WASHINGTON,

September 15, 2021- Private exporters reported to the U.S. Department of Agriculture the following activity:

-Cancellations

export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

-Cancellations

export sales of 196,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

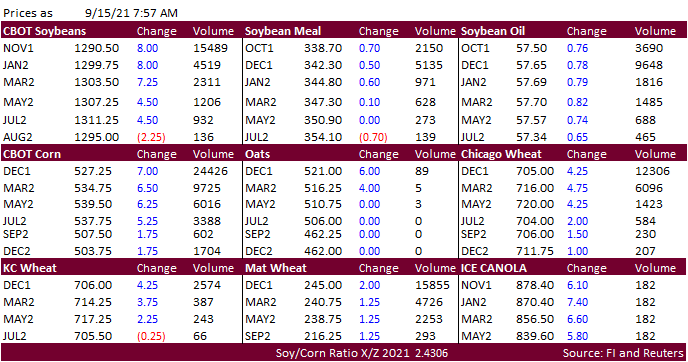

Soybeans,

corn and wheat are higher this morning in part to the grains extending their rally, higher energy markets and lower USD. There is chatter China bought additional Brazil soybean cargoes. Soybean oil is sharply higher, keeping soybean meal on the defensive.