PDF attached

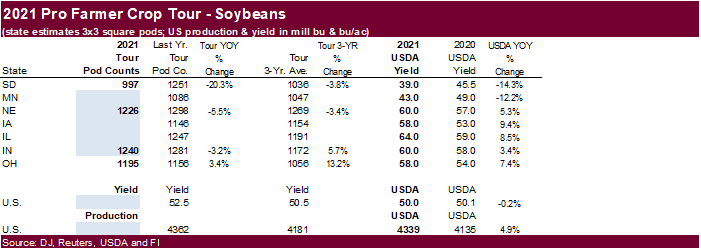

Soybeans

are lower early this morning but another 24-hour sale confirmation may limit losses. Corn is rebounding, in part to the Pro Farmer crop tour pegging day 2 corn yields below USDA’s August estimates. We thought pod counts would be a little better for the 2

ECB states reported. Wheat is higher on strong global demand and technical buying.

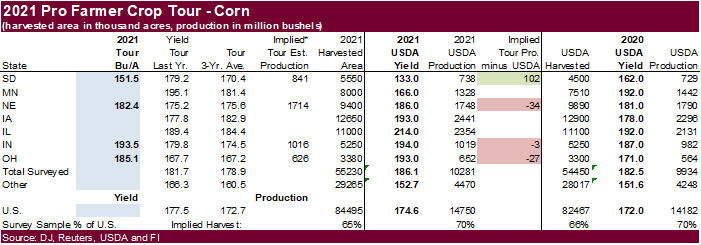

Pro

Farmer projected higher corn yields and lower soybean pod counts than last year in Nebraska. For Indiana, the tour pegged the corn yield higher than last year and pod count slightly below 2020. Although the day 2 corn yields are above last year, they still

fall short of USDA’s current projections. See table below.