PDF attached

WASHINGTON,

August 26, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

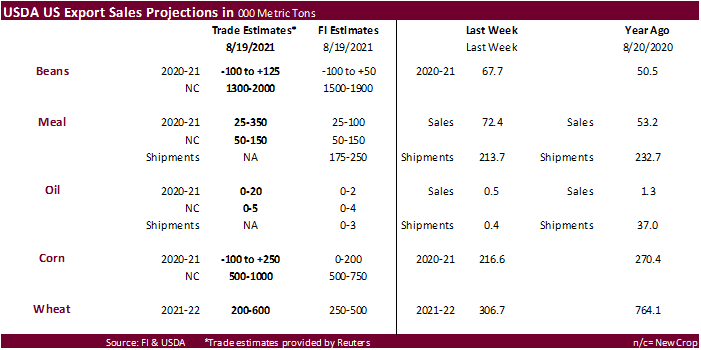

- Export

sales of 100,000 metric tons of corn for delivery to Colombia during the 2021/2022 marketing year; - Export

sales of 133,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and - Export

sales of 132,150 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

US

weather outlook looks good over the near term with precipitation falling across the north central and eastern areas through Friday, then the northern Midwest Saturday and central and eastern areas Sunday through Monday. Northeastern NE will see rain through

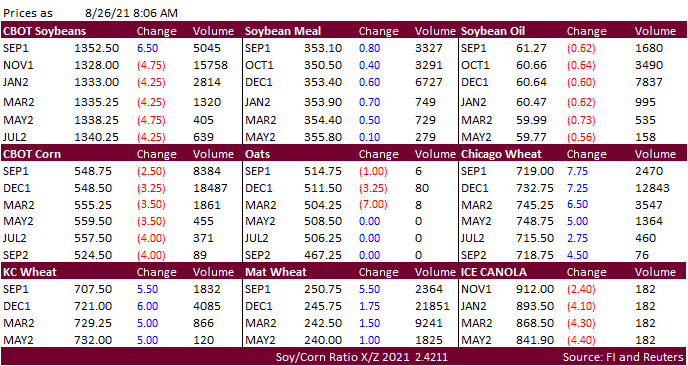

Saturday before rain expands to other parts of NE into KS and northern OK over the weekend. North Dakota, Minnesota, Wisconsin, and Iowa over next three days will see heavy rain. In a narrow range, today we are seeing a lower trade in most soybean contracts

(Sep up again), soybean oil, and corn. Soybean meal was moderately higher while wheat is higher on renewed concerns over global crop quality. WTI is lower and USD higher.

![]()