PDF attached

China

and US economic concerns are hitting global equity and commodity markets this morning. Several factors are in play. Evergrande problem in China. Upcoming Fed meeting, to name a couple. WTI crude oil is $1.43 lower and USD 17 points higher. Down futures

are pointing towards a more than 650-point decline.

The

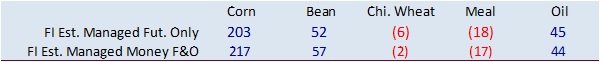

soybean complex is lower on US shipping woes and bearish outside markets. Corn is down for the third consecutive day. Funds are little more than 200,000 contracts long in corn. Wheat prices fell as well. US harvest weather remains favorable. China’s north

and southwest portions of the corn belt will see heavy rains during the first half of the workweek, delaying harvesting progress.