PDF attached

WASHINGTON,

September 13, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

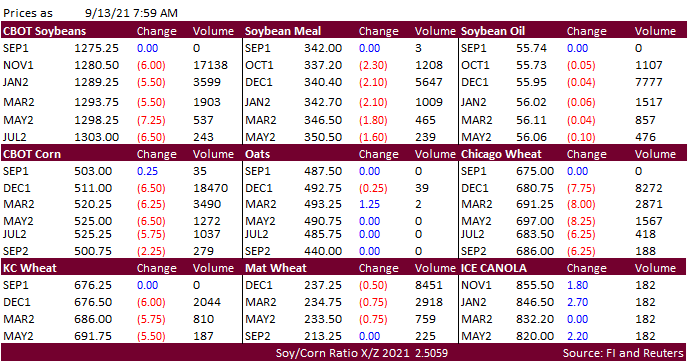

Soybeans,

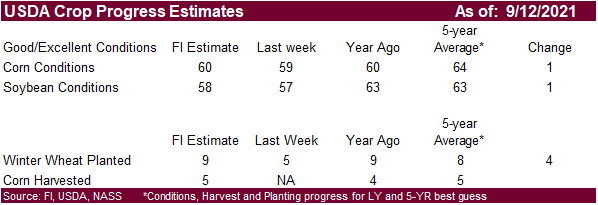

meal, corn and wheat are all lower on favorable US weekend weather for crop development, corn harvest progress and winter wheat planting progress. The USD was 26 points higher as of 7 am CT. Soybean oil found support from a snap in Malaysia’s losing streak

after Malaysian September 1-10 palm exports were reported 29% higher form the same period last month by SGS at 548,420 tons. In addition, India lowered their import taxes on crude palm oil to 2.5% from 10%. We are seeing a few more wheat import developments.

While many traders were looking for short term lows to be in during last Friday’s session, we can’t ignore favorable US harvesting pressure for corn and eventually for soybeans. Our thinking is for October yields to tick higher when updated by USDA next month

if crop conditions hold steady or improve over the next couple of weeks. Next set of major reports will be quarterly stocks and small grains summary at the end of this month. We look for US wheat production to be upward revised by a small amount.