PDF attached

WASHINGTON,

September 10, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

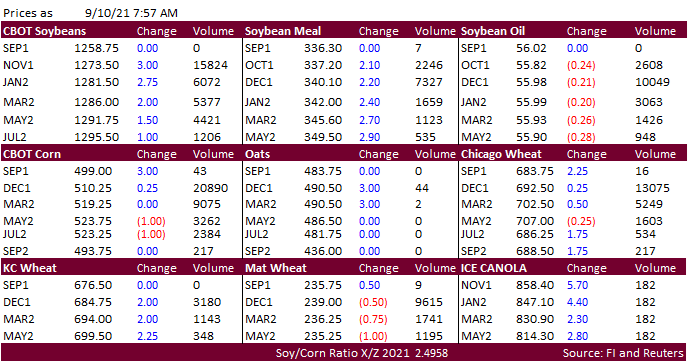

Soybeans,

corn, and wheat are catching a bid this morning on light positioning ahead of several reports due out today. USD is 10 points lower. WTI is rebounding, up $1.33 and equity futures are pointing towards a higher open.

![]()