oct and/or Nov shipment.

·

Jordan seeks 120,000 tons of wheat on July 5 for Oct/Nov shipment.

·

Pakistan seeks 500,000 tons of wheat on July 1, optional origin, for Aug/FH Sep shipment.

·

Bangladesh seeks 50,000 tons of wheat on July 5 and again July 14 for shipment within 40 days (updated 6/27).

Rice/Other

·

None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.