PDF attached

WORLD

WEATHER INC.

WORLD

WEATHER HIGHLIGHTS FOR AUGUST 3, 2021

-

Not

much changed overnight for many areas. -

The

forecast models are all predicting more rain for Iowa, Minnesota, Wisconsin and northwestern Illinois for this weekend into Monday.

-

The

additional rain will continue to restrict any expansion of the driest conditions from the northwestern Corn Belt.

-

The

GFS model run went on to predict a wetter second week of the outlook in the upper Midwest, as well.

-

The

model may be too wet for next week. -

There

will be no threatening weather for South America crop areas during the next two weeks.

-

Argentina

still needs greater rainfall of its semi-dormant wheat crop to ensure a good start in the spring -

Dryness

in southeastern Europe will fester for a while stressing unirrigated crops in the Balkan Region.

-

Portions

of Russia’s Southern Region into Kazakhstan will also continue to deal with a drying trend.

-

China’s

heavier rains have ended, but it will stay wet in many areas. -

Some

flooding rain may evolve in the southern provinces in time because of an active tropical environment. -

Australia’s

weather will be a little drier, although some showers will occur periodically in coastal areas -

Rain

is still needed in Queensland -

India

will experience more flooding rainfall in northern Madhya Pradesh and immediate neighboring areas of Rajasthan

-

Rainfall

since last Friday has varied up over 10.00 inches and this region could receive a similar amount of additional rain by the end of this week -

Flooding

could become serious enough to harm crops and personal property in the region -

The

heart of Europe will experience frequent rainfall this week slowing small grain harvest progress while maintaining favorable moisture conditions for summer crops

Source:

World Weather Inc.

Tuesday,

Aug. 3:

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - New

Zealand global dairy trade auction

Wednesday,

Aug. 4:

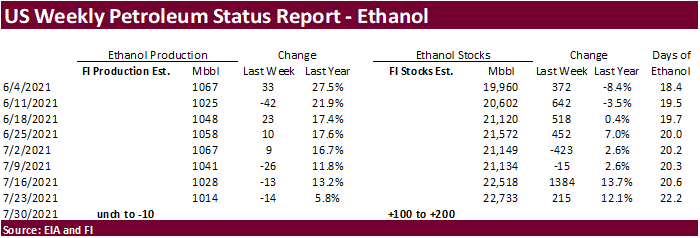

- EIA

weekly U.S. ethanol inventories, production - New

Zealand Commodity Price - France

agriculture ministry updates 2021 crop estimates

Thursday,

Aug. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soy and corn reports - FAO

World Food Price Index - Port

of Rouen data on French grain exports - Malaysia

Aug. 1-5 palm oil export data - Risi

pulp conference, Sao Paulo - BayWa

earnings

Friday,

Aug. 6:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

Aug. 7

- China’s

first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

Source:

Bloomberg and FI

Brazil

selected commodity exports for July.

Commodity

July 2021 July 2020

CRUDE

OIL (TNS) 4,375,980 7,794,507

IRON

ORE (TNS) 31,730,259 33,981,748

SOYBEANS

(TNS) 8,665,732 9,955,019

CORN

(TNS) 1,983,372 3,979,224

GREEN

COFFEE(TNS) 142,914 167,791

SUGAR

(TNS) 2,468,753 3,290,486

BEEF

(TNS) 166,293 169,274

POULTRY

(TNS) 391,625 337,257

PULP

(TNS) 1,414,066 1,447,285

Source:

Reuters and FI

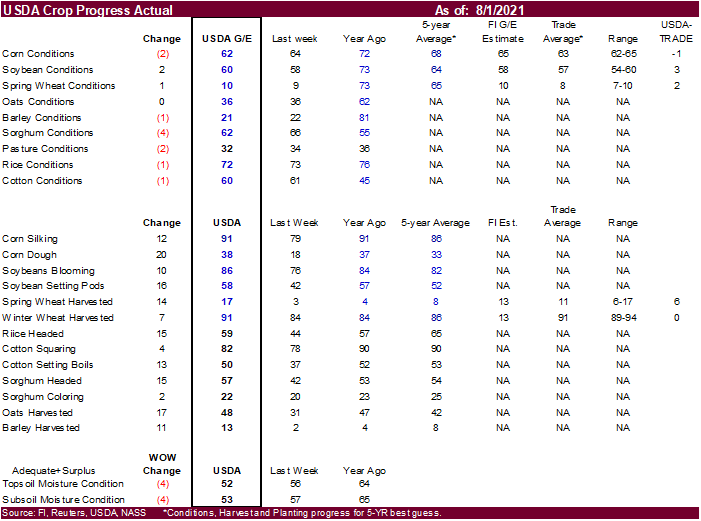

USDA

inspections versus Reuters trade range

Wheat

387,743 versus 325000-515000 range

Corn

1,383,718 versus 900000-1200000 range

Soybeans

181,193 versus 10000-300000 range

Soybean

and Corn Advisory

·

2020/21 Brazil Corn Estimate Lowered 2.0 mt to 84.0 Million Tons. (USDA estimates total corn production for marketing year (MY) 2020/21 at 93.0 million)

·

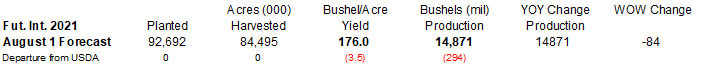

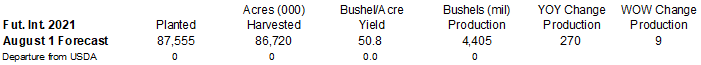

2021 U.S. Corn Yield Unchanged at 175.5 bu/ac

·

2021 U.S. Soybean Yield Unchanged at 50.0 bu/ac

·

2020/21 Argentina Corn Estimate Unchanged at 48.0 Million Tons

- Lower

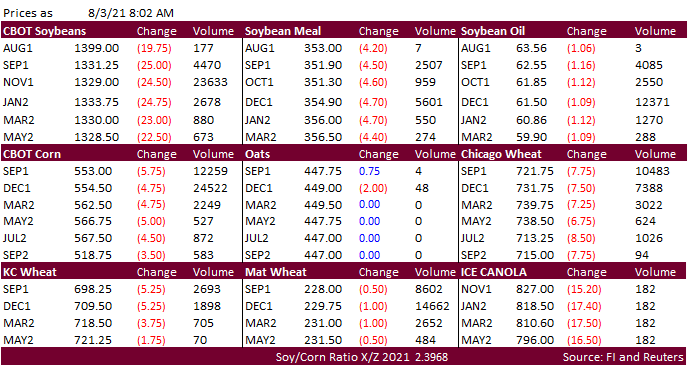

trade in corn futures this morning despite the US corn conditions declining 2 points. Corn prices are likely following the sharply lower trade in soybeans.

- The

morning weather models are forecasting more rain for IA, WI, and northwestern IL. Some of the models have rain occurring IA early next week but it looks like it dries down again after that.

- Yesterday

funds bought an estimated net 13,000 corn contracts. - China

plans to auction off 219,218 tons of US imported corn on August 6, and 49,760 tons of Ukraine imported corn.

- US

corn conditions declined 2 points to 62 percent for the G/E ratings, one point below expectations. We lowered out yield by a bushel. CO dropped 9 points and OH was up 4. IN was up 3.

- USDA

US corn export inspections as of July 29, 2021, were 1,383,718 tons, above a range of trade expectations, above 1,184,012 tons previous week and compares to 726,657 tons year ago. Major countries included China for 839,556 tons, Mexico for 316,284 tons, and

Japan for 64,142 tons. - FC

Stone sees the Brazil corn crop at 87.14 million tons versus 87.93MMT previous (59.6 second corn crop for this year).

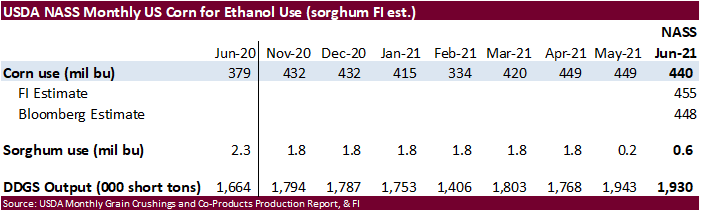

- June

US corn for ethanol use came in slightly below expectations.

Export

developments.

- Taiwan’s

MFIG bought about 55,000 tons of corn sourced from South Africa at an estimated 249.38 a bushel c&f over the December contract. The tender sought shipment between Oct. 6 and Oct. 25 if the corn is sourced from the U.S. Gulf, Brazil, or Argentina, they said.

If sourced from the U.S. Pacific Northwest coast or South Africa, shipment was sought between Oct. 21 and Nov. 9. (Reuters) - Jordan

is in for wheat and barley. The wheat import tender for 100,000 tons is on August 4 and 100,000 tons of barley on August 5.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery. - Turkey

bought around 515,000 tons sought for FH September shipment. Prices ranged from $275.80 and $286.90/ton.

-

An

improvement in the US soybean rating is leading the soybean complex lower. November soybeans are below a 100-day MA of $13.33. Major support is seen at $13.00.

-

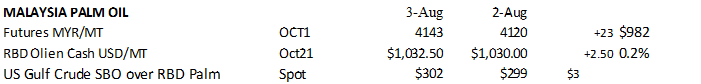

Malaysian

pam October futures were up 23 points and cash up $2.50/ton to $1,032.50/ton.

-

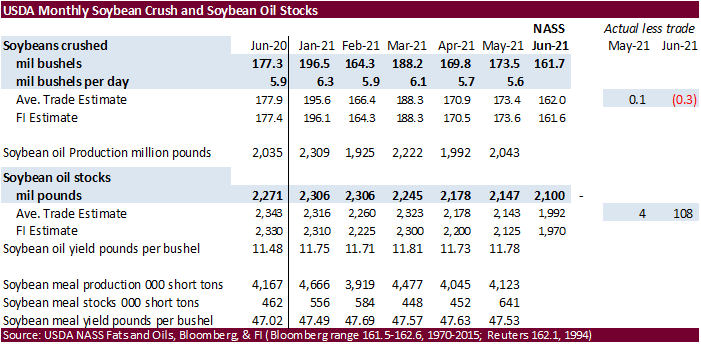

The

US June soybean crush was about as expected but soybean stocks were 108 million pounds below expectations.

-

Rotterdam

oils were 1-25 euros lower and meal 1-5 euros higher. - China

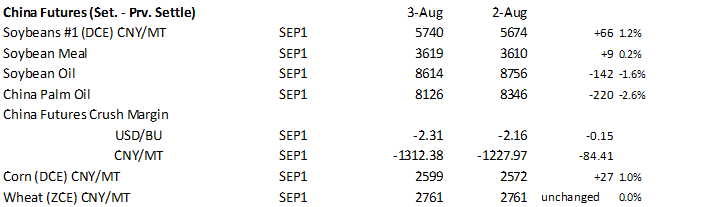

cash crush margins were last positive 63 cents on our analysis (60 previous) versus 50 cents late last week and 129 cents around a year ago.

-

Offshore

values are leading SBO 20 points higher and meal $3.00 lower. - Malaysian

palm oil:

- FC

Stone sees the Brazil 2021-22 (new-crop) soybean crop at 143.3 million tons.

-

US

soybean crop ratings were up two for the combined good/excellent, 3 points above expectations. Our August yield is up one tenth of a bushel from last week. KS was down 3, MN down 2 and NE down 2.

-

USDA

US soybean export inspections as of July 29, 2021, were 181,193 tons, within a range of trade expectations, below 242,044 tons previous week and compares to 557,607 tons year ago. Major countries included Mexico for 43,406 tons, Vietnam for 38,166 tons, and

Indonesia for 29,523 tons.

Export

Developments

- Egypt’s

GASC seeks at least 30,000 tons of soybean oil and lowest offer was $1,379 a ton c&f. Lowest offer for 10,000 tons of sunflower oil was $1,274 a ton. Both are for arrival between Oct. 1-20.

- The

USDA seeks 2,880 tons of packaged oil for use under the PL480 program today for Sep 1-30 shipment.

- Lower

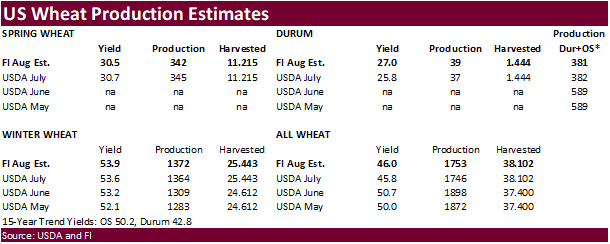

trade in US wheat futures as the US spring wheat crop finally saw an increase in crop ratings. Idaho, MN, and the Dakota’s improved from the previous week. Parts of Russia’s Southern Region into Kazakhstan will continue to see net drying.

- US

spring wheat rating increased one point. Trade was looking for a one-point decline. We made minor changes to spring and durum production. Spring wheat harvest was 17 percent, 6 points above trade expectations. Winter wheat harvest was 91 percent, as expected.

- USDA

US all-wheat export inspections as of July 29, 2021, were 387,743 tons, within a range of trade expectations, below 515,214 tons previous week and compares to 556,987 tons year ago. Major countries included Mexico for 106,275 tons, Philippines for 77,997 tons,

and Korea Rep for 49,114 tons. - December

Paris wheat was down 0.75 at 230 euros per ton as of 7:15 am CT.

- Algeria

seeks at least 50,000 tons of wheat for Aug/Sep shipment. - The

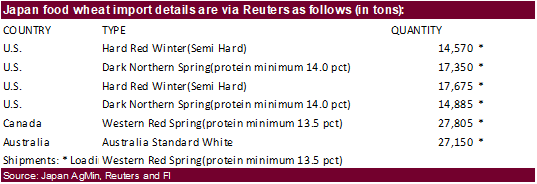

Taiwan Flour Millers’ Association seeks 48,000 tons of grade 1 northern spring, hard red winter and white milling wheat to be sourced from the United States, on Aug. 6 for shipment from the U.S. Pacific Northwest coast between Sept. 24 and Oct. 8. - Japan

seeks 119,435 tons of food wheat this week.

- Jordan

is in for wheat and barley. The wheat import tender for 100,000 tons is on August 4 and 100,000 tons of barley on August 5.

- Turkey’s

TMO seeks up to around 395,000 tons of 11.5-12.5% milling wheat (395k) for late September 16-30 shipment. The wheat is sought on August 4.

Rice/Other

-

South Korea will release 80,000 tons of rice in August to help cool domestic prices.

-

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States for arrival in South Korea on Jan. 31 and March 31, 2022.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.