PDF attached

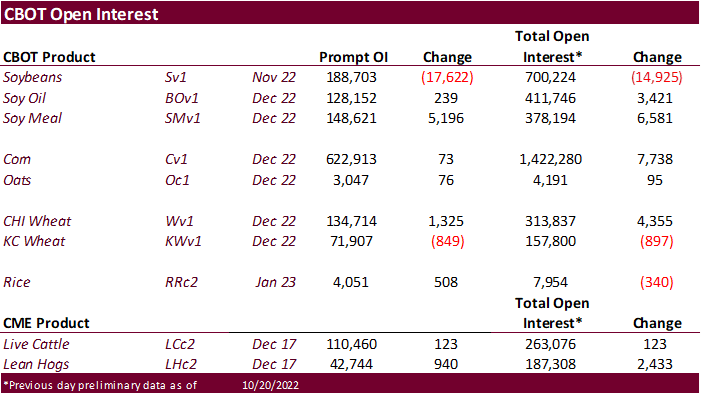

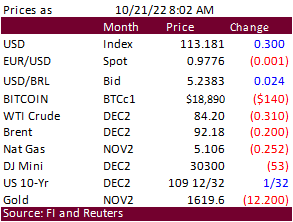

USD

was up 32 points earlier, WTI 75 cents higher and US equities lower. The soybean complex and corn are lower. Wheat is lower today after Turkish President Tayyip Erdogan said that he sees “no obstacles to extending a U.N.-brokered deal allowing Ukrainian Black

Sea grain exports, after discussions with his Russian and Ukrainian counterparts,” quoting a Reuters article. This comes a day after wheat rallied from rumors ships will not be able to enter selected Ukraine ports around November 5, allowing for the current

lineup to finish loadings and inspections in preparation of an end of the safe passage agreement, set to expire sometime during the third week of November. News was light for the corn and soybean complex.

Malaysian markets will be closed for holiday on Monday. Malaysian palm oil futures for the week

were up 7 percent. USDA Cattle on Feed is due out after the close.

The

7-day US precipitation outlook again showed an improvement in rainfall across the central US. The Midwest weather outlook was unchanged from yesterday. The Great Plains is a little wetter for the southeastern areas early next week. Argentina will see erratic

rain across La Pampa, BA, south Santa Fe, southern Cordoba, and southern Entre Rios through Thursday. Brazil will see rain bias northern areas through Tuesday.

WORLD

WEATHER HIGHLIGHTS FOR OCTOBER 21, 2022

-

Argentina’s

outlook is still favoring rain for most of the nation over the next ten days, but the rain comes in waves and is not well distributed leaving central parts of the nation with the lightest amount of moisture and least improvement until late in the ten-day period.

-

The

greatest rain will fall in northeastern and far southern parts of the nation, but all areas will get rain at one time or another by Nov. 4. -

Brazil

weather will continue favorably moist in the center west and southern parts of center south -

Rain

is expected to evolve this weekend and especially next week in the dry areas of eastern Mato Grosso and Goias and it will eventually spread throughout all of northeastern Brazil ending the dry season for many areas -

Australia’s

rainy weather pattern continues, but the greater rain totals may be more confined to coastal areas for a while -

The

wet bias will remain in place, despite lighter rainfall and worry over wheat, barley and canola conditions in the east will prevail -

Delays

in spring planting of early sorghum and cotton are also expected -

Western

Australia gets some timely rain for the southern production areas where maturity is still several weeks away which should maintain an excellent outlook for production in that State -

Tropical

Storm Roslyn will move into Nayarit and southern Sinaloa, Mexico late this weekend and its moisture feed will stream into the southern U.S. Plains -

The

storm comes inland as a Category Two storm producing damage in coastal areas -

U.S.

hard red winter wheat areas will have opportunity for “some” rain in the Texas Panhandle and areas east northeast into south-central Kansas -

The

greatest rain is expected in Oklahoma where 1.00 to 3.00 inches of moisture is expected and where wheat conditions will improve the most -

Drought

will prevail in other hard red winter wheat areas -

A

follow up rain event is “possible” in the southern Plains briefly at the end of the coming ten day period -

Rain

in Missouri and Illinois early next week and the runoff from rain in Oklahoma may eventually lift the lower Missouri and lower Mississippi Rivers briefly, but more moisture will be needed to induce a more significant lift in water levels. Follow up moisture

is a must, too, if the rivers are to stay higher when they rise and that does not seem very likely right now. -

Northern

U.S. Plains and Manitoba precipitation for Sunday into Tuesday will concentrate on the area from Montana and western North Dakota into Manitoba

-

Heavy

snowfall is expected in far southern and east-central Saskatchewan and western Manitoba Sunday and Monday -

No

changes noted in Europe, CIS, China South Africa or India -

Tropical

Cyclone still threatens Bangladesh, northwestern Myanmar and far eastern India early to mid-week next week with flooding rain and windy conditions -

Tropical

Depression 25W will become a tropical storm as it moves across the northern South China Sea this weekend with possible landfall during mid-week next week in central Vietnam

Source:

World Weather INC

Friday,

Oct. 21:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Asia

3Q 2022 cocoa grind data - FranceAgriMer

weekly update on crop conditions - US

cattle on feed, 3pm

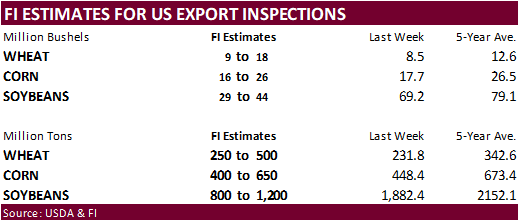

Monday,

Oct. 24:

-

MARS

monthly EU crop conditions report -

USDA

export inspections – corn, soybeans, wheat, 11am -

US

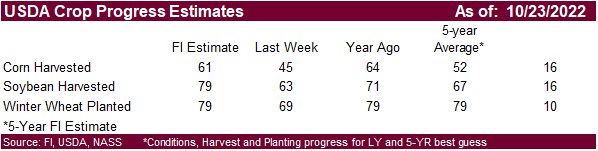

crop conditions and harvesting for corn, soy, cotton; winter wheat plantation and condition, 4pm -

US

cold storage data for pork, beef, poultry, 3pm -

Cane

crush, sugar output data by Brazil’s Unica (tentative) -

HOLIDAY:

India, Singapore, Malaysia, New Zealand, Thailand

Tuesday,

Oct. 25:

-

Malaysia’s

Oct. 1-25 palm oil export data -

EU

weekly grain, oilseed import and export data -

EARNINGS:

ADM

Wednesday,

Oct. 26:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 1 -

EIA

weekly US ethanol inventories, production, 10:30am -

EARNINGS:

Bunge, Pilgrim’s Pride -

HOLIDAY:

India

Thursday,

Oct. 27:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 2 -

Virtual

New Food Invest Conference, EMEA -

USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Oct. 28:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 3 -

FranceAgriMer

weekly update on crop conditions -

ICE

Futures Europe weekly commitments of traders report -

CFTC

commitments of traders weekly report on positions for -

various

US futures and options, 3:30pm

Source:

Bloomberg and FI

CME

Group is resting price limits

for many agriculture commodities. PDF is attached or visit https://www.cmegroup.com/notices/ser/2022/10/SER-9081.html

Macros

Canadian

Retail Sales (M/M) Aug: 0.7% (est 0.2%; prevR -2.2%)

Canadian

Retail Sales Ex Auto (M/M) Aug: 0.7% (est 0.3%; prevR -2.5%)

Canada

Wholesale Trade Falls 0.2% In Sept.: Statcan Flash

Canada

Retail Sales Fall 0.5% In Sept.

·

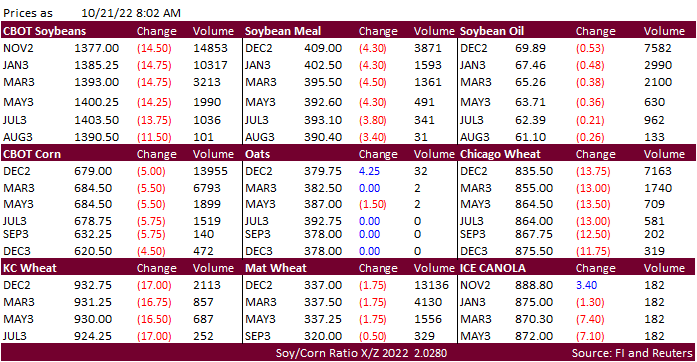

Corn futures

are lower from a higher USD and weakness in wheat. The back end of the 7-day US Midwest weather outlook calls for additional precipitation.

·

Yesterday the BA grain exchange lowered their Argentina corn crop area estimate to 7.3 million hectares from 7.5 million previous. Producers are shifting some area into soybeans.

·

China today offered to sell 20,000 tons of pork from reserves.

·

USDA Cattle on Feed is due out after the close.

·

CBOT soybeans are lower this morning. Some cited soybeans backing up across the US interior due to shipping problems along the Ohio and Mississippi rivers.

·

News was light.

·

Malaysia will be closed for holiday on Monday.

·

Malaysian palm oil futures for the week were up 7 percent. Heavy rainfall may disrupt production across Indonesia and Malaysia over the short term. Malaysia palm oil exports so far during October are down from the previous month.

·

Malaysian January palm oil futures increased 4 Ringgit to 4,101 and cash was down $2.50/ton to $937.50/ton.

·

China November soybeans were down 0.5%, meal 0.1% higher, soybean oil 0.4% lower and palm oil 0.6% lower.

·

Rotterdam vegetable oils were mixed (SBO lower and RSO higher) from this time yesterday morning. SA meal was mostly higher.

·

Offshore values this morning were leading soybean oil 30 points lower earlier this morning (303 points lower for the week to date) and meal $8.40 short ton lower ($20 lower for the week).

·

Wheat is lower today after Turkish President Tayyip Erdogan said that he sees “no obstacles to extending a U.N.-brokered deal allowing Ukrainian Black Sea grain exports, after discussions with his Russian and Ukrainian counterparts,”

quoting a Reuters article.

·

This comes a day after wheat rallied from rumors ships will not be able to enter selected Ukraine ports around November 5, allowing for the current lineup to finish loadings and inspections in preparation of an end of the safe

passage agreement, set to expire sometime during the third week of November.

·

FranceAgriMer reported France planted 46% of their soft winter wheat crop as of October 17, up from 21 percent week earlier and compares to 36 percent year ago. Barley was 67 percent planted, up from 54 percent year ago.

·

Paris December wheat was down 1.75 euros earlier at 337.00 per ton.

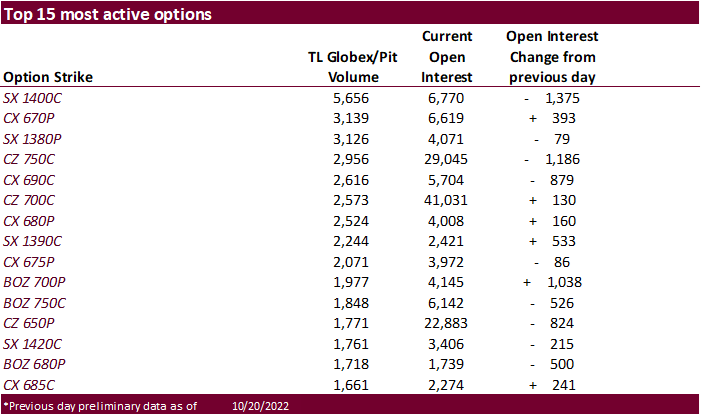

Options

volume was above average yesterday.

·

Yesterday the BA grain exchange lowered their Argentina crop estimate to 15.2 million tons from 16.5 million previous.

·

China will auction off 40,200 tons of wheat from state reserves on October 26. They sold 41,359 tons on October 12.

·

Turkey started buying wheat and up to 395,000 tons was purchased out of 495,000 tons sought at $326.80-354.00 per ton for November through FH December shipment.

·

Results are awaited for Saudi Arabia’s SAGO seeking 535,000 tons of wheat for March and April shipment. It includes 12.5% protein hard milling wheat.

·

Thailand seeks up to 180,000 tons of optional origin feed wheat for Feb-Apr shipment.

·

Iraq is in for 50,000 tons of wheat on October 24, valid until October 27.

·

Jordan seeks 120,000 tons of wheat on October 25 after buying 60,000 tons this week at $374/ton c&f for FH March shipment.

·

Pakistan seeks 500,000 tons of wheat on October 26.

·

Jordan reopened another import tender for barley set to close October 26.

·

Mauritius seeks 25,800 tons of wheat flour, optional origin, on October 28 for January through September 30, 2023, shipment.

Rice/Other

·

None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.