PDF attached

Chinese

demand for US soybeans total at least 627k this week. USDA: Private exporters reported sales of 517,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

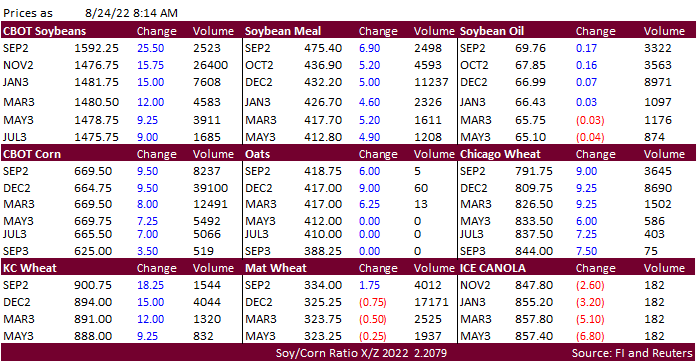

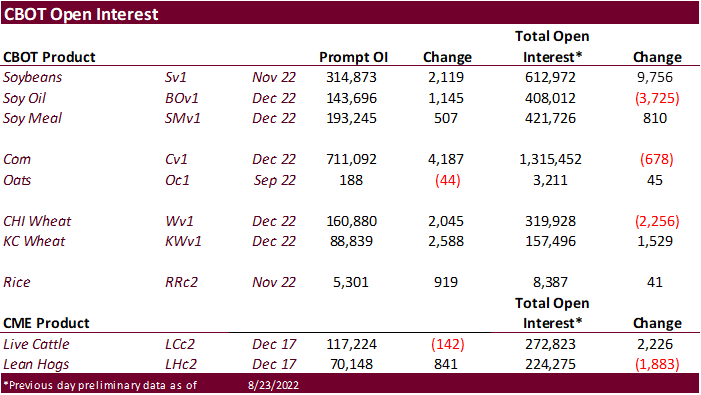

CBOT

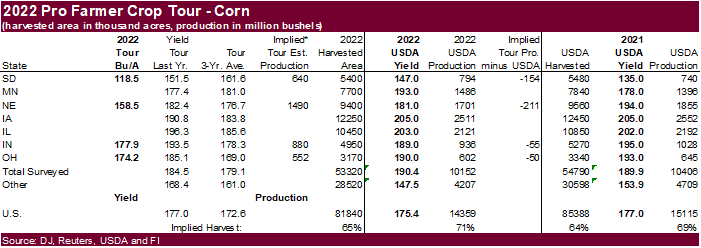

agriculture futures are higher after the second day of the Pro Farmer crop tour showed potential corn and soybean yields below average for Nebraska and a lesser extent, Indiana. Based on the two days of tour results for corn, implied production for the combined

four states is 471 million bushels below USDA August. Global import demand is slowly picking up. US weather forecast is mostly unchanged. Minor spring wheat harvesting delays are seen while the Delta saw too much rain causing concern over crop conditions.

China’s Yangtze Valley, bias northwest/east will gradually see an increase in rain. WTI crude oil is higher for the third consecutive day. USD was up 20 points and US equities are suggesting a higher open. Overseas agriculture product values were higher.

Offshore

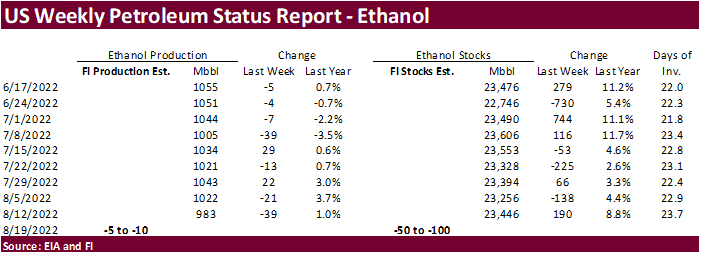

values were leading SBO 10 points higher earlier this morning and meal $4.40 short ton lower. A Bloomberg poll looks for weekly US ethanol production to be up 7,000 thousand (965-985 range) from the previous week and stocks down 177,000 barrels to 23.269 million.

“Indiana

corn yields were projected at 177.85 bushels per acre (bpa), the Pro Farmer Midwest Crop Tour said on Tuesday evening, below the 2021 crop tour average of 193.48 bpa and the three-year crop tour average of 178.26 bpa. The four-day crop tour, which does not

project soybean yields, estimated the amount of soybean pods in a 3-by-3-foot square in Indiana at an average of 1,165.97 pods, down from last year’s average of 1,239.72 pods but above the three-year average of 1,148.26 pods.” (Reuters)

“Nebraska’s

corn yield was projected at 158.53 bushels per acre (bpa), the Pro Farmer Midwest Crop Tour said on Tuesday evening, well below the 2021 crop tour average of 182.35 bpa and the tour’s three-year average of 176.68 bpa. The four-day crop tour, which does not

project soybean yields, estimated the amount of soybean pods in a 3-by-3-foot square in Nebraska at an average of 1,063.72 pods, down from last year’s average of 1,226.43 pods and the three-year average of 1,245.06 pods.” (Reuters)

WORLD

WEATHER HIGHLIGHTS FOR AUGUST 24, 2022

-

Too

much U.S. rain has fallen this week from western Georgia through central and southern Mississippi, Louisiana and southern Arkansas to portions of Texas and southern Oklahoma where 3.00 to more than 7.00 inches was common -

Local

rain totals over 15.00 inches occurred in the Dallas, Texas area with some unofficial amounts to 11.00 inches in a part of the lower Delta -

The

rain has induced flooding and farming delays along with raising the potential for crop quality declines -

Soybeans

and rice may have been most impacted -

Tropical

disturbances are being closely monitored over the Atlantic Ocean for possible development; no imminent threat to major land masses is seen through the weekend -

Tropical

Storm Ma-On continues to trek toward western Guangdong, China with landfall expected there Thursday -

Typhoon

Tokage remains well east of Japan and unlikely to threaten land -

Not

much change in the U.S. outlook today -

Scattered

showers and thunderstorms will impact most crop areas in the Great Plains, Midwest, Delta and southeastern states through the first half of next week and then drier in the following week -

The

mix will be good for crops and fieldwork, although additional moisture from Texas to Georgia will not be welcome -

Canada’s

Prairies precipitation will continue restricted for the next ten days -

Western

Argentina will remain drier than desired while rain falls in the east and in southern Brazil and Uruguay -

India’s

weather is improving with less frequent and less significant rain -

Russia’s

weather will continue in a net drying mode along with parts of Ukraine and Kazakhstan, despite a few showers; temperatures will be warmer than usual -

Declining

soil moisture will maintain some worry over winter crop establishment -

Europe

weather has not changed with rainfall expected to be most significant from Italy to eastern Germany and western Poland as well as in some of the Balkan Countries while leaving western Europe a bit drier biased -

Excessive

rain will continue in parts of Pakistan and eastern Afghanistan through Friday resulting in some floods -

Northeastern

China will experience some net drying while the southern Yellow River Basin becomes wet -

Drought

in the Yangtze River Basin will continue for ten more days in central parts of the region while other areas see some gradual improvement

Source:

World Weather INC

Bloomberg

Ag Calendar

Wednesday,

Aug. 24:

- EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Unica may release cane crush, sugar production data (tentative) - US

poultry slaughter

Thursday,

Aug. 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysia’s

Aug. 1-25 palm oil export data - USDA

red meat production

Friday,

Aug. 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

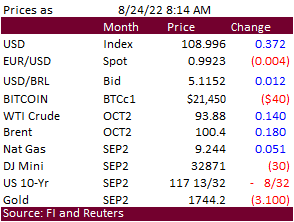

Macros

Mortgage

applications to purchase a home fell 1% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume was 21% lower than the same week one year ago. (CNBC)

Durable

Goods came 0% month over month, est. +0.6%.

·

Corn is higher for the sixth consecutive day on US yield concerns and follow through technical buying. Yesterday’s volume was very large for both futures and options. China, EU, and US corn crop prospects have steadily deteriorated

over the past month and with the investment funds shedding their long position mid-summer over global economic fears, they are back in buying across the ag space, led by corn.

·

The USD is higher this morning and crude oil higher.

·

Heavy rain across the US Delta is seen delaying corn harvest progress and fieldwork activity for the balance of the week.

·

The annual Pro Farmer crop tour for day 2 showed most yield potentials for corn and pod counts for soybeans below normal levels for NE and IN.

·

Based on the two days of tour results for corn, implied production for the combined four states is 471 million bushels below USDA August.

·

Texas ranchers are apparently increasing slaughter rates for their cows as more than 93 percent of the state is experiencing some type of drought.

·

A Bloomberg poll looks for weekly US ethanol production to be up 7,000 thousand (965-985 range) from the previous week and stocks down 177,000 barrels to 23.269 million.

·

South Korea’s KOCOPIA group bought two non-GMO corn cargoes from the Black Sea at $378 and $379.40/ton c&f for FH November arrival.

·

Soybeans

are higher led by bull spreading and Chinese demand. September is now at a premium over November of about $1.15, widest to date. Outside product markets were higher overnight but soybean oil sold off before the electronic close in part to WTI crude oil, higher

USD and meal/oil spreading.

·

Private exporters reported sales of 517,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

·

Germany on Wednesday prioritized the transportations of energy products on most of its railways, a blow for grain traders that are unable to fully utilize the Rhine River.

·

Indonesia extended its palm oil export waiver until October 31, that has been in place since mid-July.

·

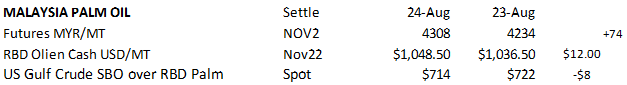

Malaysia November palm oil was 74MYR higher at 4308 per ton, and cash was up $12 at $1048.50/ton.

·

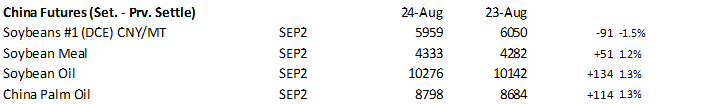

China soybean futures were down 1.5 percent, meal 1.2% higher, soybean oil up 1.3%, and palm 1.3% higher.

·

Rotterdam vegetable oils were

10-20 euros higher, and meal up 7-13 euros for the positions we follow, from this time yesterday morning.

·

Offshore values were leading SBO 10 points higher earlier this morning and meal $4.40 short ton

lower.

·

Private exporters reported sales of 517,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

·

This comes after they bought 110,000 tons earlier this week.

·

USDA this week seeks 1,500 tons of vegetable oil for the AMS/CCC to use in export programs. Shipment was set for Oct 1-31, later if from plants at the port.

·

US wheat

futures are higher following strength in corn and technical buying. China’s drought situation is adding to the bullish undertone but at this time we don’t know the extent of the damage.

·

Paris December wheat was down 0.75 euro at 325.50 per ton as of 7:50 am CT.

·

Romania’s wheat crop was estimated at 9 million tons, a decline from 11.3 million tons for 2021. Despite the lower crop, they expect to remain a net exporter.

·

APK-Inform: Ukraine 2022 grain crop seen at 52.5 to 55.4 million tons, down from a record 86 million last year.

·

South Korea ended up buying 50,000 tons of US wheat on Friday for November shipment at $331-$333 per ton (soft white).

·

Jordan saw four participants for their barley import tender.

·

Jordan also announced they seek 120,000 tons of wheat on August 30.

·

Iraq passed on US wheat that was to close earlier this month (no prices were provided).

·

Yesterday Egypt’s GASC bought 240,000 tons of Russian wheat on Aug. 22, according to Reuters. Shipment is for Sep 20 through November 10. Additional purchases could still be made, they added. Average price was thought at $368

per ton.

·

Japan seeks 118,881 tons of food wheat from the United States, Canada and Australia, on Thursday.

·

Taiwan Flour Millers’ Association seek 34,025 tons of grade 1 milling wheat from the United States on August 25 for shipment out of the PNW between October 12 and October 26.

·

Bangladesh seeks 50,000 tons of milling wheat on September 1, optional origin, for shipment within 40 days of contract signing.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 6.

·

We read that China’s drought situation has had the largest impact on rice production.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.