PDF attached

Private

exporters reported the following sales activity:

-126,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-198,000

metric tons of soybeans for delivery to Spain during the 2022/2023 marketing year

![]()

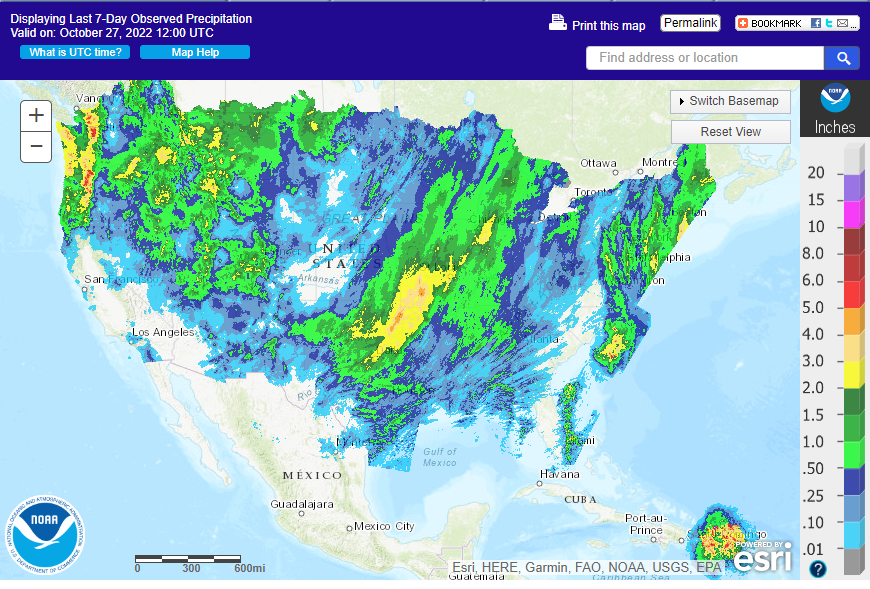

Weather

The

southern Great Plains have an opportunity for rain today through Saturday before returning Tuesday. Parts of the US Midwest southwestern, central and southern areas will see rain sometime through Sunday. Argentina’s BA, eastern Santa Fe and Entre Rios will

see rain this weekend before turning drier next week. Brazil’s central and northern growing areas will continue to get rain for the balance of this week. Temperatures in Argentina and Brazil will fall early next week bringing potential frosts to some of the

growing areas.

Past

seven days

WORLD

WEATHER HIGHLIGHTS FOR OCTOBER 28, 2022

-

Argentina

is still expected to experience frost and freeze conditions Monday and Tuesday that may damage some winter and early summer crops -

Argentina

rainfall will be very limited after showers occur in the east this weekend ahead of the big cold surge -

Western

Australia could see some frosty temperatures in the south Sunday and Monday, but no damaging cold is expected -

Australia’s

greatest rain will fall in southern parts of the nation during the next couple of weeks with Victoria wettest along with a few southeastern South Australia locations and a few in southern New South Wales -

Some

net drying is anticipated for early harvest areas in Queensland and northern New South Wales -

Warming

temperatures in these same areas should lead to eventual better planting conditions for sorghum and cotton -

U.S.

weather will be relatively tranquil in this first week of the outlook, though rain falling in Oklahoma and northern Texas today will move through the Delta and Tennessee River Basin this weekend -

Some

of this rain will also reach the lower Ohio River Valley. -

Rainfall

of 0.30 to 1.50 inches is expected from the Delta to the lower Ohio River Valley with a few greater amounts -

North-central

Texas and south-central Oklahoma will be wettest with another 0.50 to 1.50 inches falling on top to totals to 1.39 inches so far today -

Most

of the northern and central Plains and northern and western Midwest will be dry for a week and then a more active weather pattern is expected -

Western

U.S. hard red winter wheat areas will get a restricted amount of rainfall during the next week with the exception of southern Oklahoma and north-central Texas -

U.S.

central and eastern U.S. weather will become more active Nov. 3-10 with moisture likely in the northern Plains and upper Midwest early in that period and then from the southeastern Plains into the Ohio River Valley in the latter part of that 7-day period -

No

serious changes in weather were noted today for Europe, CIS, China or India -

Some

rain will impact China’s Yangtze River Basin, but it will stay light and much greater amounts will be needed to ease dry -

China’s

most meaningful rainfall in the Yangtze River Basin will not fall for about ten days leaving concern about rapeseed planting and establishment -

Europe’s

drying trend is not a huge problem after rain fell earlier this month, but drought remains in the lower Danube River Basin, eastern Spain and southwestern France -

Many

river levels are still low across the continent, despite recent precipitation

Source:

World Weather INC

Friday,

Oct. 28:

-

Asia-Pacific

Agri-Food Innovation Summit, Singapore, day 3 -

FranceAgriMer

weekly update on crop conditions -

ICE

Futures Europe weekly commitments of traders report -

CFTC

commitments of traders weekly report on positions for -

various

US futures and options, 3:30pm

Monday,

Oct. 31:

-

Malaysia’s

Oct. 1-31 palm oil export data

-

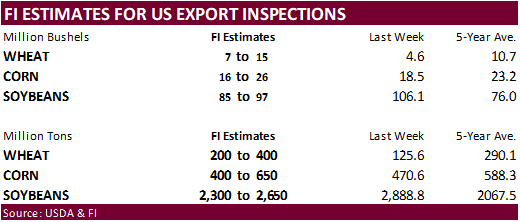

USDA

export inspections – corn, soybeans, wheat, 11am -

Agricultural

prices paid, received, 3pm -

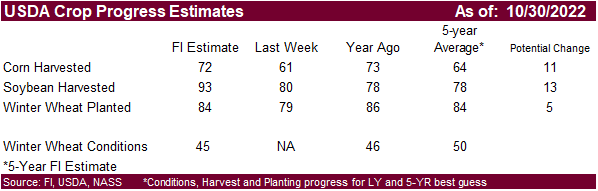

US

crop conditions and harvesting for corn, cotton, soy; winter wheat planting, 4pm -

HOLIDAY:

Chile

Tuesday,

Nov. 1:

-

Australia

commodity index -

EU

weekly grain, oilseed import and export data -

New

Zealand global dairy trade auction -

Purdue

Agriculture Sentiment. 9:30am -

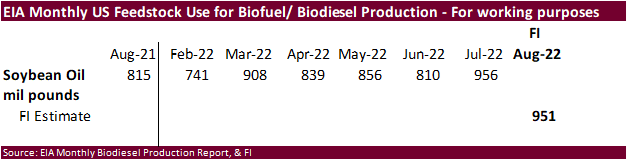

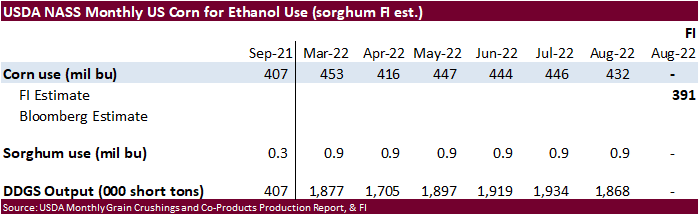

USDA

soybean crush, DDGS production, corn for ethanol, 3pm -

US

winter wheat condition, 4pm -

Honduras,

Costa Rica monthly coffee exports -

International

Cotton Advisory Committee releases monthly outlook -

HOLIDAY:

France, Chile

Wednesday,

Nov. 2:

-

Indonesian

Palm Oil Conference in Bali, day 1

-

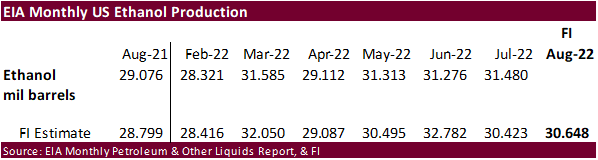

EIA

weekly US ethanol inventories, production, 10:30am -

HOLIDAY:

Brazil

Thursday,

Nov. 3:

-

Indonesian

Palm Oil Conference in Bali, day 2

-

USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am -

HOLIDAY:

Japan

Friday,

Nov. 4:

-

Indonesian

Palm Oil Conference in Bali, day 3

-

FAO

World Food Price Index -

FranceAgriMer

weekly update on crop conditions -

ICE

Futures Europe weekly commitments of traders report -

CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm

Source:

Bloomberg and FI

Macros

US

Personal Income Sep: 0.4% (est 0.4%; prev 0.3%)

US

Personal Spending Sep: 0.6% (est 0.4%; prev 0.4%)

US

Real Personal Spending Sep: 0.3% (est 0.2%; prev 0.1%)

US

Employment Cost Index Q3: 1.2% (est 1.2%; prev 1.3%)

US

PCE Deflator (M/M) Aug: 0.3% (est 0.3%; prev 0.3%)

US

PCE Deflator (Y/Y) Aug: 6.2% (est 6.3%; prev 6.2%)

US

Core PCE Deflator (M/M) Aug: 0.5% (est 0.5%; prevR 0.5%)

US

Core PCE Deflator (Y/Y) Aug: 5.1% (est 5.2%; prev 4.9%)

Canadian

GDP (M/M) Aug: 0.1% (est 0.0%; prev 0.1%)

Canadian

GDP (Y/Y) Aug: 4.0% (est 3.7%; prevR 4.4%)

·

Corn prices are lower on selling in outside markets and lower wheat. SK bought 134,000 tons of corn from either South America or South Africa.

·

Yesterday a Reuters article said Mexico still plans to ban genetically engineered corn by 2024, potentially halving US imports of yellow corn when the ban goes into effect. Mexico is US’s largest customer.

·

Temperatures in Argentina and Brazil will fall next week bringing potential frosts to some of the growing areas. Commodity weather group warned Brazil’s Rio Grande do Sul and Santa Catarina states, along with Argentina could see

risks for emerged corn and wheat.

·

South Korea’s Major Feedmill Group (MFG) bought an estimated 134,000 tons of corn sourced from South America or South Africa for arrival in South Korea in February 2023. One consignment of 68,000 tons was bought at $329.98 a ton

c&f and another 66,000 tons at $330.99 a ton c&f.

·

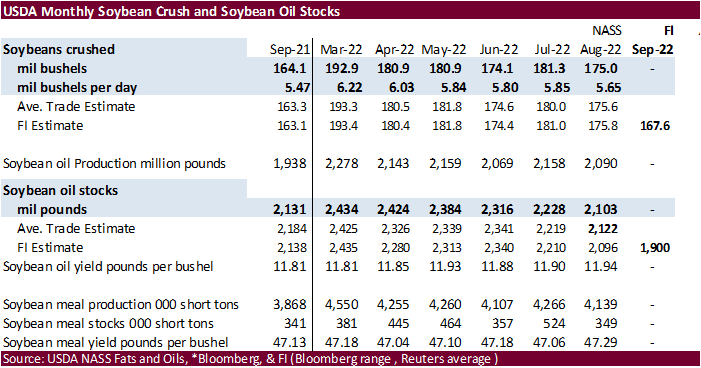

CBOT

soybean complex is mostly lower. Meal is hanging in there with good US exports off the PNW and South Korea buying 120,000 tons of meal overnight. SBO is lower from weakness in palm oil and WTI crude oil. We are looking for a pull back for December soybean

oil to the 69-70 cent area if NASS reports a higher than expected end of September ending soybean stocks on Tuesday. We see soybeans in a sideways trading range over the short term.

·

USDA announced sales to China and Spain.

·

Brazil elections are this weekend and in general producers would like to see Bolsonaro to win, per recent chat board.

https://www.npr.org/2022/10/28/1131962073/brazil-presidential-election-bolsonaro-lula

·

Gulf soybean and corn offers are starting to thin out as low water levels along the Mississippi River are hindering barge arrivals.

·

China plans to auction off 500,000 tons of soybeans from reserves on November 11.

·

CNGOIC reported China’s soybean crush volume slipped last week to 1.61 million tons. AgriCensus noted its down 650,000 tons from the previous month and unchanged from the previous year. Soybean meal stocks were a low 260,000 tons

and soybean oil stocks were 750,000 tons.

·

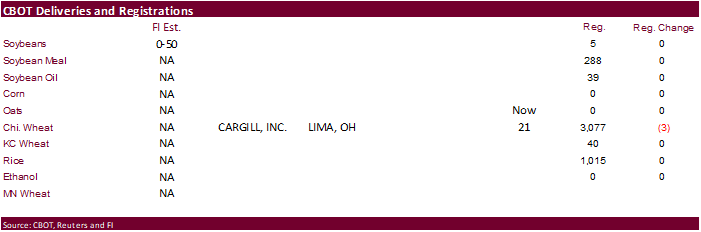

First Notice Day deliveries for November soybeans is seen in a 0-50 range.

·

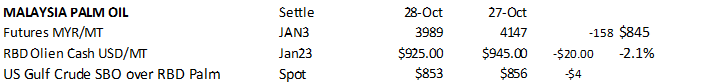

Malaysia January palm oil futures fell 158 Ringgit to 3,989 and cash was down $20.00/ton to $925.00/ton.

·

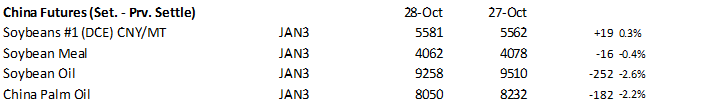

China November soybeans were up 0.3%, meal down 0.4%, soybean oil 2.6% lower and palm oil 2.2% lower.

·

Rotterdam vegetable oils were 15-22 euros lower from this time yesterday morning. SA meal was mixed.

·

Offshore values this morning were leading soybean oil 57 points lower (181 lower for the week to date) earlier this morning and meal $7.30 short ton lower ($0.70 lower for the week).

-

126,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year -

198,000

metric tons of soybeans for delivery to Spain during the 2022/2023 marketing year

-

South

Korea’s MFG bought 120,000 tons of soybean meal at an estimated net $528.49/ton c&f for arrival around March 21.

·

US wheat futures are easier after recent rain fell across the dry areas of the southern Great Plains.

·

French soft wheat plantings reached 63% complete as of October 24, above 58 percent year ago.

·

Paris December wheat was up 0.25 euro earlier at 336.75 euros a ton.

·

China plans to auction off 40,000 tons of wheat from state reserves on November 2.

·

Yesterday the EU Crop Monitor increased its estimate for the EU soft wheat production to 127.2 million tons from 127.0 million a month ago. Soft wheat exports for 2022-23 was estimated at 36 million tons, unchanged from previous.

·

Results awaited: Mauritius seeks 25,800 tons of wheat flour, optional origin, on October 28 for January through September 30, 2023, shipment.

·

Iraq seeks 50,000 tons of wheat on October 30, nearly one week later than their original close date.

·

Jordan seeks 120,000 tons of hard milling wheat on November 1 for March/April shipment.

·

Jordan is back in for 120,000 tons of barley on November 2 for March/April shipment.

Rice/Other

·

None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.