PDF attached

Higher

trade. There was additional talk of China securing soybeans off the PNW. USDA confirmed this.

WASHINGTON,

Aug 6, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 131,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

Morning

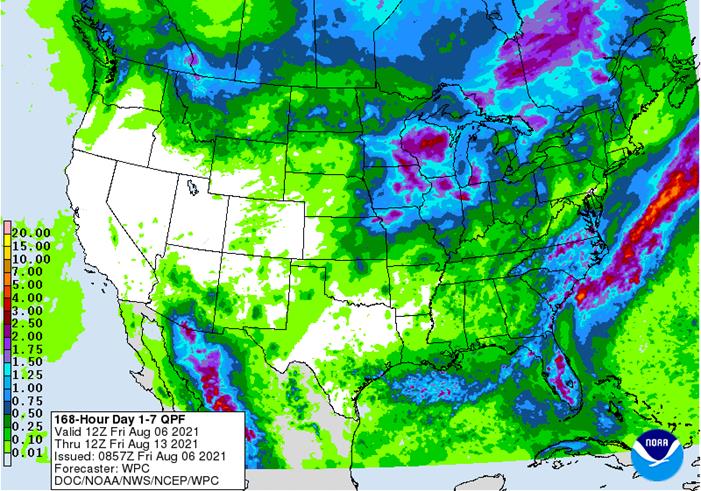

weather forecast still calls for Midwest to see rain across the west central and northwestern areas today through Monday. The Delta is a little drier, favoring corn harvesting.

![]()

WORLD

WEATHER INC.

WORLD

WEATHER HIGHLIGHTS FOR AUGUST 6, 2021

-

Very

important rain will impact the western U.S. Corn Belt this weekend and again early next week. After that, the region will be drying down for a while. The rain will help delay the onset of moisture stress for many crops. The lighter rainfall is in this next

five days the quicker crop stress will evolve later this month. -

Tropical

weather will become more active in the Atlantic Ocean Basin this weekend and next week with a couple of disturbances expected one of which may bring enhanced rain to Florida in about a week to ten days.

-

Argentina

is expecting rain this weekend and some short term benefit is expected in some of its wheat and barley production region.

-

Brazil

weather will be non-threatening for the next ten days. -

Drying

in Europe’s Balkan region and from eastern Ukraine into Kazakhstan will catch the eye of traders during the coming

-

China

weather will be a little more benign for a while. -

Australia

is still waiting for greater rain in Queensland. -

Most

of the nation’s wheat, barley and canola is favorably established from Western Australia to Victoria and New South Wales -

Europe

harvest delays will continue periodically from France through Poland to Belarus, the Baltic States and northwestern Russia -

Grain

and oilseed quality concern will remain, but the very little damage is expected -

Ethiopia

rainfall will continue abundant in the coming week to ten days -

Rain

will also be sufficient to support coffee, cocoa, rice and other crops in Uganda and Kenya -

Indonesia

and Malaysia rainfall should be well distributed, although still a little light in parts of Java -

Philippines

and mainland areas of Southeast Asia will see a good mix of rain and sunshine -

Thailand

will continue to report limited rainfall over the coming week impacting some rice, sugarcane and other crops -

Greater

rain is expected in the second week of the forecast -

Xinjiang,

China weather will be mostly good, but crop development may be a little behind the normal pace -

West

Texas cotton areas would also benefit from warmer temperatures to stimulate an improvement in degree day accumulations and some of that warming is expected over the next few days

Source:

World Weather Inc.

Friday,

Aug. 6:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

Aug. 7

- China’s

first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

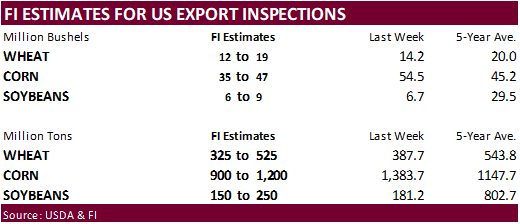

Monday,

Aug. 9:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - Ivory

Coast cocoa arrivals - EARNINGS:

Minerva - HOLIDAY:

Japan, Singapore

Tuesday,

Aug. 10:

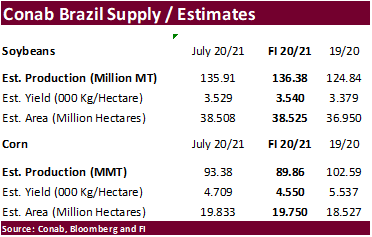

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases data on yield, area and output of corn and soybeans - Purdue

Agriculture Sentiment - HOLIDAY:

Malaysia

Wednesday,

Aug. 11:

- EIA

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board’s stockpiles, output and production data - Brazil’s

Unica publishes data on cane crush and sugar output (tentative) - Vietnam’s

customs department releases July trade data - EARNINGS:

JBS, Wilmar - HOLIDAY:

Indonesia

Thursday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

farm ministry’s monthly supply-demand report (CASDE) - New

Zealand Food Prices - Port

of Rouen data on French grain exports - HOLIDAY:

Thailand

Friday,

Aug. 13:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri

Source:

Bloomberg and FI

US

Change In Nonfarm Payrolls Jul: 943K (est 858K; prevR 938K; prev 850K)

US

Unemployment Rate Jul: 5.4% (est 5.7%; prev 5.9%)

US

Average Hourly Earnings (M/M) Jul: 0.4% (est 0.3%; prevR 0.4%; prev 0.3%)

US

Average Hourly Earnings (Y/Y) Jul: 4.0% (est 3.9%; prevR 3.7%; prev 3.6%)

7US

Change In Private Payrolls Jul: 703K (est 709K; prevR 769K; prev 662K)

US

Change In Manufacturing Payrolls Jul: 27K (est 26K; prevR 39K; prev 15K)

US

Average Weekly Hours All Employees Jul: 34.8 (est 34.7; prevR 34.8; prev 34.7)

US

Labor Force Participation Rate Jul: 61.7% (est 61.7%; prev 61.6%)

US

Underemployment Rate Jul: 9.2% (prev 9.8%)

Canadian

Net Change In Employment Jul: 94.0K (est 150K; prev 230.7K)

Canadian

Unemployment Rate Jul: 7.5% (est 7.4%; prev 7.8%)

Canadian

Hourly Wage Rate Permanent Employees (Y/Y) Jul: 0.6% (est 0.2%; prev 0.1%)

Canadian

Participation Rate Jul: 65.2% (est 65.5%; prev 65.2%)

Canadian

Full Time Employment Change Jul: 83.0K (prev -33.2K)

Canadian

Part Time Employment Change Jul: 11.0K (prev 263.9K)

- US

corn futures are mostly higher on strength in soybeans amid China demand and higher wheat. Morning weather forecast still calls for Midwest to see rain across the west central and northwestern areas today through Monday, so expect limited upside movement.

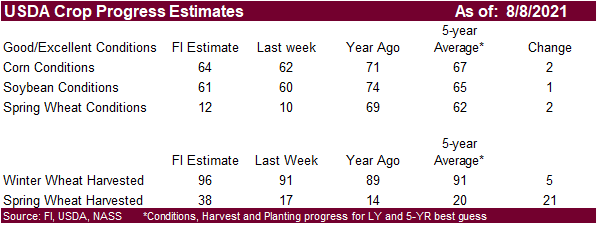

- Farm

Futures pegged the US corn yield at 178.7 bu/acre and production at 15.1 billion bushels. USDA is at 179.5 bu and 15.165 billion.

- We

look for USDA to cut Brazil corn production by 5 million tons next week. Latest Brazil corn production to come out was AgRural, with a 60.9 million ton estimate, down from 65.3 million tons a year ago.

- China’s

Sinograin sold 26,447 tons of imported US corn, 12% of what was offered. They also sold 12,962 tons of non-GMO corn from the Ukraine, 26% of what was offered.

- Argentina’s

BA Exchange reported that the corn harvest is 89.2% complete and left production unchanged at 48 million tons.

Export

developments.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

-

US

soybean complex is higher. Recall the last two Friday’s soybeans traded sharply lower. There was additional talk of China securing soybeans off the PNW and this was confirmed by USDA as they announced 131,000 tons of soybeans were sold to China for 2021-22

delivery. -

Offshore

values are leading soybean oil 80 points higher (333 higher for the week to date) and meal $1.00 lower ($2.40 lower week to date).

-

Rotterdam

oils were up 2 euros. Rotterdam meal was 4-6 euros higher. -

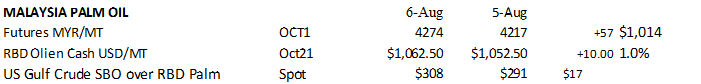

Malaysian

pam October futures was down 74 points and cash down $10/ton to $1,052.50/ton.

-

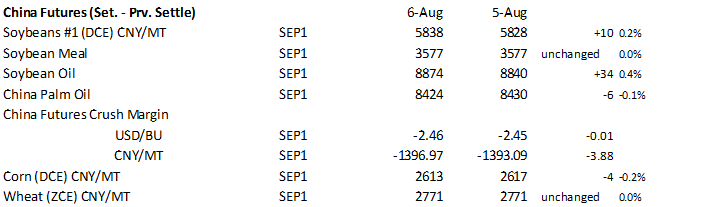

China

futures were mixed again for the complex, with soybeans up 10 yuan or 0.2%, meal unchanged, and SBO up 34. China palm was 6 yuan lower.

- China

cash crush margins were last positive 80 cents on our analysis (88 previous) versus 50 cents late last week and 129 cents around a year ago.

- Malaysian

palm oil:

Export

Developments

- USDA

reported under the 24-hour reporting system 300,000 tons of soybeans were sold to unknown destinations for 2021-22 delivery.

- Wheat

is higher due to ongoing concerns over global high protein wheat supplies. World import demand remains steady. Other news is light.

- No

change in the morning weather forecast was indicated for the Great Plains . Rain is expected for eastern NE and northeastern KS Saturday and then Monday. - Russia’s

formula based wheat export customs duty will decline to $31/ton, from $31.40/ton, according to the AgMin. China’s Sinograin sold 26,447 tons of imported US corn, 12% of what was offered. They also sold 12,962 tons of non-GMO corn from the Ukraine, 26% of

what was offered.

- December

Paris wheat was up 0.75 at 228.50 euros per ton as of 8:00 am CT. - Argentina’s

BA Exchange left the wheat planting unchanged at 6.5 million hectares from last week and the crop is 99.7% planted.

- The

Taiwan Flour Millers’ Association bought 48,000 tons of grade 1 northern spring, hard red winter and white milling wheat to be sourced from the United States, for shipment from the U.S. Pacific Northwest coast between Sept. 24 and Oct. 8. - Tunisia

bought an unknown amount of soft wheat and barley (100,000 floated) for

late Aug through third week of September shipment. - Pakistan

seeks 400,000 tons of wheat for Sep and Oct shipment. - South

Korea seeks 135,100 tons of (50,000) Australian, (35,100) Canadian and (50,000) US wheat on Friday for October shipment.

- Jordan

is back in for 120,000 tons of wheat on August 11. - Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

Algeria

seeks at least 50,000 tons of wheat for Aug/Sep shipment. - Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23.

Rice/Other

-

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States

for arrival in South Korea on Jan. 31 and March 31, 2022.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.