PDF attached

US

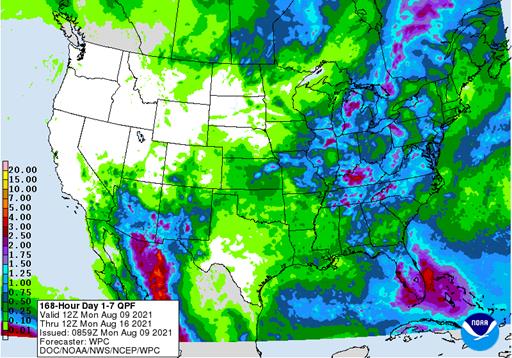

WCB was active over the weekend with majority of the area seeing good rain. Northern North Dakota was dry. South Dakota through NE, KS, IA into WI and IL saw rain. Ridging will set in this week keeping moisture limited across the WCB. ECB will be wet this

week, benefiting soybeans. Global tender announcements were quit over the weekend and fundamental news was light.

A

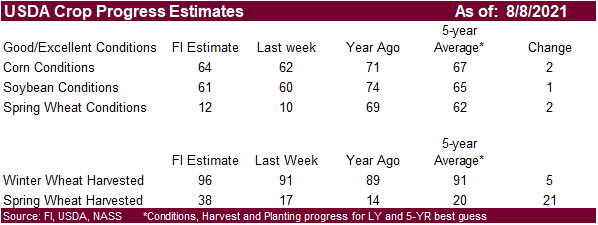

Refinitiv poll calls for the corn yield to average 177.6 and 50.4 soybeans, with production at 15.004 and 4.375 billion, respectively. USDA was at 15.165 & 4.405 billion bushels for July, both below the Reuters trade average, but not by much. Traders should

monitor not only changes in the US balance, but reductions ion Canadian rapeseed & wheat production, Black Sea supplies (Russia wheat), and Brazil corn production.

WORLD

WEATHER INC.

Rainfall

during the weekend was erratic enough to raise some concern about soil moisture in the areas that missed the rain like northwestern Iowa, southeastern South Dakota, northeastern Nebraska and parts of eastern Iowa. Rain was heavier than expected in Wisconsin,

but it is not as important of a production state as Iowa and Minnesota. Net drying is expected in many areas across the Midwest during the coming ten days after early week rainfall diminishes and that will raise concern over crop conditions in the areas that

have been driest for the longest period and for those areas recently missed by weekend rain.

Weather

in Europe will trend drier during the coming ten days and that could impact late season oilseed crops especially those in the southeast where it is already too dry.

Western

parts of the CIS are still a little too dry in some areas, but rain will fall in the north this week and in southwestern parts of Russia’s Southern Region, including Krasnodar, which should improve summer coarse grain and oilseed production.

China’s

drier weather during the weekend was good for most coarse grain and oilseed crops. A good mix of weather is expected in the key production areas this week and early next week to perpetuate the better environment.

India’s

summer crops are in mostly good shape, but groundnuts and a few soybean, corn and sorghum crops from Gujarat into Rajasthan will be trending too dry over time. Flooding recently in northern Madhya Pradesh and southeastern Rajasthan has been a concern and assessments

of crop damage are beginning.

Australia

canola continues well established and poised to entre spring in better than usual condition. Canola in Canada, however, has suffered big losses and production will be much lower than usual.

Corn

and soybean production in the eastern U.S. Midwest and southeastern China is expected to continue to advance well.

Southeast

Asia palm oil production areas will experience much better crop weather in the next two weeks as rainfall slowly increases.

Overall,

weather today is likely to provide a bullish bias to market mentality.

Source:

World Weather Inc.

Monday,

Aug. 9:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - Ivory

Coast cocoa arrivals - EARNINGS:

Minerva - HOLIDAY:

Japan, Singapore

Tuesday,

Aug. 10:

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases data on yield, area and output of corn and soybeans - Purdue

Agriculture Sentiment - HOLIDAY:

Malaysia

Wednesday,

Aug. 11:

- EIA

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board’s stockpiles, output and production data - Brazil’s

Unica publishes data on cane crush and sugar output (tentative) - Vietnam’s

customs department releases July trade data - EARNINGS:

JBS, Wilmar - HOLIDAY:

Indonesia

Thursday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

farm ministry’s monthly supply-demand report (CASDE) - New

Zealand Food Prices - Port

of Rouen data on French grain exports - HOLIDAY:

Thailand

Friday,

Aug. 13:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri

Source:

Bloomberg and FI

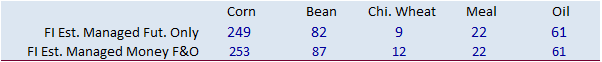

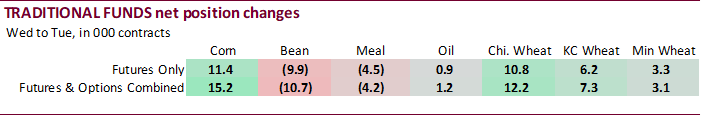

Commitment

of Traders

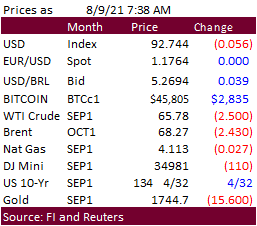

- Lower

start to what will be a busy week with Conab, MPOB and USDA updating supply estimates.

- News

was light over the weekend. Traders are eying outside markets with rising COVID-19 variant cases pressuring energy markets and most US stocks.

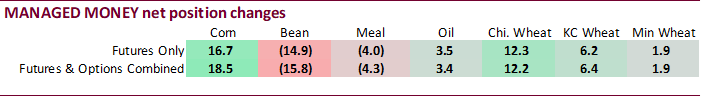

- Money

managers increased their net long position for corn as of last Tuesday from the previous week and reduced their long position in soybeans. They still hold a large net long position in corn with an estimated 253,000 going home on Friday.

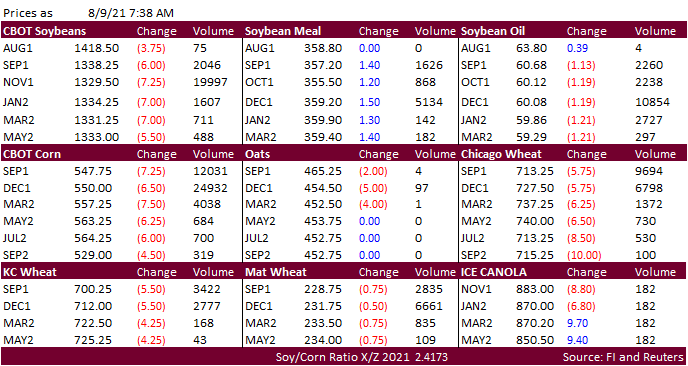

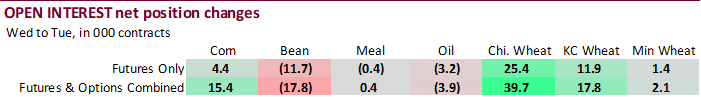

- CBOT

corn open interest Friday was down 21,602 contracts (Sep fell 36,795 contracts). Option open interest was up 52,247.

Export

developments.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

-

US

soybean complex is mixed with most soybean positions lower after China reported a decline in July soybean arrivals from a year ago and Covid-19 concerns. Sharply lower WTI crude oil is pressuring soybean oil. Meal is higher on unwinding of product spreads.

-

There

were no CBOT deliveries and no registration changes for the complex. -

China

July soybean imports were 8.67 million tons, down a hefty 14 percent from 10.1 million during July 2020. Jan-Jul soybean imports are still running above year ago.

-

Safras

reported Brazil producers sold an estimated 24 percent of the upcoming 142.2 million soybean new-crop (their estimate),up from 21.5% in June and compares to 43.3% year earlier. Average is just over 20%. We think producers have been reserve sellers due to

market volatility and concerns over the ongoing drought situation. -

India

sunflower oil imports for 2021-22 could end up a record, according to International Sunflower Oil Association. Offers for crude sunflower oil was quoted by Reuters at $1,280/ton for late 2021 delivery, below $1330//ton for degummed soybean oil.

-

Offshore

values are leading soybean oil 25 points lower and meal $1.10 higher. -

Rotterdam

oils were up a wide range of 1-25 euros (rapeseed oil bias upside). Rotterdam meal was unchanged to 3 euros higher.

-

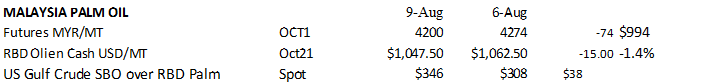

Before

Malaysia goes on a one-day holiday on Tuesday, October futures fell 74 points and cash down $15/ton to $1,047.50/ton.

-

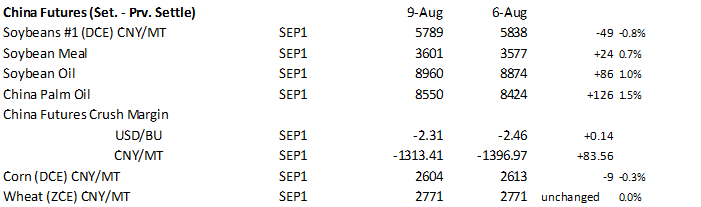

China

soybean futures were down 49 yuan or 0.8%, meal up 0.7%, SBO up 86 or 1.0% and palm up 126 or 1.5%.

- China

cash crush margins were last positive 96 cents on our analysis versus 80 cents late last week and 136 cents around a year ago.

- Malaysian

palm oil:

Export

Developments

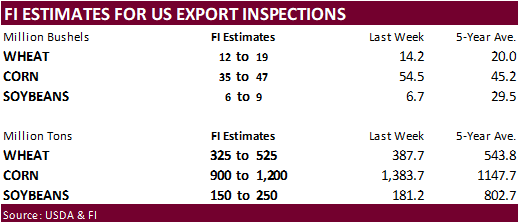

- USDA

last week bought 3,990 tons of packaged oil for use in export programs. 3,770 tons ranged from $2,072.90 to $2623.69 per ton and 220 tons priced at $1,994,73 per ton. - USDA

On August 17 seeks 290,000 tons of veg oil for use in export programs. 210 tons in 4 liter cans and 80 tons in 4 liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

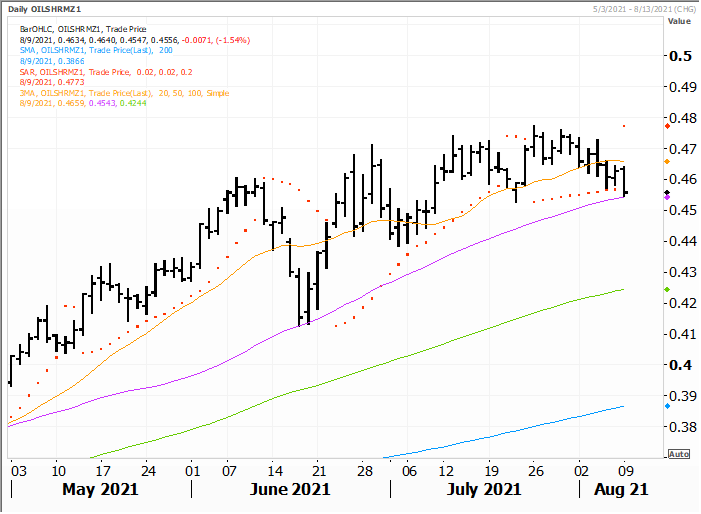

December

oil share

Source:

Reuters and FI

- Wheat

is lower in Chicago and KC while Minneapolis is catching a bid on expectations for USDA to trim the US spring wheat production on Thursday by 20 million bushels to 325 million.

- December

Paris wheat was down 0.50 at 231.75 euros per ton as of 7:25 am CT. - Russian

wheat exports are down 25% so far this season from a year earlier as of August 5 to 2.8 million, according to the Federal Center of Quality and Safety Assurance for Grain and Grain Products. However, for the week ending Aug 5, wheat exports did shoot up to

just over 1 million tons from about 700,000 previous week.

- Jordan

is back in for 120,000 tons of wheat on August 11. - Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

Algeria

seeks at least 50,000 tons of wheat for Aug/Sep shipment. - Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment.

Rice/Other

-

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226

tons of rice from the United States for arrival in South Korea on Jan. 31 and March 31, 2022.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.