PDF attached

Partial

rain relief was noted for the US northern Great Plains and Canadian Prairies over the weekend. Areas benefiting included north-central North Dakota into southwestern Manitoba, and northern Minnesota into southeastern Manitoba. Iowa, Kansas and Missouri saw

1-2 inches of rain. Tennessee saw heavy local rain with one area receiving up to 17 inches. This week 0.5-1.5 inches will fall across the northern Plains and Great Lakes region.

MN and WI will see the heaviest amount of rain. Net drying is expected in the central and southern Plains, the southwestern Corn Belt.

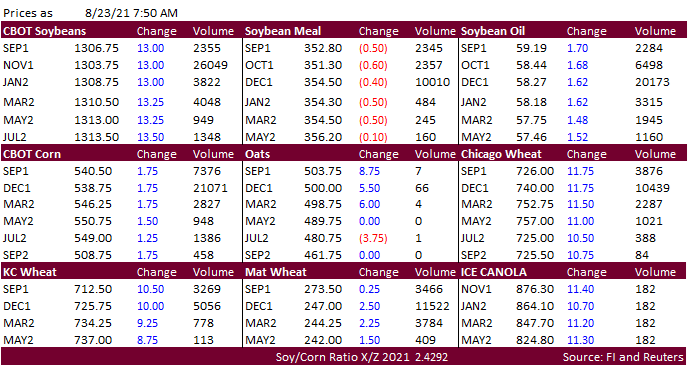

US

agriculture markets are mostly higher (meal turned lower) on technical buying, lower USD, sharply higher energy markets, and oversold conditions after heavy selling occurred late last week.

Note

many of the outside markets failed to follow the sharply lower Friday session in US agriculture markets. This week we could see a volatile trade as details may emerge regarding EPA’s proposal to lower US biofuel mandates and ongoing concerns over rising cases

of the Delta Covid-19 variant that could impact grain transportations. Malaysian palm oil was up 51 points to 4,316 and cash was up $12.50/ton at $1,080/ton. China soybean complex futures trended lower led by soybeans (down 1.1%). Offshore values were leading

soybean oil 338 points higher and meal $1.40 lower. Global

wheat import demand remains robust.

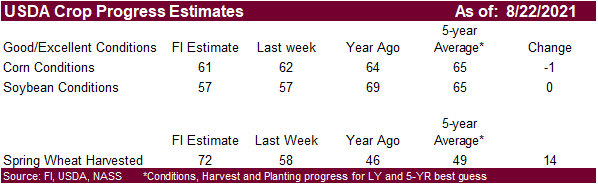

We

look for US corn conditions to decline 1 in the combined good and excellent categories, and soybeans to remain unchanged. At 61 and 57 for corn and soybeans respectively, if realized, they both would be at a season low. Since more than 50 percent of the

spring wheat crop had been collected, USDA will not issue a crop progress update. Spring wheat G/E last week settled at 11 percent. Note the range this season was 9 to 45 percent, 45 at the beginning of the season. September MN rallied about $1.43 since

April 30.