PDF attached

US

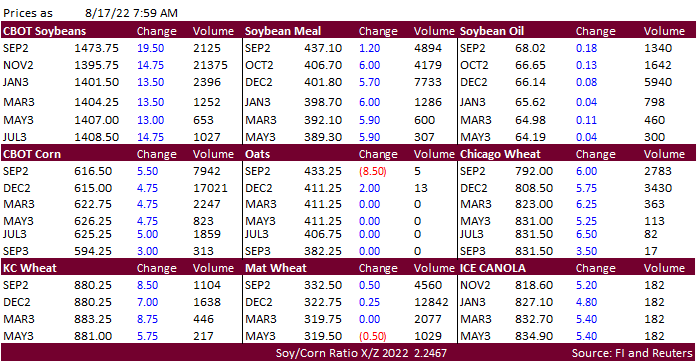

president Biden signed the $430 billion Climate, Healthcare And Tax Bill yesterday. US agriculture markets are higher on technical buying. USD is higher, WTI was mixed and US equities pointing towards a lower open. Soybeans are higher in part to technical

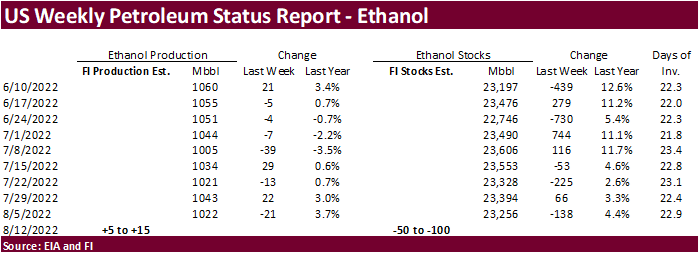

buying. Corn and wheat futures are also rebounding while fundamentals have not changed. Ukraine continues to increase grain shipments. A Bloomberg poll looks for weekly US ethanol production to end up unchanged at 1022 thousand (1003-1034 range) from the previous

week and stocks up 24,000 barrels to 23.256 million.

WORLD

WEATHER HIGHLIGHTS FOR AUGUST 17, 2022

-

No

major changes were noted overnight -

Rain

is still expected to fall significantly in Texas and parts of Oklahoma early next week after lighter showers occur tonight into Friday morning -

Relief

to months of dryness are expected in northern and western Texas, but the moisture comes too late for most crops this year -

Improved

range and pasture conditions are anticipated and a better environment for early wheat planting will be possible, although follow up rain will be important -

Timely

rain will fall in U.S. Midwest Corn and Soybean Belt Production areas while temperatures remain mild -

Canada’s

Central and southwestern Prairies, the northwestern U.S. Plains and U.S. Pacific Northwest will remain dry biased over the next ten days -

Europe

showers and thunderstorms will scatter across many areas, but the need will remain for greater rain especially in western Europe and in the western Balkan Countries and areas northeast into Hungary -

Rain

will fall in western parts of Russia’s Southern Region today into Saturday offering some short-term relief from dry and warm weather -

Eastern

portions of Russia’s Southern Region, western Kazakhstan and areas north into the heart of the New Lands will be dry and warm through the next ten days -

Waves

of rain will continue from east-central through northwestern India and Pakistan over the next ten days -

China’s

Yangtze River Basin will remain hot and dry for another week and then some scattered showers and thunderstorms will begin to evolve bringing some cooler temperatures -

Northern

China rainfall will continue frequent keeping many summer crop areas wet -

Dry

areas in western Argentina will remain dry; rain is still needed, but not likely for at least ten days -

Southern

Brazil will continue wet biased over the coming week and then a little drier

Source:

World Weather INC

Bloomberg

Ag Calendar

Wednesday,

Aug. 17:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - HOLIDAY:

Indonesia

Thursday,

Aug. 18:

- China’s

second batch of July trade data, including corn, pork and wheat imports - International

Grains Council report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Aug. 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Brazil’s

Conab releases sugar, cane and ethanol output data - US

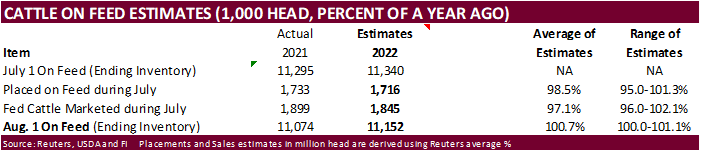

cattle on feed, 3pm - EARNINGS:

Deere

Saturday,

Aug. 20:

- China’s

third batch of July trade data, including soy, corn and pork imports by country - AmSpec

to release Malaysia’s Aug. 1-20 palm oil export data

Source:

Bloomberg and FI

USDA’s

Farm Service Agency says it will release the Aug. 12 FSA acreage data on Monday, Aug. 22: “The Crop Acreage file originally scheduled to be posted on August 12 will be posted on August 22 at 3pm ET.”

https://www.fsa.usda.gov/news-room/efoia/electronic-reading-room/frequently-requested-information/crop-acreage-data/index

US

Retail Sales Advance (M/M) Jul: 0.0% (exp 0.1%; R prev 0.8%)

–

Retail Sales Ex-Auto (M/M) Jul: 0.4% (exp -0.1%; prev 0.9%)

–

Retail Sales Ex-Auto, Gas Jul: 0.7% (exp 0.4%; prev 0.7%)

–

Retail Sales Control Group Jul: 0.8% (exp 0.6%; R prev 0.7%)

·

Corn futures are rebounding today after taking a hit over the past two days. Fundamentals have not changed. Ukraine continues to increase grain shipments. Welcome rain fell across the central and southern US areas, France and

UK, over the past day.

·

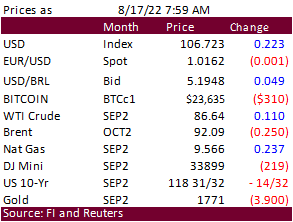

USD as higher by 30 points as of 7:55 am CT and WTI crude oil slightly lower.

·

Anec sees Brazil corn exports during August reaching 8.09 million tons versus 7.88 million seen last week.

·

EU corn imports reached 3.59 million ton since July 1, against 1.78 million tons previous period year earlier.

·

A Bloomberg poll looks for weekly US ethanol production to end up unchanged at 1022 thousand (1003-1034 range) from the previous week and stocks up 24,000 barrels to 23.256 million.

Due

out Friday

·

None reported

·

Soybeans

are higher. Most of this reversal is technical. US cottonseed crush will be down resulting in less cotton meal and this has thought to be supporting soybean meal.

·

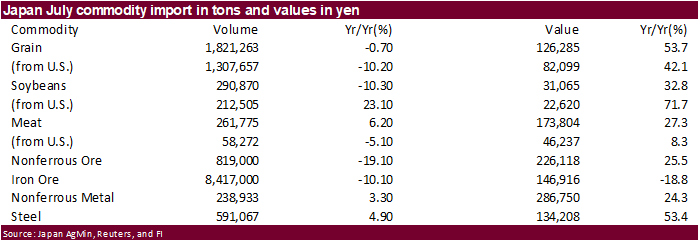

India’s SEA reported July oilmeal shipments during July fell 47 percent to 227,247 tons from 431,480 tons a month earlier but are up from 191,663 tons year ago. Soybean meal shipments were only 14,618 tons.

·

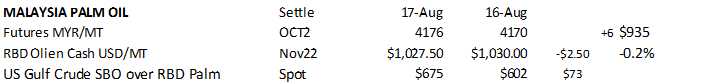

Malaysia left their crude palm oil export duty unchanged for the month of September at 8 percent. The reference price was 3,907.51 ringgit ($875.34) per ton for September versus August of 5,257.91 ringgit a ton.

·

Malaysia October palm oil was 6 MYR higher to 4176/ton, and cash was down $2.50 at $1,027.50/ton.

·

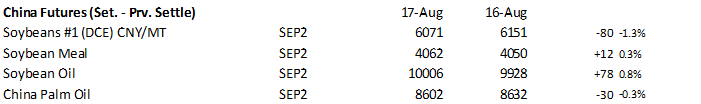

China soybean futures were down 1.3 percent, meal 0.3% higher, soybean oil up 0.8%, and palm 0.3% lower.

·

Rotterdam vegetable oils were

unchanged to down 5 euros earlier, and meal unchanged for the positions we follow, from this time yesterday morning.

·

Offshore values were leading SBO 113 points higher earlier this morning and meal $10.30 short ton higher.

·

European Union soybean imports so far for 2022-23 (July 1 start) reached 1.57 million tons by Aug. 14, against 1.77 million tons by the same week in last season. EU rapeseed imports reached 718,647 tons, compared with 435,611

tons a year earlier. Soymeal imports were 1.67 million tons against 1.98 million tons the prior season. EU sunflower oil imports were at 191,978 tons, against 188,648 tons a year earlier.

Export

Developments

·

Tunisia seeks 6,000 tons of crude degummed vegetable oil on Wednesday for August 27 to September 10 shipment.

·

Yesterday Egypt bought 47,000 of local soybean oil. They were looking for arrival Oct. 1-25 and/or Nov. 1-20, 2022. No prices were provided.

·

US wheat

futures are higher on technical buying after trading lower over the last couple of days.

·

A director general from the Ukrainian Agribusiness Club told Bloomberg producers in Ukraine are lacking storage for their “grain harvest and need additional space to stock as many as 15 million tons.”

·

The US plans to spend $68 million on 150,000 tons of Ukrainian wheat for the UN World Food Program, with some of it headed to the Africa Horn.

·

At least four more ships have left Ukrainian ports on Tuesday that included sunflower meal, sunflower oil and corn.

·

Russia is having a hard time booking grain cargoes from logistical problems and western sanctions preventing banks to finance some transactions.

·

India wheat production was estimated by the farm ministry at 106.84 million tons for 2021-22, up slightly from 106.41 million tons earlier. Harvest was completed around April.

·

Paris September wheat was unchanged at 332 euros as of 7:40 am CT.

·

European Union soft wheat imports so far for 2022-23 (July 1 start) reached 3.58 million tons, compared with 3.14 million tons by the same week in 2021-22.

·

Jordan passed on 120,000 tons of barley on August 17 for LH Dec through LH Feb shipment.

·

Bangladesh seeks 50,000 tons of milling wheat on September 1, optional origin, for shipment within 40 days of contract signing.

·

Results awaited: Iraq’s state grains buyer seeks 50,000 tons of milling wheat from the United States.

·

Japan’s AgMin seeks 70,000 tons of feed wheat and 40,000 tons of feed barley on August 19 for arrival by January 26, 2023.

Rice/Other

·

Results awaited: Iraq’s state grains buyer seeks 50,000 tons of rice.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.