PDF attached

WASHINGTON,

September 17, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

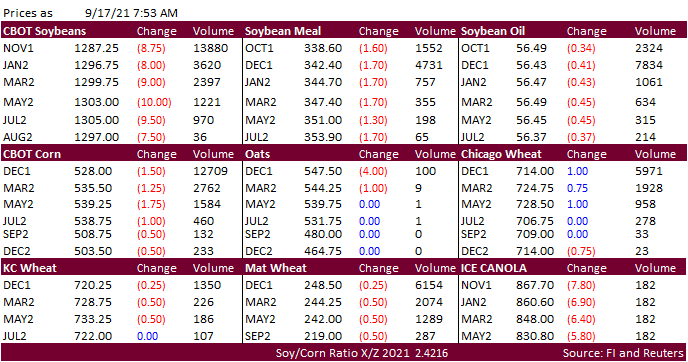

Weakness

in the soybean complex this morning is seen as risk off ahead of the weekend after gains were posted earlier this week. Corn and wheat futures are lower to mixed.

Look

for a quiet trade today. USD is down 7 and WTI off 21 cents.

![]()