PDF attached

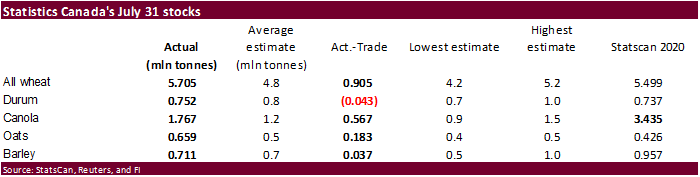

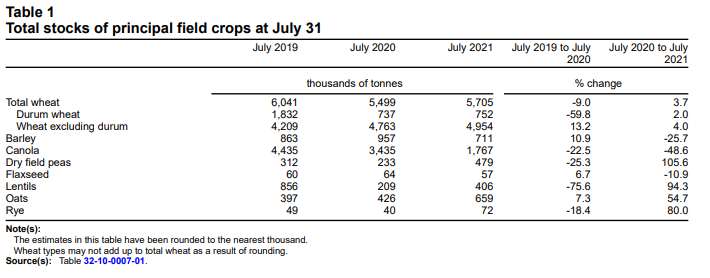

StatsCan

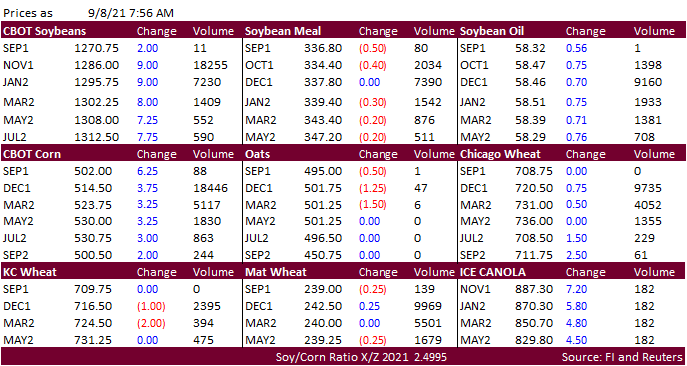

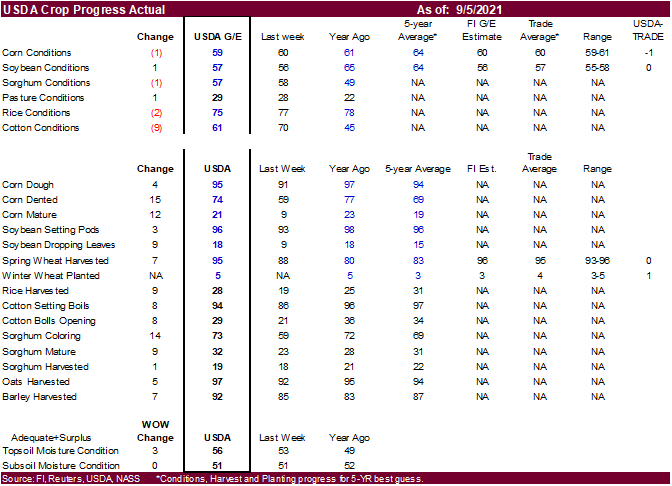

reported bearish stocks for July 31 Canadian canola and all-wheat. Soybeans and corn are seeing a light technical rebound. Wheat was mixed to lower. USD is higher, WTI up more than 90 cents and equities mixed. USDA reported US corn conditions declined 1

point to 59 (trade 60) and soybeans improved one point to 57 (trade 57). Offshore values are leading the soybean products higher. Look for positioning ahead of USDA’s S&D update to increase today into Thursday.