PDF attached

Follow

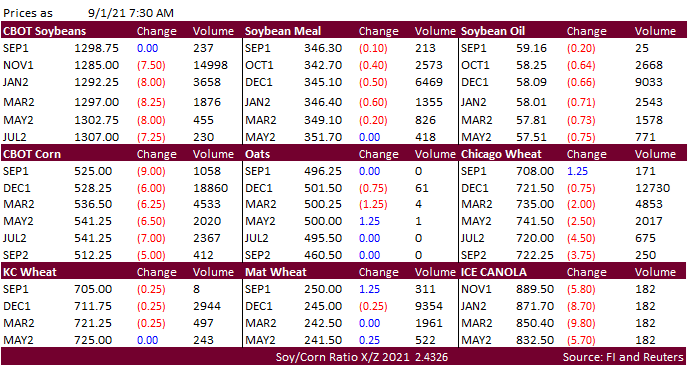

through selling on US Gulf export concerns for corn and soybeans while wheat is mixed as global import demand remains strong with Algeria the latest country to buy a large amount of wheat. The US will see good rain for the remainder of the week benefiting

late developing crops bias the north and central Great Plains into the central/lower western Corn Belt.