PDF attached

WASHINGTON,

August 24, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

•

Export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

•

Export sales of 125,300 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year.

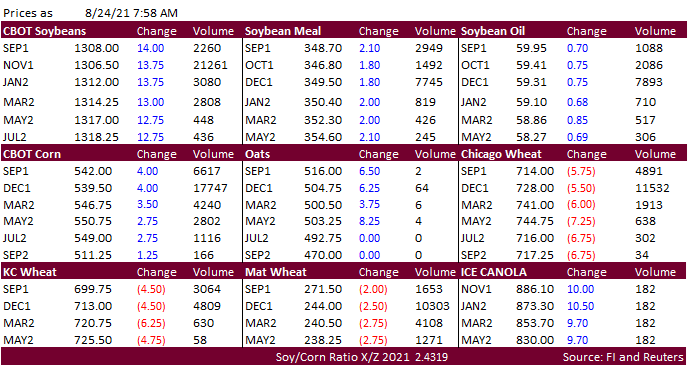

Soybeans

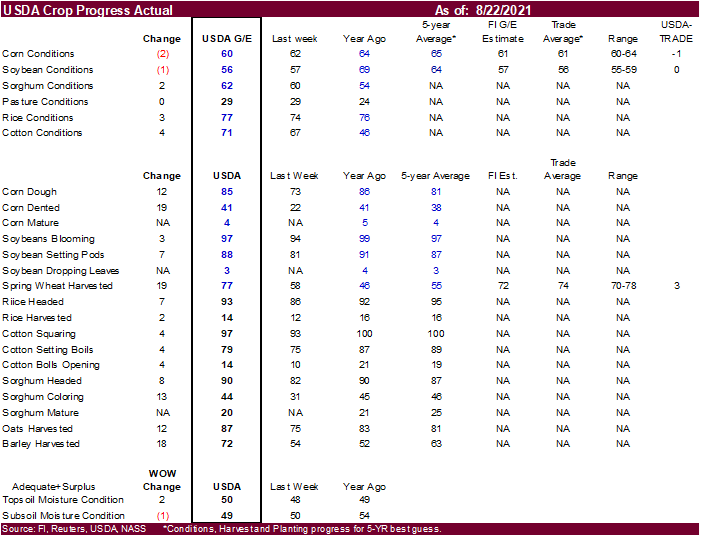

and corn are higher after USDA reported a 1 and 2 point decline in crop ratings, respectively. Soybeans are the strongest to the upside as August is an important month for US development. Much of the US corn across the Midwest is nearly made. Rains this

week across the Midwest will be beneficial for soybeans and late corn development. 41 percent of the US corn crop was in the dented stage, above 38 percent average. 4 percent of the corn was mature. 3 percent of the US soybean crop was dropping leaves.

We lowered our US corn yield from 174.5 to 173.6/bu per acre. Our US soybean yield was taken down from 50.7 to 50.3/bu per acre. The US spring wheat is 77 percent complete with harvest, up from 58 percent last week and 55 percent 5-year average.