PDF attached

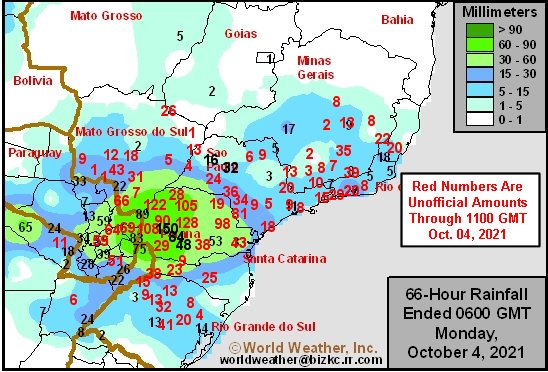

WTI is about 52 cents higher and USD down 28. US equities are near unchanged to lower. The soybean complex is lower led by soybeans (9-month low) and soybean oil. Offshore values are leading soybean oil 91 points higher and meal lower. The Higher lead in offshore values is due in large part to a 78-point increase in Malaysian palm futures. The US should see mostly dry weather across the Great Plains and western Corn Belt this week. The Midwestern central and eastern areas should see favorable rain through Thursday. Brazil’s Mato Grosso, southern MGDS, Minas into Parana should see some rain this week. Argentina will be mostly dry.

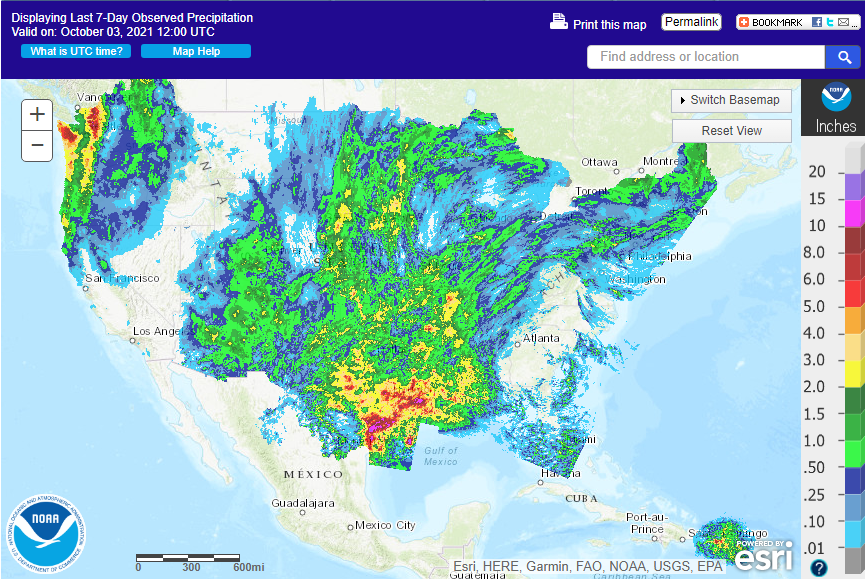

7-day

WORLD WEATHER HIGHLIGHTS FOR OCTOBER 4, 2021

- Significant rain fell in interior southern Brazil during the weekend inducing some local flooding and saturating the ground from southeastern Paraguay and far southern Mato Grosso do Sul into Parana.

- Rain will be lighter in this same region for a while, but more heavy rain is possible next week.

- Center west and the remainder of center south Brazil experienced scattered showers and will see more of the same over the next ten days.

- In the United States, weekend rainfall scattered through many areas, but ended in the southern Plains.

- This week will be drier in the central and southern Plains and western Corn Belt while scattered showers continue in the eastern Midwest, Tennessee River Basin and southeastern states.

- Unseasonably warm to hot weather is expected in eastern Canada’s Prairies the northern U.S. Plains and northern Midwest early this week with cooling likely during the weekend and especially next week.

- There is some potential for relief to drought in the northern Plains and Canada’s Prairies next week, although how significant that will be remains to be seen.

- Northern India will be drier this week

- Heavy rain will fall near and north of the Yellow River in China.

- Western Australia will be drier biased while showers occur in the eastern part of the nation.

- Western parts of the CIS will be drier biased and mild into the weekend and then some showers will evolve again.

- Western Europe will trend drier while rain falls more significantly in Italy and the Balkan Countries which will ease long term dryness.

- Weekend rain in France, the U.K and parts of Germany helped ease some of the region’s dryness

- Southeast Asia will remain adequately moist

- Colombia may experience some heavier rainfall in the coming week to ten days impacting coffee and other crop areas.

Source: World Weather Inc.

Monday, Oct. 4:

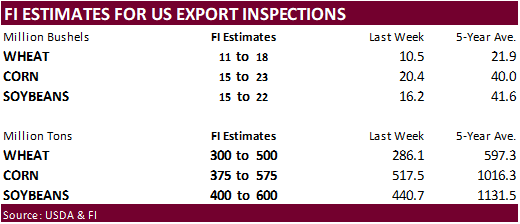

- USDA export inspections – corn, soybeans, wheat, 11am

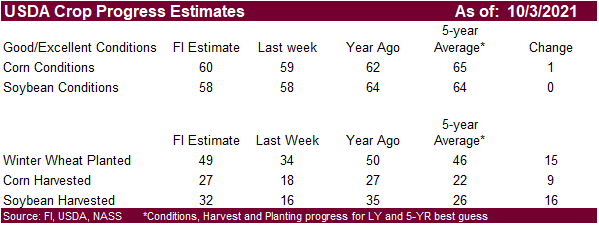

- U.S. crop conditions – corn, cotton, soybeans; winter wheat planted, 4pm

- Ivory Coast cocoa arrivals

- HOLIDAY: China

Tuesday, Oct. 5:

- EU weekly grain, oilseed import and export data

- Moscow Golden Autumn Agriculture conference (Oct. 5-8)

- Malaysia Oct. 1-5 palm oil exports

- U.S. Purdue Agriculture Sentiment, 9:30am

- New Zealand Commodity Price

- New Zealand global dairy trade auction

- HOLIDAY: China

Wednesday, Oct. 6:

- EIA weekly U.S. ethanol inventories, production

- Agricultural Technology and Food Salon, a virtual event organized by IFIC (Oct. 6-7)

- HOLIDAY: China

Thursday, Oct. 7:

- FAO Food Price Index & cereals supply/demand brief

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Brazil’s Conab report on yield, area and output of corn and soybeans

- Port of Rouen data on French grain exports

- HOLIDAY: China

Friday, Oct. 8:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- China’s CNGOIC to publish supply-demand reports on corn, soybeans and other commodities

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

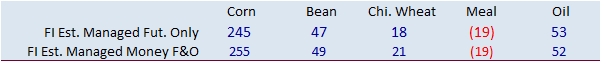

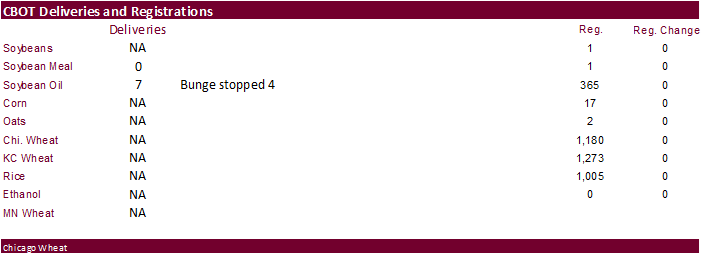

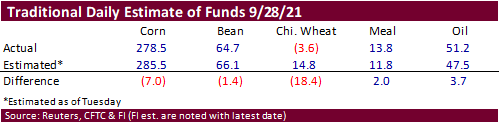

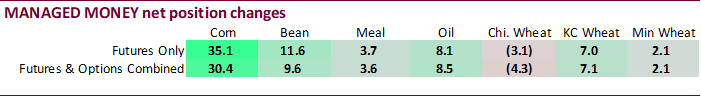

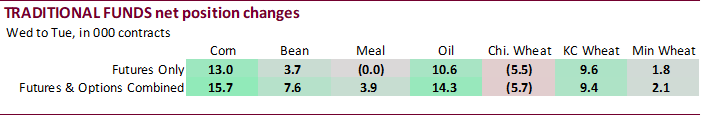

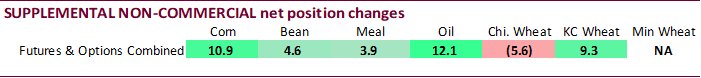

The traditional fund position for Chicago wheat ended up net short 3,600 contracts, rather than net long the trade expected, at a 18,400 difference (more short). Funds were more less long than expected in corn. For the soybean complex, the fund positions were near expectations. Index funds added a good number of net longs to corn, soybean oil and KC wheat, while they sold Chicago wheat.

Macros

Canadian Building Permits (M/M) Aug; -2.1% (est 3.4%; prevR -4.1%; prev -3.9%)

· Corn is lower in the front four contracts despite a lower USD. US weather looks favorable and Brazil is slated to see additional rain this week favoring plantings. News was quiet.

· There were no corn tender announcements overnight.

Export developments.

- None reported

· The soybean complex is lower led by soybeans (9-month low) and soybean oil. China has been absent for several days from buying soybeans.

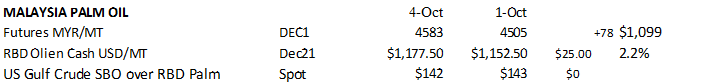

· Offshore values are leading soybean oil 91 points higher and meal lower. The Higher lead in offshore values is due in large part to a 78-point increase in Malaysian palm futures. Cash palm oil was up $25/ton to $1,177.50/ton.

· Strategie Grains see the EU 2022 rapeseed area up 7 percent to 5.6 million hectares in part to high prices. 2021 EU rapeseed harvested area is seen at 5.23 million hectares with production at 17.03 million, up from 16.93 projected a month ago.

· The shortfall in the Canadian canola crop, projected to be the lowest in 13 years, is hammering the export market with only 388,000 tons exported from August 1 through mid-September, down 71 percent from year earlier.

· The Midwestern central and eastern areas should see favorable rain through Thursday.

· Brazil’s Mato Grosso, southern MGDS, Minas into Parana should see some rain this week.

· Argentina will be mostly dry.

· China is on holiday through October 7.

· China cash crush margins were last 176 cents/bu on our analysis versus 159 cents late last week and 90 cents around a year ago.

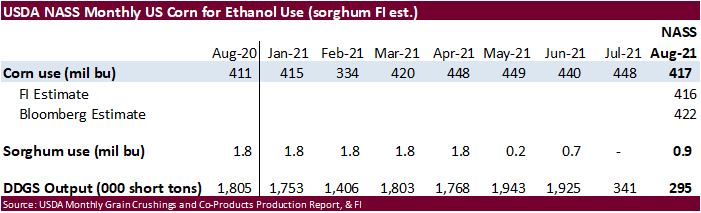

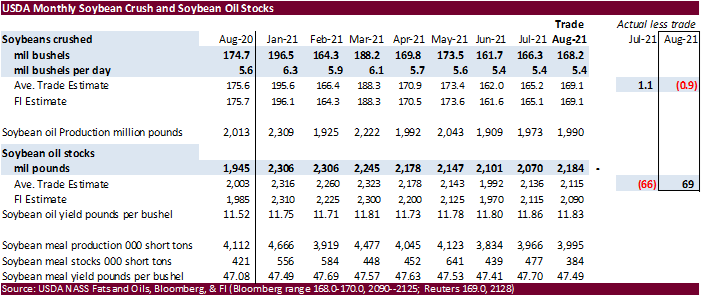

· US soybean oil for biofuel production improved for the month of July to 792 million pounds from 663 million during June, and up from 775 million during July 2020. With two months of data left for SBO for biofuel for the Oct-Sep crop year, we are using 8.750 billion pounds, 50 less than USDA’s estimate.

Export Developments

- Egypt seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil for November 25 and December 20 arrival.

· Wheat is mixed with a higher trade in Chicago on technical buying. KC and MN are lower in part to a slightly lower trade in EU wheat futures and favorable North America weather over the weekend. Rain over the past week favored southern and central US Great Plains.

· The USD was 28 points lower as of 7:50 am CT.

· Russian wheat prices are up for the 12th consecutive week with IKAR estimating 12.5% protein wheat at $307/ton, up $3.00/ton from previous week and SovEcon up $1.50 to $306/ton.

· The US should see mostly dry weather across the Great Plains and western Corn Belt this week.

Export Developments.

· Taiwan seeks 48,000 tons of wheat on October 7 for November 25 and December 9 shipment.

· Jordan seeks 120,000 tons of feed barley on October 7 and 120,000 tons of wheat on October 6.

· Bangladesh plans to buy 100,000 tons of wheat from Russia in a government-to-government tender.

· The UN seeks 200,000 tons of milling wheat on October 8 for Ethiopia for delivery 90 days after contract signing.

· Turkey seeks 310,000 tons of feed barley, on Oct. 8.

Rice/Other

· Bangladesh seeks 50,000 tons of rice on October 4.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.