PDF attached

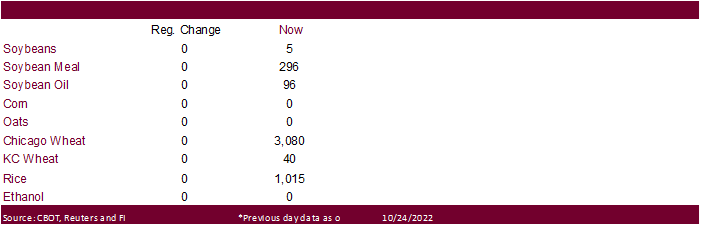

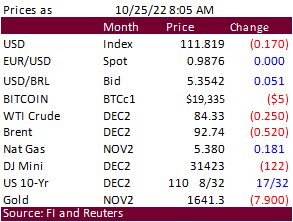

US

stocks are starting the day off mixed. Earnings season continues with tech stocks reporting this week. WTI crude oil is lower by about $0.61, and USD down 20 points. CBOT soybean complex is mixed with meal higher, soybean oil lower, and soybeans unchanged

to higher. Corn and wheat futures are lower from good US fieldwork progress reported by USDA, slow US export pace and rain falling across the US Great Plains this week.

Malaysia

is back from holiday and January palm oil futures increased 26 Ringgit to 4,127 and cash was up $5.00/ton to $942.50/ton. Offshore values this morning were leading soybean oil 26 points lower earlier this morning and meal $4.30 short ton higher. Algeria begins

buying wheat today and traders will be watching origins.

The

US weather forecast is largely unchanged. The Midwest will see rain favoring the central areas today, then northeastern areas Wednesday before drying down Thursday through Saturday. The US Great Plains will see additional rain, falling today across southeast

KS, eastern OK, eastern TX; then Nebraska, western KS, western OK, CO, and parts of the southern GP Friday through Saturday. Northern Brazil will see rain through Wednesday. The far southern areas for Brazil are dry. Some southern areas in Brazil that saw

too much rain recently may require replanting. Argentina will see rain today and Wednesday, then again Saturday (erratic showers).

Below

normal precipitation and high temperatures are expected for most of China’s southern region over the next 10 days.

WORLD

WEATHER HIGHLIGHTS FOR OCTOBER 25, 2022

-

Significant

rain will fall today from Buenos Aires into Cordoba and La Pampa with some of the rain shifting northeast Wednesday -

Rain

totals of 1.00 to 3.00 inches in central and western Buenos Aires and 1.00 to 2.00 inches in southern Cordoba will be ideal in bolstering soil moisture for wheat and for future corn and sunseed planting and development -

Follow

up rain Saturday and Sunday will further improve crop and field conditions -

East-central

Argentina may be wettest -

Brazil

still sees an ideal mix of rain and sunshine next two weeks -

Rain

fell beneficially from northern and eastern Texas to Wisconsin Monday improving topsoil moisture and induce a little runoff -

Lower

Ohio River Basin, Tennessee River Basin and lower Mississippi River Basin will get some light rain today 0.20-0.75 inch with follow up rainfall of 0.50 to nearly 2.00 inches this late weekend that might contribute to a little runoff, but river levels are unlikely

to experience a dramatic rise -

Any

small rise, though might lead to a little less restriction on barge movement and a lower premium on freight costs, but more rain will still be needed to induce a sustainable change -

No

significant changes in Europe, western Asia, India or China -

Some

light rain will impact China’s rapeseed region in the coming week to ten days, but it will not be enough to seriously improve long term soil moisture which is still quite low in eastern and southern parts of the production region -

Australia’s

rain frequency and intensity will ease a bit over the next ten days and the change will be welcome for allowing flood water to recede and to support a “possible” better harvest environment for early season wheat, barley and canola -

Rainy

weather will return, but it may focus more on Queensland and northern New South Wales rather than areas to the south when it does – at least for a little while -

South

Africa weather will remain well mixed and supportive of spring planting and winter crop maturation and harvest progress

Source:

World Weather INC

Tuesday,

Oct. 25:

-

Malaysia’s

Oct. 1-25 palm oil export data -

EU

weekly grain, oilseed import and export data -

EARNINGS:

ADM

Wednesday,

Oct. 26:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 1 -

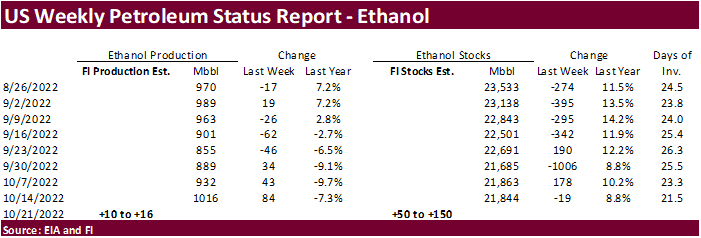

EIA

weekly US ethanol inventories, production, 10:30am -

EARNINGS:

Bunge, Pilgrim’s Pride -

HOLIDAY:

India

Thursday,

Oct. 27:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 2 -

Virtual

New Food Invest Conference, EMEA -

USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Oct. 28:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 3 -

FranceAgriMer

weekly update on crop conditions -

ICE

Futures Europe weekly commitments of traders report -

CFTC

commitments of traders weekly report on positions for -

various

US futures and options, 3:30pm

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

125,582 versus 200000-500000 range

Corn

470,623 versus 300000-650000 range

Soybeans

2,888,829 versus 1000000-2000000 range

Macros

Philadelphia

Fed Non-Manufacturing Regional Business Activity Index -14.9 In Oct Vs 2.5 In Sept

US

FHFA House Price Index (M/M) Aug: -0.7% (est -0.6%; prev -0.6%)

·

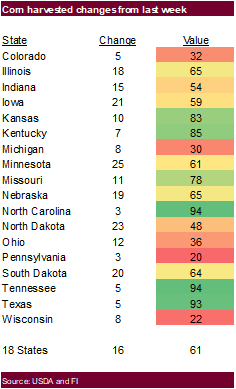

Corn futures

are lower from

good US fieldwork progress reported by USDA and slow US export pace.

·

US Frozen Pork Belly Stocks were reported at 36.592 million pounds on September 30.

·

US Frozen Beef Stocks were reported at 522.862 million pounds on September 30.

·

South Korea’s KFA in bought about 66,000 tons corn from South America or South Africa at an estimated $334.96 a ton c&f for arrival around Feb. 5, 2023.

·

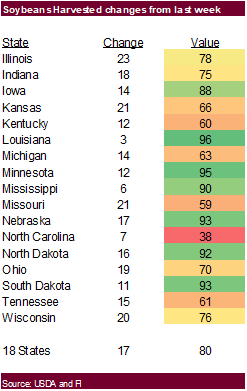

CBOT soybean complex is mixed with meal higher, soybean oil lower, and soybeans unchanged to higher. Brazil still sees an ideal mix of rain and sunshine next two weeks. Both Brazil and Paraguay soybean plantings are rapid (Paraguay

nearly complete). The CBOT January crush is around $2.64/bu, a new high.

CBOT

January crush

Source:

Reuters & FI

·

China exported 201,000 tons of biodiesel to the EU during the month of September, up from 97,000 tons year ago. July-September exports to the EU stand at 561,000 tons, up from 274,000 year earlier.

·

Argentina producer movement is still slow, but we think crushers are covered through November.

·

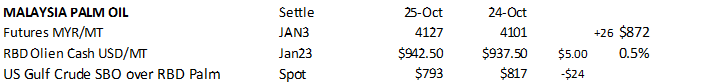

ITS reported Malaysia October 1-25 palm oil shipments at 1.128 million tons, down 3.5 percent from Aug 1-25. AmSpec reported 1.146 million tons, down from 1.075 million previous period month ago.

·

Malaysia is back from holiday and January palm oil futures increased 26 Ringgit to 4,127 and cash was up $5.00/ton to $942.50/ton. During the session futures reached an 8-week high. Heavy rain is seen threatening palm oil production.

Indonesia’s September palm oil exports fell 36% from August.

·

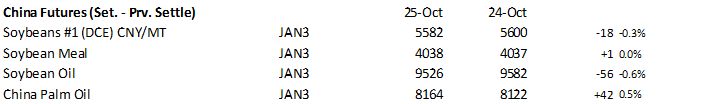

China November soybeans were down 0.3%, meal 0.1% higher, soybean oil 0.6% lower and palm oil 0.5% higher.

·

Rotterdam vegetable oils were mixed (SBO 20 lower and RSO 20 higher) from this time yesterday morning. SA meal was mostly lower.

·

Offshore values this morning were leading soybean oil 26 points lower earlier this morning and meal $4.30 short ton higher.

-

Egypt

seeks vegetable oils (no specific amounts noted) on October 26 for Dec 10-30 arrival, and some local vegetable oils. They are looking for 180-day letters of credit.

·

Wheat is trading near a one-month low on slow US exports and additional rain falling across the US Great Plains this week. Algeria begins buying wheat today and traders will be watching origins. Russian wheat could be lowest offer.

·

US winter wheat plantings increased to 79% complete as of Sunday, ahead of the five-year average of 78% and below the average analyst estimate of 81%.

·

Welcome rains fell Monday across parts of Kansas, Oklahoma and Texas, but more rain is needed to end drought conditions. The Great Plains will be mostly dry over the next few days.

·

Paris December wheat was down 1.75 euros earlier at 337.25 euros a ton.

·

Eastern Australia will see unwanted additional rain this week.

·

Ukraine’s producer union Ukrainian Agrarian Council sees October grain exports up 8.7 percent from September.

·

Ukraine’s AgMin sees the winter grain planted area decrease 30-40% from last year. They see winter grain sowings at 3.8 million hectares versus 6 million year earlier. Only 4.6 million of the 2022 crop was collected.

·

Russian wheat prices fell last week. IKAR consultancy reported Russian prices for wheat with 12.5% protein content, Black Sea, at $312 per ton FOB at the end of last week, down $11 from a week earlier. Russia’s grain exports rose

to 1.06 million ton last week from 910,000 tons a week earlier, according to SovEcon.

·

Algeria should start buying wheat today in their import tender that’s valid until Wednesday, for November 16-December 31 shipment.

·

Jordan saw three participants for 120,000 tons of wheat.

·

Taiwan seeks 38,515 tons of US wheat of various classes on Thursday for Dec 14-Dec 25 shipment out of the PNW.

·

Thailand bought about 60,000 tons of wheat out of 180,000 tons sought, from Australia or the Black Sea, at an estimated $350/ton c&f for Feb-Apr shipment.

·

Pakistan seeks 500,000 tons of wheat on October 26.

·

Jordan reopened another import tender for barley set to close October 26.

·

Mauritius seeks 25,800 tons of wheat flour, optional origin, on October 28 for January through September 30, 2023, shipment.

·

Iraq seeks 50,000 tons of wheat on October 30, nearly one week later than their original close date.

Rice/Other

·

South Korea bought an estimated 31,200 tons of rice from Vietnam and other origins for up to 90,100 tons sought on October 19. US offers were rejected.

·

Results are awaited on Egypt seeking 50,000 tons of sugar, optional origin, on October 25 for arrival between Dec 1-31.

·

(Bloomberg) — US stockpiles of cold-stored orange juice plunged in September by 43% from a year earlier to the lowest since late 1977.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.