PDF attached

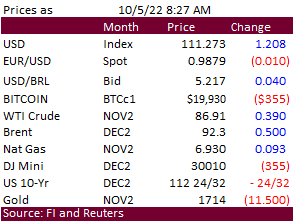

USD

is reversing to the upside and WTI higher. US equities are pointing towards

a lower open. Some are citing recession concerns. CBOT grains are mostly lower on little news. Tunisia is seeing offers for soft wheat at 383.49 euros per ton. US weather remains favorable for harvest and unfavorable for Midwest River levels. US Midwest weather

conditions will remain drier than normal. The southern Great Plains will remain on the drier side over the next week. Argentina planting progress improved but more rain is needed. Brazil is in good shape. Offshore values were leading soybean oil 167 points

lower earlier this morning and meal $0.10 short ton higher.

WORLD

WEATHER HIGHLIGHTS FOR OCTOBER 5, 2022

-

Not

many changes overnight -

Argentina

will get a few showers today, but no drought busting rain is expected anytime soon -

Erratic

rainfall is projected for U.S. hard red winter wheat areas during the coming week -

Some

forecast models are trying to increase rain from the Texas Panhandle into Oklahoma next week, but confidence in this is low -

U.S.

Delta, lower eastern Midwest and southeastern states will be dry biased through the weekend and then may experience a few showers next week

-

The

latter part of the week would be wettest -

Low

water levels on the Mississippi, lower Missouri and Ohio Rivers will continue to be a concern over the next few weeks -

No

major rain events are expected to seriously change the river levels and barge restrictions may continue -

Minimal

precipitation is expected in Canada’s Prairies except early next week when rain and some wet snow occurs in western and southern Alberta as a cold airmass arrives -

Very

cool conditions are expected in eastern Canada’s Prairies, the northern U.S. Plains and northern Midwest during the balance of this week -

Hard

freezes will occur as far south as northeastern Nebraska and northern Iowa as well as northwestern Illinois Friday and Saturday morning’s

-

Frost

will occur southward into southern Nebraska, northern Missouri and the remainder of northern Illinois and Michigan -

Crop

damage is not likely to be significant -

Brazil’s

center west and center south crop areas will be plenty moist over the next couple of days supporting long term planting and emergence conditions for soybeans, corn, rice, cotton and other crops -

Sugarcane,

citrus and coffee will benefit as well -

There

will be a little too much rain in some areas resulting in some delayed farm progress in Mato Grosso do Sul, Parana and Sao Paulo -

Europe’s

weather will remain drier biased for a while which should promote fieldwork

-

Western

Russia, Belarus and neighboring areas will see less rain over the next ten days helping to reduce flood potentials after recent excessive moisture -

China’s

greatest rain will be between the Yellow and Yangtze Rivers during the balance of this week and into the weekend while welcome drying occurs to the north

-

China’s

driest region will be in the southeast with drought still prevailing in the southern Yangtze River Basin

-

Some

relief from drought is expected in the northern Yangtze Basin where 1.00 to nearly 3.00 inches of rain is expected by Saturday -

Central

and northeastern India will need to dry out after rain falls this week -

Northwestern

India and Pakistan will be seasonably -

Frequent

rain in New South Wales and southwestern Queensland through Saturday will result in some local flooding – especially in New South Wales -

Additional

rain will fall in the same areas early next week -

Western

and South Australia crops should stay in favorable condition

Source:

World Weather INC

Bloomberg

Ag Calendar

- US

Trade Data for August - EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

Oct. 1-5 palm oil export data - HOLIDAY:

China, India, Bangladesh

Thursday,

Oct. 6:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - New

Zealand commodity price - Brazil’s

Conab releases data on area, yield and output of corn and soybeans - HOLIDAY:

China

Friday,

Oct. 7:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Vietnam

customs data on September coffee, rice and rubber exports - HOLIDAY:

China, Argentina

OPEC+

JMMC Agrees Oil Output Cuts Of 2 Mln BPD – RTRS Sources

US

Trade Balance Aug: -$67.4B (est -$67.7B; prev -$70.7B)

US

Crude Oil Exports Fell To 3.65 Million BPD In August (3.80 Million BPD In July) – Census

Canadian

Trade Balance Aug: C$1.52B (est C$3.50B; prev C$4.05B; prevR C$2.37B)

Canadian

Building Permits (M/M) Aug: 11.9% (est -0.5%; prev -6.6%; prevR -7.3%)

Due

out October 6

·

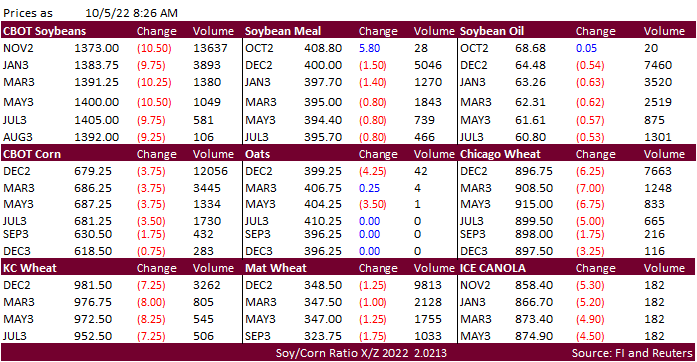

Corn futures are lower on widespread commodity selling and a rebound in the USD. WTI crude oil turned higher

·

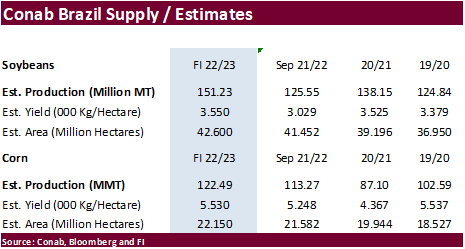

Trade estimates for the USDA October report will be released over the next two days. We hear StoneX is at 51.3 for the US soybean yield (4.442 billion) and 173.9 bu/yield for US corn (14.056 billion). FI is using 49.8 and 170.1

bu/acre for soybean and corn, respectively.

·

Memphis-Cairo Barge Freight (offer) for the October position increased to 3,000 percentage points for the nearby position, up from 2,000 late last week.

·

Anec looks for Brazil October corn exports at 4.208 million tons, up from 1.873 million tons October 2021.

·

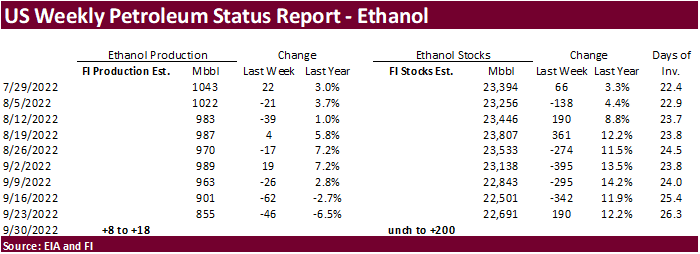

A Bloomberg poll looks for weekly US ethanol production to be up 19,000 thousand to 874k (860-900 range) from the previous week and stocks down 50,000 barrels to 22.641 million.

·

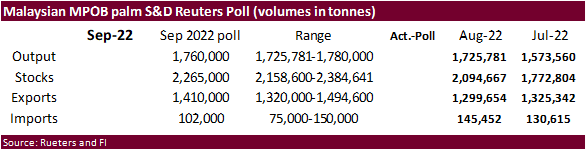

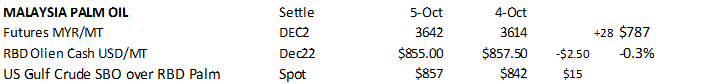

CBOT soybean complex is lower, influenced by outside markets and light news. Palm oil futures were up for the fifth consecutive day but prices are failing to counter weakness in soybean oil.

·

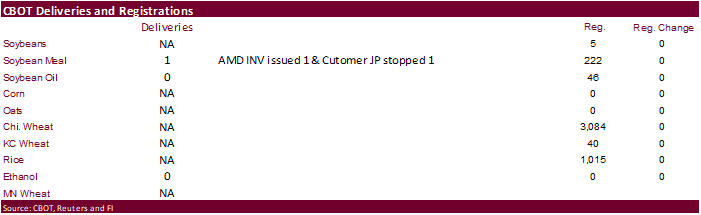

CBOT deliveries were zero for soybean oil and 1 for meal.

·

Malaysian December palm oil futures increased 28 points to 3,642 and cash was down $2.50/ton to $855.00/ton.

·

China is on holiday this week for Golden Week

黄金周

·

Rotterdam vegetable oils were mixed from this time yesterday morning. SA meal was 2.-5 euros lower.

·

Offshore values were leading soybean oil 167 points lower earlier this morning and meal $0.10 short ton higher.

·

US wheat prices are lower in a risk off trade and higher USD.

·

News was light.

·

StoneX sees Brazil wheat production at 10 million tons and imports at 6.2 million tons for 2022-23.

·

Paris December wheat was off 1.00 euro earlier at 348.75 per ton.

·

Tunisia’s lowest offer for soft wheat was $383.79/ton c&f. The state grains agency seeks 150,000 tons of soft wheat, 100,000 tons of durum wheat and 100,000 tons of feed barley, all in 25,000-ton consignments. The wheat is sought

for shipment between Nov. 1 and Dec. 15 depending on origin, durum between Nov. 1 and Dec. 15 and barley between Nov. 1 and Dec. 5.

·

Results awaited, lowest offer $386/ton for Ukraine origin: Iraq seeks 50,000 tons of wheat, optional origin. Russia is excluded from the import tender.

·

Jordan seeks 120,000 tons of barley on October 12 after passing on October 5, for March and April shipment.

·

Jordan seeks 120,000 tons of wheat set to close October 11.

·

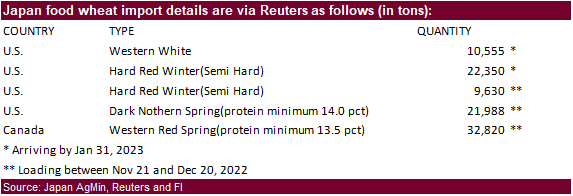

Japan seeks 97,343 tons of food wheat later this week for arrival by January 31.

·

Turkey seeks 495,000 tons of barley on October 11.

-

Iraq

seeks 50,000 tons of milling wheat on October 10, optional origin.

·

China plans to sell 40,000 tons of wheat from reserves on October 12, from the 2014-2017 crops.

·

Mauritius seeks 25,800 tons of wheat flour, optional origin, on October 28 for January through September 30, 2023, shipment.

Rice/Other

·

Mauritius seeks 6,000 tons of rice on October 20, optional origin, for Jan-Mar shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.