PDF Attached

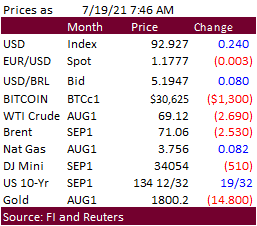

WTI is sharply lower after OPEC and its allies agreed to boost output. USD is up 18 points. Virus concerns are impacting other global markets. US equities are lower. 30 year yield is trading 1.81%, lowest since February 1.

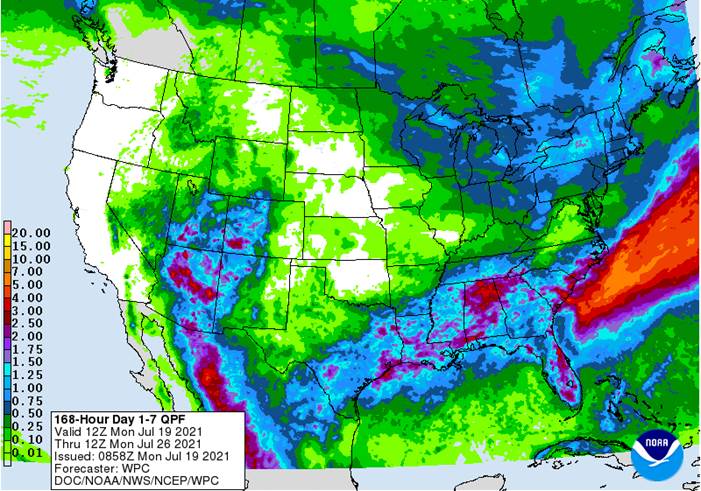

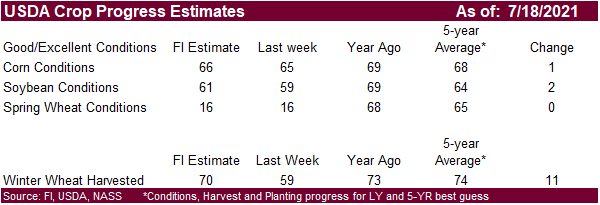

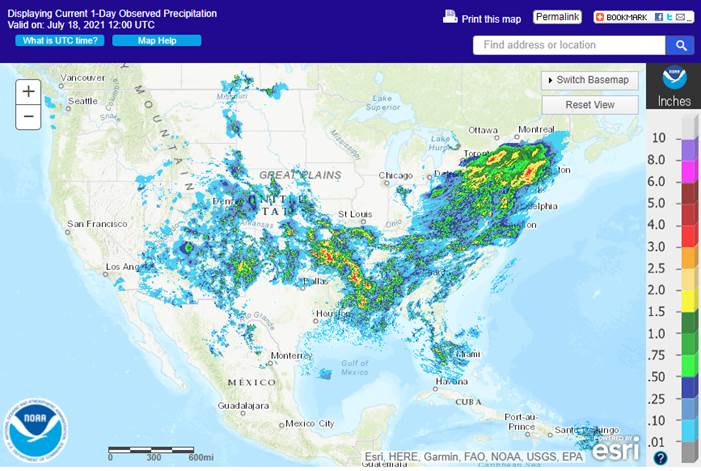

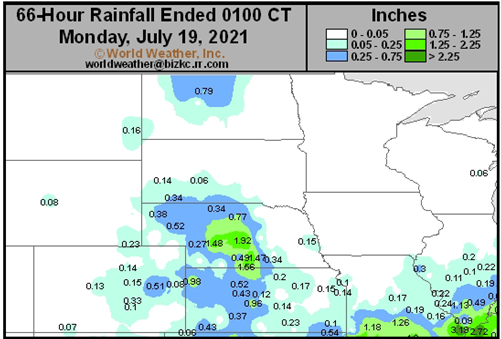

Ag prices are higher on US weather concerns. ND saw a small amount of rain over the weekend across the central growing areas, but amounts were not heavy enough to counter evaporation. It is going to remain hot across the northern Great Plains this week. Rest of the far WCB with exception of western NE was dry. The ECB and Delta saw good rain over the weekend. The WCB will be mostly dry through Thursday. US Midwest rainfall will increase Friday through Sunday from central and eastern Minnesota, Wisconsin and parts of Michigan to the Ohio River Valley. Amounts will range from 0.30 to 0.90 inch and local totals of 1.00 to 2.00 inches. Manitoba and a few northeastern Saskatchewan, Canada locations may receive some rain briefly during mid-week this week and again late this week, according to World Weather Inc.

WORLD WEATHER HIGHLIGHTS FOR MONDAY, JULY 19, 2021

- Frost and freezes occurred this morning in southern Brazil impacting wheat most significantly, but also bringing a little frost to minor sugarcane and coffee production areas of Parana, Mato Grosso do Sul and Sul de Minas.

- Drying will be accelerated in the northern U.S. Plains and western Corn Belt this week and probably into early next week as well.

- Temperatures will be quite warm to hot helping to accelerate the decrease in soil moisture and increase in crop moisture stress.

- In Russia, drying is expected in the far northwest and from the southern half of the Southern Region into Kazakhstan while rain falls elsewhere.

- Europe weather will be improved this week with less rain, but small grains from eastern France to Poland were harmed by the recent excessive moisture recently.

- India’s monsoonal precipitation continues poorly distributed and just like last week the forecast models suggest improving weather is coming, but not until late this week and into next week.

- Australia weather will remain favorably mixed, although a little more rain would benefit Queensland, northern New South Wales, South Australia and northwestern Victoria

- Tropical Storm In-Fa will become a typhoon during mid-week and may bring damaging wind, rain and flooding to northern Taiwan and Fujian, China

- Rainfall of 10.00 to 20.00 inches will occur in Taiwan with wind speeds possibly reaching over 100 mph near the coast

- Fujian, china will receive 10-15 inches of rain possibly from the storm and lighter wind speeds

- Tropical Storm Cempaka will also threaten Guangdong this week with flooding rainfall of 10.00 to 15.00 inches possible

- The storm will move inland Tuesday and the system will remain over land into Thursday or Friday

- A third tropical cyclone will form over open water in the western Pacific Ocean during mid- to late week this week that could impact Honshu, Japan next week

- Two tropical systems in the eastern Pacific will move away from Mexico this week and not harm any landmass

- China received locally heavy rain and flooding again during the weekend causing a little concern about pockets of flood damage

- Portions of western Ivory Coast and western Ghana received some rain during the weekend, but both nations will experience net drying for a while

Source: World Weather Inc.

Bloomberg Ag Calendar

Monday, July 19:

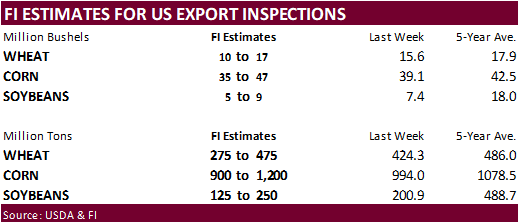

- USDA export inspections – corn, soybeans, wheat, 11am

- U.S. crop conditions – corn, cotton, soybeans, wheat, 4pm

- Ivory Coast cocoa arrivals

Tuesday, July 20:

- China customs to publish by-country breakdown for imports of farm goods including soy

- New Zealand global dairy trade auction

- EU weekly grain, oilseed import and export data

- HOLIDAY: Malaysia, Indonesia, Singapore

Wednesday, July 21:

- EIA weekly U.S. ethanol inventories, production

- Malaysia July 1-20 palm oil export data

- HOLIDAY: India

Thursday, July 22:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- USDA to release world supply-demand outlook for orange and its juice

- Port of Rouen data on French grain exports

- USDA total milk, red meat production

- U.S. cold storage data – pork, beef, poultry

- HOLIDAY: Japan

Friday, July 23:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- U.S. cattle on feed, poultry slaughter, cattle inventory

- HOLIDAY: Japan

Source: Bloomberg and FI

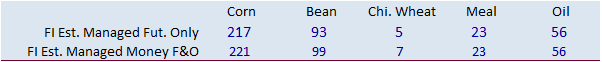

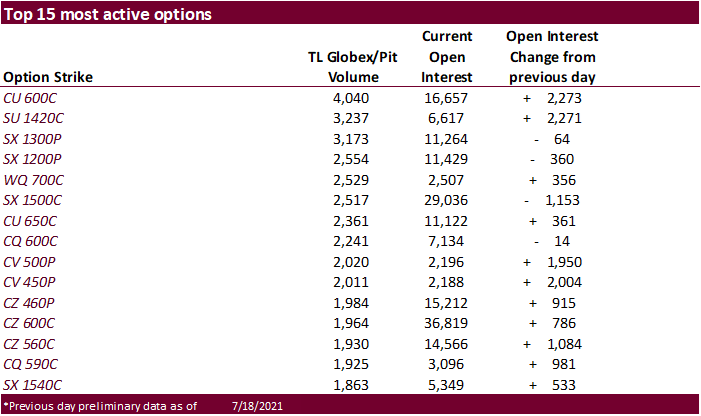

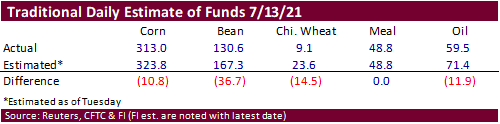

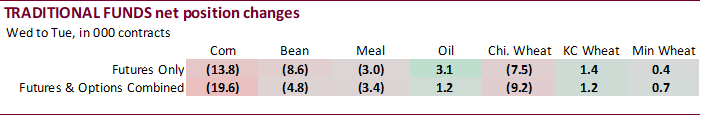

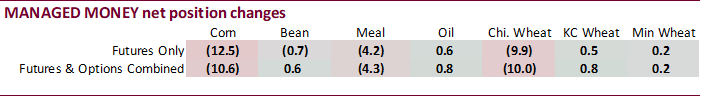

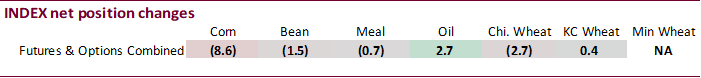

Commitment of Traders

Funds sold more longs than expected with exception of soybean meal.

Selected China commodity imports

|

Commodity |

June 2021 (tonnes) |

% change y/y |

YTD (tonnes) |

% change y/y |

|

Corn |

3.75 mln |

305 |

15.3 mln |

318.5 |

|

Wheat |

750,000 |

-17 |

5.37 mln |

60.1 |

|

Barley |

1 mln |

100 |

5.65 mln |

131.1 |

|

Sorghum |

1.1 mln |

61 |

4.79 mln |

169.4 |

|

Pork |

340,000 |

-13.7 |

2.3 mln |

8.5 |

|

Sugar |

420,000 |

1.7 |

2.03 mln |

63.3 |

US$ is surging & $ Yields continue to puke lower following last week comment from Powell. “Large reverse repo numbers are being driven by a scarcity of safe assets”.

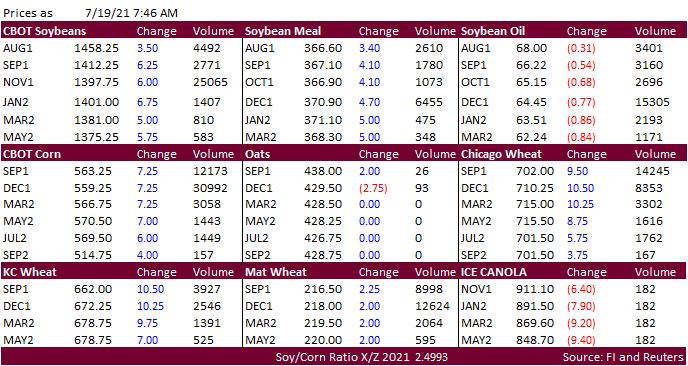

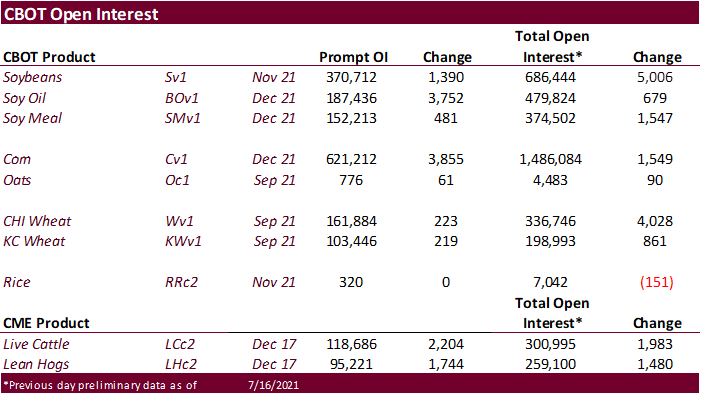

- Corn is higher despite a sharp decline in energy prices and rally in the USD. Equities are weaker this morning. US WCB will trend drier through Thursday. The fund position as of last Tuesday showed longs were less long than expected. At 209,000 contracts net long, they were off from 219,400 contracts previous week.

- Germany reported a 3rd case of ASF in the eastern state of Brandenburg. A couple cases of ASF were discovered in Germany last week, 2 at small farms.

- China hog prices may extend their rebound according to the National Development and Reform Commission. They said, “the number of hogs slaughtered in July and August is seen declining to some extent.” We also think a ban on Germany pork imports would also drive up prices.

- China plans to increase pork reserves on July 21 by buying from the domestic market.

- China reported June corn imports at 3.75 million tons and year to date imports at 15.3 million (up 318% from previous period in 2020).

- Ghana Confirms Bird-Flu

- Outbreak With 600,000 Animals at Risk (Bloomberg)

Export developments.

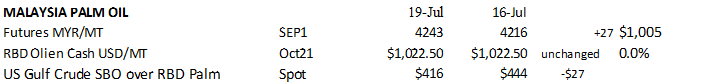

- Soybeans and meal are higher this morning while soybean oil is lower on sharply lower crude oil after OPEC agreed to increase production. Malaysian palm futures were up 27 points basis the Sep position. Futures did touch a 6-week high. The Southern Peninsula Palm Oil Millers’ Association estimated palm oil production during July 1-15 fell by 3.5% from the same period in June.

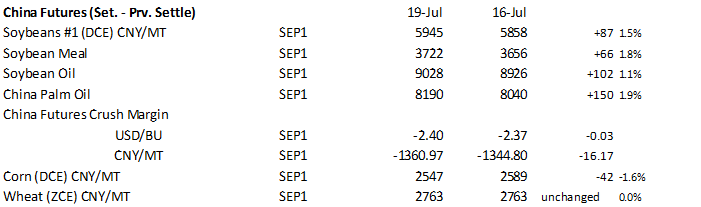

- China futures rallied 1.5 to 1.9% for the soybean complex and palm oil.

- APK-Inform reported sunoil export bid prices had increased about $120/ton from the previous week to $1,190-$1,230 per ton on a free-on-board basis from Black Sea ports with for July-August.

- US crop progress and inspections due out later. We look for an improvement in corn and soybeans.

- November Canadian canola fell 2.30 early this morning.

- China cash crush margins were last positive 8 cents on our analysis, up from negative 4 cents late last week.

- Offshore values are leading SBO 44 points lower and meal $1.40 higher.

- Rotterdam rapeseed prices were near unchanged and soybean oil up about 20-30 euros and meal were mixed.

- Malaysian palm oil:

- South Korea’s Agro-Fisheries & Food Trade Corp. seeks around 7,600 tons of GMO-free soybeans on July 21 for arrival in South Korea between Aug. 20 and Oct. 20.

- Wheat is higher (2-month high) led by a surge in MN prices this morning. US weather concerns were noted. Black Sea weather concerns are adding to the bullish undertone.

- Sharply higher USD may limit gains.

- Russian wheat export prices rose last week by about $3/ton from the previous week to $241/ton, according to IKAR. SovEcon showed a $5/ton increase to $239/ton.

- Russian wheat shipments so far this season (June 1 start) fell 37% from previous season to 400,700 tons as of July 15.

- Ukraine grain exports reached 1 million tons since June 1, including 292,000 tons of wheat, 207,000 tons of barley and 498,000 tons of corn.

- September Paris wheat was up 2.25 at 216.50 euros.

- Friday Matif wheat volume was heavy.

- Bangladesh saw offers for 50,000 tons of wheat (335.00/ton CIF lowest).

- The Philippines bought 50,000 tons of Black Sea wheat at $287/ton c&f for shipment between September 4 and September 24.

- Ethiopia seeks 400,000 tons of wheat on July 19.

- Pakistan’s TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- South Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh seeks 50,000 tons of rice on July 18.

- Mauritius seeks 6,000 tons of white rice on July 27 for October through December shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.