PDF attached

WASHINGTON,

August 17, 2021–Private exporters reported to the U.S. Department of Agriculture the following activity:

- Export

sales of 198,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and - Export

sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Pro

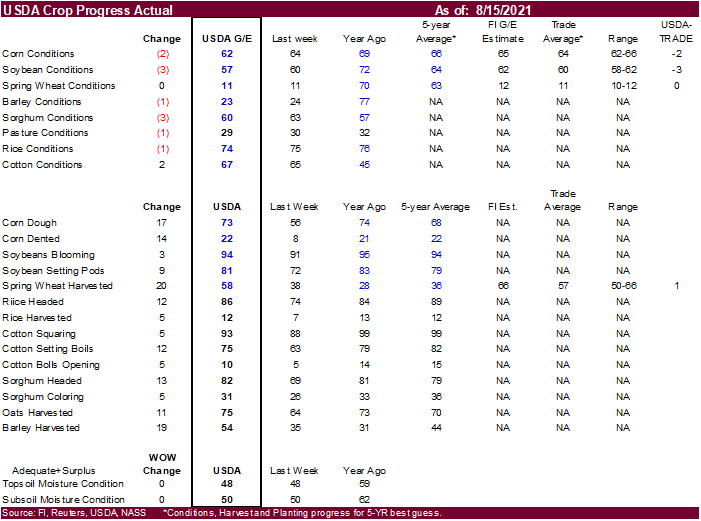

Farmer projected lower corn yields and soybean pod counts than last year in South Dakota but higher Ohio yields and pod counts, as expected. Day one of the Pro Farmer crop tour (2021/2020/3-year average corn yield/soybean pod count):

Ohio

Corn: 185.06/167.69/167.20

Ohio

Soybeans: 1195.4/1155.7/1056.0

South

Dakota Corn: 151.45/179.24/170.44

South

Dakota Soybeans: 996.9/1250.9/1036.1

Despite

a decline in US corn and soybean crop ratings, agriculture commodity futures sold off late in the electronic overnight trade. Corn was higher overnight and is unchanged to weaker after wheat extended losses. Soybeans, canola and meal were still higher. Soybean

oil was down sharply in part to weakness in outside related markets and follow through selling the US energy markets. The rapid US spring wheat harvest progress is pressuring US wheat this morning despite ongoing problems with the EU wheat crop. China’s

sow herd declined 0.5% in July to 45.6 million from the previous month, first monthly decline in nearly two years, in part to weaker hog prices. China’s pig herd increased 0.8% in July from the prior month to 439 million and was 31% larger than a year earlier.

We saw only one tender update since late yesterday. South Korea’s NOFI bought 138,000 tons of feed corn from South America.